Tariff threats and volatility in financial commodity prices

EU imposes anti-dumping duties on Chinese fused alumina

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThis week, financial commodity prices were marked by high volatility, driven by trade tensions between the United States and the European Union linked to the dispute over Greenland.

President Trump threatened to impose 10% tariffs on imports from the seven European countries that had sent military troops to Greenland, effective from February 1, with a possible increase to 25% starting June 1 if a favorable agreement were not reached. In response, the European Union launched an internal discussion on the possible use of extraordinary anti-coercion measures, the so-called “trade bazooka,” which could restrict U.S. access to the European single market and indefinitely freeze the trade agreement negotiated last summer.

These tensions were reflected in commodity financial markets and in the U.S. dollar, which depreciated especially on January 20, at the peak of the period of greatest uncertainty. Toward the end of the week, however, the climate gradually eased, with Trump backing down on tariffs and announcing that a preliminary framework for a possible agreement on Greenland had been defined together with European partners.

Weekly summary of financial commodity prices

Financial prices of energy products recorded a further increase this week, with oil showing particularly unstable movements. Among the main factors supporting crude oil prices were the depreciation of the U.S. dollar at the beginning of the week, news regarding the production shutdown of Tengizchevroil at the Tengiz and Korolev fields following two fires, as well as renewed geopolitical tensions between the United States and Iran on Friday.

Oil derivatives were also influenced by the entry into force on January 21 of the new ban imposed by the European Union on imports of refined products derived from Russian oil, with diesel prices posting the strongest increases among the main quoted derivatives.

The most pronounced dynamics in the energy sector, however, concerned natural gas markets. The sudden cold wave in the United States supported heating demand, leading to a sharp rise in prices that also spilled over into European markets, which were already sharply higher than the previous week, fueling concerns about potential temporary supply tensions. Prices of U.S. Henry Hub reached $5.28/MMBtu, while European TTF Netherlands prices climbed to €45.4/MWh.

