Basic inorganic chemical prices: between speculation and great uncertainty

The slowdown in the global economic cycle poses a sustainability problem for the large increases implemented between the end of 2021 and the first four months of 2022

Published by Luigi Bidoia. .

Conjunctural Indicators Inorganic Chemicals Global Economic TrendsThe article 'The Great Speculation' describes the recent price rises of organic chemical commodities and the high price increases they are suffering at the hands of the distribution system.

This article deals with the corresponding aspects of inorganic chemicals, using the same methodology based on a comparison between the prices declared by a panel of industry players (in this case represented by the Milan Chamber of Commerce Committees) and the prices recorded when the products pass through customs in the 27 EU countries.

The inorganic chemical industry

The inorganic chemical industry developed during the 19th century, reaching full development in the early 20th century. From an industrial point of view, therefore, inorganic chemistry predates organic chemistry by almost a century.

In order to analyse the different market forms and price formation mechanisms, it is useful to distinguish between basic chemicals and fine and speciality chemicals.

The production of basic products takes place on a large scale in large plants, using continuous processes.

The exploitation of economies of scale and the efficiency of the production process are two of the main competitive factors. Product homogeneity pushes companies into fierce price competition. The result is that the unit price of these products is relatively low, below USD 1 per kilogram.

The basic products, through successive synthesis and purification steps, are transformed into intermediates, to then be used in the production of specialities, through batch processes, by medium and even small companies. As one moves away from the basic products, the unit price increases, both because of the greater amount of labour and energy incorporated and because of the increasing possibility for companies to implement differentiation strategies.

Within the inorganic chemical industry, five sub-industries can be distinguished, depending on the chemical processes used.

Chlor-alkali compound industry

The basic process of this industry is the transformation of sodium chloride (sea salt) into chlorine and sodium hydroxide (also known as caustic soda). The basic products of this industry include sodium carbonate (or soda ash), calcium oxide (or lime) and hydrochloric acid. Chlorine is also used to produce vinyl chloride, the starting material for the manufacture of polyvinyl chloride (PVC). A derivative salt is sodium hypochlorite, which is widely used to produce disinfectants and bleaches.

An important role within this industry is played by potassium, which is very similar to sodium chemically, and its compounds.

Both the chlor-alkali process to produce chlorine and sodium hydroxide and the process to isolate potassium metal from caustic potash are based on electrolysis.

