Continued optimism regarding the reopening of China

An overview of current trends in the commodity landscape

Published by Giulio Corazza. .

Energy Ferrous Metals Food Non Ferrous Metals Commodities Financial Week

In the preceding months, there has often been talk of a slowdown in the global economy, fears of a recession, and a possible general decline in financial commodity prices.

However, with the arrival of 2023, what financial markets expect, as early as the end of the year, is a recovery in the global business cycle.

Right now all eyes seem to be on China, whose abandonment of its zero covid policy has greatly affected market sentiment.

In the past few days, Chinese Vice Premier Liu He announced at the World Economic Forum in Davos that China could recover its pre-Covid-era growth trends this year.

Expectations of this growth are supporting the level of commodity prices in financial markets.

ENERGY PRODUCTS

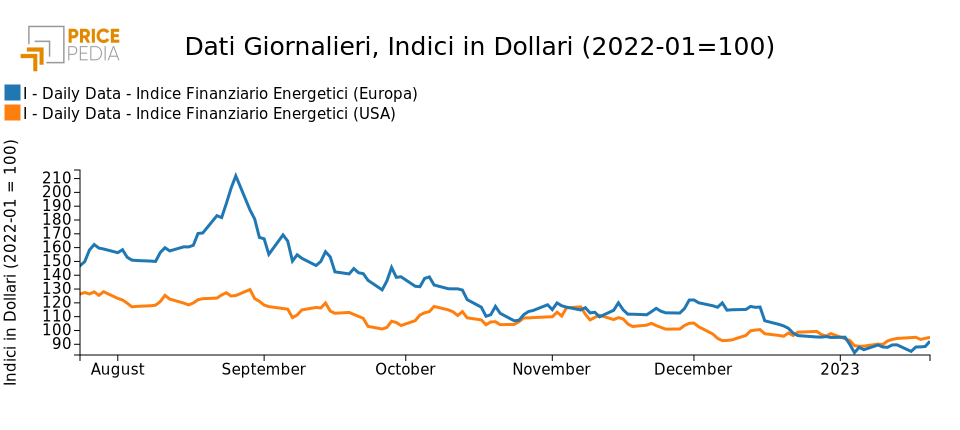

The following graph shows the PricePedia financial indexes of dollar prices of energy products Europe and the US. In recent months, both indexes have shown a downward trend and a stable phase in the last week.

PricePedia financial indexes of energy prices in Europe and the U.S.

