China economic update October 2025

The decline in supply favours a recovery in industrial metal prices

Published by Luca Sazzini. .

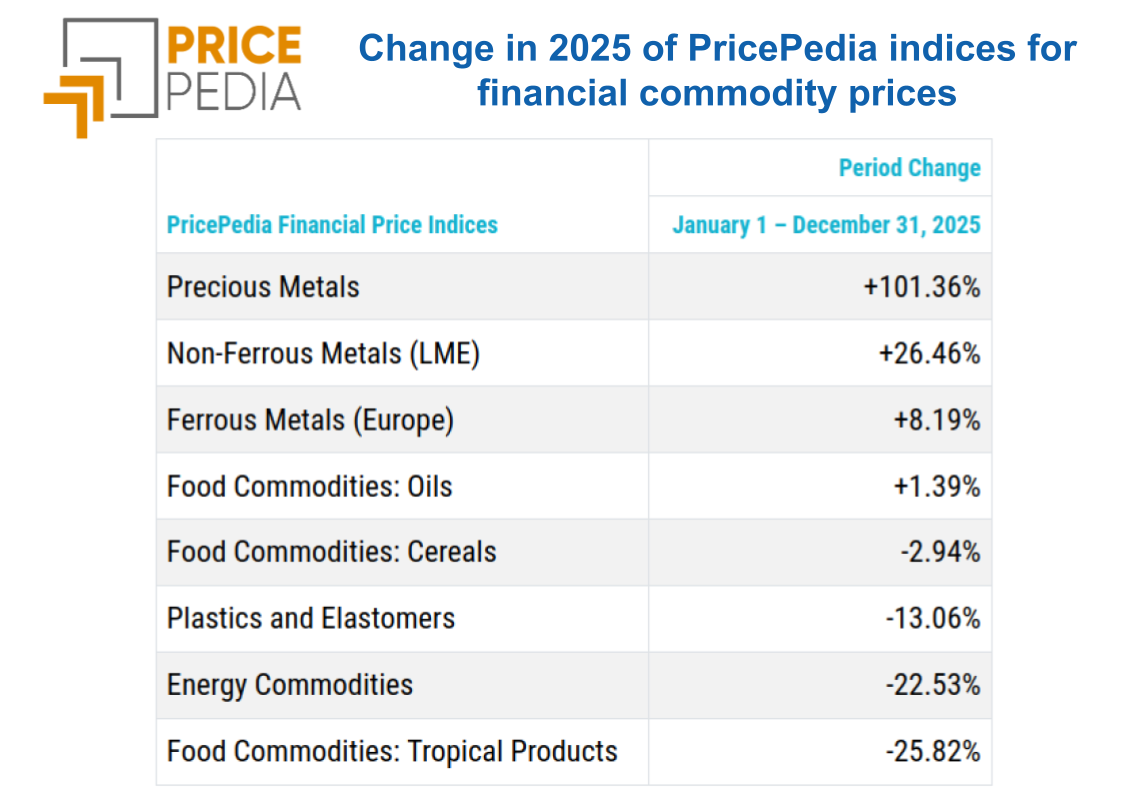

Conjunctural Indicators Global Economic TrendsThe update of the monthly prices of Chinese commodities from PricePedia for October 2025 has been published.

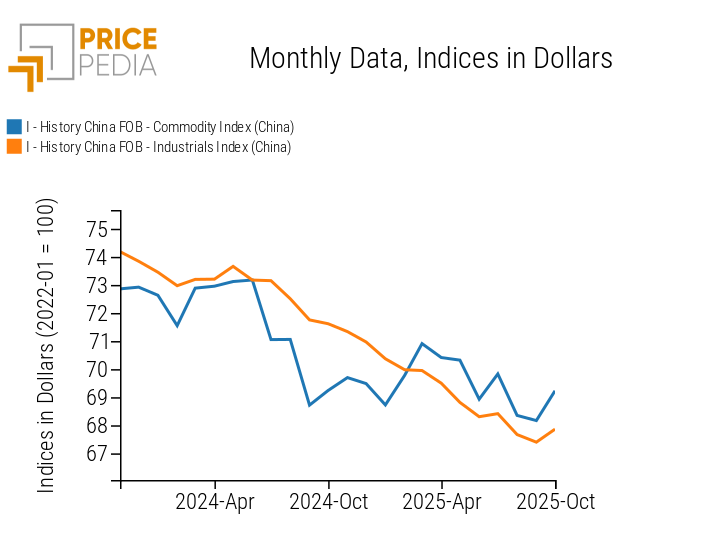

In aggregate terms, the dollar prices of Chinese commodity exports recorded an increase, with a month-on-month change of +1.58%. When translated into euros, the growth is even more pronounced, amounting to +2.45%.

The following chart shows the dollar-denominated dynamics of FOB export prices over the past two years for the Chinese Total Commodity index[1] and the Chinese Industrial index[2].

In October, the aggregate of industrial commodities also recorded a monthly increase in dollar export prices, equal to 0.70%, temporarily interrupting its downward trend.