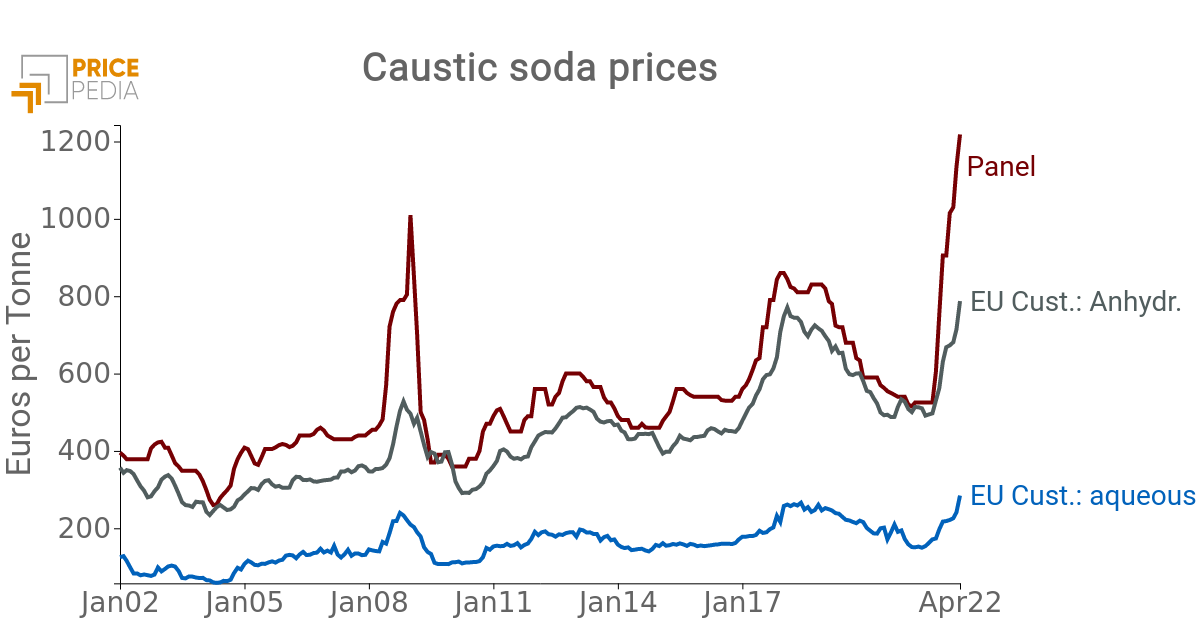

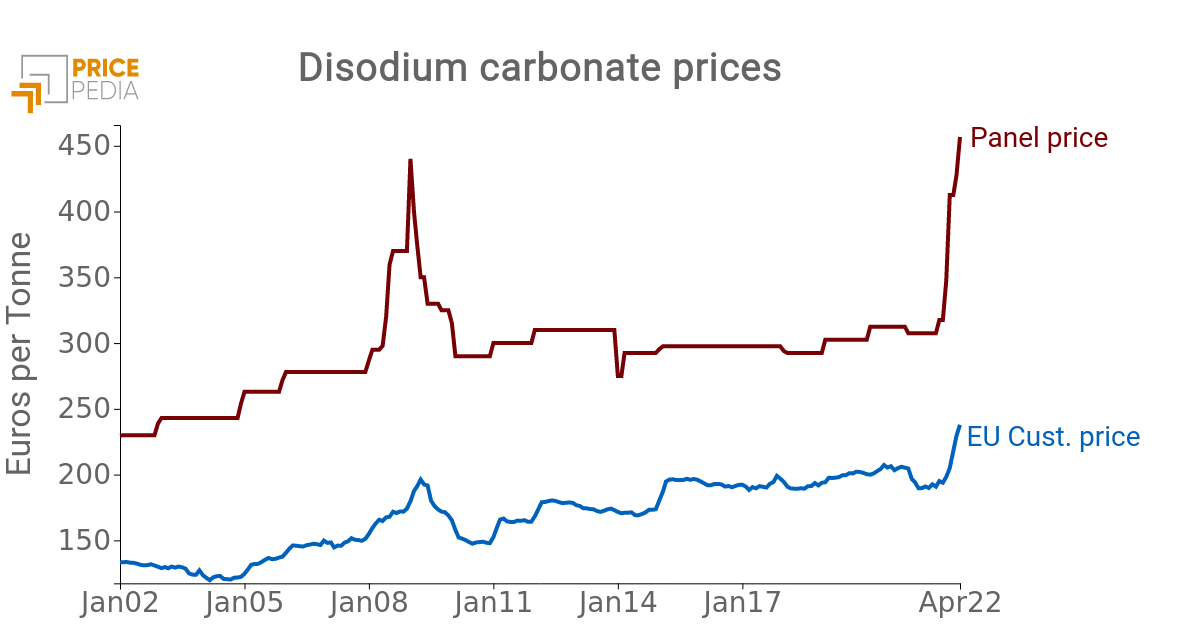

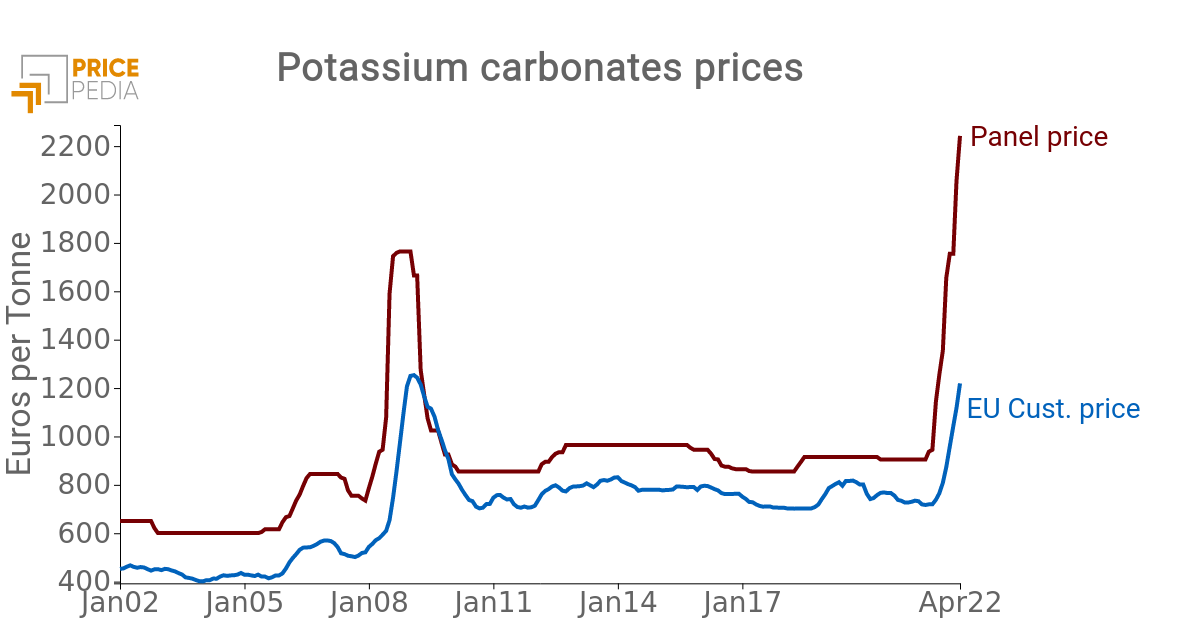

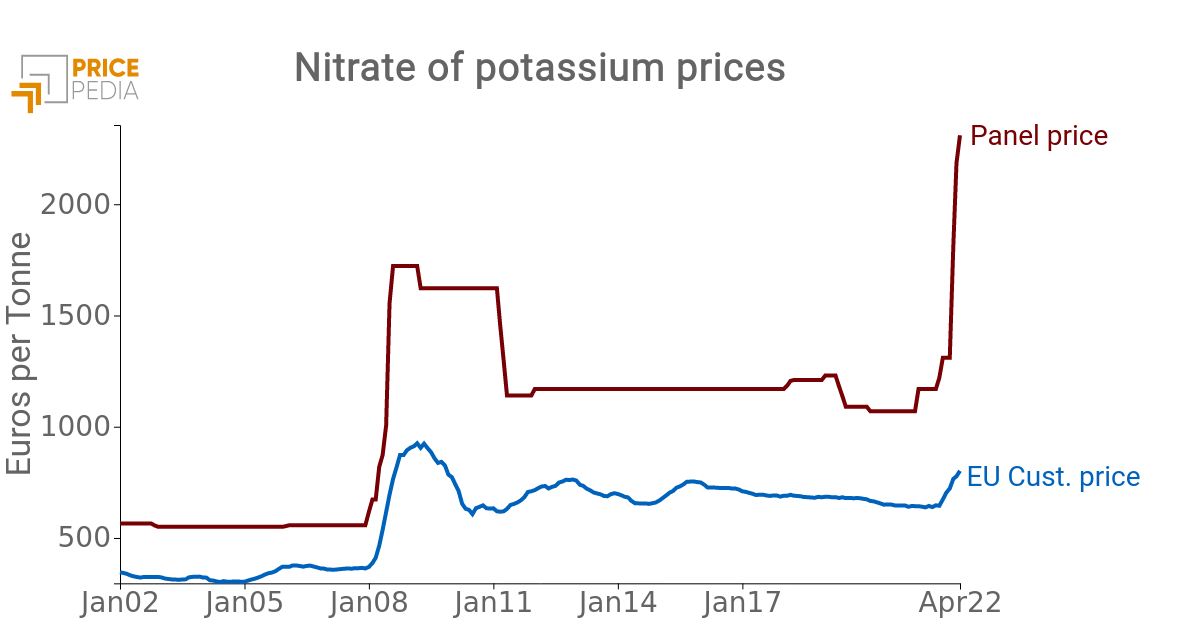

The following graphs show the prices of some of the commodities in this industry, comparing prices recorded by EU customs flows with those collected through a panel of experts.

Price of basic sodium and potassium compounds (euros per tonne)

|

|

|

|

The analysis of these graphs allows to highlight the following facts:

- for all the products analyzed, the historical dynamics of the two types of prices are perfectly aligned, indicating how the prices of each product are influenced by the same factors;

- for all products, the panel price is significantly higher than the customs price. This difference reflects the different stages of distribution to which the prices refer. Customs prices tend to reflect producer prices more, while panel prices record prices to user firms more. This distance tends to be a high percentage for products with a low unit price, reflecting the costs of transport and storage that are not proportional to the value of the product;

- for all four products analyzed, between the end of 2021 and the beginning of 2022 there was a very strong increase in panel prices, corresponding to much more contained increases in customs prices;

- particularly high are the increases recorded by potassium compounds, which in a few months passed from values close to 1000 euro / ton to values close to 2000 euro. The increase in the cost of producing metallic potassium by electrolysis appears to have provided the rationale for these increases.