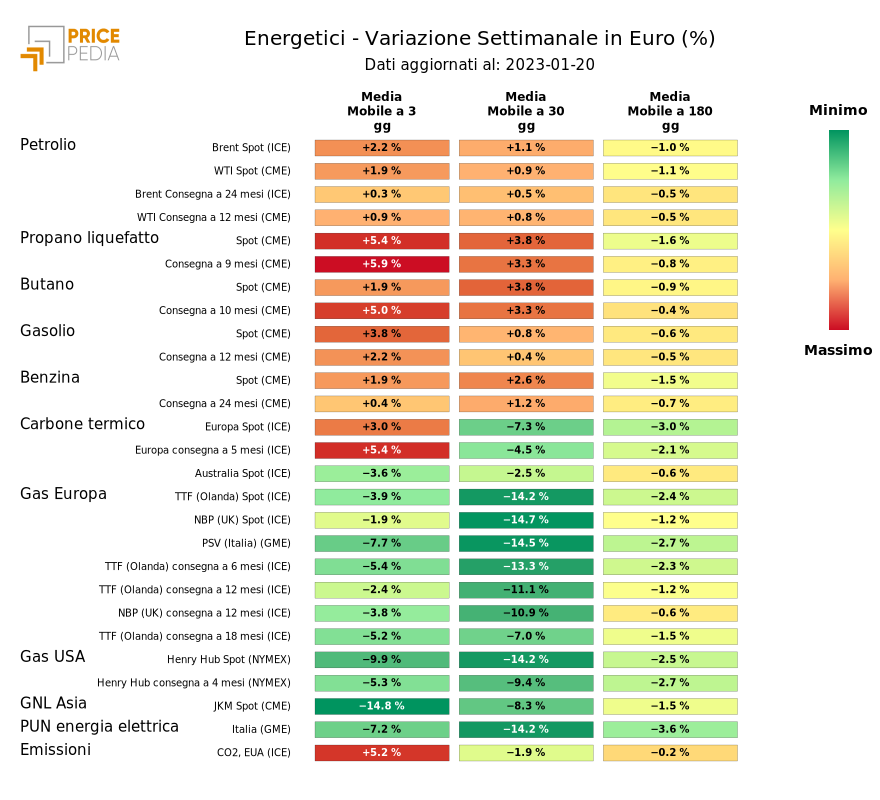

The heatmap below provides an overview of the trend in euro prices of energy products.

In a recent report released by the International Energy Agency (IEA), demand for oil is expected to grow by the year 2023.

This week the price of oil and its derivatives are registering an increase. Bucking the trend, however, is the price of natural gas, which continues to decline, albeit at lower rates of change.

HeatMap of energy product prices in euros

METALS

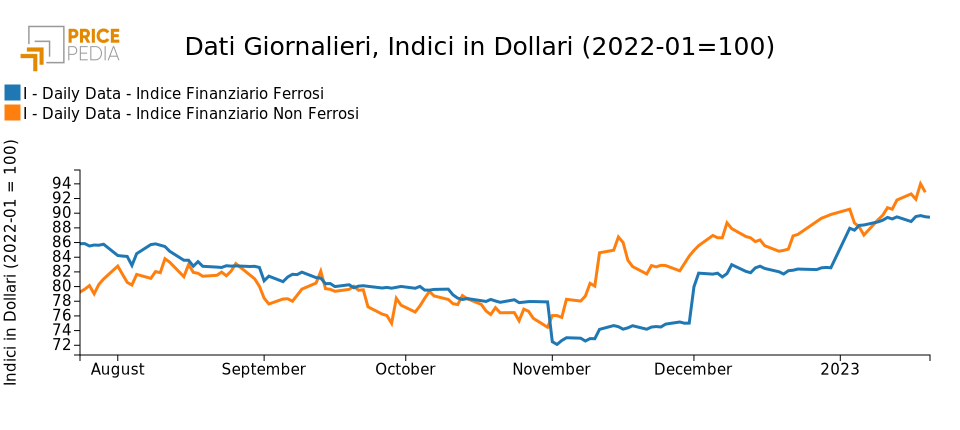

The following graph shows the PricePedia financial indexes of dollar prices of ferrous and nonferrous metals. In recent months the PricePedia indexes, after a downward phase in summer-autumn 2022, have recovered ground. This week, the non-ferrous metals index shows a significant increase while the ferrous index is more moderate.

