Commodity prices amid geopolitical tensions, inventory changes, and uncertainty over US tariffs

Trump considers reducing US tariffs on steel and aluminum

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekFinancial commodity markets remain characterized by high volatility, with prices recording opposite movements in recent days.

Brent opened the week higher, supported by persistent geopolitical uncertainty in the Middle East and rising tensions between the United States and Iran. Washington is considering the seizure of sanctioned Iranian tankers off the Strait of Hormuz and has recently deployed a second aircraft carrier to the region, intensifying tensions.

Additional risks have also emerged from the Russian-Ukrainian front, with reports of a Ukrainian drone attack on the Lukoil refinery in Volgograd, one of Russia’s main refining infrastructures.

Despite these tension factors, the oil market experienced a significant price correction on Thursday, triggered both by reassuring rumors regarding the progress of negotiations between the United States and Iran and by the release of the weekly Energy Information Administration (EIA) report, which highlighted a sharp increase in U.S. crude oil inventories and confirmed that overall global supply is expected to exceed demand in 2026.

The European natural gas market closed the week with a sharper decline than oil. In both of the first two trading days, financial prices of the TTF Netherlands fell by 5%, due to milder weather forecasts and the regularity of flows from Norway.

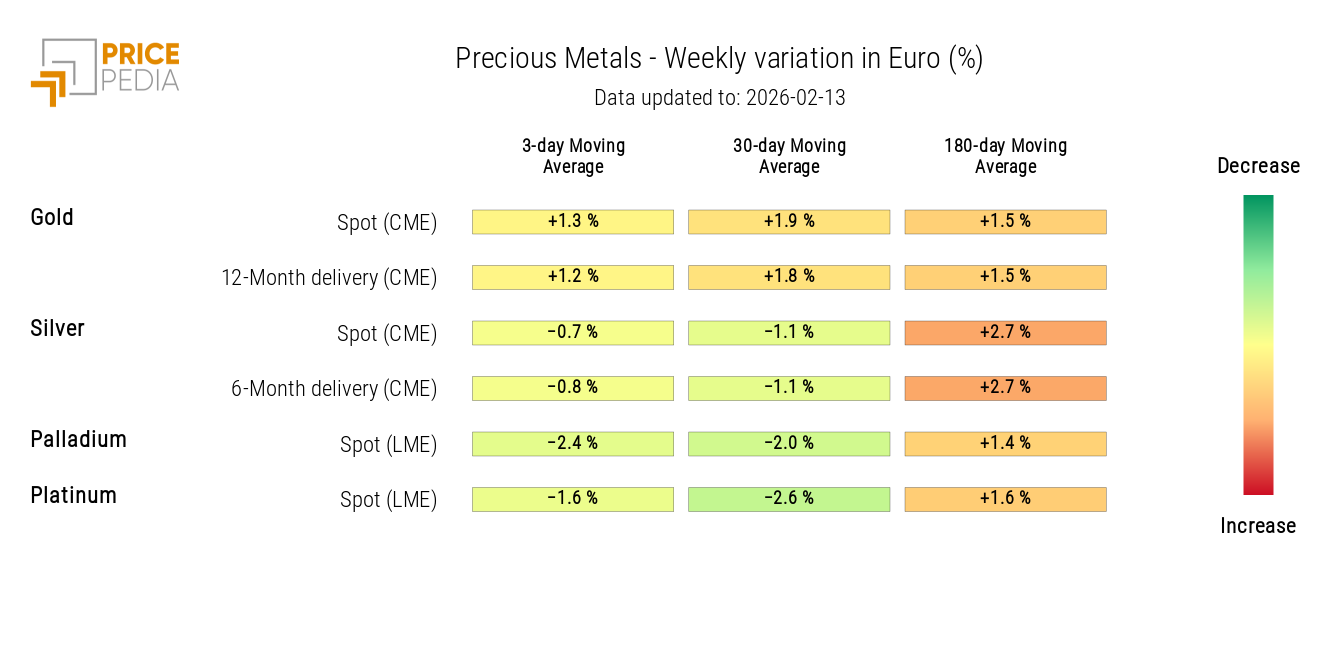

Precious metals prices started to recover, supported by renewed geopolitical tensions and the depreciation of the U.S. dollar. During the week, gold and silver returned above $5,000/ounce and $80/ounce respectively. However, a picture of marked volatility remains for both safe-haven assets: in Thursday’s session, a correction was recorded, with gold down 3% and silver down 10%, amid easing geopolitical tensions and the simultaneous strengthening of the dollar.

