Speculative actions at LME increase uncertainty over commodity prices

An overview of current trends in the commodity landscape

Published by Giulio Corazza. .

Energy Ferrous Metals Food Non Ferrous Metals Commodities Financial Week

On the commodity price front, this week sees a differentiated situation. Prices in some sectors are showing a continued decline, while others are signaling a reversal of the trend.

Despite recent encouraging data on U.S. inflation, the Fed has announced that it will continue to implement a restrictive monetary policy. This policy, shared by the ECB, is expected to limit the growth of commodity prices.

ENERGY PRODUCTS

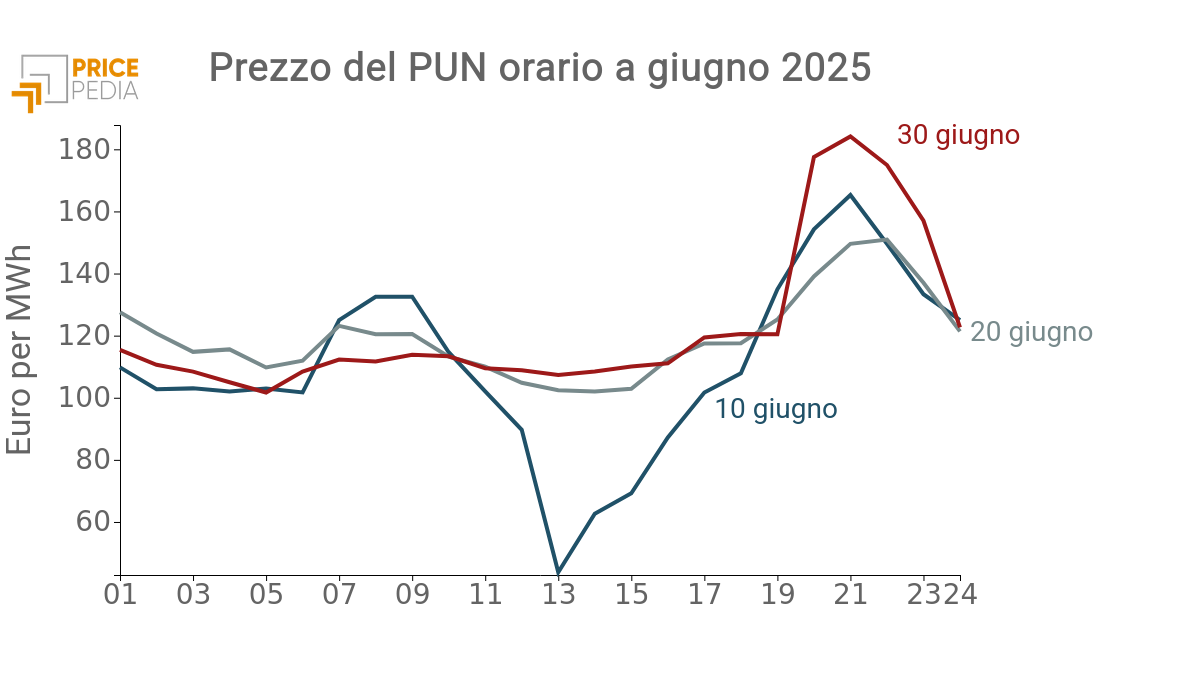

