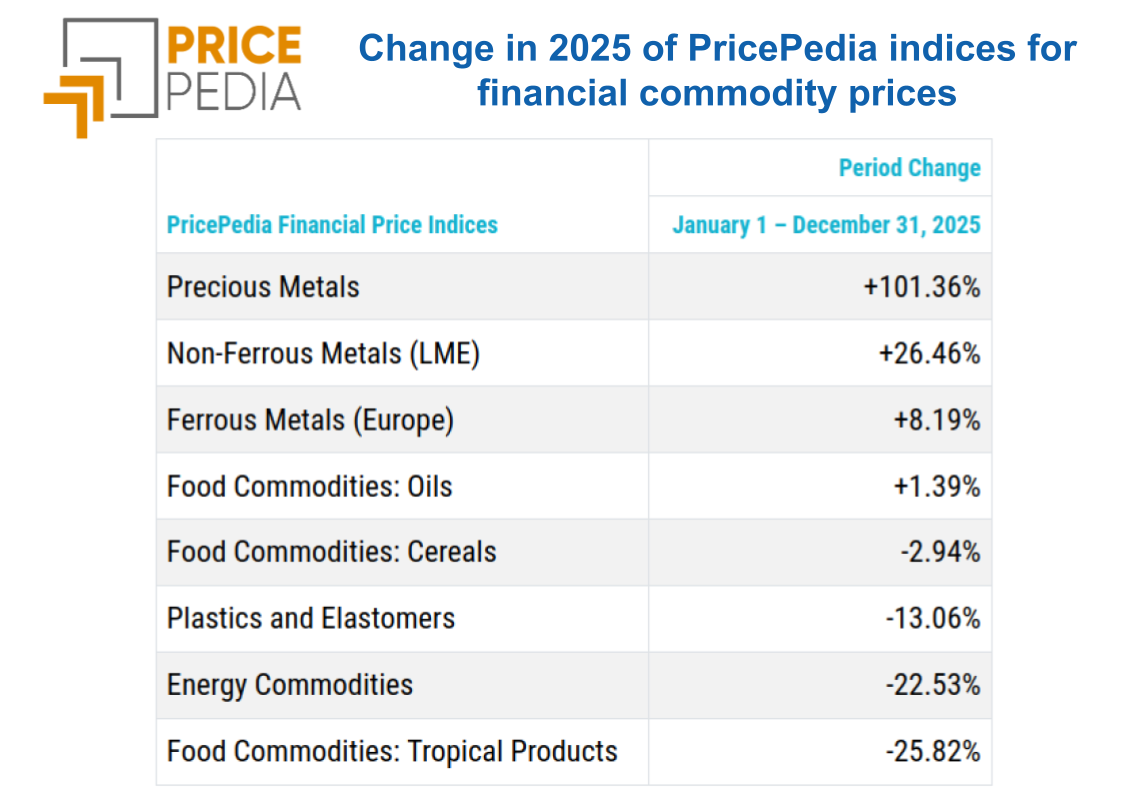

China and geopolitics: the impact on financial commodity prices

Energy prices fall ahead of possible peace agreement in Ukraine

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThis week, financial markets were characterized by a high level of uncertainty.

In the United States, the S&P 500 index recorded a decline, while the commodity market showed heterogeneous movements influenced both by geopolitical tensions and by the latest news on the Chinese economy.

In the energy sector, oil prices have fallen in recent days, supported by the resumption of talks between the United States and Russia for a possible peace agreement in the war in Ukraine. Signs of an agreement reduce concerns about new U.S. sanctions against Russia, the strictness in enforcing existing restrictions, and Ukrainian attacks on Russian energy infrastructure.

This prospect has supported a decline in prices starting Wednesday, easing tensions tied to fears of a drop in Russian supply. At the same time, concerns persist over possible global disruptions, such as those generated by Iran's seizure of an oil tanker in the Gulf of Oman, a strategic corridor for global oil transit.

News of the resumption of peace talks in Ukraine also impacted the European natural gas TTF Netherlands market, which has fallen again after the slight recovery at the end of last week linked to colder weather forecasts.