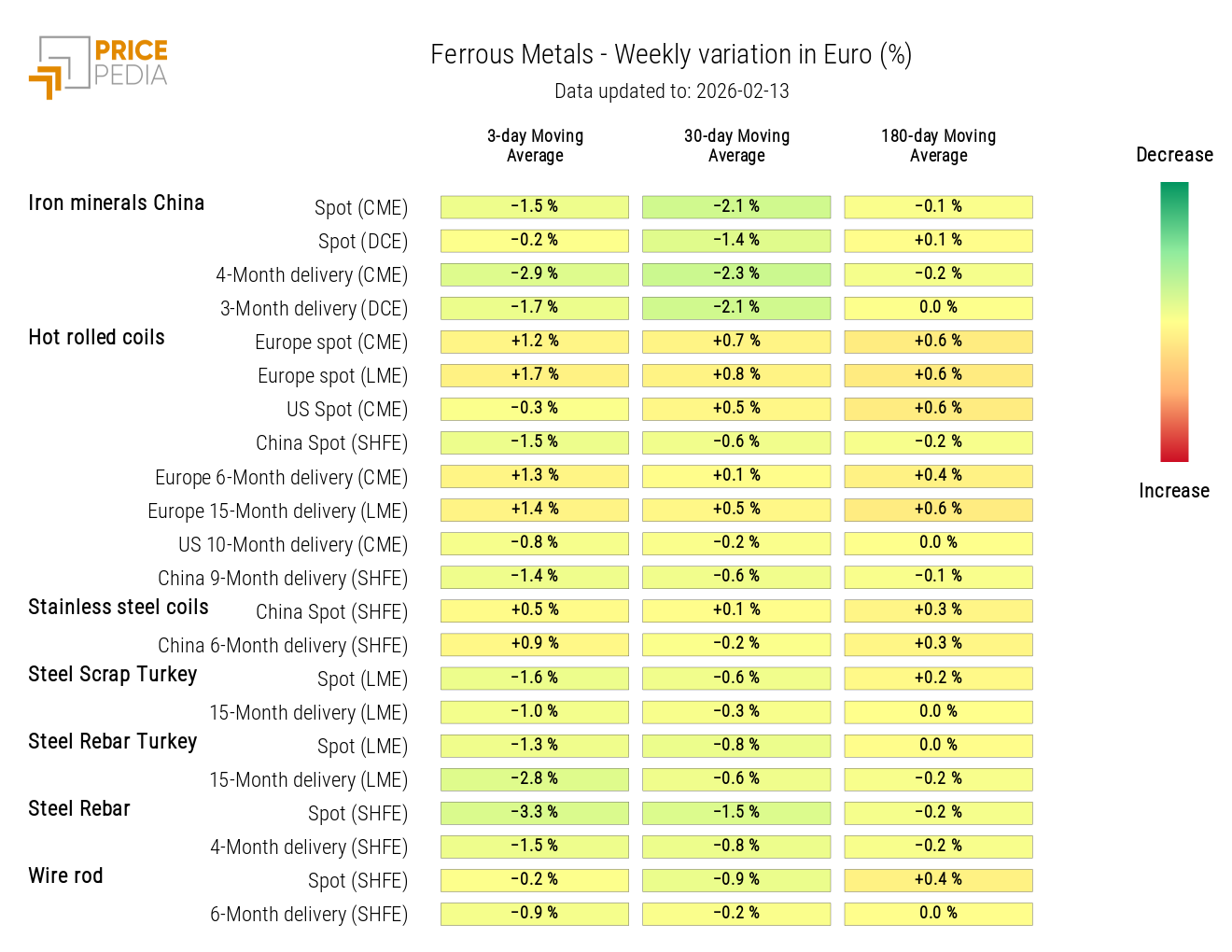

In the industrial metals sector, ferrous metals prices show divergent trends, with sideways dynamics in Europe and declines in China, mainly due to the drop in Chinese prices of SHFE rebar.