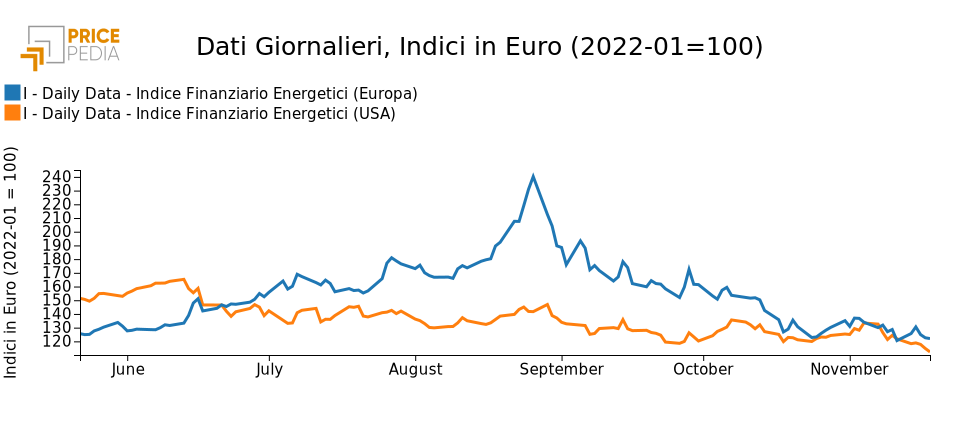

The following graph shows the PricePedia financial indexes of energy product prices Europe and the US.

While the U.S. index remains on a negative trend, the price index in Europe reports an increase.

PricePedia financial indexes of energy prices in Europe and the U.S.

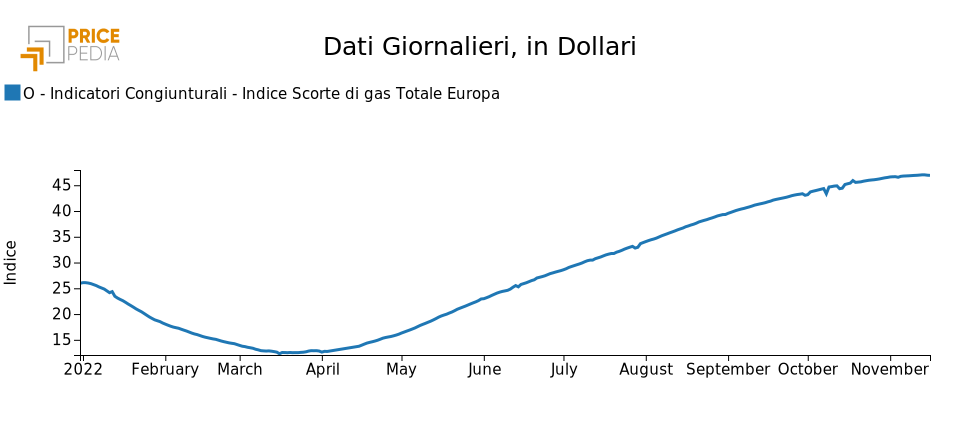

The following graph shows the trend of European gas stocks as a percentage of annual imports. For the past few days, stocks have passed a high point and started to decline. This aspect and expected temperatures below seasonal averages pushed up the price of natural gas quoted at the TTF, which reversed its bearish trend and then fell back on Friday.