In the metals sector, the momentum of the previous week has weakened. Prices had been supported by expectations of a possible rate cut by the Federal Reserve (FED), fueled by signs of significant weakness in the U.S. labor market. However, the minutes of the latest FED meeting revealed that the decision to cut rates was not unanimous, reducing the likelihood of an additional cut in December.

This week, China has been the main influence on industrial metals. Prices of ferrous metals rose on a weekly basis due to the sharp decline in steel production in China in October. The most significant increases concerned steel rebar and Chinese iron ore.

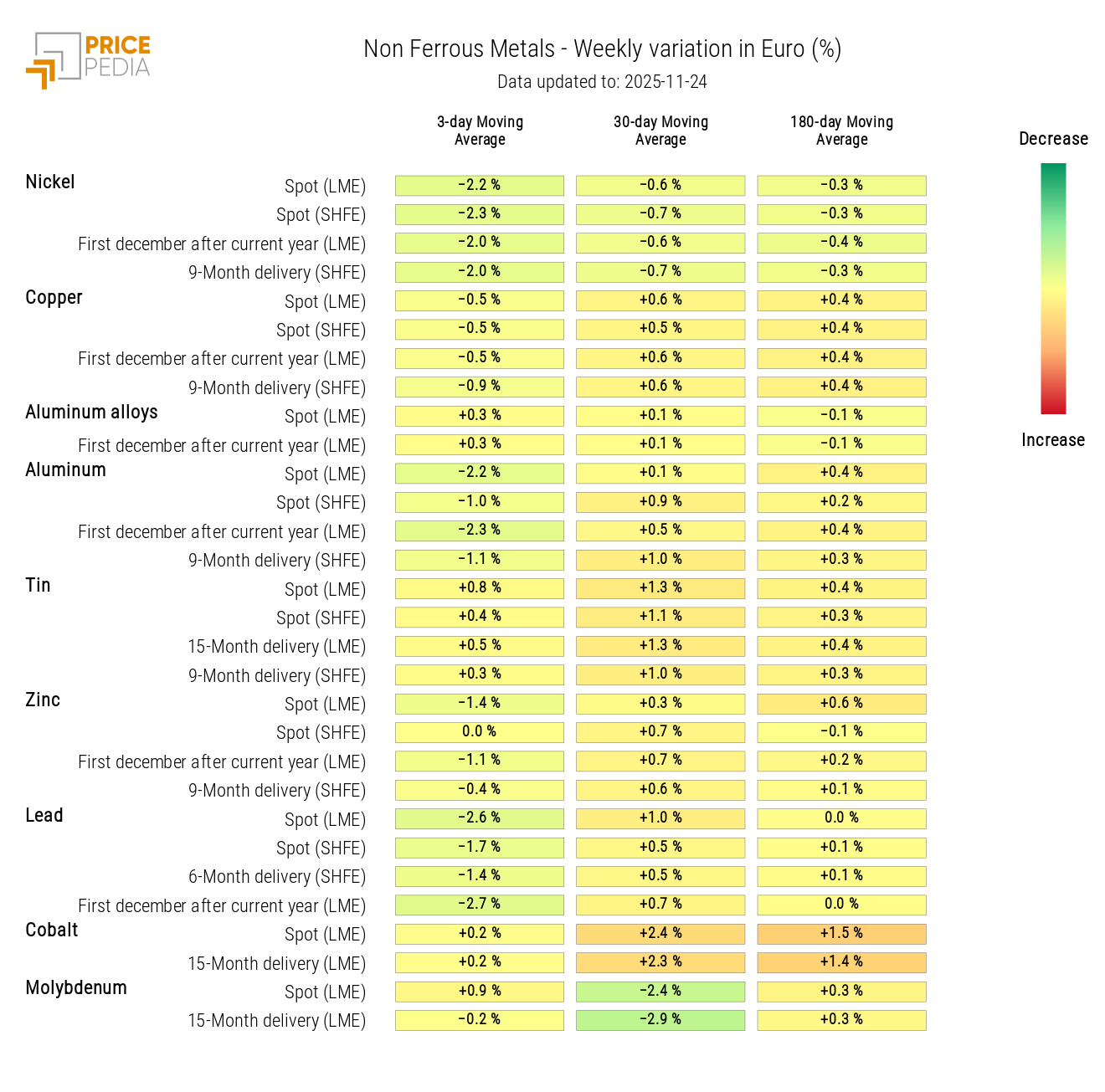

Non-ferrous metals, on the other hand, followed a predominantly bearish trend driven by diplomatic tensions between China and Japan and weaker-than-expected Chinese economic data for October. Weakness in investment, industrial production, and retail sales further depressed domestic demand, contributing to a broad decline in consumption. Additional downward pressure came from rising stock levels of nickel, aluminum, zinc, and lead on the Shanghai Futures Exchange (SHFE).

Regarding copper, Freeport announced plans to restart production at the Grasberg operations in Indonesia: a partial restart expected to ease smelters’ supply challenges caused by shortages of raw materials.