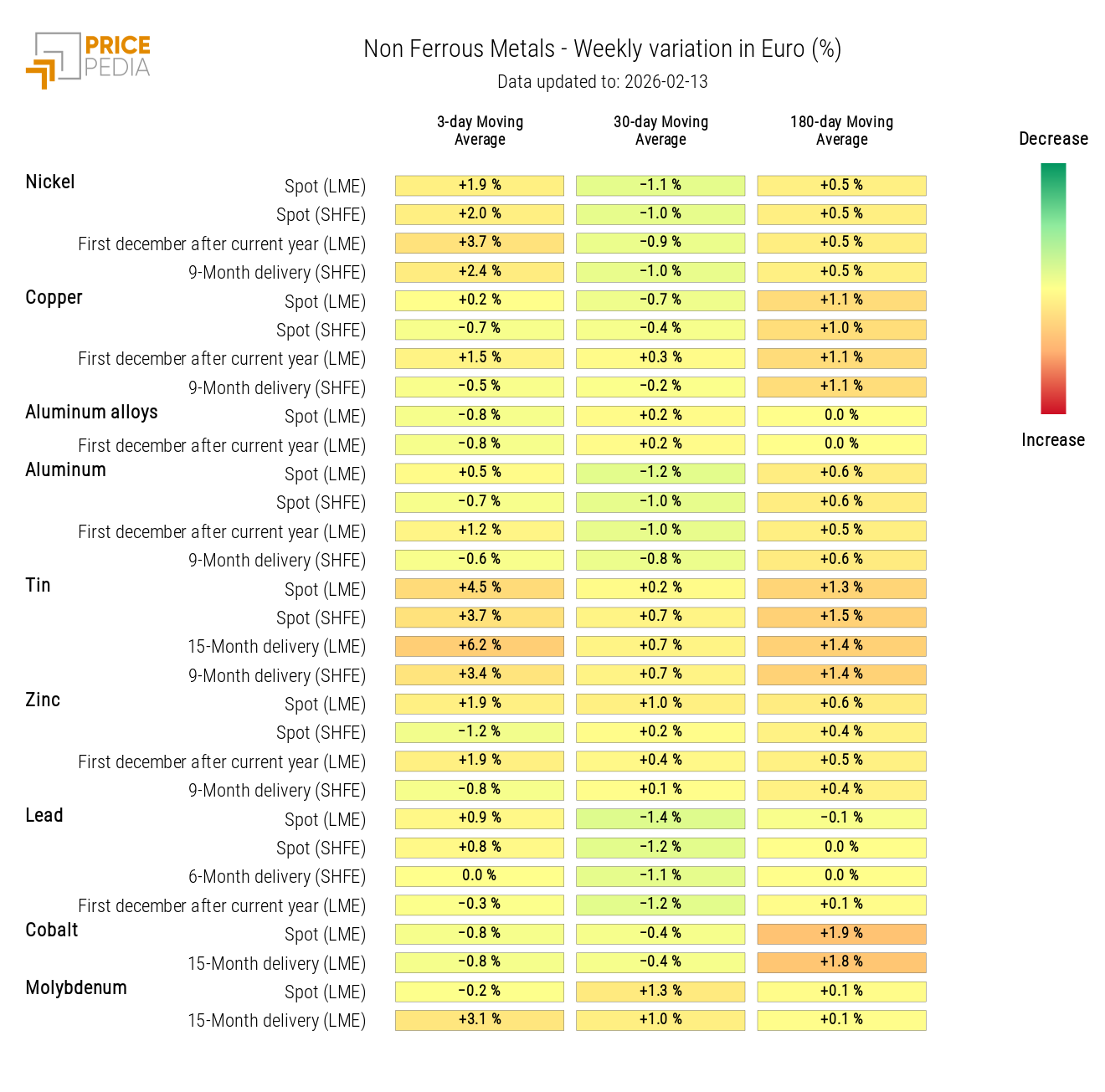

Among non-ferrous metals, a generalized increase was observed at the beginning of the week, especially for tin, which partially recovered from last week’s sharp fall, when it had lost over 15% compared to previous weekly levels.

This was followed by nickel, which recorded a weekly increase linked to new concerns about future supply from Indonesia. For 2026, in fact, the Indonesian government has drastically reduced the production quota of PT Weda Bay Nickel, the world’s largest nickel mine, with the aim of rebalancing global supply and supporting prices.

Overall, however, most non-ferrous metals closed the week substantially stable compared to last Friday, as the decline recorded in the final session effectively offset the gains accumulated in previous days.

