Signs of optimism from copper price, but recession risk remains on the scene

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

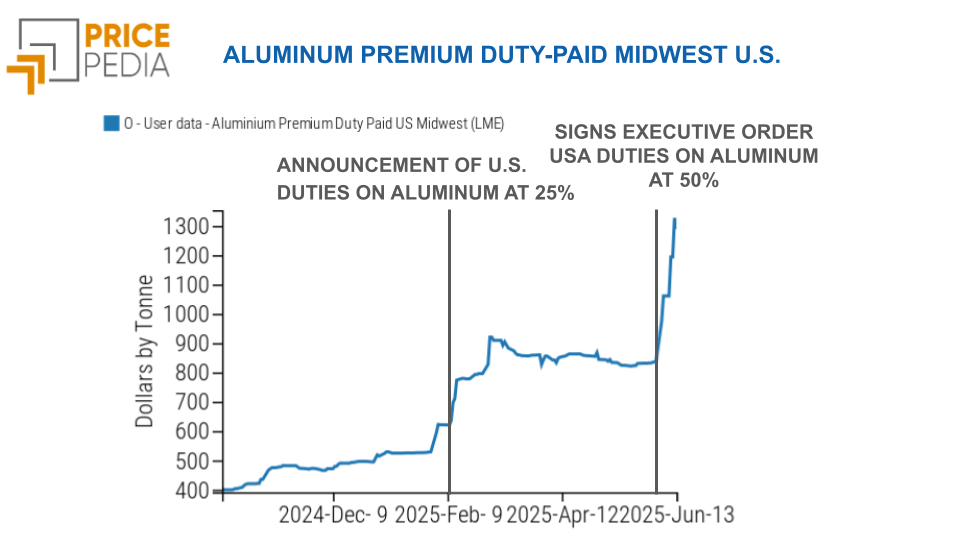

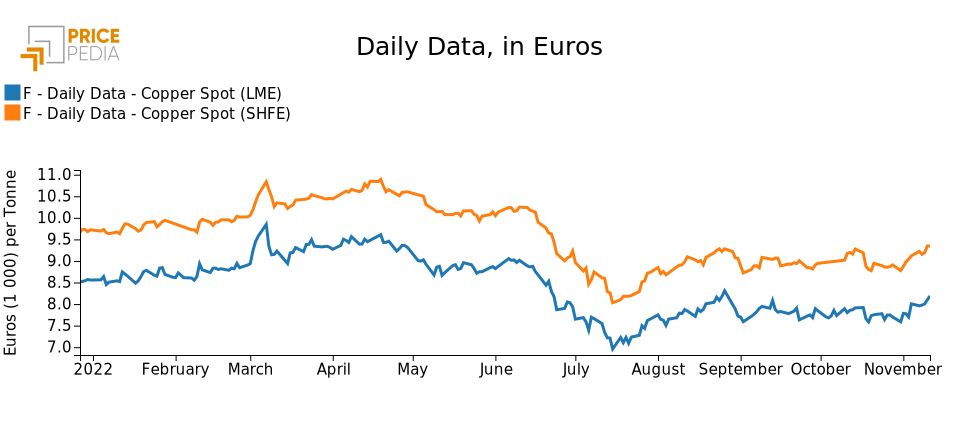

LME Copper Non Ferrous Metals Doctor Copper SaysOver the past few days, the price of copper seems to confirm the modest upward trend that began last week. Indeed, looking at the closing values on Friday, November 11, we can see that, on both the Shanghai Futures Exchange (SHFE) and the London Metal Exchange (LME), the price is 5% higher than 14 days earlier.

Prospects of a slowdown for US inflation

Among the week's events that influenced the dynamics of copper, we can find the release of the latest US inflation data, published on Thursday 10 by the US Census Bureau.

In October, US inflation slowed more than expected, limiting its increase to 7.7 % YoY, the smallest increase since January 2022. The US Consumer Price Index rose instead by 0.4 % MoM, in line with September.

US Consumer Price Index for All Urban Consumers

(12-month % change)

The slowdown in US inflation generated an inevitable response in the markets, fuelling hopes that the tipping point has now been passed, and that this reversal may also bring with it a slowdown in the pace of rate hikes by the Federal Reserve.

The dollar reacted with a weakening, falling back below parity with the euro on Thursday, driven by the effects of risk sentiment; even more pronounced was the weakening on Friday (USD 1.03 per EUR), in light of a general flight of investors from the safe haven: this seems to signal a first significant reversal, after an appreciation of the greenback going on since mid-2021.

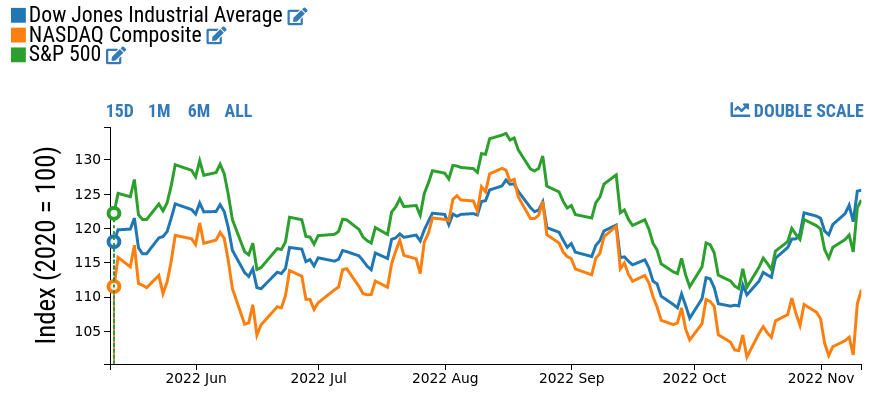

US 10-year bond yields also reacted with a contraction on Thursday, closing at their lowest level since early October. For its part, the stock market celebrated this glimmer of normalization on the inflation front, as noted by the significant rise in indices on November, 10 and 11.

US stock market indices

Thus, the price of copper also joined the optimistic trend in the markets, taking a significant upward trend in euro values as well.

News from China

Some news from China also pushed up the price of copper this week. It was reported on Tuesday that the Chinese copper industry was lobbying the authorities in the face of a general concern about the global supply of copper, which is increasingly being used for renewable energy and electric vehicles. An increase in extraction is therefore called for, in the face of growing concerns about possible disruptions in global supplies.

Confirmation of an effective easing of China's strict rules on the Covid front, following last week's rumours, and despite the ongoing increase in the number of new cases, came today. For example, a two-day easing of the quarantine for close contact with infected persons and for travellers entering the country is expected, as well as the removal of a measure aimed at penalizing airlines that had led to the entry of numerous cases into the country.

The news of the easing of the zero-Covid policy was welcomed by the markets, pushing up non-ferrous metals, as well as the yuan. Nevertheless, experts have already warned investors, pointing out that the normalization process also started in China will most likely be gradual, and the full reopening cannot yet be said to be close.

To sum up...

Although some positive news this week has fuelled market optimism, as perceived by the price of copper, it still seems too early to speak of a turnaround. Indeed, according to the latest data the risk of a coming recession remains on the scene, as evidenced by the general slowdown in manufacturing activity on a global scale observed in October, with Western countries leading the way.

In the month just ended, the global manufacturing PMI reached its lowest value since mid-2020, below the 50 threshold. This decline reflects a weakening on the orders front and an increase on the inventories front - values usually interpreted as signs of recession. Similarly, world trade in Q3-2022 also seems to join the chorus, providing the evidence of a deceleration after a first half of solid growth.