The slight recovery in non-ferrous metals on Thursday, supported by expectations of a new Chinese stimulus cycle for the real estate sector, was not enough to reverse the weekly trend, with major non-ferrous prices closing lower.

Among agricultural commodities, prices remained relatively stable overall, despite strong weekly fluctuations. The most significant changes again concerned the tropicals segment: cocoa continued its decline after the one-year postponement of the new EU deforestation rules, while coffee showed a partial recovery.

EU Inflation

In October 2025, inflation in the euro area, measured by the Consumer Price Index (CPI), stood at 0.2% on a monthly basis and 2.1% year-on-year, both in line with analysts’ expectations. The growth of the core index (the CPI excluding the most volatile components) also aligned with forecasts, rising 0.2% m/m and 2.4% y/y.

These figures are consistent with the ECB’s price-stability objective, placing inflation near the 2% target. Based on this scenario, European monetary policy is likely to maintain a cautious stance, favoring a phase of rate stability.

NUMERICAL APPENDIX

ENERGY

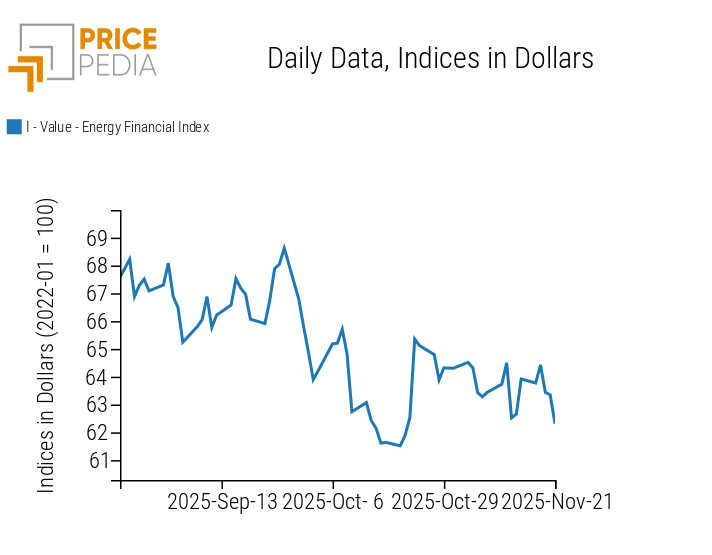

The PricePedia financial index for energy records a weekly decline, influenced by recent geopolitical easing linked to a possible peace agreement in Ukraine.