Europe gas stocks index

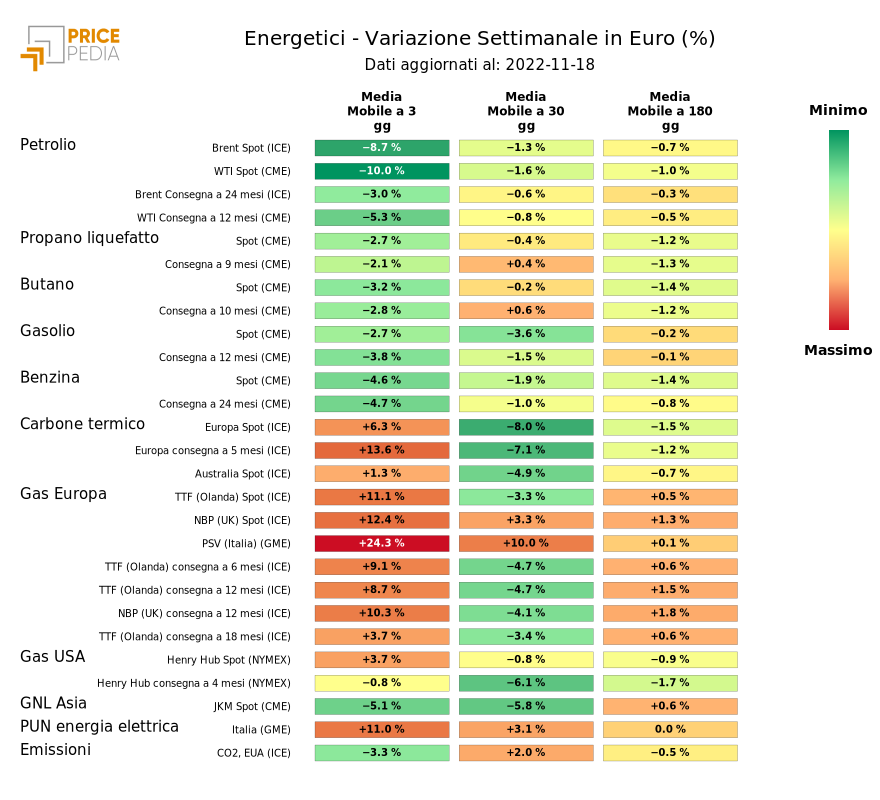

The heatmap below provides an overview of the price trends of energy products. Particularly pronounced is the negative change in the price of oil and its derivatives. OPEC recently revised downward the demand for oil for the period 2022-2023, and this aspect has not helped support the price level.

HeatMap of energy prices

METAL PRODUCTS

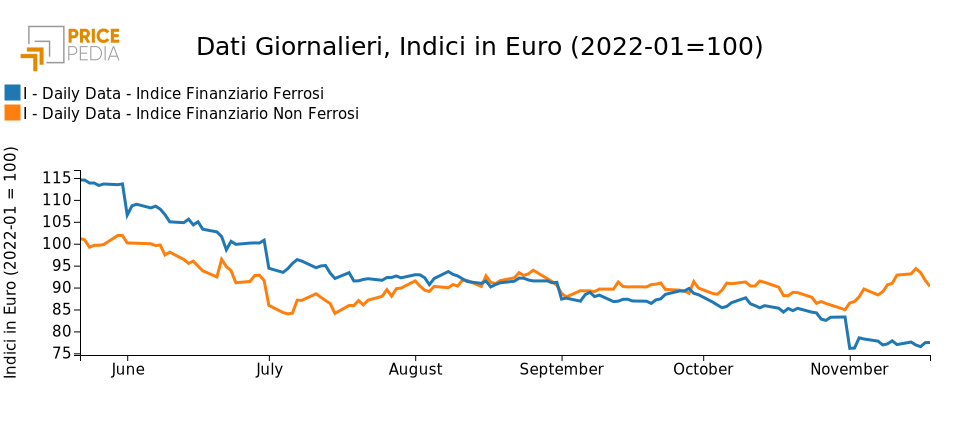

The following graph shows the PricePedia financial indexes of ferrous and nonferrous metal prices. While the ferrous index shows relative stability, the nonferrous index records in the first part of the week a continuation of the bullish phase that began in November, abruptly interrupted in the last two days.

