Sorbitol: a Commodity Only in Appearance

Prices, market segmentation and evolving competitive dynamics between Europe, China and the United States

Published by Luigi Bidoia. .

Bio-Based Chemicals Chinese industry

Polyols are substances that are used in many chemical processes in relatively small proportions, yet play a functionally decisive role. Among polyols, sorbitol is the one that best combines versatility, stability and compatibility, to the point that it can be considered, in chemical processes, the equivalent of salt in cooking.

Like salt, it has a relatively low price compared with other chemical products and, again like salt, it is relatively easy to produce, starting from renewable raw materials (biomass) that are widely available in many countries.

These characteristics of sorbitol are reflected in a strong segmentation of the global market into three major areas – Europe, Asia and North America – each dominated by a leading country: France in Europe, China in Asia and the United States in North America.

Despite the protection provided by the high incidence of transport costs, a reshaping of positions among the three main players is currently underway in the global sorbitol market. This realignment takes different forms across geographical markets. In all cases, however, a common factor emerges: Chinese production is progressively displacing production from France and the United States.

In Asia in particular, whereas at the beginning of this century sorbitol produced in China hardly crossed national borders, the country has gradually gained market share to the point that, in recent years, sorbitol of French origin has also become marginal.

In the European Union, imports from China remained insignificant until 2020; following rapid growth in subsequent years, by 2025 they are estimated to have approached 10% of total EU imports. In non-EU Europe, China has recently captured two markets of particular importance: as of 2025, it has become the leading country of origin for Turkish sorbitol imports. An even more pronounced shift has occurred in Russia, where, after 2022, imports from France have virtually disappeared, almost entirely replaced by those originating from China.

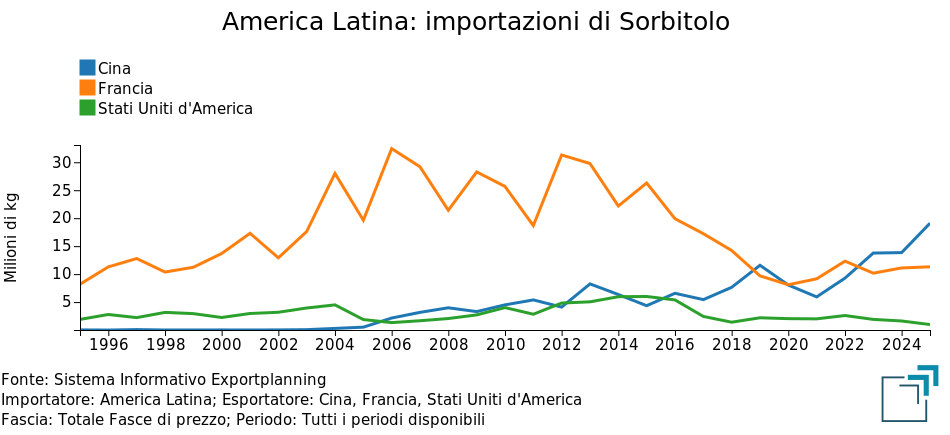

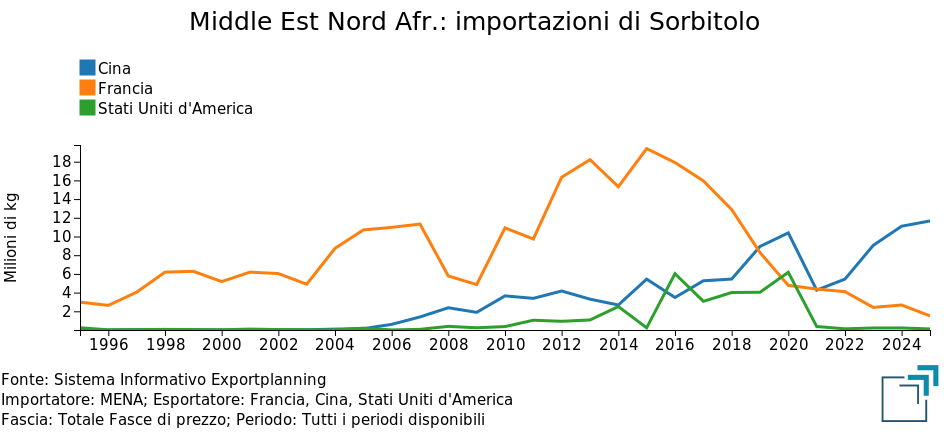

A phase of market penetration by Chinese imports is also underway in North America. However, the regions where the balance of power between Chinese and French exports has changed most profoundly and rapidly in recent years are Latin America and the Middle East and North Africa, as shown in the charts presented below.

Imports of sorbitol from France, China and the United States

|

|

The impact of market segmentation on international prices

The still limited presence of Chinese sorbitol on the European Union market is clearly reflected in the weak relationship between sorbitol prices observed in intra-EU customs trade and those of sorbitol exported from China. The table below compares selected European prices with the corresponding Chinese prices over the past six years.

Prices should be understood as referring to aqueous solutions containing 70% sorbitol. A first product distinction concerns the nature of the product: whether it is a solution of pure sorbitol or a sorbitol-based solution, in which sorbitol represents the predominant but not exclusive chemical component. A second distinction, relevant for European prices, relates to the presence or absence of mannitol above a given threshold.

Sorbitol prices in the EU and China (euro/tonne)

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

| Aqueous solution of pure sorbitol | ||||||

| with D-mannitol > 2%: intra-EU | 651 | 758 | 958 | 1423 | 1020 | 970 |

| with D-mannitol < 2%: intra-EU | 604 | 634 | 906 | 1107 | 890 | 854 |

| China FOB | 724 | 801 | 817 | 870 | 757 | 725 |

| Sorbitol-based aqueous solution | ||||||

| with D-mannitol > 2%: intra-EU | 590 | 576 | 778 | 1271 | 924 | 810 |

| China FOB | 461 | 574 | 637 | 633 | 591 | 547 |

The analysis of these prices highlights the following key points:

- the 2022–2023 crisis, with price increases reaching up to 100%, affected exclusively the European market;

- prior to the 2022–2023 crisis, European and Chinese prices were broadly aligned; in the years following the crisis, however, a significant gap has emerged, with European prices currently averaging around 30% higher than Chinese prices;

- solutions of pure sorbitol command, on average, higher prices than sorbitol-based solutions: by around 10% in the European Union and by nearly 40% in the case of products of Chinese origin. This differential highlights the importance that users—particularly in the food and pharmaceutical industries—attach, both in the European Union and in China, to the purity and controllability of raw materials.

Conclusions

Sorbitol is a relatively simple chemical product, easy to manufacture at relatively low cost, yet it plays an essential role in many industrial processes. Its direct impact on production costs is limited; by contrast, the costs associated with its unavailability or with inadequate quality can be significant, particularly in regulated sectors.

In the European market, France maintains a well-established leadership position, ensuring high standards of quality, reliability and continuity of supply. However, in recent years this leadership has been progressively eroded in extra-EU markets by the growing competitiveness of Chinese producers, especially in more price-sensitive segments.

For a European buyer, these dynamics suggest that sorbitol should not be viewed as a simple commodity, but rather as a strategic raw material: the choice between European and Asian suppliers is not merely a question of price, but of balancing cost, reliability, quality controllability and supply risk. In this context, market segmentation offers opportunities for optimisation, but requires informed and differentiated sourcing decisions depending on final applications.