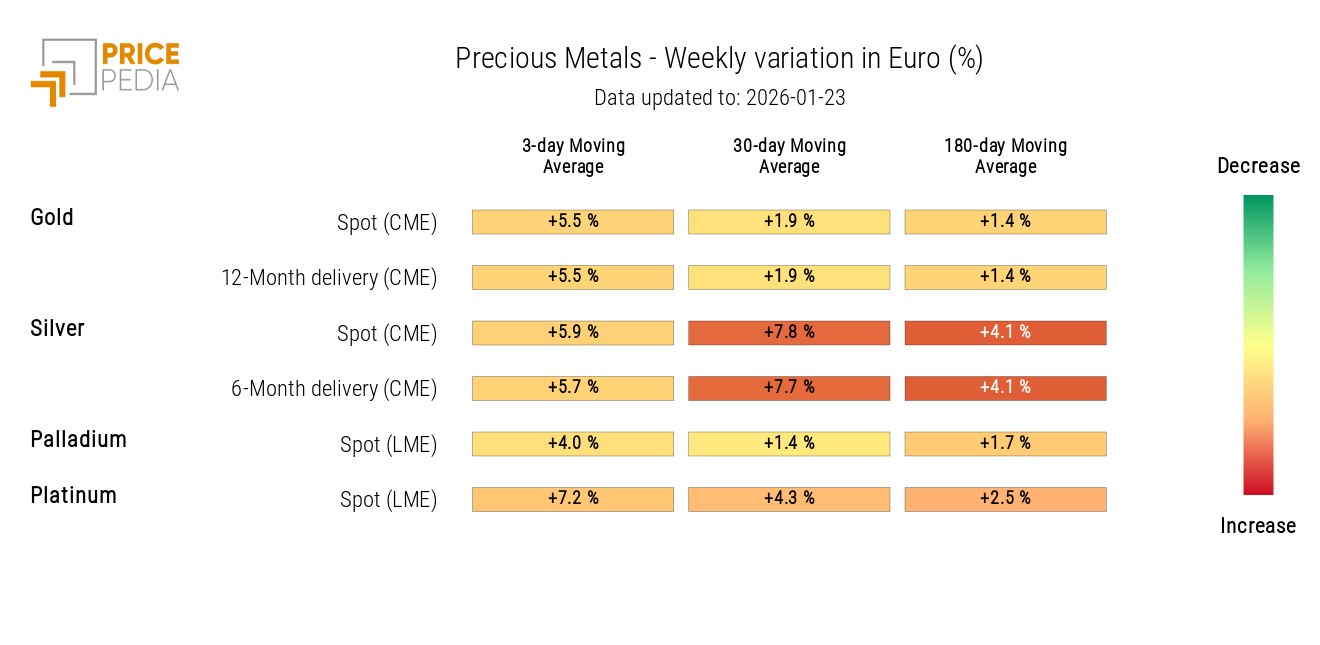

Prices of precious metals once again surpassed their all-time highs, driven by the escalation of trade tensions between the United States and Europe. Gold prices approached $5,000/ounce, while silver prices exceeded $100/ounce.