PricePedia Financial Index of Energy Prices in USD

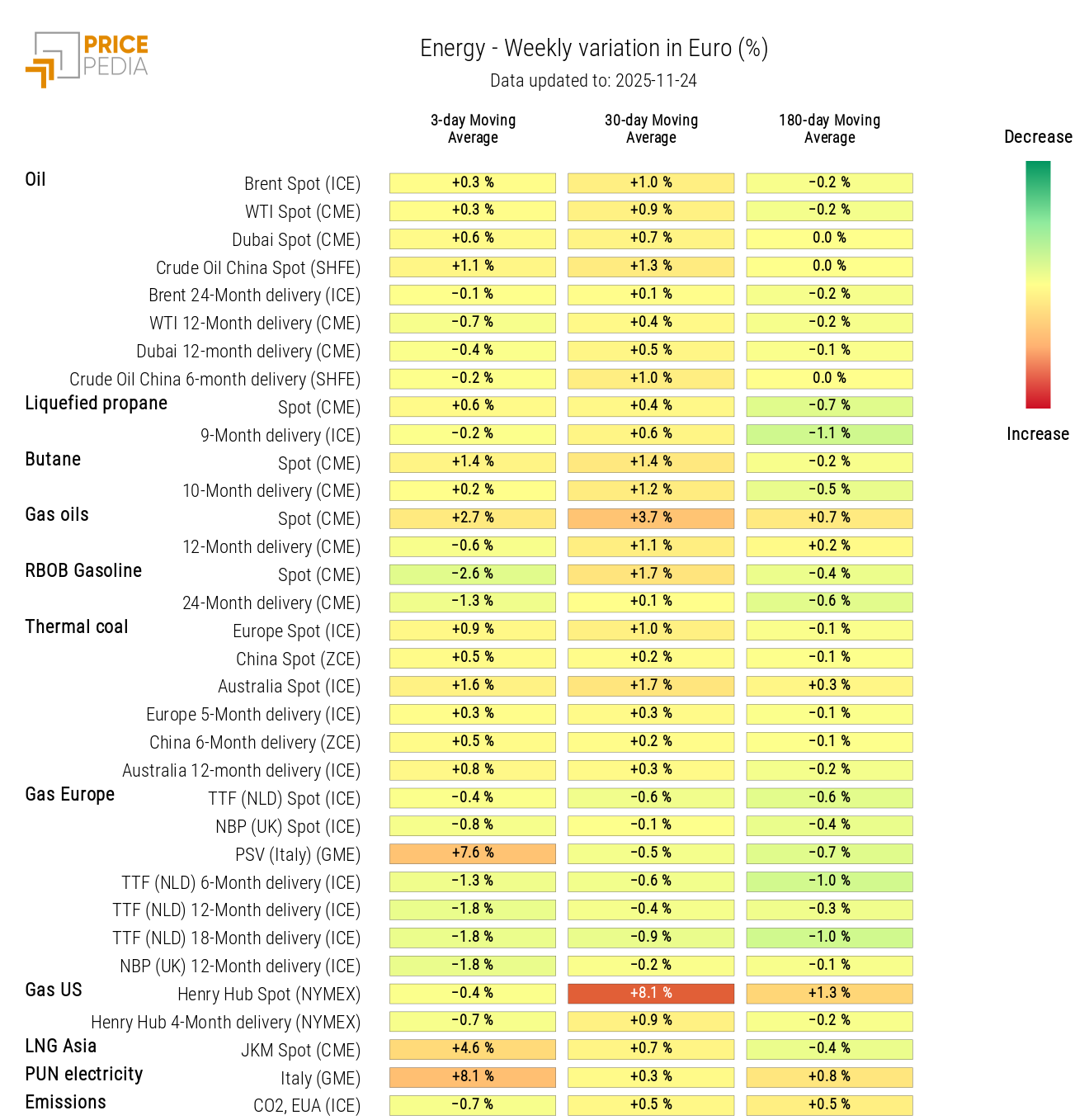

The energy heatmap shows an increase in the 3-day moving average for butane, PSV, and JKM prices, alongside declines in gasoline and TTF prices.

