China economic update December 2025

Prices in dollars are essentially stable, but become negative when converted into euros

Published by Luca Sazzini. .

Conjunctural Indicators Global Economic TrendsThe monthly update of Chinese commodity prices on PricePedia for December 2025 has been published.

In aggregate terms, Chinese commodity export prices in dollars show a slight increase, with a month-on-month change of 0.35%. In euros, however, the monthly change is negative at -0.90%, reflecting the appreciation of the euro during the period.

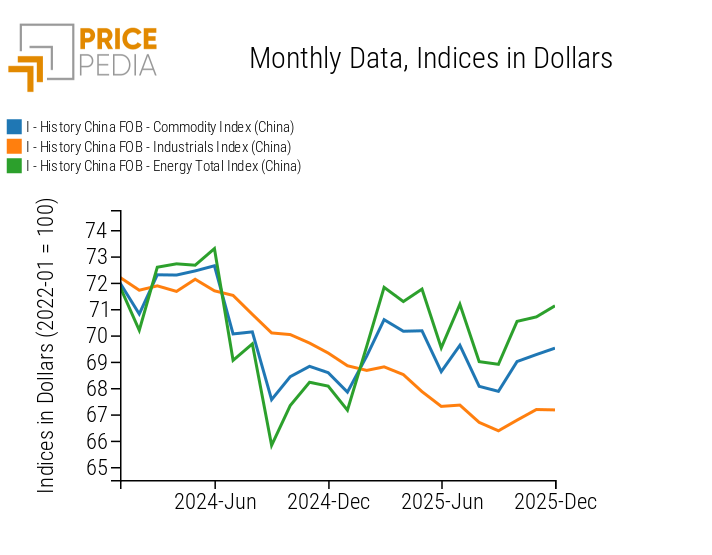

The following chart shows the dollar trend of FOB export prices over the past two years for the three main aggregated indices of Chinese commodities on PricePedia: Total Commodities[1], Industrials[2], and Total Energy.

In December, the growth of the Total Commodities China aggregate is mainly due to the increase in Chinese export prices, expressed in dollars, of energy commodities, which recorded a month-on-month increase of 0.6%. By the end of the year, there was indeed a growth in Chinese export prices of petroleum derivatives, with the most significant increases in propane and liquefied butanes, both showing monthly changes exceeding 2%.

The recent recovery in FOB prices of industrial commodities has, on the other hand, eased, with an aggregate month-on-month change of -0.02%.

Overall, these data seem to confirm the hypothesis that Chinese export prices reached a local minimum in September 2025, considering that in the last three months there has been a recovery in aggregate FOB prices in dollars.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of Industrial Commodities by Category

The following table shows the month-on-month changes in Chinese export prices in dollars for the categories included in the industrial commodities aggregate.

Month-on-month changes of industrial commodities by category, expressed in $/ton

| 2025-08 | 2025-09 | 2025-10 | 2025-11 | 2025-12 | |

|---|---|---|---|---|---|

| I-Historical China FOB-Total Ferrous Index (China) | −1.76 | −0.41 | +1.31 | +0.02 | −1.25 |

| I-Historical China FOB-Total Non-Ferrous Index (China) | −0.40 | +0.21 | +2.22 | +2.78 | +1.78 |

| I-Historical China FOB-Total Plastics and Elastomers Index (China) | −1.52 | −1.77 | −0.90 | −0.17 | +0.35 |

| I-Historical China FOB-Total Organic Chemicals Index (China) | −0.97 | −1.22 | −1.40 | −0.88 | −1.45 |

| I-Historical China FOB-Total Inorganic Chemicals Index (China) | −0.39 | +0.18 | +0.23 | −0.72 | −0.74 |

| I-Historical China FOB-Total Specialty Chemicals Index (China) | +0.22 | +1.56 | −0.29 | −1.07 | −2.10 |

| I-Historical China FOB-Total Pharmaceutical Chemicals Index (China) | −1.57 | −1.69 | −0.20 | 0.00 | −1.83 |

| I-Historical China FOB-Total Textile Fibers Index (China) | −0.12 | −0.68 | +0.10 | +0.16 | −0.08 |

Analysis of the table shows growth in non-ferrous metals prices, which in December recorded a month-on-month change of nearly 2%. Chinese FOB prices of raw tin and cathode copper both recorded increases exceeding 5%, consistent with the price trends on the London Metal Exchange (LME) and Shanghai Futures Exchange (SHFE). In December, the non-ferrous base metals sector was still influenced by supply-side tensions and concerns, supporting the continuation of the price growth phase.

Prices of plastics, inorganic chemicals, and textile fibers remained relatively stable, with month-on-month changes compared to November below 1% in absolute value.

Chinese export prices of ferrous metals in dollars fell by -1.25% m/m, almost completely canceling the recovery observed in October.

The most significant decreases occurred in the organic chemicals, specialty, and pharmaceutical chemicals sectors, with monthly changes of -1.45%, -2.10%, and -1.83% respectively. The dynamics of the chemical sector mainly reflect the difficulties in growth of the Chinese industry, persistent domestic demand weakness, and local producers' efforts to gain new foreign markets through more competitive pricing. Recent expansive fiscal and monetary policies by the Chinese government should help support the recovery in demand for chemical commodities and mitigate the current market oversupply.

[1] The PricePedia FOB Total Commodities China index results from the aggregation of FOB indices for industrial and energy commodities.

[2] The FOB index of Chinese Industrials prices results from the aggregation of FOB indices for the following categories: Ferrous, Non-Ferrous, Plastics and Elastomers, Organic Chemicals, Inorganic Chemicals, Specialty Chemicals, Pharmaceutical Chemicals, and Textile Fibers.