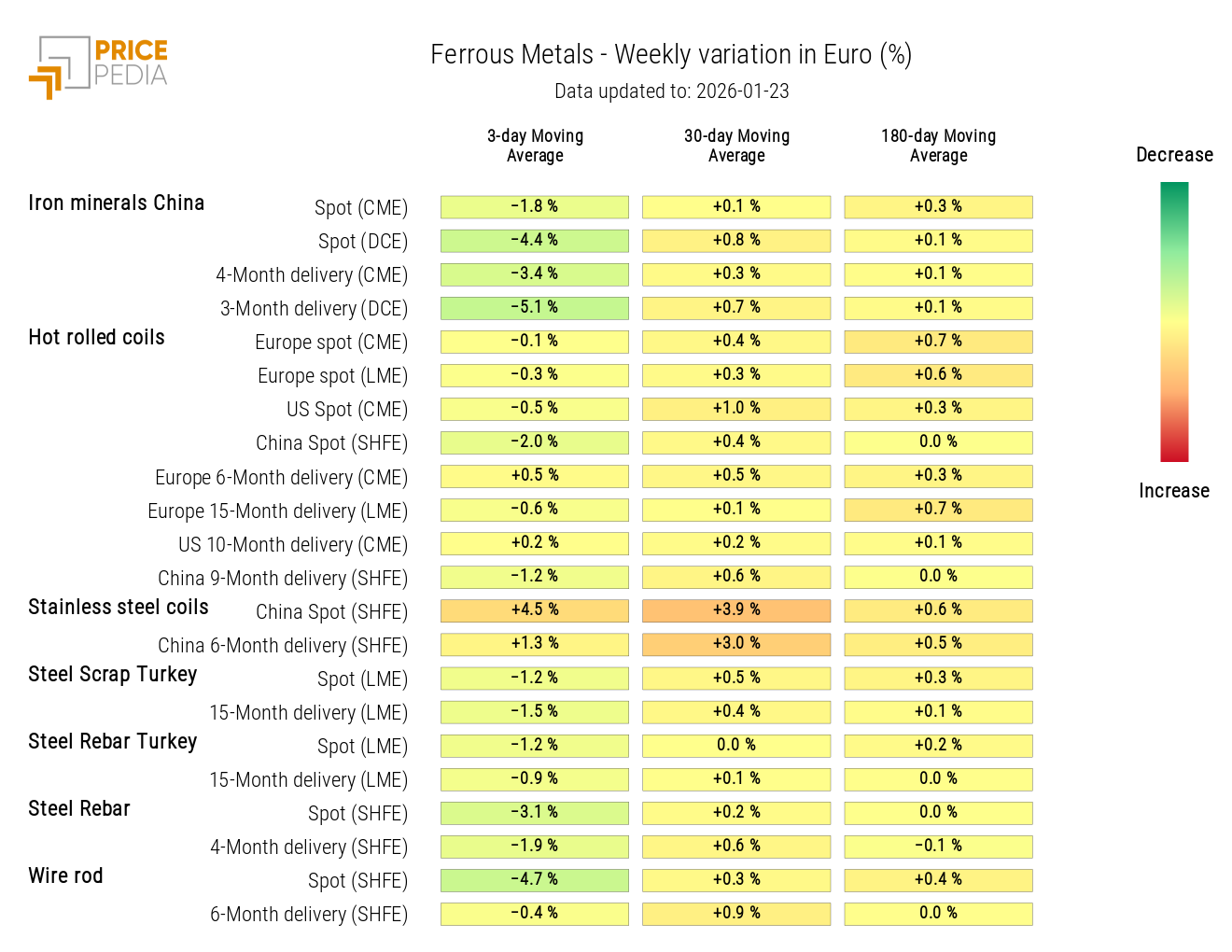

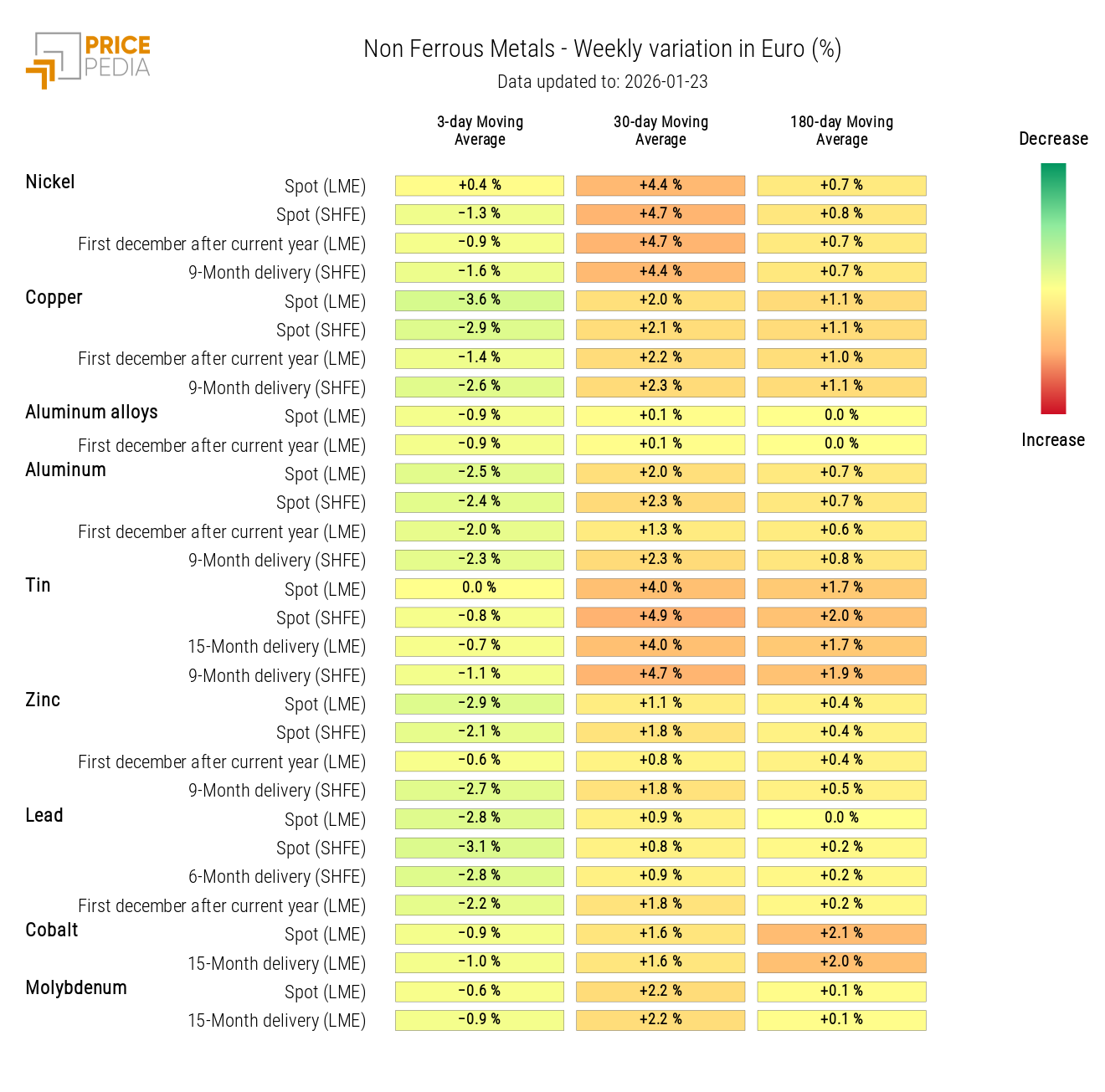

In the industrial metals segment, a generalized decline in prices was recorded, affecting both ferrous and non-ferrous metals. Among ferrous metals, a sharp drop in iron ore prices in China is particularly noteworthy, attributable to rising inventories and renewed concerns about Chinese demand, further exacerbated by a new accident at a steel plant in the country.

Non-ferrous base metals also posted significant corrections after the strong gains recorded in previous weeks. Copper, which had recently reached new all-time highs, was the most penalized metal, partly due to rising inventories at LME warehouses, which increased for the first time since September.