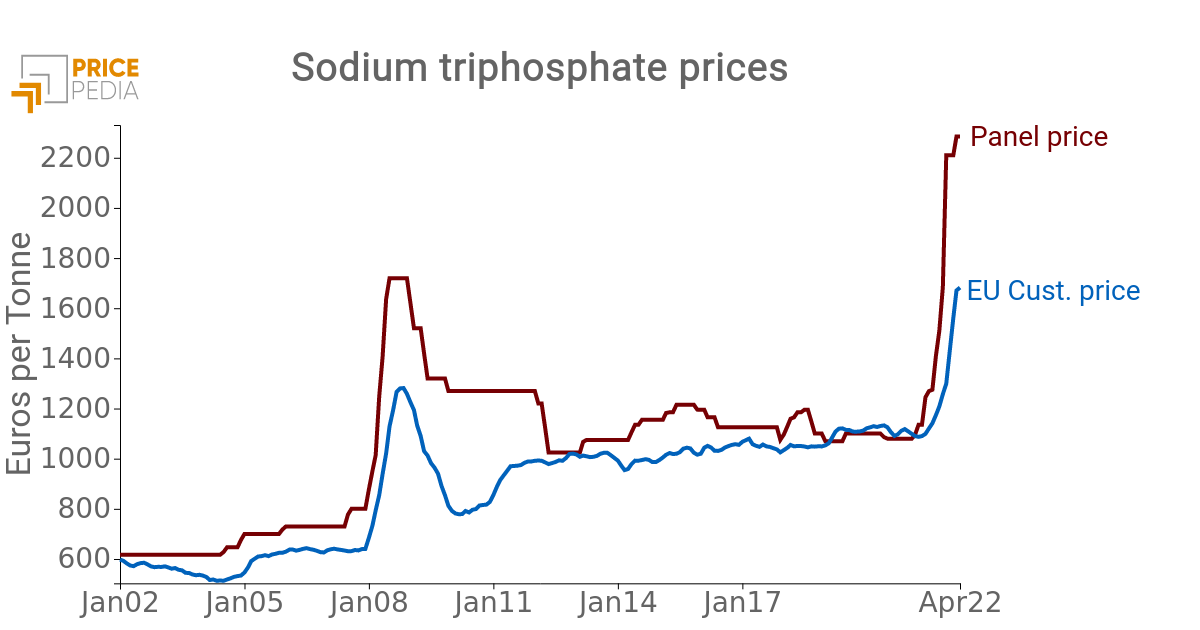

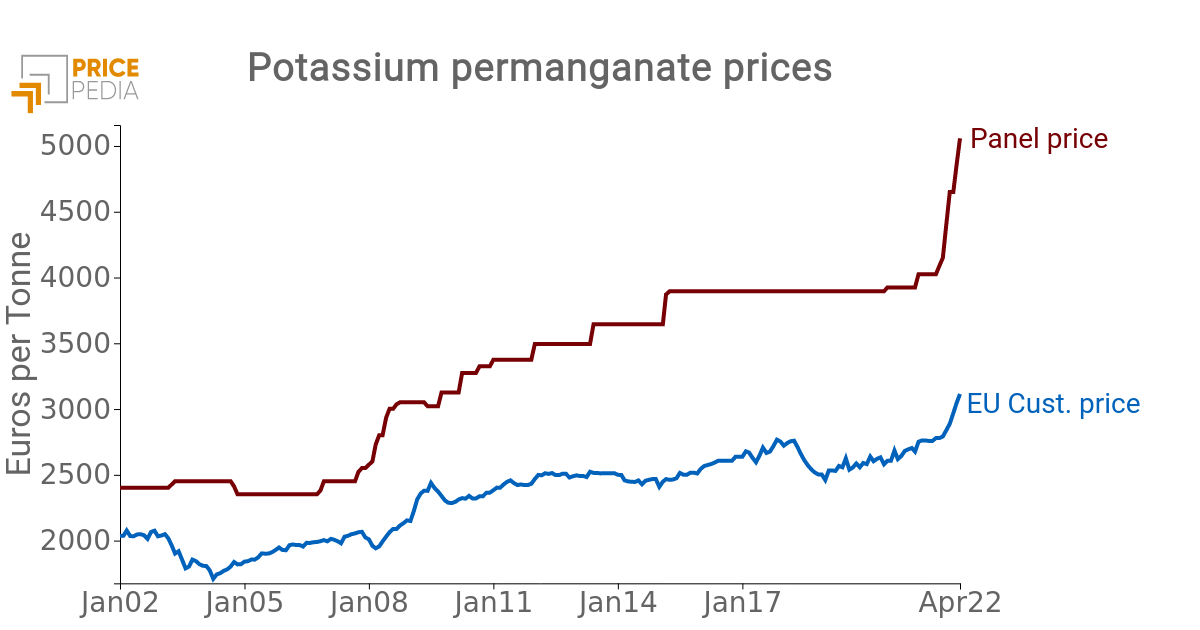

The following two graphs show compounds, one derived from sodium and one from potassium, which have higher price levels than the basic products. The above facts apply to sodium triphosphate. The price of potassium permanganate, on the other hand, follows a different model, with a clear growth trend and a growing gap between the panel price and the customs price. This seems to be the result of policies of differentiation of the offer, made possible by the wide variety of uses of the product in very different sectors.

