Prices poised between relaxation of zero-covid policy in China and slowing global growth

An overview of current trends in the commodity landscape

Published by Giulio Corazza. .

Energy Ferrous Metals Food Non Ferrous Metals Commodities Financial Week

News had leaked out last week that China was planning to ease its anti-covid policy. Initially the news was denied, however, on Friday it was announced that it would reduce quarantine time for travelers and close contacts of those with covid. This represents an important step for China's economic development and could be reflected in a general increase in prices across the commodity sector.

After last week's increases in some commodity sectors this week there is a general decrease in the price level. The exception is the prices of nonferrous metals, which are also rising again this week.

ENERGY

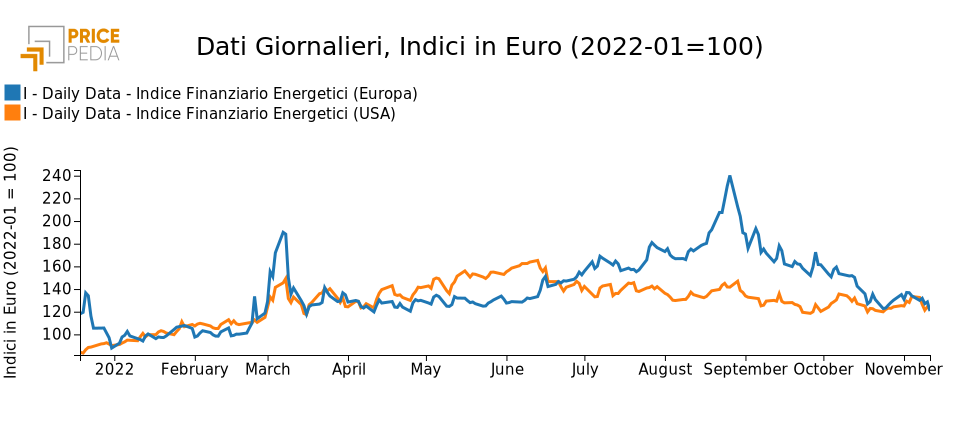

On the energy products front, after last week's increases, PricePedia financial indexes signal a phase of price retraction.

PricePedia financial indexes of energy prices in Europe and the U.S.

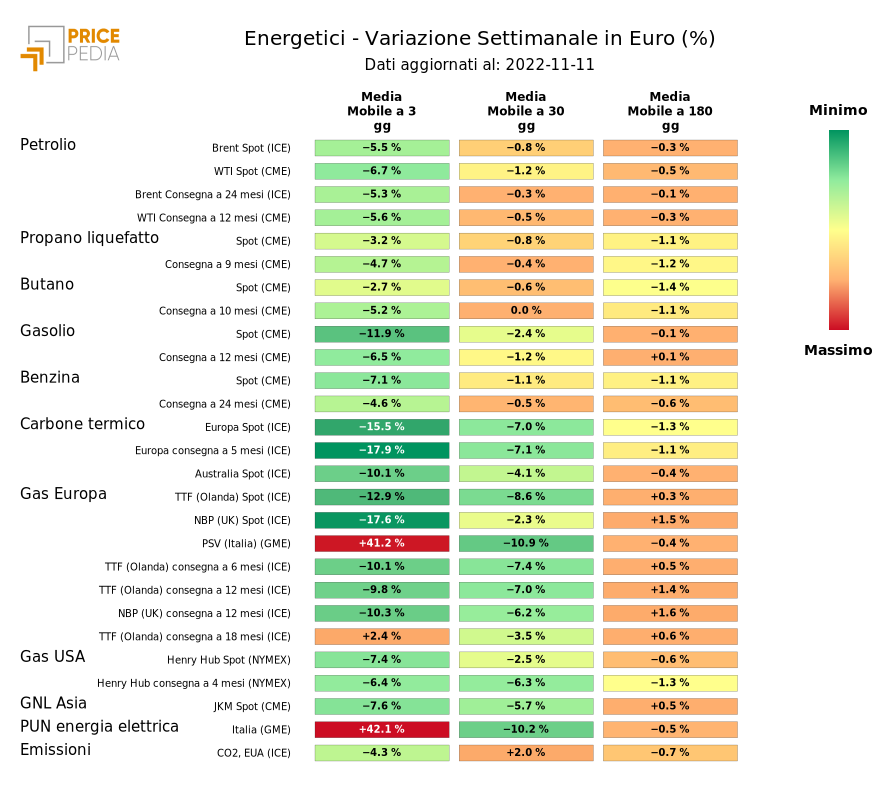

The heatmap below provides an overview of energy product price trends.