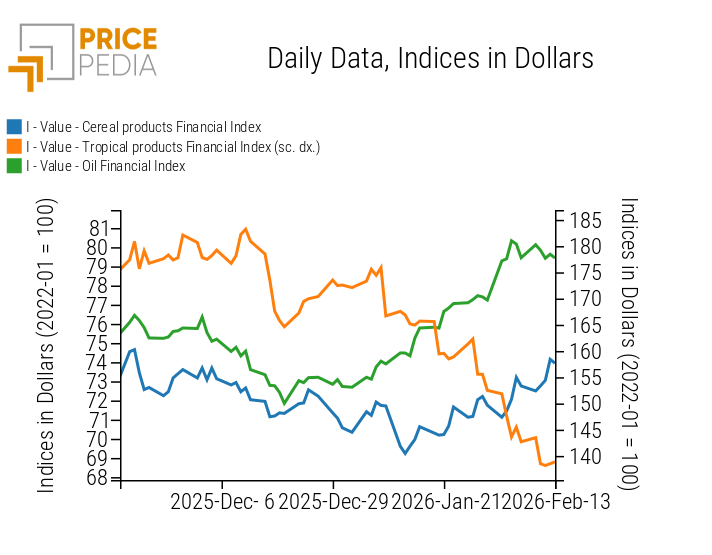

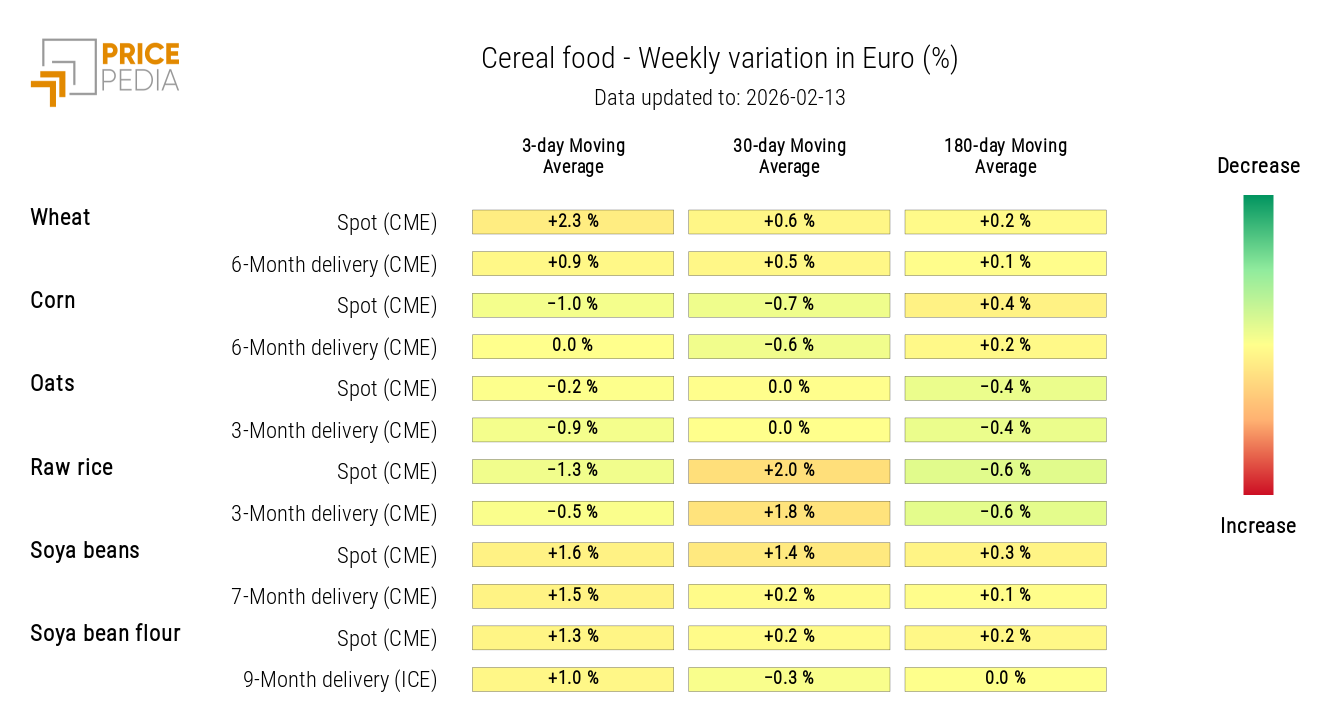

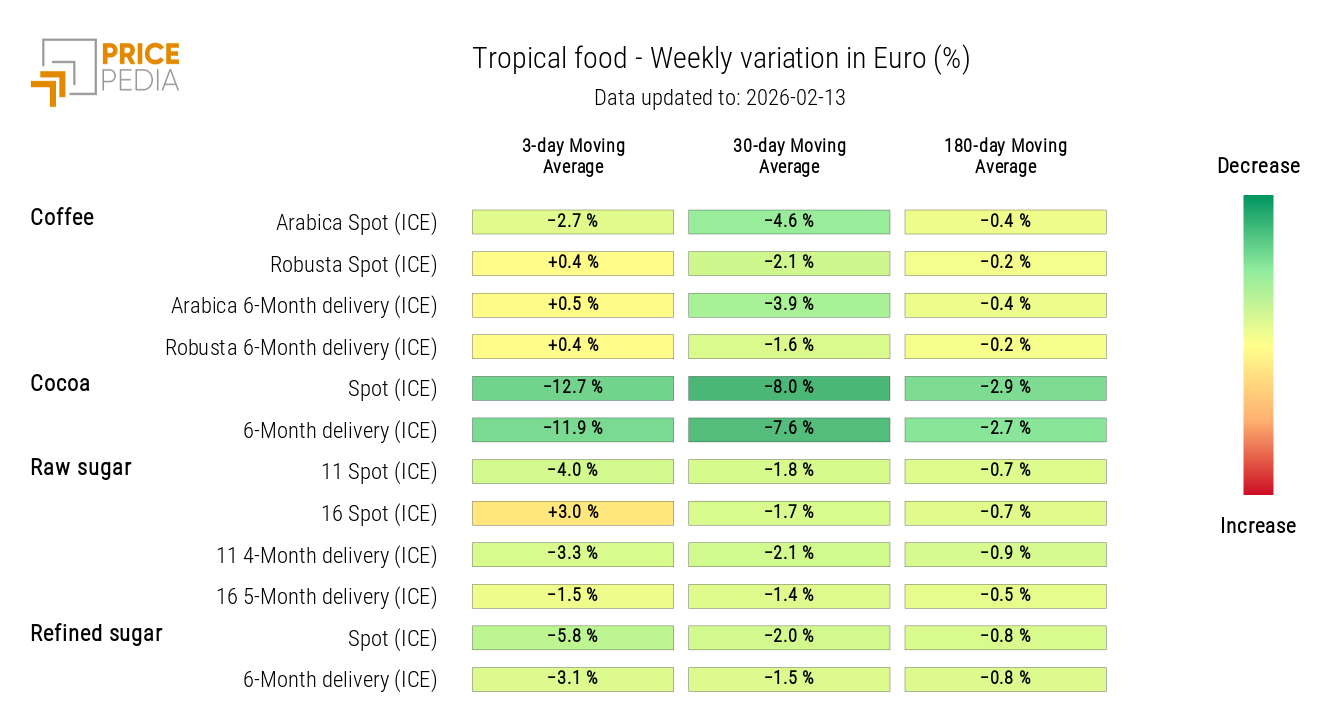

In the food commodities segment, grains prices show a slight increase, vegetable oils remain stable, while tropical products are declining. In particular, cocoa and sugar recorded the largest weekly drops.

The decline in cocoa is attributable to expectations of a more abundant harvest in Ghana and Ivory Coast, slowing industrial demand, and Ghana’s decision to reduce the guaranteed price for producers, encouraging a greater supply flow into the international market. For some time, Ghanaian traders had avoided purchasing cocoa for export, as domestic prices were excessively high compared to international ones.

The decline in sugar, on the other hand, stems from increased production in Brazil’s Center-South region and growing expectations of a global surplus, as highlighted in the latest report by the Brazilian Sugarcane Industry Association (UNICA).

US Trade Policy on Steel and Aluminum

One of the main trade measures of the Trump administration was the introduction of tariffs on steel, aluminum, and their derivatives, with additional rates of up to 50%, aimed at protecting domestic production. Recently, however, the administration is considering reducing tariffs on certain categories of steel and aluminum products to mitigate the impact on consumers ahead of the November midterm elections. The review is part of a broader examination of goods subject to tariffs, with the objective of reducing costs for businesses and consumer prices.

In 2025, according to a study by the Federal Reserve Bank of New York, about 90% of the costs of U.S. tariffs fell on U.S. companies and consumers, rather than on foreign producers.