Price of other sodium and potassium compounds (euros per ton)

|

|

Nitrogen Compound Industry

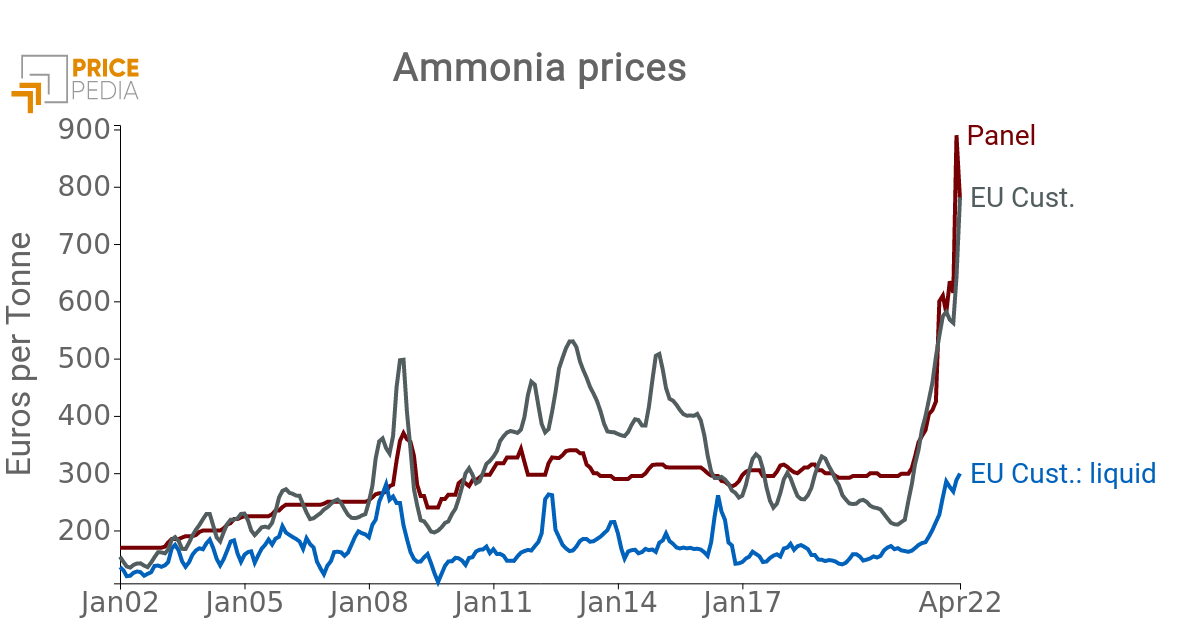

Ammonia is the basic element of this industry. Through an oxidation process, this is transformed into nitric acid, which is the second basic element of this industry. Most nitrogen compounds, mainly fertilisers and explosives, are derived from ammonia and nitric acid.