The price of oil, which last week was fueled by hopes of an easing of anti-covid policies in China, entered a correction phase this week until Friday morning, when the price rose again.

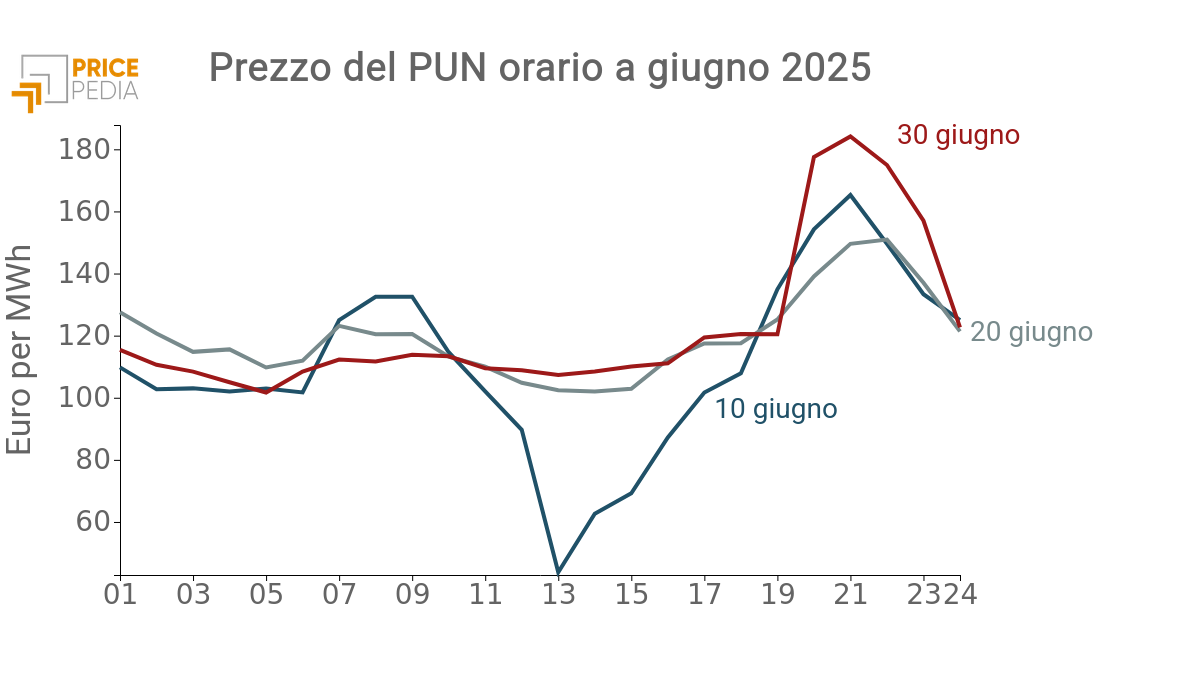

In the face of the early winter cold, there are reports of sharp increases in natural gas and electricity prices in Italy.

HeatMap of energy prices

METALS

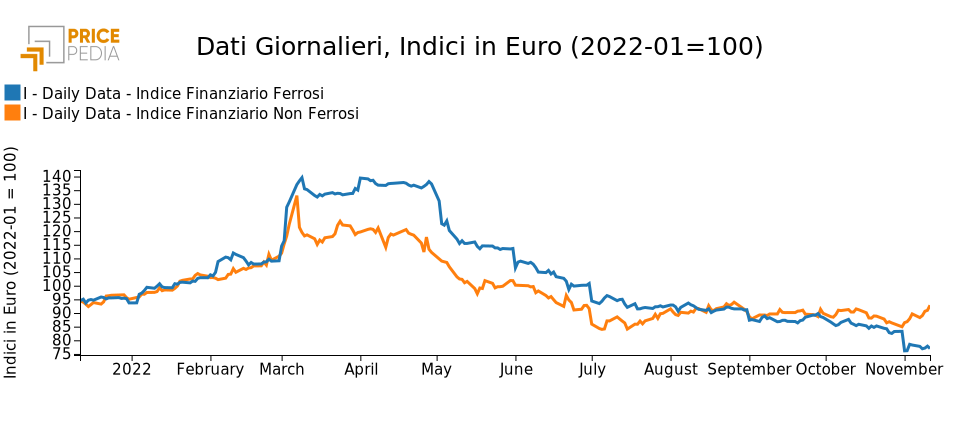

The following graph shows the PricePedia financial indexes of ferrous and nonferrous metal prices. While the ferrous index is declining sharply, the nonferrous index tends to be more resilient. Since July, this dynamic has become increasingly clear: ferrous metals are experiencing a decline that is being countered by resistance in nonferrous metals.