Financial PricePedia indices of ferrous and nonferrous metals in dollars

FERROUS METALS

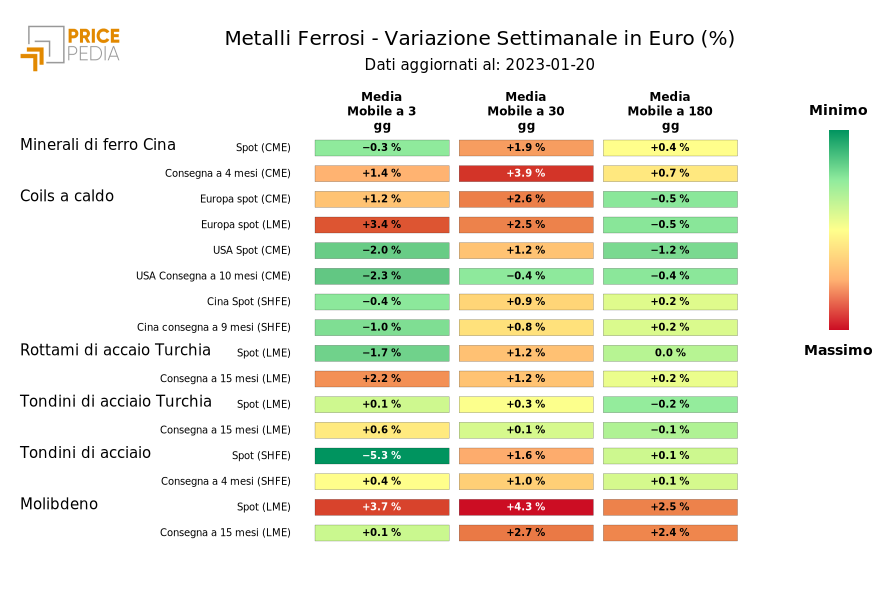

The heatmap below provides an overview of the euro price trends of ferrous metals. Particularly pronounced is the negative change in steel rods listed on the Shanghai Stock Exchange.

HeatMap of ferrous metal prices in euros

NON-FERROUS METALS

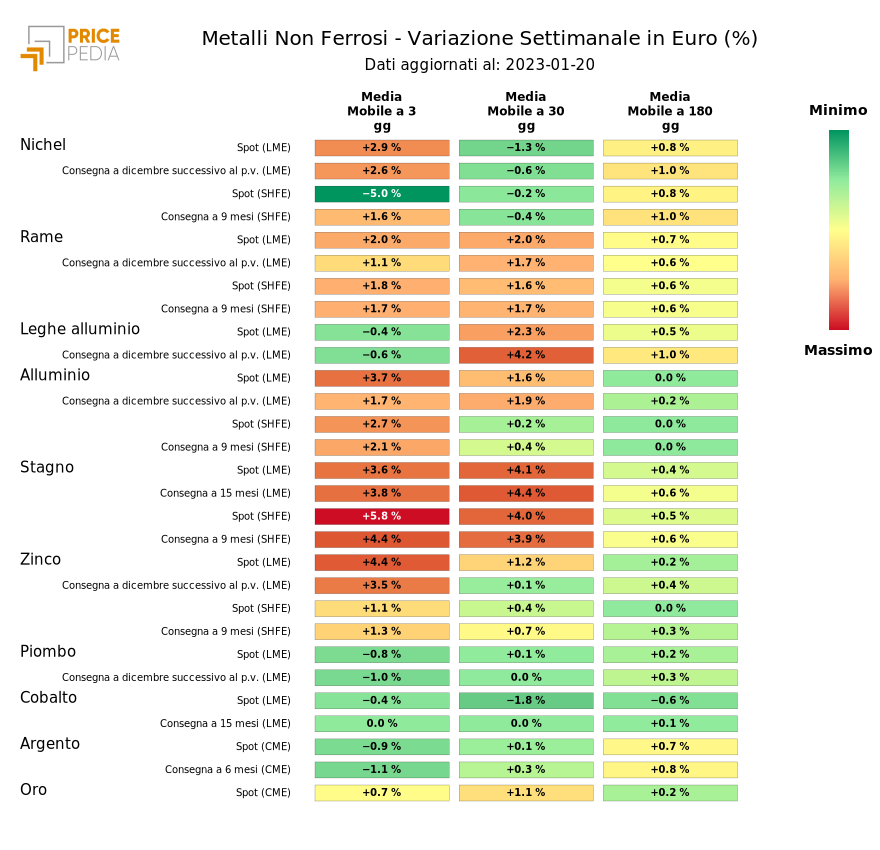

The heatmap below provides an overview of the price trends of nonferrous metals. Particularly significant is the increase in nickel, tin and zinc prices.