NUMERICAL APPENDIX

ENERGY

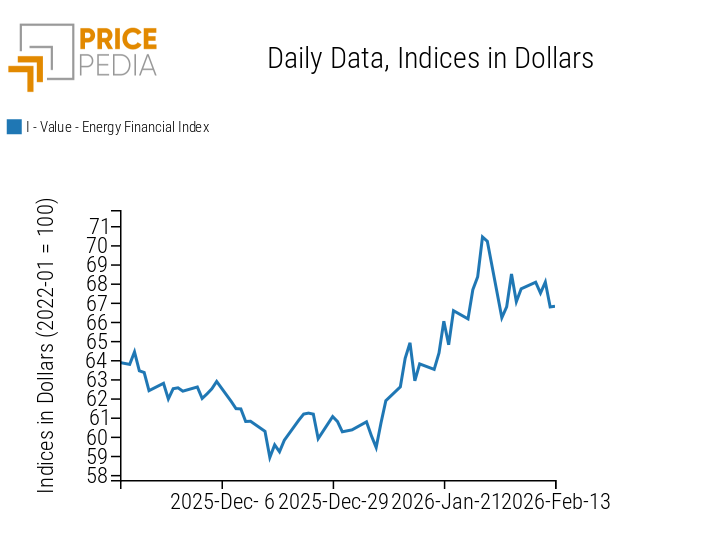

The PricePedia financial energy index, net of various fluctuations, closes the week with a price decline.