Financial PricePedia indexes of ferrous and nonferrous metals

FERROUS

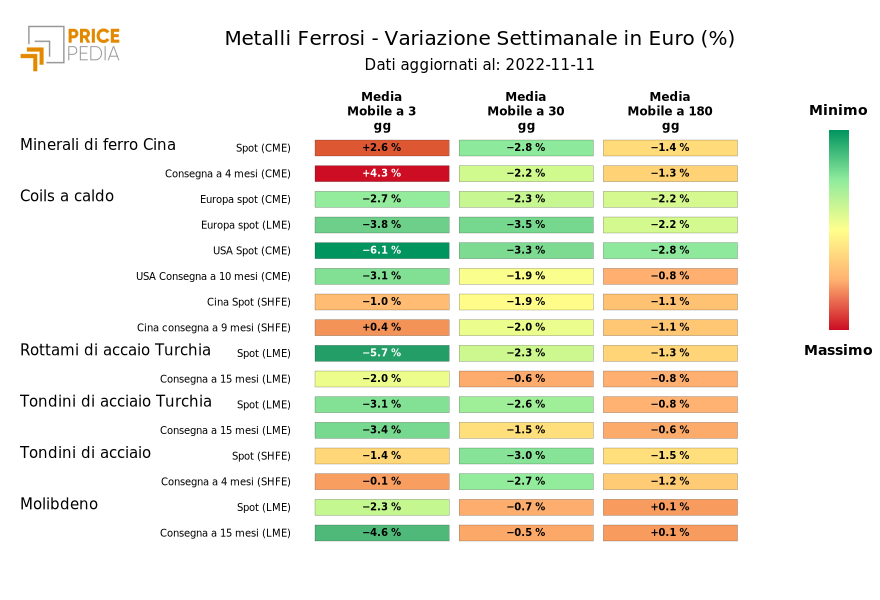

The heatmap below provides an overview of ferrous metal price trends. It reports

the continued decline in hot coils quoted on the financial markets (LME, ICE and SHFE).

In Europe, the 180-day moving average in the US also shows a weekly decline of more than -2%.

Conversely, the price of iron ore in China bucked the trend this week: the rate

weekly change in the three-day moving average of the spot contract and the four-month contract registers

an increase of 2.6 percent and 4.3 percent, respectively.

HeatMap of ferrous metal prices

NON FERROUS

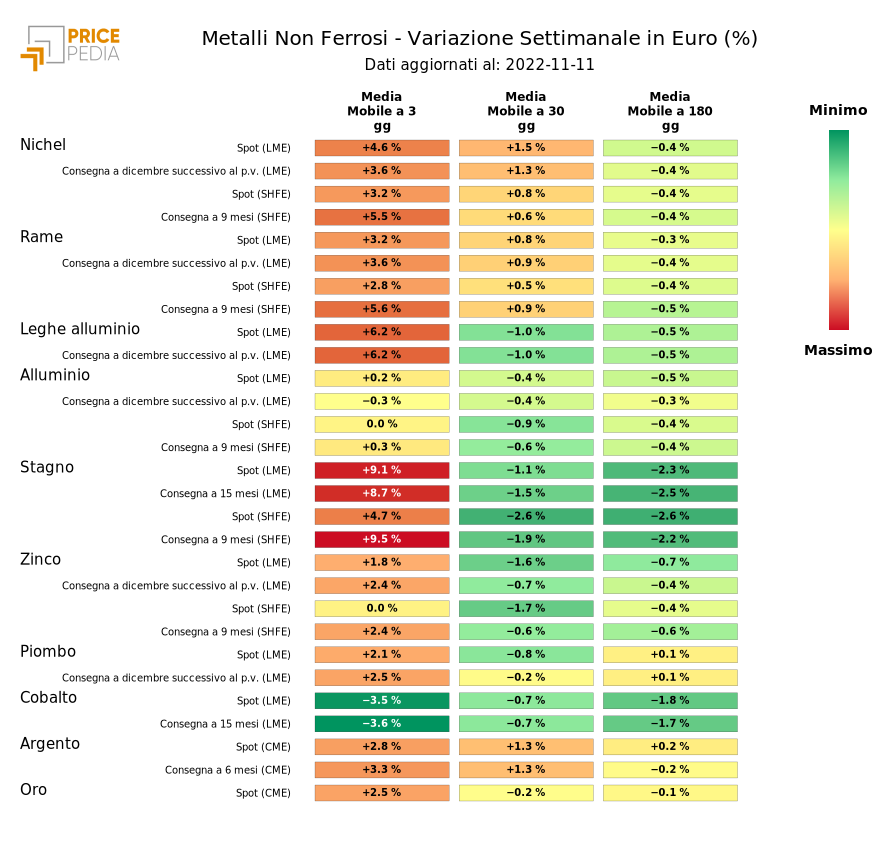

The heatmap below provides an overview of the price trends in nonferrous metals. As can be seen, almost the entire sector is showing an increase.