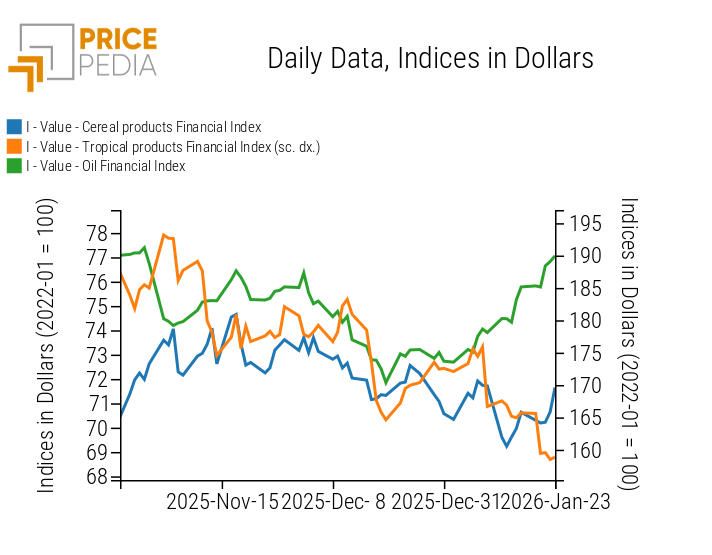

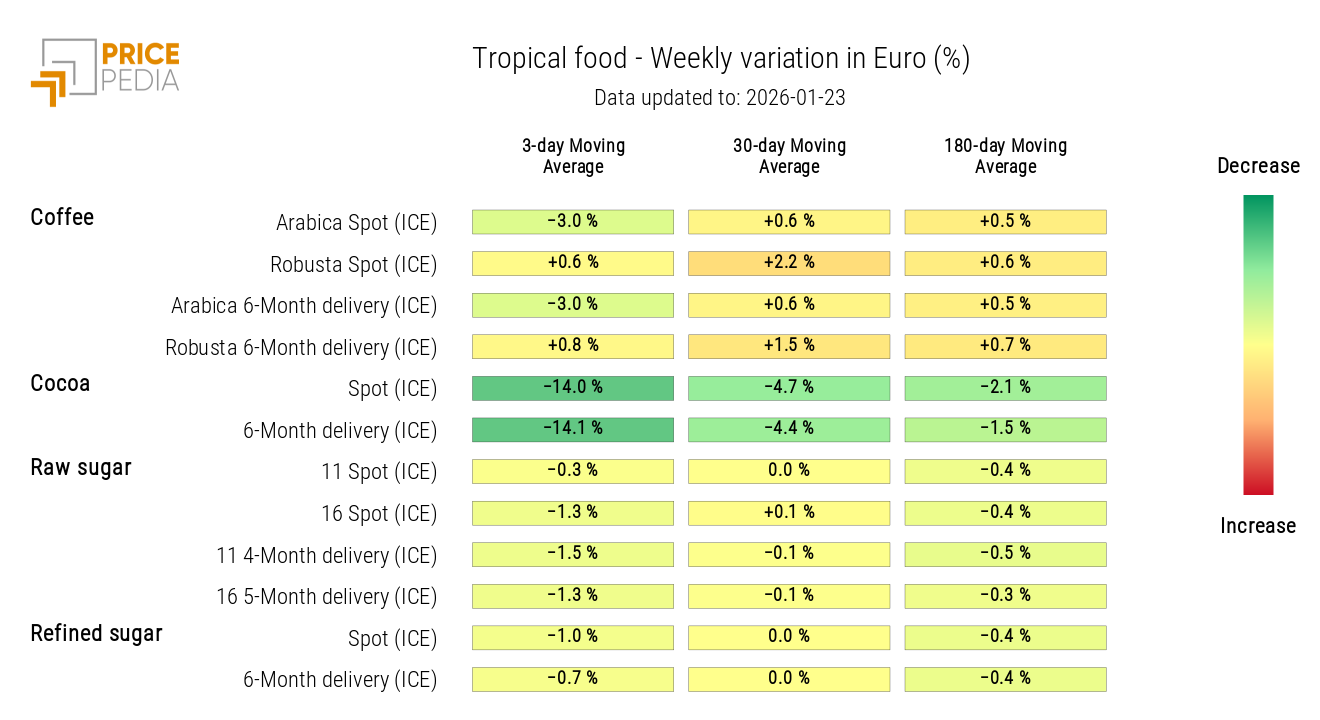

In the agricultural commodities sector, the downward trend in tropical products prices continues, mainly driven by cocoa, while prices of cereals and edible oils increased.

New anti-dumping duties on Chinese alumina

The European Commission has imposed new anti-dumping duties on imports of fused alumina from the People’s Republic of China, with rates ranging from 88.7% to 110.6% for an initial period of five years, in order to counter unfair trade practices that harm European industry.

At the same time, a duty-free tariff quota has been introduced allowing a limited volume of Chinese imports to enter the EU without charges, while all quantities exceeding this threshold will be subject to duties.

Fused alumina is a key material for the production of steel, glass, ceramics, and various industrial and defense-related applications, and represents a strategic input within the European production system.

According to Brussels, the new measures will help restore fair competition conditions in the EU market, reduce dependence on Chinese imports, and ensure supply security for downstream users.

NUMERICAL APPENDIX

ENERGY

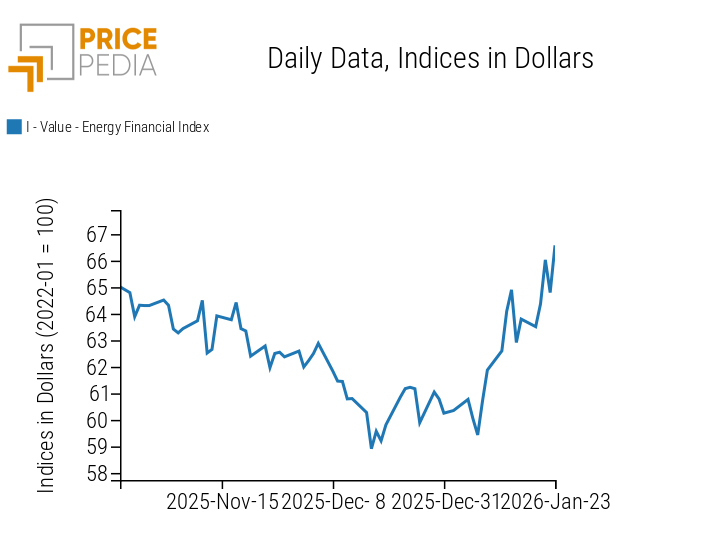

Despite mixed fluctuations, the PricePedia financial index for energy products indicates growth again this week.