PricePedia financial indexes of ferrous and nonferrous metals

FERROUS METALS

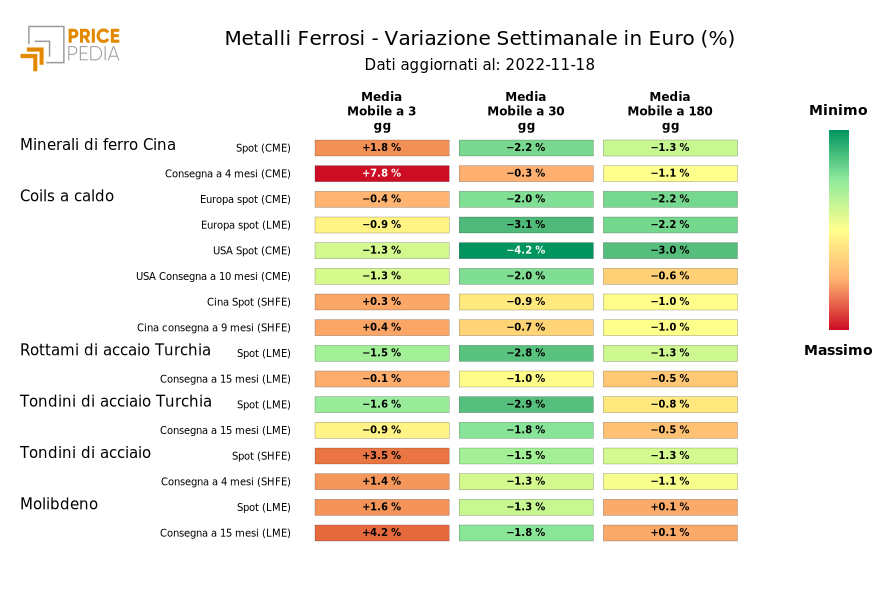

The heatmap below provides an overview of ferrous metal price trends. Particularly pronounced is the change in iron ore and steel rebar listed on the Shanghai Stock Exchange, which is offset by further slight decreases in coil prices.

HeatMap of ferrous metal prices

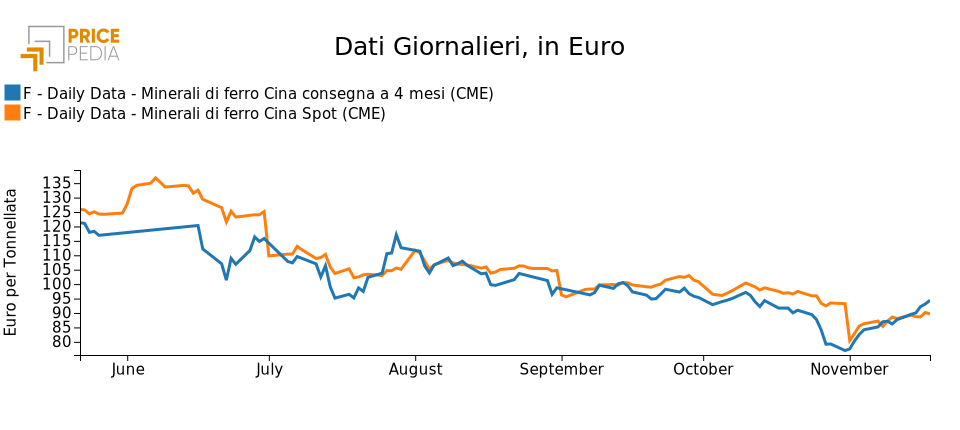

Of particular note is the momentum in November in iron ore, up sharply especially in 4-month futures prices. This strong growth in futures brought the price structure back into contango, signaling expectations of a recovery in global steel demand in the near term.