PricePedia Financial Index of Energy Prices in US Dollars

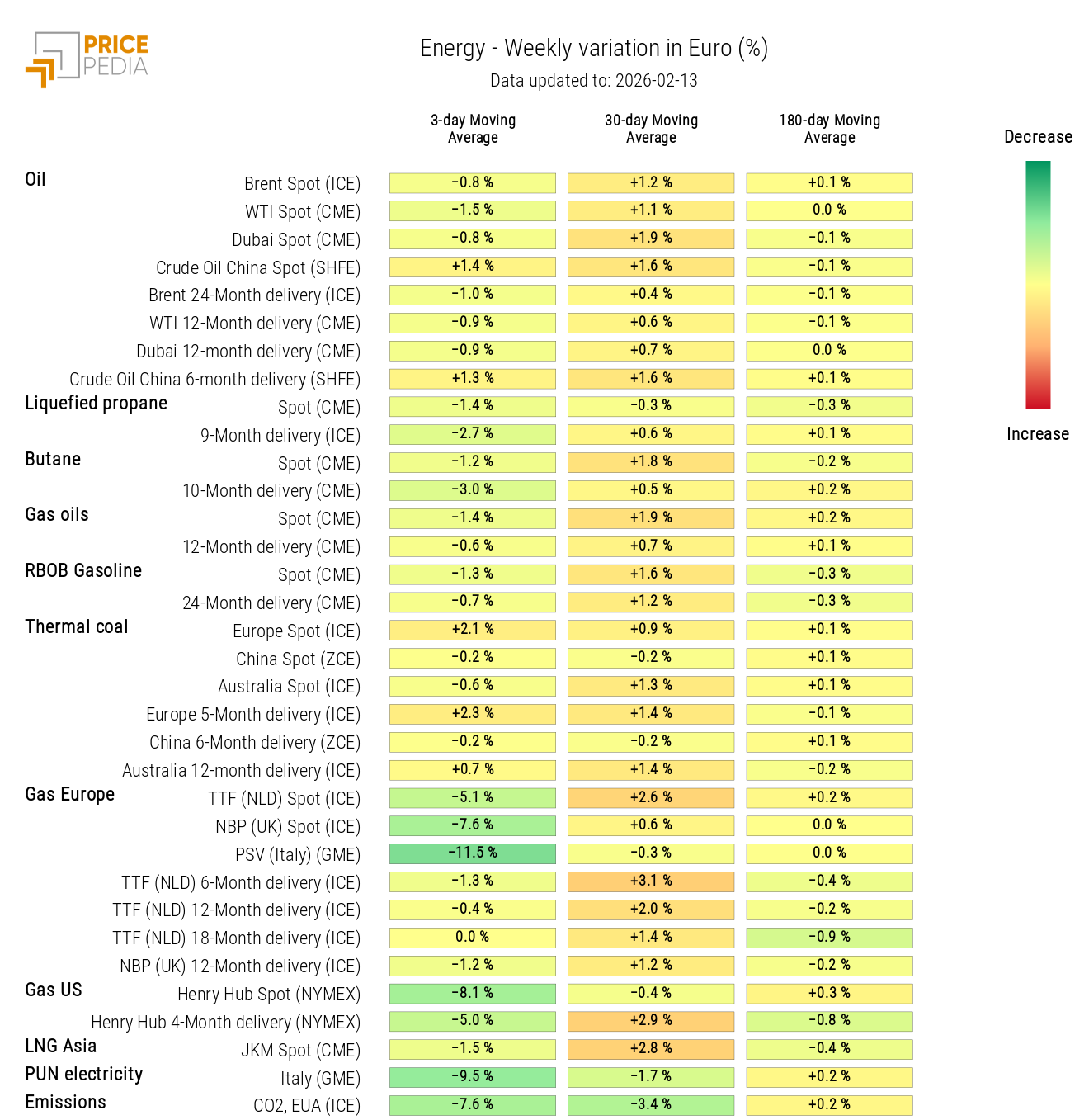

Analysis of the energy heatmap shows a decline in financial prices of European and U.S. natural gas.

HeatMap of Energy Prices in Euro

PRECIOUS METALS

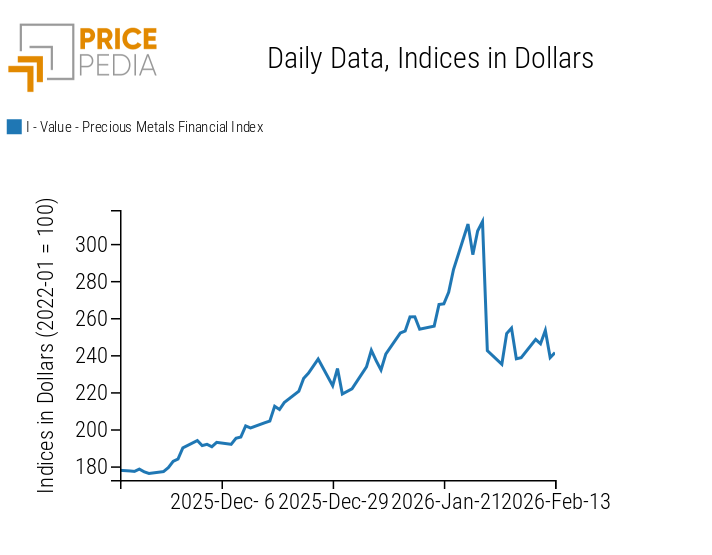

The financial index of precious metals signals a weekly price increase, partially offset by Thursday’s decline.

PricePedia Financial Index of Precious Metals Prices in US Dollars

The precious metals heatmap highlights substantial price stability.

HeatMap of Precious Metals Prices in Euro

FERROUS

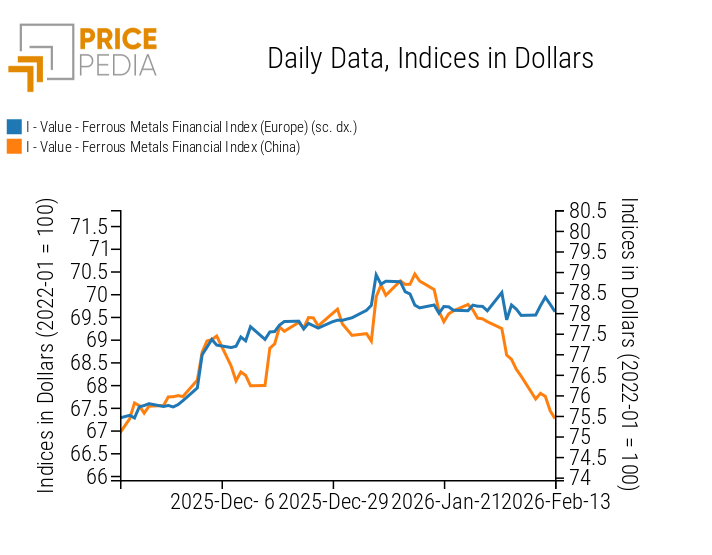

The China ferrous metals index recorded a price decline, while the Europe index remained stable.

PricePedia Financial Indices of Ferrous Metals Prices in US Dollars

Heatmap analysis shows a decline in Chinese SHFE rebar prices and China CME iron ore prices.

