Covid cases and news from Ukraine reverse copper's course

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

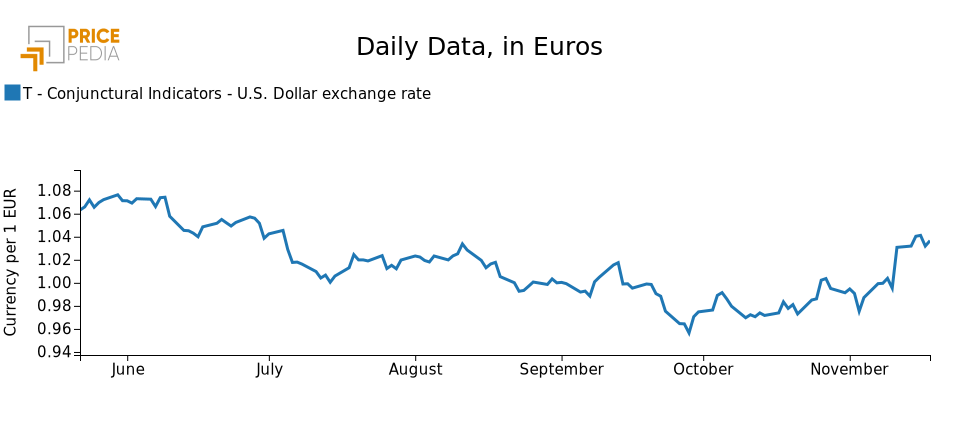

Exchange Rates LME Copper Non Ferrous Metals Doctor Copper SaysAfter a bullish phase in the first half of November, the price of copper has reversed course during the week now drawing to a close. As can be seen in the chart below, after peaking on Friday, November 11, the price has been declining on both the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) over the past few days: prices in euro fell by 4.5% on the LME and by 5.2% on the Chinese exchange, after rising 7.9% and 6.5% in the first half of the month.

Reasons for the turnaround

The events that weighed on the price of copper this week relate as much to geopolitical issues as to pandemic developments.

On the first point, the news that shook the markets on Tuesday concerned a Russian-made missile that hit Polish territory, leading to the death of two people. While initial speculations raised fears of an escalation of the conflict in Ukraine, thus increasing geopolitical concerns and weighing on investors' appetite for risk, the latest statements by the Polish leader and NATO have partially allayed initial fears. The hypothesis currently considered most plausible is that of an accident, due to a missile launched by Ukrainian forces defending the country from Russian attacks.

The second issue that has weighed on the price of copper in recent days is the continued rise of Covid cases in China, the largest consumer of the commodity on a global scale. The new wave of the virus is in fact beginning to generate fears of a negative effect on demand, in relation to the possible imposition of new restrictions, but also on the country's general economic performance.

This reverses the trend observed in the markets last week, when the announcement of an easing of restrictions had more than offset the news of an increase in cases, and investors' celebrations had driven up the price of copper at the SHFE.

FED dampens markets' hopes

Contributing to last week's market celebrations were hopes of a slowdown in the Fed's contractionary monetary policy, in the face of lower-than-expected US inflation in October.

On the contrary, recent statements by various central bank officials have made it clear that it is still too early to declare victory, and that lower-than-expected inflation is not enough to guarantee a reversal in price dynamics. James Bullard stated that it is currently premature to talk about a pause in rate hikes, which should be raised to at least 5-5.25 per cent from the current 3.75-4 per cent.

This week's news therefore considerably slowed the weakening of the dollar and the flight from the safe haven that began last week, providing relative stability to the exchange rate against the euro.

Focus China: is the economy slowing down?

Looking more closely at recent developments in the Chinese economy, which as we have seen influence the dynamics of the copper price, we can spot signs of growth as well as some cautionary elements.

The October data from the National Bureau of Statistics of China reported a 5% year-on-year increase in industrial production, while retail sales of consumer goods contracted by 0.5%, most likely penalized by the rise in Covid cases at the end of October. There were also signs of a slowdown on the export front last month: Chinese exports fell by 7.5% month-on-month, and 0.3% year-on-year, according to data released by the General Administrator of Customs of the People's Republic of China. In September, the Asian giant's exports had increased by 2.5% month-on-month and 5.7% year-on-year.

Positive signals are coming from the government's support initiatives, such as the recent announcement of a 16-point plan to support a struggling real estate sector, a significant player on the copper front.

For the Chinese economy, the fourth quarter thus seems to have begun with the aim of continuing on a path of recovery, which, however, is struggling to consolidate. The possible reversal on the zero-Covid policy could, however, provide new scope for combining economic growth with an as-yet undefeated pandemic.