PricePedia Financial Index of energy prices in dollars

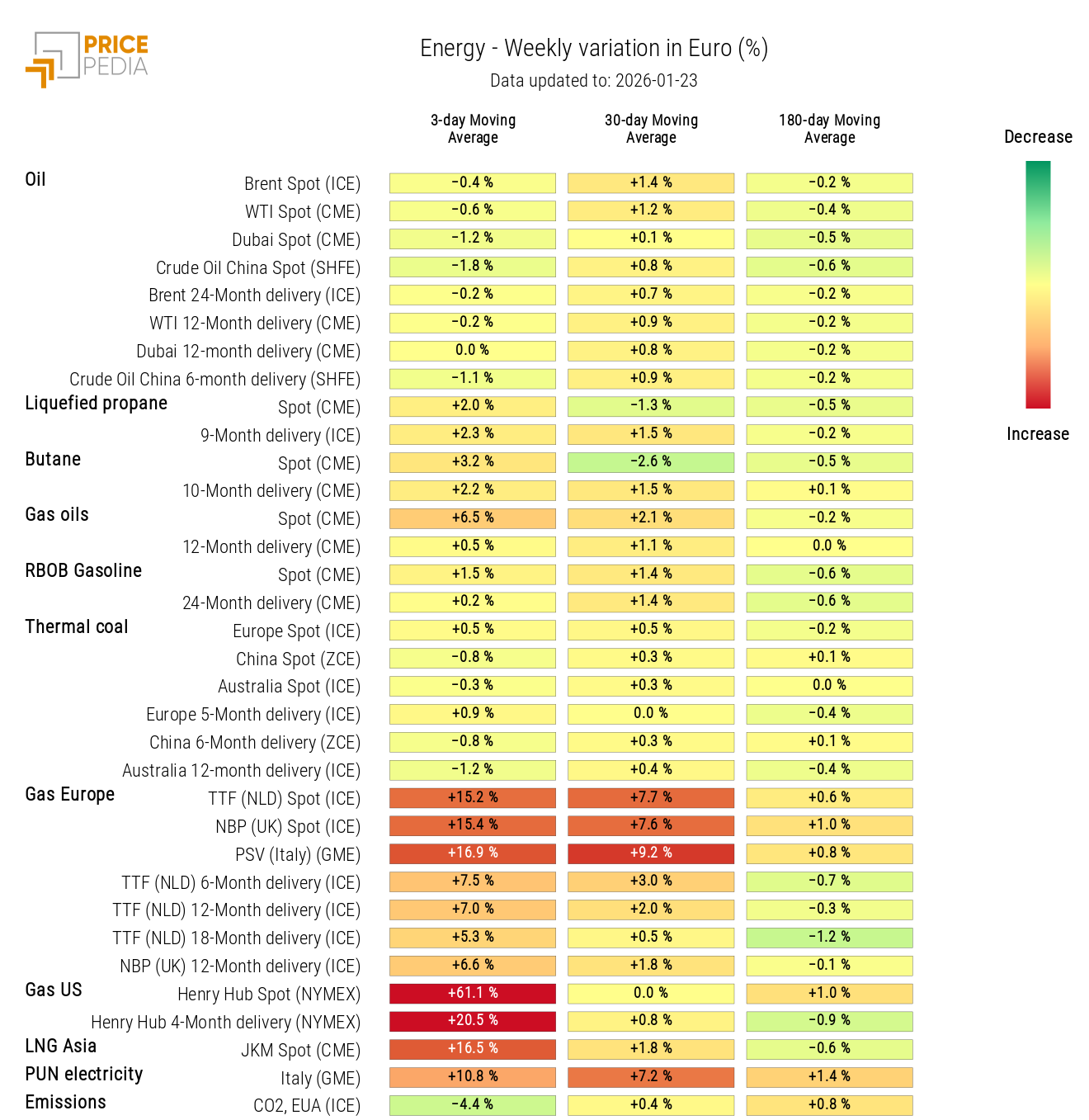

The energy heatmap highlights a significant rise in natural gas prices and a more moderate increase for diesel.