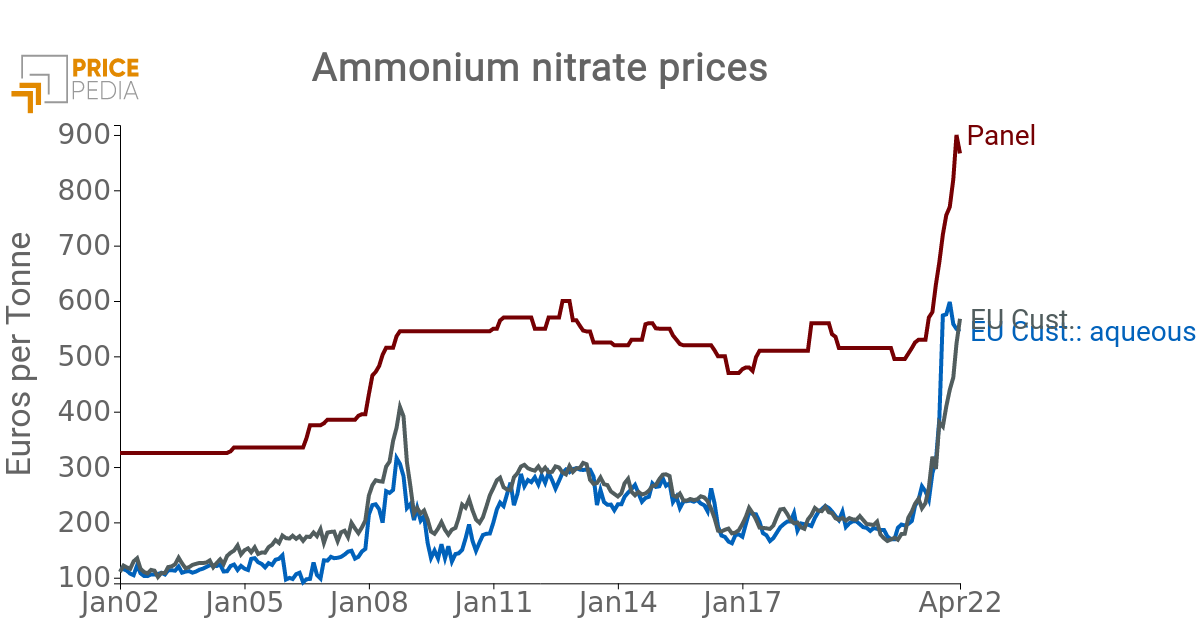

The following two graphs show the price of ammonia and ammonium nitrate.

Again, the facts reported for the commodities of the chlor-alkali compound industry apply, with one important exception. The increase in the last few months reported by panel and customs prices has similar intensities, signalling the objectivity of the determinants behind these increases. The production of ammonia requires large amounts of heat energy, and for some processes, electricity. Furthermore, the low unit cost of the product makes the ammonia market highly regional. In this situation, the growth of electricity prices in Europe, which increased 4-fold between the first and second half of 2021, could not fail to have a strong impact on the costs and prices of ammonia and its derivatives.

Price of nitrogen compounds (euros per tonne)

|

|

Sulphuric acid and sulphate industry

Sulphuric acid is the chemical produced in the largest quantities worldwide. Its price has rarely exceeded $100 per tonne. For a long time, it was produced from sulphur extracted from mines. With the development of the oil industry and the growing demand for ever purer fuels, sulphur production is increasingly becoming a by-product of fuel purification processes. The reaction of sulphuric acid with metals and non-metals produces a variety of sulphates, from the most common ammonium sulphate to the more differentiated barium sulphate and chromium sulphate.

