Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

Exchange Rates LME Copper Non Ferrous Metals Doctor Copper SaysIn the broad basket of commodity prices, "Doctor Copper" has a reputation for providing valuable insights about economic trends: we are talking about copper, given its many applications in multiple sectors (e.g. construction, electronics, the energy sector, transport and so on).

An increasing demand, and consequently a rising copper price, therefore tends to suggest an expanding economy; a falling price, in the face of shrinking demand, may instead indicate a coming slowdown in the world economy. This is therefore an anticipatory signal with respect to official macroeconomic data, useful in assessing the health of the world economy.

In addition to the actual supply and demand conditions, the price of copper also reflects the expectations of highly specialized traders about the prospects of the world economy: it is therefore considered a source of "knowledge" because, operating on the market (agreeing to sell at one price or buy at another), traders actually "reveal" their expectations.

It is, of course, not an official indicator designed to monitor economic activity, and should therefore be interpreted with relative caution.

Copper price dynamics: a look at the last few months

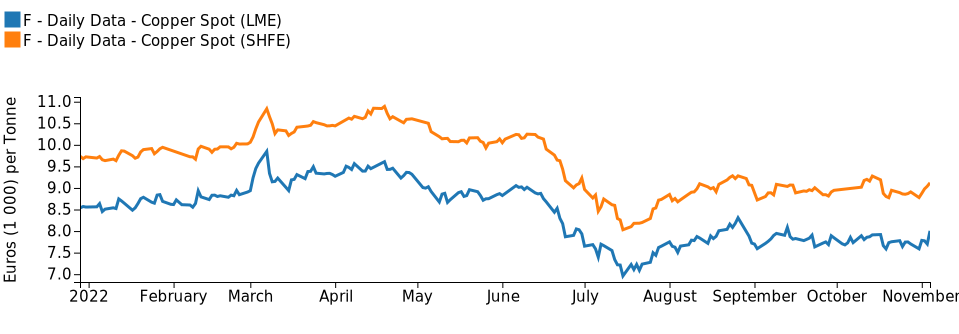

Looking at copper prices over the latest months, we can see how, after a slump that began in spring and became more pronounced in the first half of the summer, the price partially recovered in the second half. Since the beginning of September, the price has been showing substantial stability, both on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

Copper spot price: daily data, in euros

The spring turnaround in the price of copper is linked to the monetary policy tightening initiated by the US Federal Reserve, and several other central banks worldwide, in the face of rising inflation, and incorporates the markets' growing fear of a possible recession. In addition to that, we can find the China factor: the weakness of Chinese demand also weighed on the price, in a context of persistent zero-Covid policy, considering that the country accounts for over 50% of copper consumption on a global scale.

It should also be noted that, in recent months, both the LME and SHFE prices have been in backwardation (spot price higher than future price), indicating that the market expects possible (slight) reductions in the near future.

Copper spot and future price: daily data, in euros

|

|

|---|

This stability therefore seems attributable to the strong uncertainty that is dominating the economic scene, in which experts still do not clearly see the likely direction of the global business cycle.

Weekly update: copper price & macroeconomic scenario

Let us now take a closer look at the dynamics of copper price over the past week: in this climate of general stability, modest fluctuations in quotations occurred.

In particular, we can see a contraction on Monday due to the release of China's Purchasing Managers Indexes (PMI), which were lower than expected in October for all sectors. Markets thus discounted fears of falling Chinese demand, against a backdrop of rising Covid cases and lackluster macroeconomic signals.

We can then see a slight rise on Tuesday, November 1, ahead of the Fed's monetary policy meeting, reflecting markets' hopes for an easing of the US monetary policy's restrictive stance.

Conversely, the FED meeting led to a new rate hike of 75 basis points: the target range for the federal funds rate is now 3.75-4%. Powell confirmed that it is still premature to speak of a monetary policy easing, although there was talk of a reduced speed of the tightening process compared to what has been done so far, a calibration of interventions aimed at assessing their effects.

The chairman of the FED emphasized the issue of the delay with which rate hikes affect economic activity and inflation, which therefore makes these moves particularly sensitive. Adding to the complex picture is the issue of financial markets, which tend to react even before the policy is implemented, in relation to expectations.

The outcome Federal Open Market Committee meeting strengthened the dollar, which moved away from parity with the euro.

In the absence of the market's expected signs of monetary policy normalization, the spot price of LME copper contracted on 2 and 3 November, while the SHFE rose after Monday's decline on rumours of a possible easing of the country's zero-Covid policy. Also supporting the copper price was the news, released on Thursday, of a blockade at the Peruvian Las Bambas mines.

More significant was the rise in copper prices yesterday (November 4), first on the Chinese market and then on the LME, as well. In fact, further reports circulated in China that the government is considering abandoning the zero-Covid policy. This was accompanied by official statements that economic growth remains a priority for the Chinese government and that liberalization policies will continue. All this has fuelled expectations of an increase in inputs demand for industry and construction in China, promptly registered by the price of copper.

Conclusions

The world economic cycle is likely to be subject to high uncertainty in the near future. Paying attention to the dynamics of the copper price will provide an additional source of information on possible developments.