HeatMap of energy prices in euros

PRECIOUS METALS

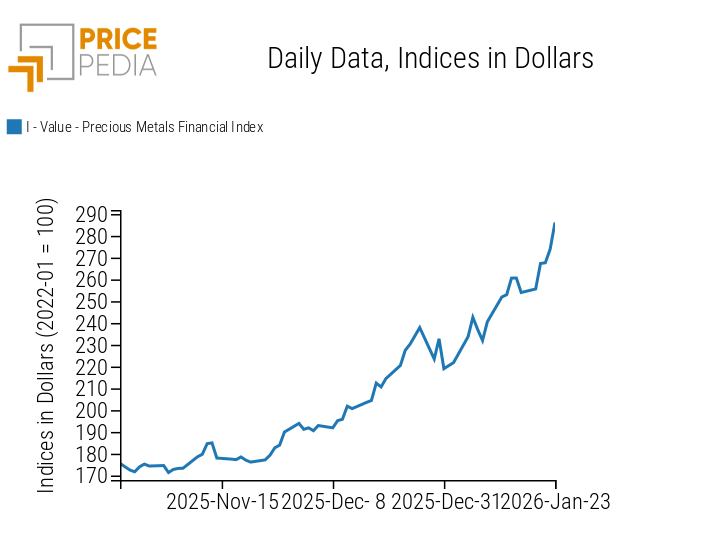

The precious metals financial index reaches new all-time highs, supported by geopolitical tensions between the United States and Europe.

PricePedia Financial Index of precious metals prices in dollars

The precious metals heatmap highlights rising prices of safe-haven assets.

HeatMap of precious metals prices in euros

FERROUS METALS

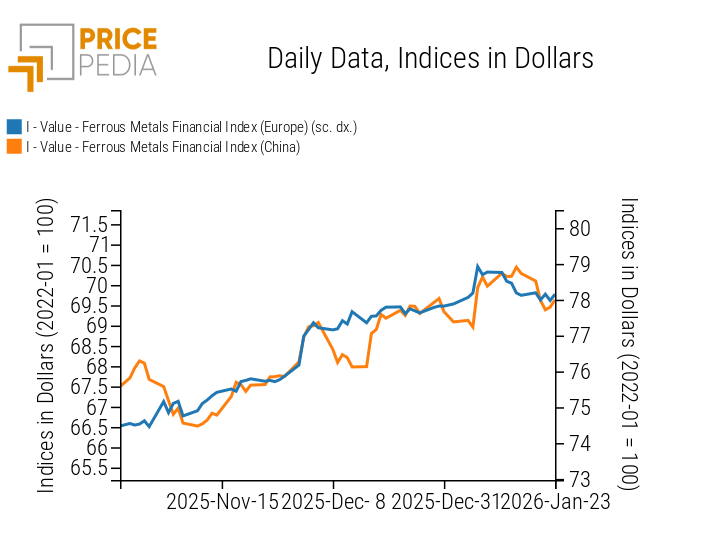

The Chinese financial index for ferrous metals records a decline in prices, while the European market index shows greater stability.

PricePedia Financial Indices of ferrous metals prices in dollars

The ferrous metals heatmap signals a significant decline in Chinese iron ore prices.

HeatMap of ferrous metals prices in euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