HeatMap of Ferrous Prices in Euro

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

INDUSTRIAL NON-FERROUS

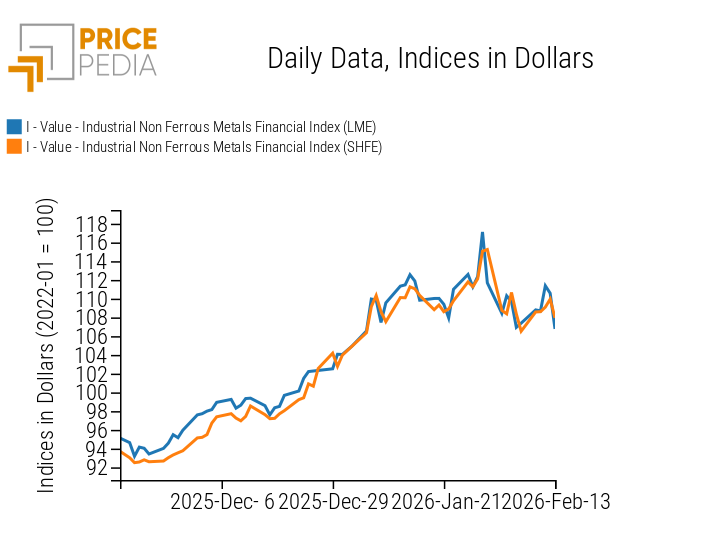

After the increases in the first days of the week, both non-ferrous metals indices underwent a correction that offset the gains accumulated in previous days.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in US Dollars

Heatmap analysis of non-ferrous metals shows a recovery in tin and nickel prices.

HeatMap of Non-Ferrous Prices in Euro

FOOD

The three food product indices followed divergent dynamics: the grains index recorded a slight increase, the tropical index continued its decline, while the edible oils index remained stable.

PricePedia Financial Indices of Food Prices in US Dollars

CEREALS

The cereals heatmap shows weekly price growth for wheat and soybeans.

HeatMap of Cereal Prices in Euro

TROPICAL

The tropical heatmap indicates a weekly decline in the 3-day moving average of cocoa and sugar prices.

HeatMap of Tropical Food Prices in Euro

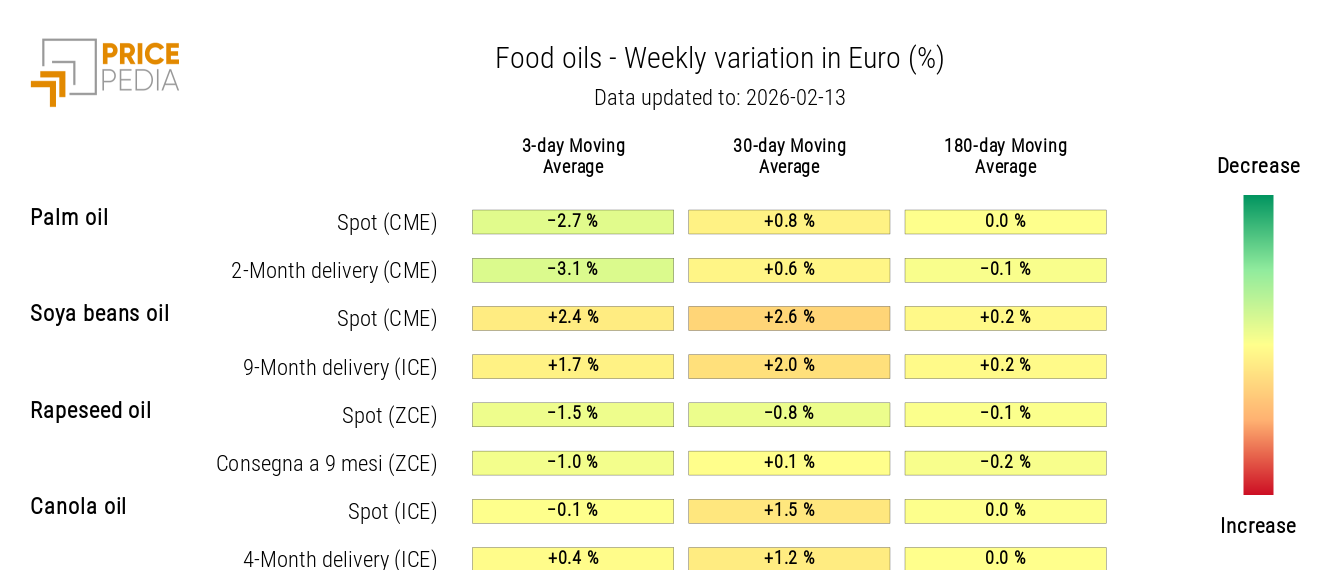

OILS

The edible oils heatmap highlights a decline in palm oil prices, compared to a slight increase in soybean oil prices.

HeatMap of Edible Oil Prices in Euro