HeatMap of non-ferrous metal prices in euros

FOOD PRODUCTS

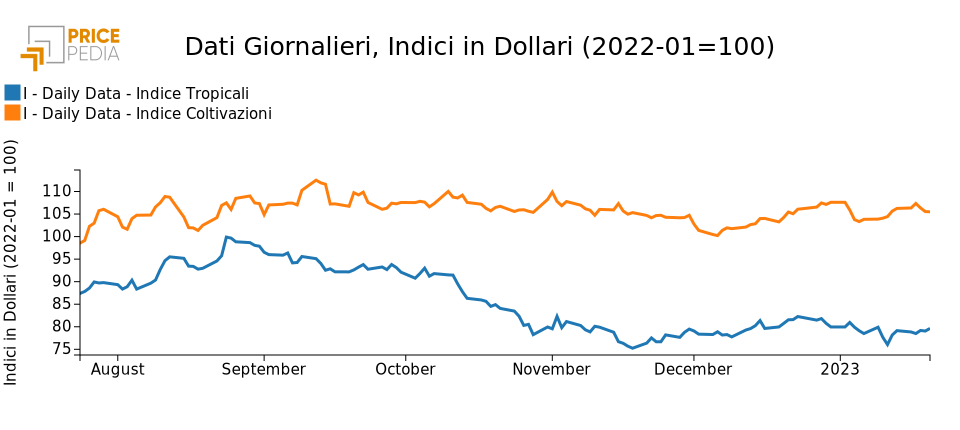

The following graph shows the PricePedia financial indexes of food commodity prices in dollars. The index of crop and tropical products both show signs of stability.

PricePedia Financial Indices of Food Products in Dollars.

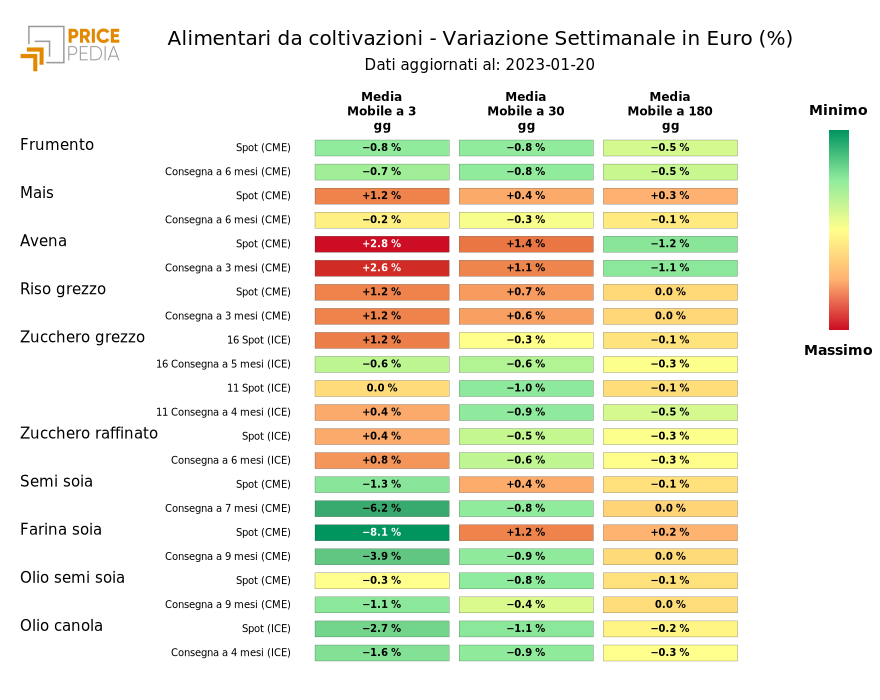

The heatmap below provides an overview of the trend in euro prices of crop foods. Prices this week have diverged slightly: on the one hand cereals and sugar show slight increases; on the other, soybeans show slightly decreasing prices.

HeatMap of food prices from crops in euros