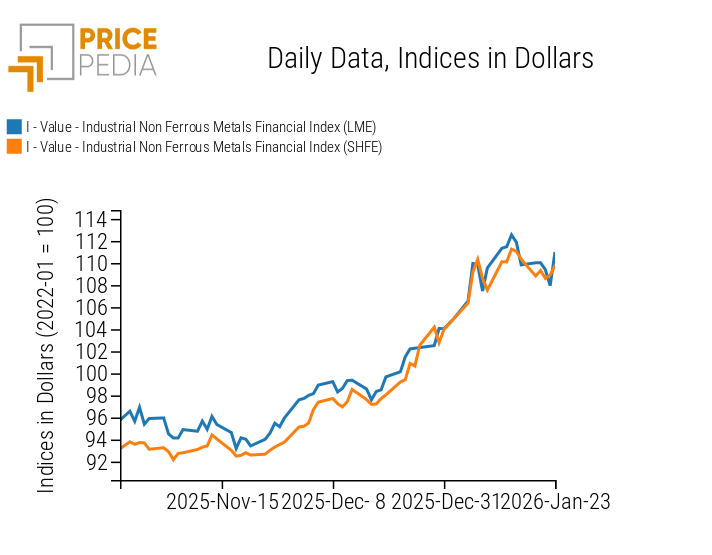

Both financial indices for non-ferrous metals show a weekly price contraction, with a partial recovery on Friday.

PricePedia Financial Indices of non-ferrous industrial metals prices in dollars

Analysis of the non-ferrous heatmap shows a weekly decline in prices of the main base metals.

HeatMap of non-ferrous metals prices in euros

AGRICULTURAL COMMODITIES

The cereal and edible oil indices show rising prices, while the tropical products index records a decline.

PricePedia Financial Indices of agricultural commodity prices in dollars

TROPICAL PRODUCTS

The tropical products heatmap highlights a sharp collapse in cocoa prices and a more moderate decline in coffee prices.

HeatMap of tropical food commodity prices in euros

EDIBLE OILS

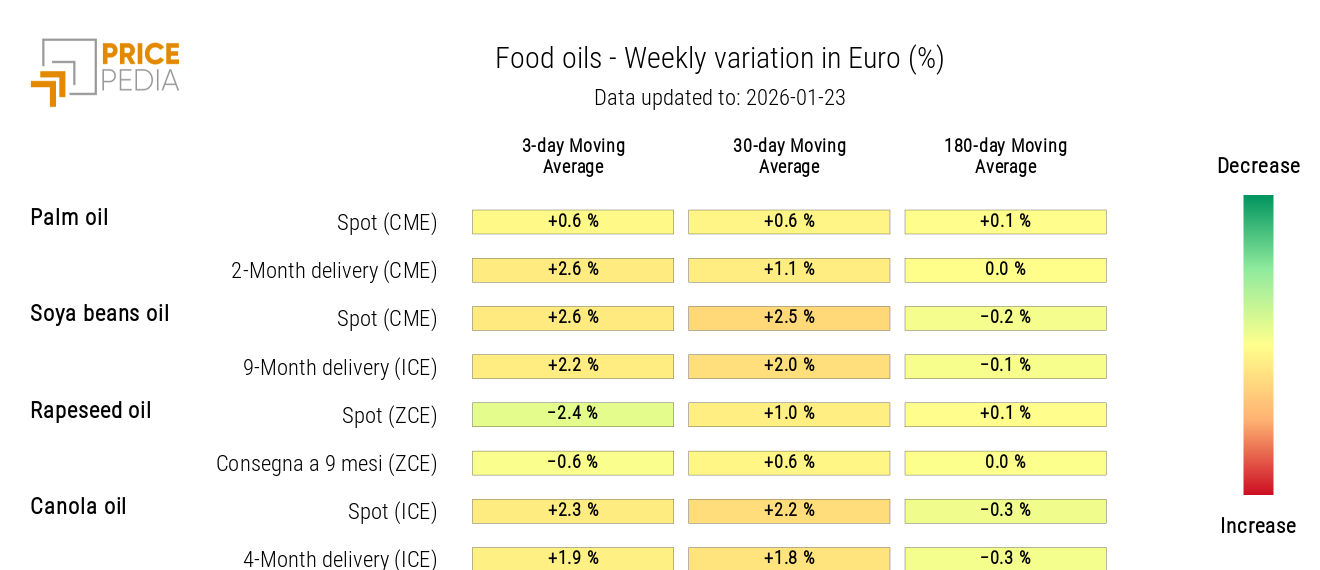

The edible oils heatmap indicates rising prices for soybean oil and canola oil, against a decline in rapeseed oil.

HeatMap of edible oil prices in euros