Commodity prices and their impact on the furniture industry

An indicator of purchasing material prices for the sector

Published by Pasquale Marzano. .

Conjunctural Indicators Analysis tools and methodologies

In recent years, the furniture industry has faced a far more unstable cost dynamic compared to the past, largely driven by the strong volatility of the prices of key commodities used in production processes.

Although these inputs account for a non-predominant share of total costs, the sharp fluctuations recorded in 2021-2022 had a significant impact on companies' cost structures, amplifying margin pressures and contributing to variability in production prices.

To measure the extent to which changes in the prices of materials purchased by companies in the furniture industry affect their overall costs, an aggregate price index for this category was constructed, excluding the energy component. For this purpose, prices of more than 100 industrial raw materials were considered and aggregated using weights that reflect the importance of each material in the sector’s procurement structure.

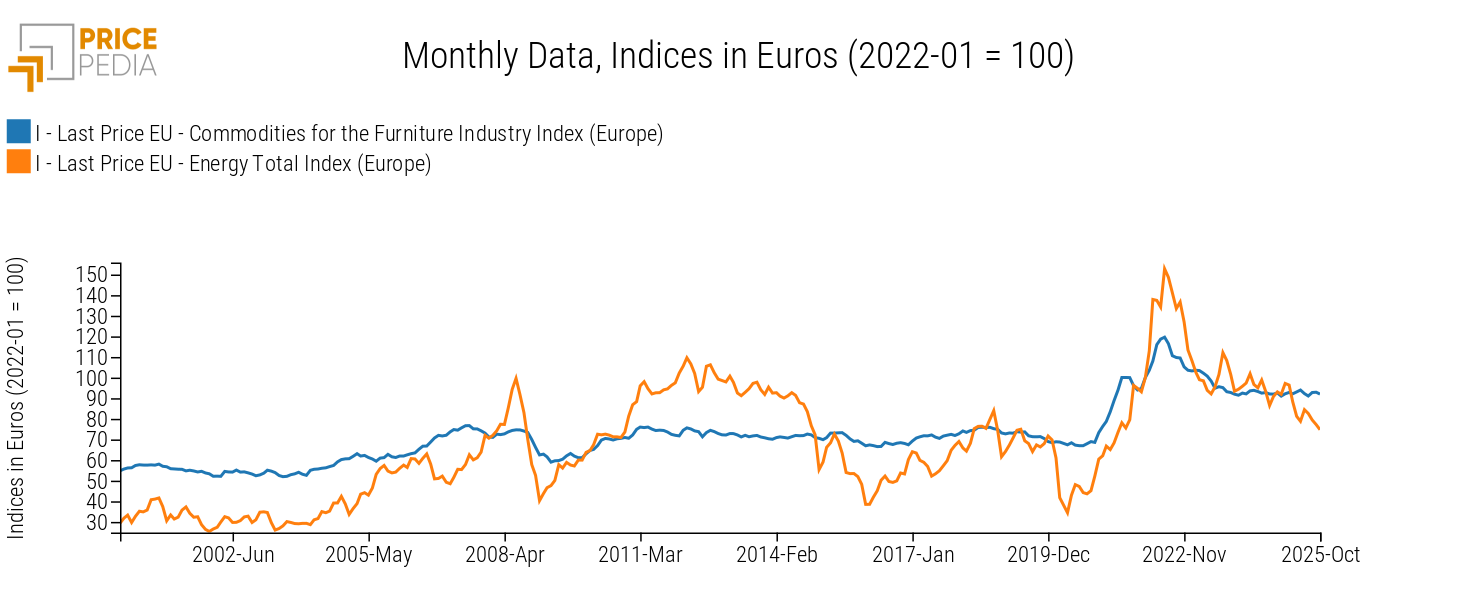

In the chart below, this index is compared with the trend of energy raw materials, in order to highlight their time variability.

Commodities for the furniture industry and energy raw materials compared

The price index of energy raw materials shows greater variability throughout the period considered. By contrast, prices of the industrial commodities purchased by the furniture industry showed relatively contained fluctuations up to 2020. However, during 2021-2022, historically high increases emerged, exceeding +50% compared with the 2020 average.

From 2023 onwards, both energy and furniture-industry commodities recorded declining quotations. Nevertheless, for the latter group, prices stabilised at levels consistently higher than the pre-Covid 2019 average.

Cost structure

Starting from the dynamics of the commodity-price component, it is useful to quantify the effective contribution of industrial commodity and energy prices to the evolution of total variable costs in the furniture industry.

The table below reports the cost-structure breakdown for the European furniture industry, obtained from the input-output matrices published by Eurostat for 2021.

Tab. 1: Cost-structure breakdown of the furniture industry

| Cost component | Share (%) |

|---|---|

| Energy | 2 |

| Industrial commodities | 32 |

| Other goods | 6 |

| Services | 33 |

| Labour | 27 |

| Total | 100 |

Services represent the main cost item, accounting for one third of total costs. Together with labour, they reach 60%.

As for industrial commodities and energy, their combined incidence is relatively low, amounting to 35%. However, in periods of high volatility such as the 2021-2022 price-increase cycle followed by the subsequent drop, even cost components with lower incidence can generate significant fluctuations in overall cost dynamics.

The next table shows the overall impact of changes in the prices of energy and industrial commodities on the average costs of the furniture industry from 2021 onwards. The table also reports the variation in EU producer prices for furniture manufacturing, representing the selling prices charged by producers.

Tab. 2 Impact on the costs of the furniture industry

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Industrial commodity costs - direct and indirect | +10.34 | +7.18 | -3.55 | -1.78 | +0.02 |

| Energy | +1.49 | +1.66 | -0.54 | -0.14 | -0.26 |

| Total cost incidence - furniture industry | +11.73 | +8.84 | -4.09 | -1.92 | -0.24 |

| EU Producer Prices - AT3100 Furniture Manufacturing | +3.4 | +11.2 | +5.8 | +0.6 | +0.7 |

In 2021 and 2022, the combined increase in commodity and energy prices represented a significant contribution to the rise in costs for the furniture industry. The overall effect amounted to +11.7% and +8.8%, respectively.

In subsequent years, however, the prices of both components declined and, consequently, their contribution to cost variation turned negative and less intense.

As for EU producer prices for furniture manufacturing, a progressive adjustment to cost dynamics can be observed in 2021-2022: it is plausible that part of these higher costs was absorbed by producers themselves through margin compression. Over the past three years, producer prices have increased, in line with other cost components, such as labour and services, which show less volatile but more structural dynamics.

Conclusions

The analysis shows that, in recent years, the volatility of raw-material and energy prices has played a decisive role in shaping the cost dynamics of the furniture industry. Although these components do not account for the largest share of the sector's cost structure, their high variability has generated amplified effects, contributing to a climate of uncertainty and putting pressure on company margins. The subsequent normalisation observed between 2023 and 2025 reduced the impact of these components, allowing for a gradual recovery of margins.