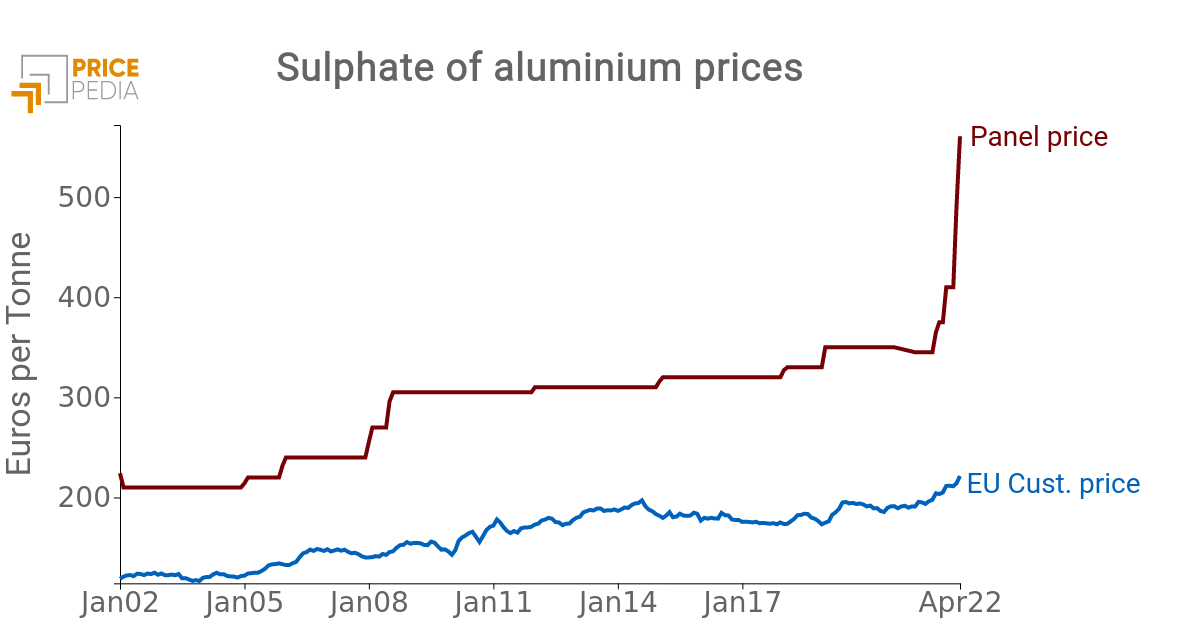

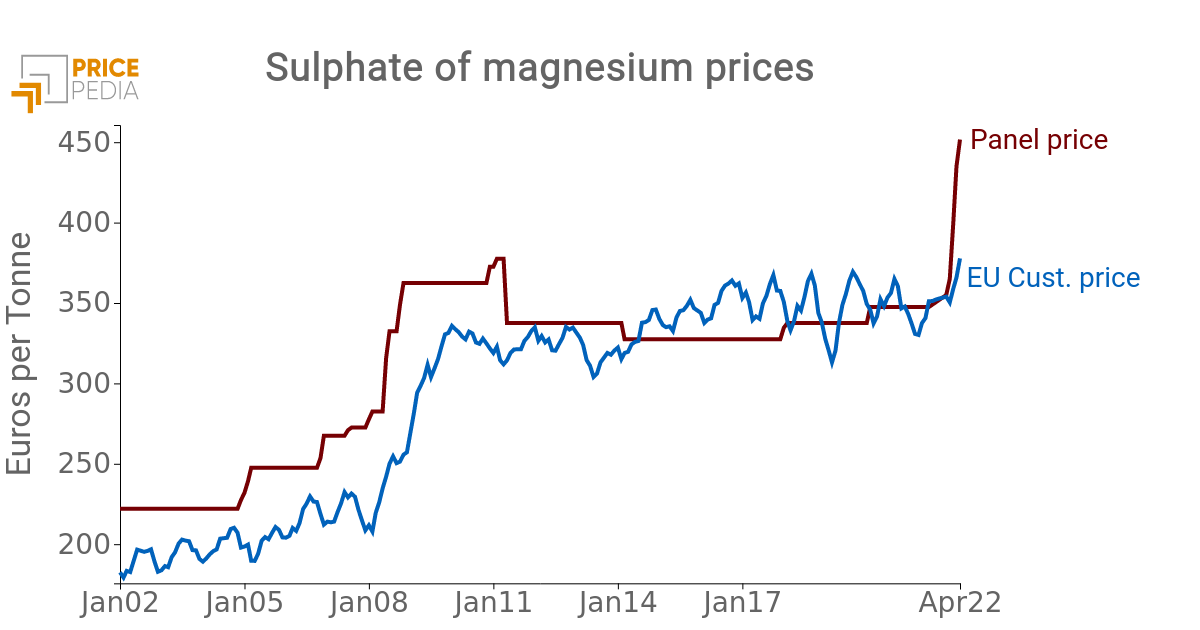

Price of sulphates (euros per ton)

|

|

The abundant production of sulphuric acid, its low price and the relatively low costs to produce its derivatives have limited the average price level of sulphates. Over the course of this century, their prices have been on an upward trend in relation to the dynamics of companies' general costs. The factor characterising them in recent months is the significant growth recorded in expert panel surveys, which is, however, matched by a relative stability of prices recorded at customs.

Phosphorus Compound Industry

Phosphorus is extracted from phosphate ores, mainly phosphoric acid, produced by the reaction of phosphates with sulphuric acid. The price of phosphoric acid can vary greatly depending on its purity from sulphuric acid. Phosphoric acid is the starting material for the production of fertilisers and, with high degrees of purity, for detergents or used in the food and pharmaceutical industries.

Metal compounds industry

The metal compound industry groups together inorganic chemicals not included in the industries described above. This industry mainly produces metal oxides and metal salts, obtained by combining a metal with a non-metal.