Particularly pronounced is the variation in the prices of tin, nickel and aluminum alloys.

HeatMap of non-ferrous metal prices

FOODS

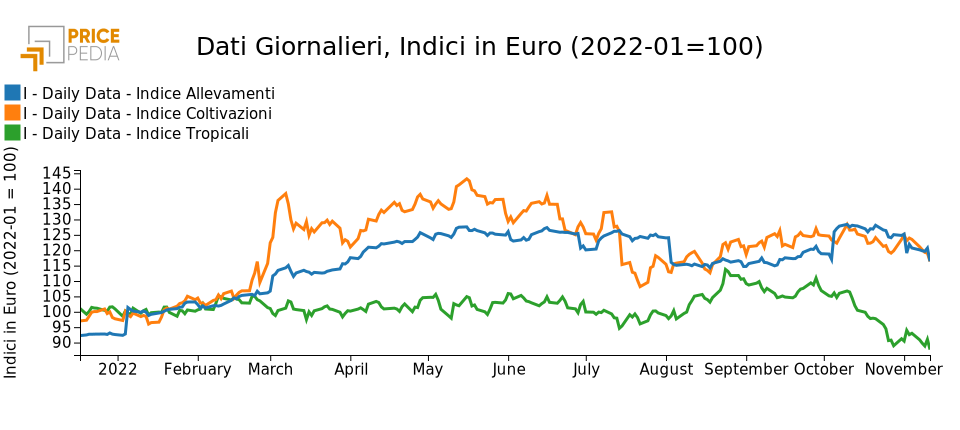

The following graph shows the PricePedia financial indices of food prices. All inidices show negative changes in the last period.

PricePedia Financial Indices of Food Products

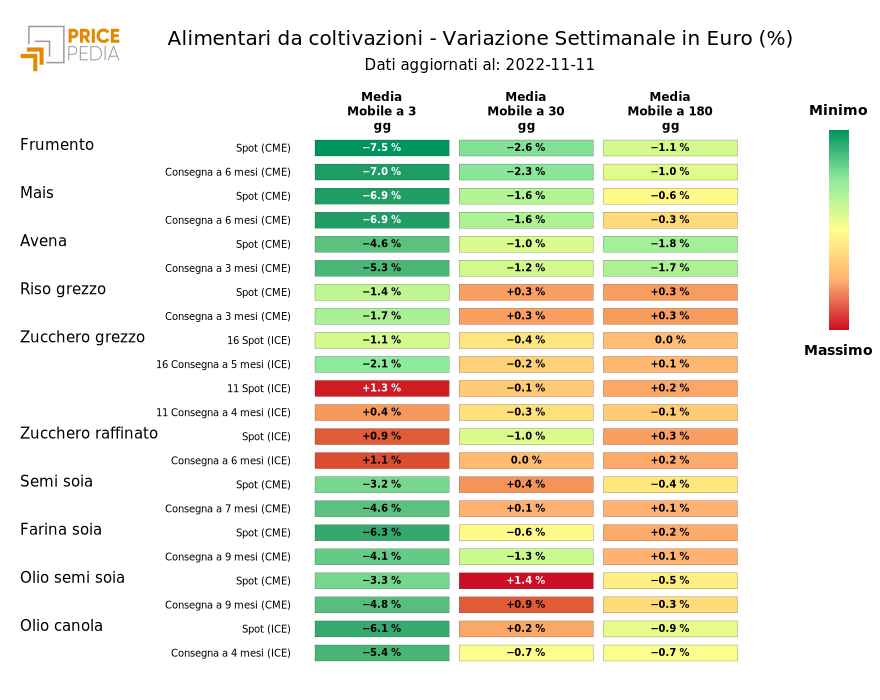

FOODS FROM CROPS

The heatmap below provides an overview of the trend in crop food prices. As can be seen from the map, most crop products show a decrease. Only the price of refined sugar remains

on a slight upward path.

In a medium-term view, the downward trend in the prices of

wheat, corn and oats.

HeatMap of crop food prices