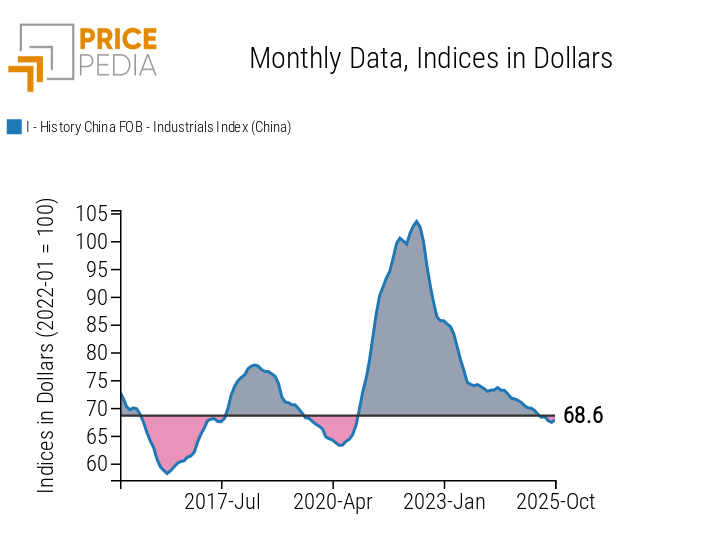

Analyzing the long-term historical series of industrial commodity prices, it appears that Chinese industrial commodity prices may have reached a new price floor, at levels similar to the average of the 2015–2019 four-year period.

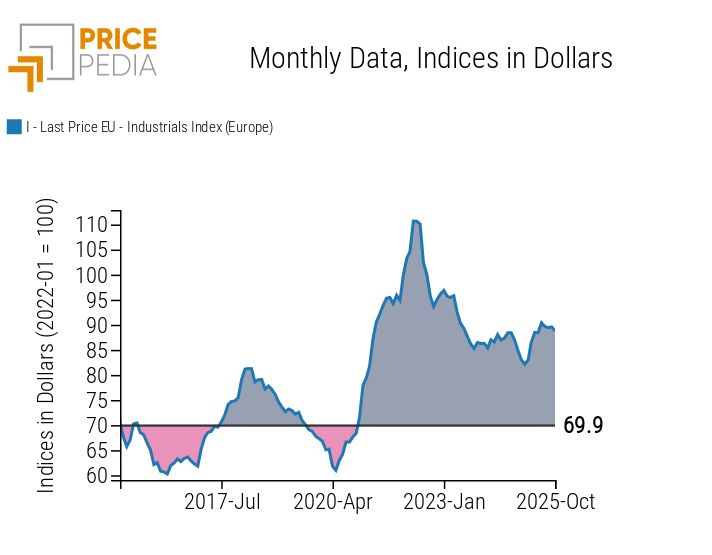

The dynamics of the past two years differ sharply from those observed in Europe, where industrial commodity prices remain significantly higher than the average of the five years preceding the pandemic.

The two charts below show the trend of the aggregate industrial index in China and in Europe, each compared with its respective average over the 2015–2019 four-year period.

| Dynamics of China’s industrial FOB price index relative to the 2015–2019 four-year average | Dynamics of Europe’s industrial index relative to the 2015–2019 four-year average |

|

|

As already highlighted in the article: Monthly commodity prices update for June 2025, from 2015 to the first half of 2022 the dynamics of the two aggregate industrial commodity indices in China and Europe were broadly similar, but in the more recent period the Chinese industrial commodity price index has shown a sharper contraction, returning to the average levels of the 2015–2019 four-year period.

The Chinese market has in fact been characterised by a significant excess supply, linked to the persistent weakness of domestic demand, undermined by the crisis in the real-estate sector. To support the economy, the government is introducing new stimulus measures aimed precisely at the real-estate sector. Expansionary fiscal policies in favour of the sector, combined with production caps on steel and aluminium to reduce excess supply, are expected to provide support to industrial commodity prices, helping to interrupt the downward trend observed in recent years.

In Europe, by contrast, prices of the industrial commodity index have remained higher, still 27% above the average of the 2015–2019 four-year period. Since 2022, the year in which the two indices began to follow different paths, the European Union has introduced several trade barriers aimed at protecting its industry from falling Chinese export prices. These measures have proved particularly effective, significantly limiting the decline in European domestic prices compared with international benchmarks, which are very often represented by Chinese prices.

Analysis of industrial commodities by individual category

The table below shows the month-on-month dynamics of dollar export price changes for the product categories included in the industrial commodities aggregate.

Month-on-month changes in industrial commodity prices by individual category, expressed in $/ton

The analysis of the table highlights that in October there was a significant increase in industrial metal prices, both ferrous and non-ferrous, with month-on-month changes exceeding 2% for both categories. The strongest increase occurred in ferrous metals, driven by the decline in Chinese steel exports. This reduction reflects the drop in Chinese domestic production caused by stricter environmental constraints and the impact of the extended national holiday at the beginning of the month.

In the non-ferrous metals sector, the price increase was driven by a combination of factors that significantly reduced supply.

Cobalt metal prices rose by 7% month-on-month following the new export quota system introduced by the Democratic Republic of the Congo, announced on 6 October and officially enforced on 16 October 2025. [3]

The increase in copper prices and its derivatives is linked to ongoing supply disruptions at several major global mines, including Grasberg, El Teniente, Constancia and Quebrada Blanca.

The rise in tin prices (+5%) is associated with falling Indonesian exports, while the increase in aluminium and its derivatives reflects the reduction in Chinese supply, as smelters are now approaching the capacity ceiling set by the government.

With the exception of industrial metals and Specialty Chemicals, which remained stable on a monthly basis, the other commodity families within the industrial price index recorded declines. Industrial demand for commodities in China remains weak, and even in the industrial metals sector, the rebound in prices is attributable entirely to supply constraints rather than strong domestic demand.

[1] The PricePedia Total Commodity Index results from the aggregation of indices related to industrial, food, and energy commodities.

[2] The PricePedia Industrial Index results from the aggregation of the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Pharmaceutical Chemicals, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibres.

[3] For further details, see the analysis: Cobalt Price Forecast