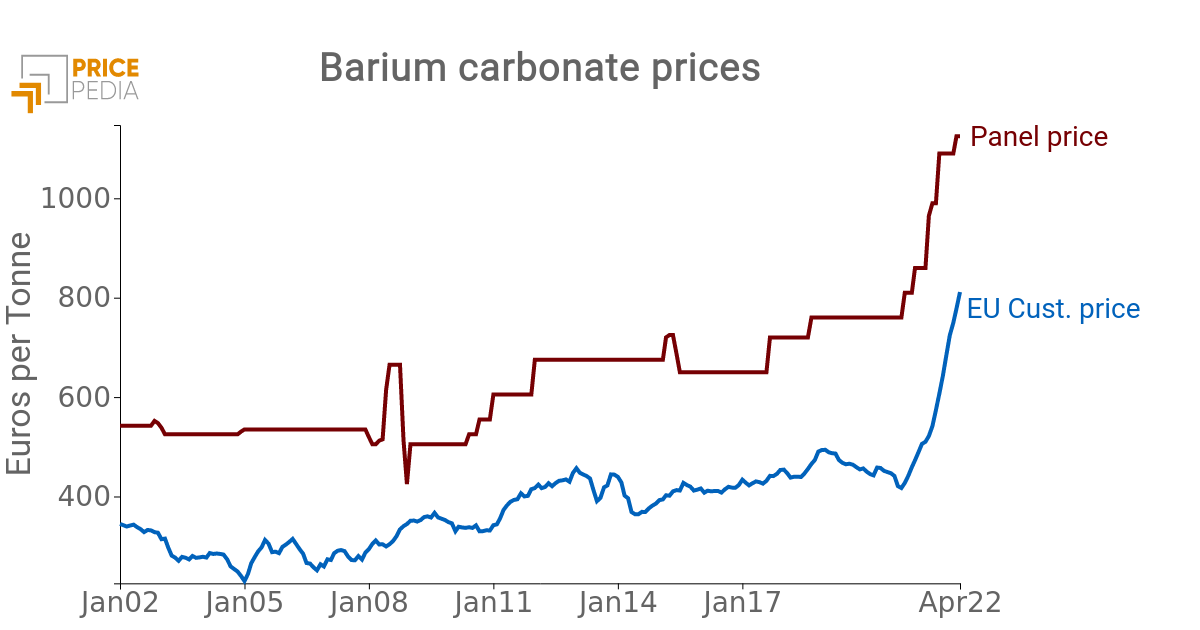

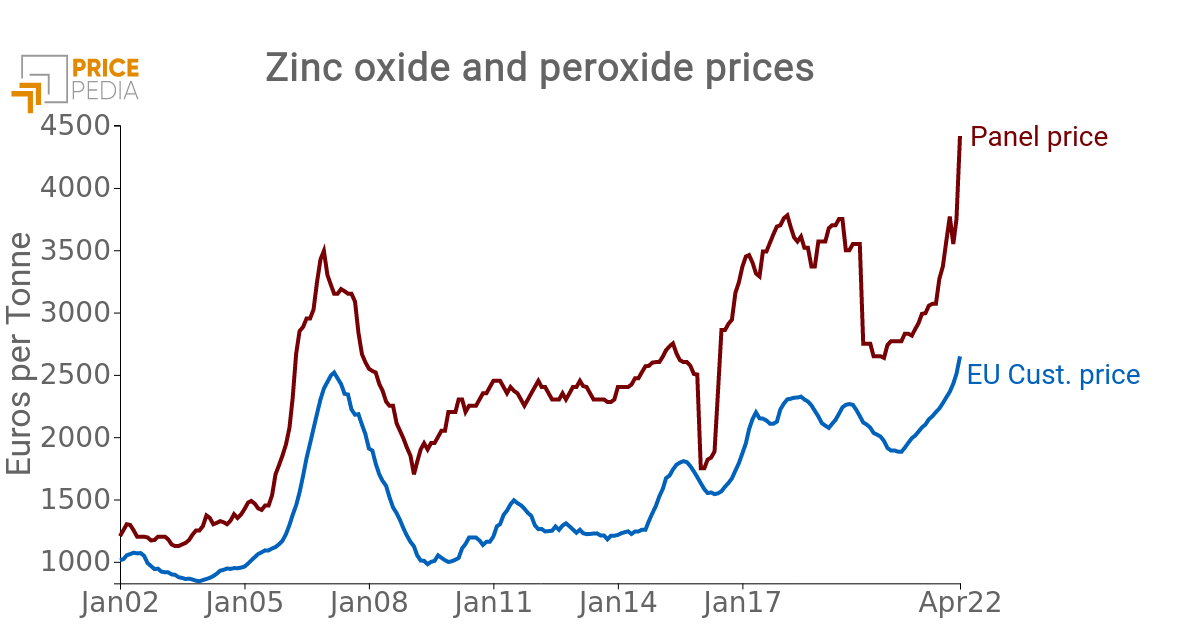

Below is a price graph of two metal compounds.

Price of barium and zinc compounds (euros per ton)

|

|

The facts described for chlor-alkali compounds are also valid for these prices, with one exception: the price growth recorded in recent months is consistent between the two different surveys. As in the case of the nitrogen compound industry, underlying this coherence are objective determinants, such as the generalized rise in metal prices. In fact, between the spring of 2020 and that of 2022, the price of metals in Europe doubled on average.

Conclusions

The recent sharp increases in the prices of basic products of inorganic chemistry are determining factors in the increase in the price of metals and electricity, which has strongly influenced the production costs of ammonia and other chemical compounds produced by electrolysis.

These determinants justify trend increases (compared to the corresponding month of 2021) in the basic prices of inorganic chemicals in the order of 60%. The prices of the same goods recorded by panels of operators in the sector, however, recorded much more sustained increases, the result of probable speculative actions.

The industries in which these actions seem to be most present are that of sulfuric acid and sulphates and that of chlor-alkali compounds. The products of the first industry are in fact relatively protected from increases in the prices of metals and electricity. Despite this, the panels of operators in the sector record very high rates of price growth. In the case of the chlor-alkali industry, on the other hand, the direction of price changes is certainly justified by the increase in the price of electricity in Europe. On the other hand, the intensity of these increases is not equally justified.