Iron ore price

NONFERROUS METALS

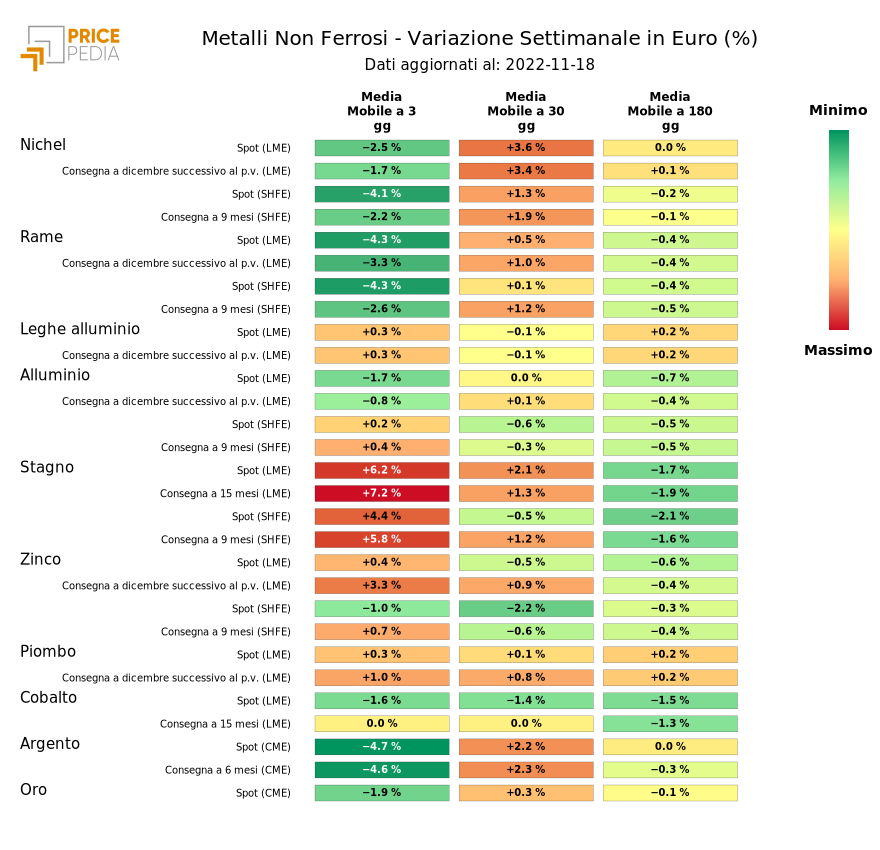

The heatmap below provides an overview of non-ferrous metal price trends. Particularly relevant are the changes in tin prices.

HeatMap of non-ferrous metal prices

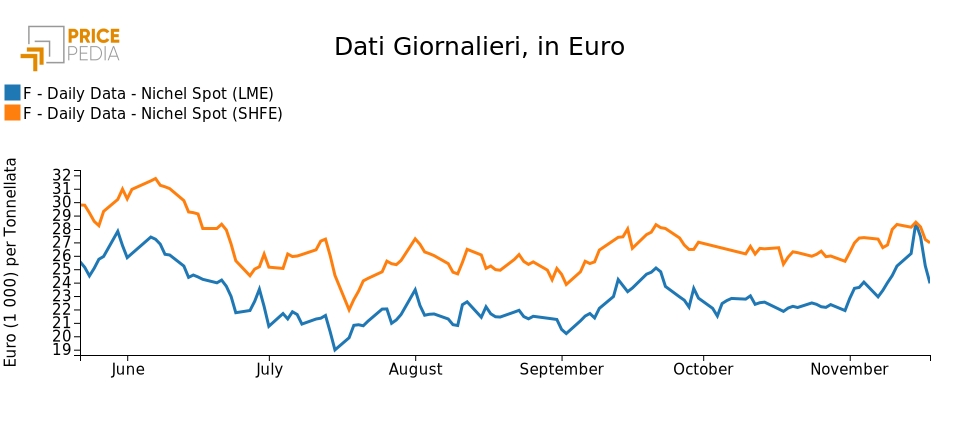

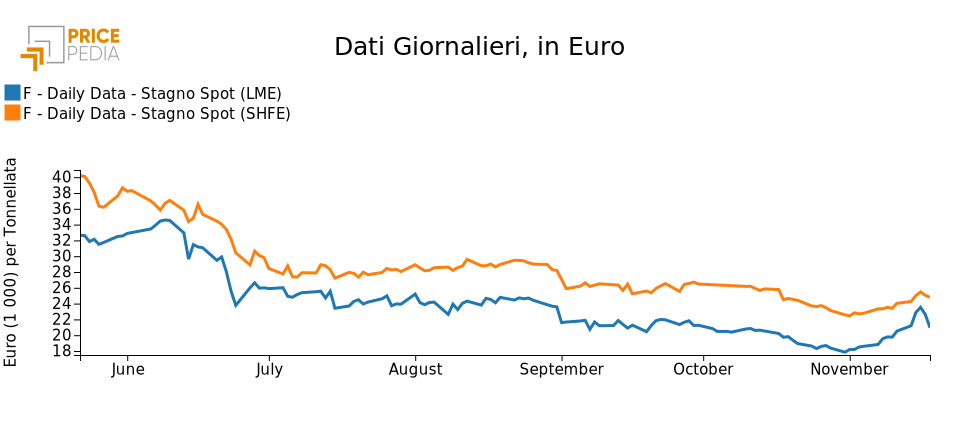

During the week, tin and nickel were characterized by a phenomenon that specialists refer to as the "short squeeze." The rise in prices since the beginning of November forced quick buying of stocks by traders who had sold short, betting on lower prices.

These transactions only affected the quotations at the London Metal Exchange, as is clear from the following two graphs. They compare the prices of the two metals on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

| Nickel | Tin |

|

|

FOOD PRODUCTS

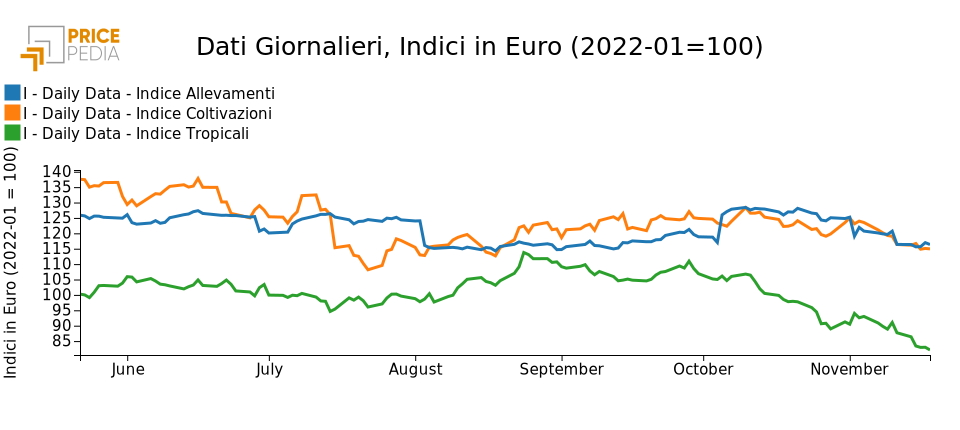

The following graph shows the PricePedia financial indexes of food prices.

The indexes for crop and tropical products show a continued decline while the index for livestock products reports relative stability during the week.

PricePedia financial indexes of food products prices

FOODS FROM CROP

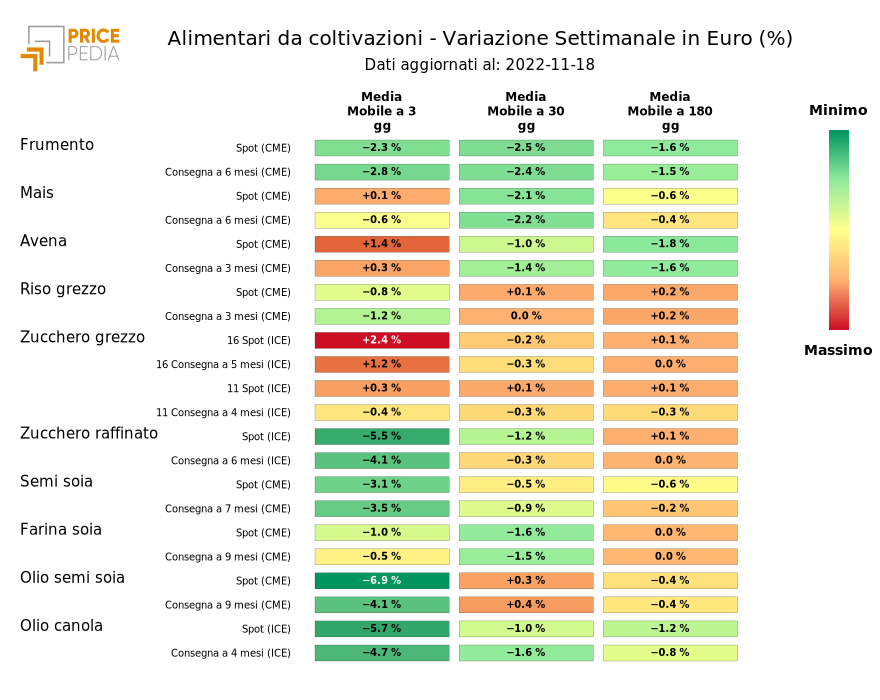

The heatmap below provides an overview of the trend in crop food prices.

On Thursday the agreement between Russia and Ukraine on agricultural exports through Black Sea ports was renewed. The increased availability of Ukrainian agricultural products on international markets

will tend to weaken the prices of agricultural products.

HeatMap of foods from crop prices