HeatMap of Energy Prices in EUR

PRECIOUS METALS

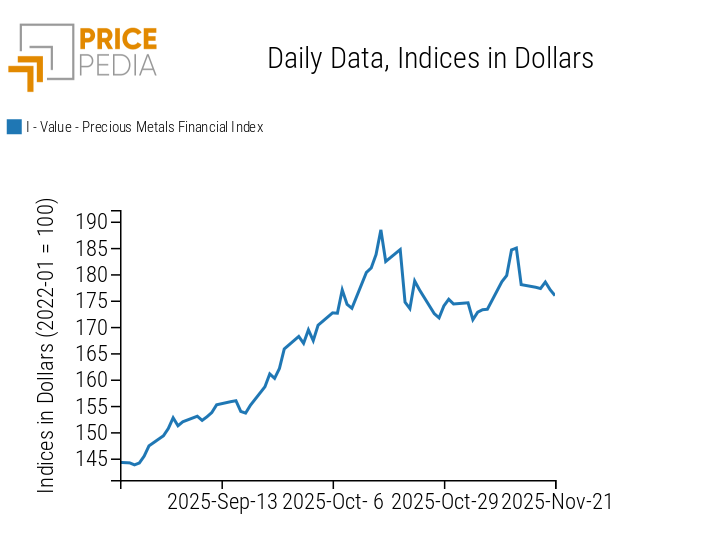

The financial index of precious metals shows a slight decline in prices, tied to geopolitical easing and reduced expectations of a FED rate cut.

PricePedia Financial Index of Precious Metal Prices in USD

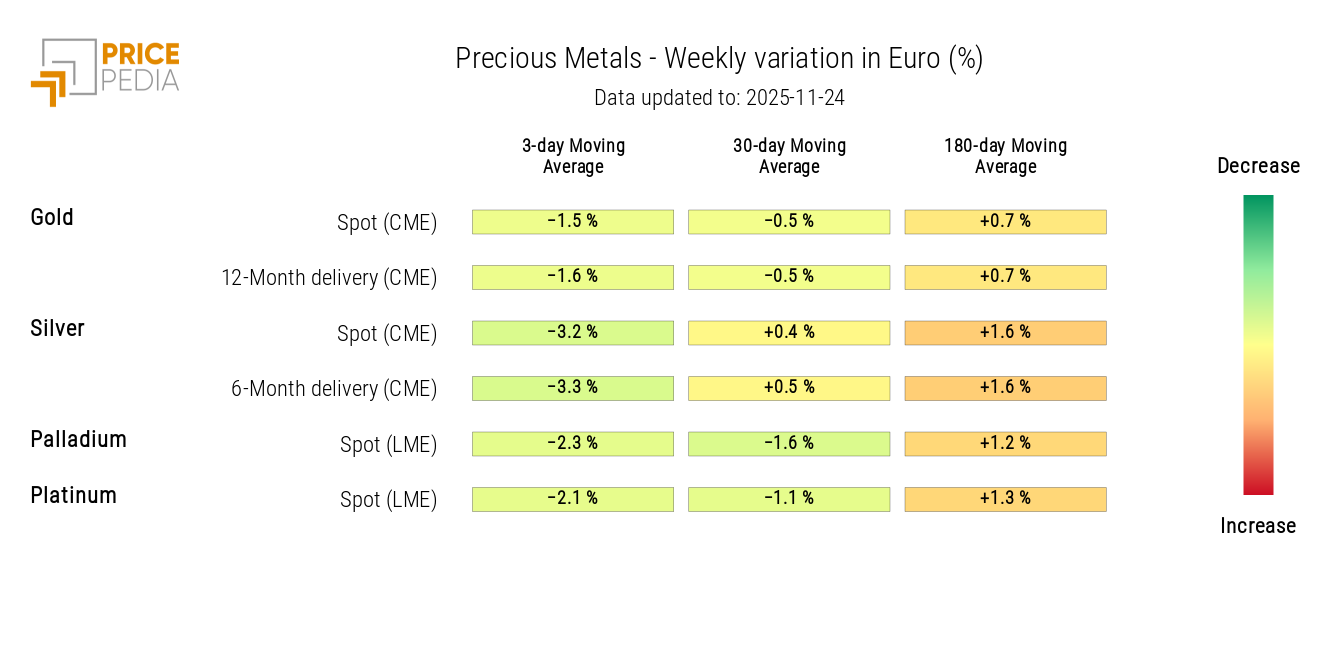

The precious metals heatmap indicates a generalized decline in prices, more pronounced for silver.

HeatMap of Precious Metal Prices in EUR

FERROUS METALS

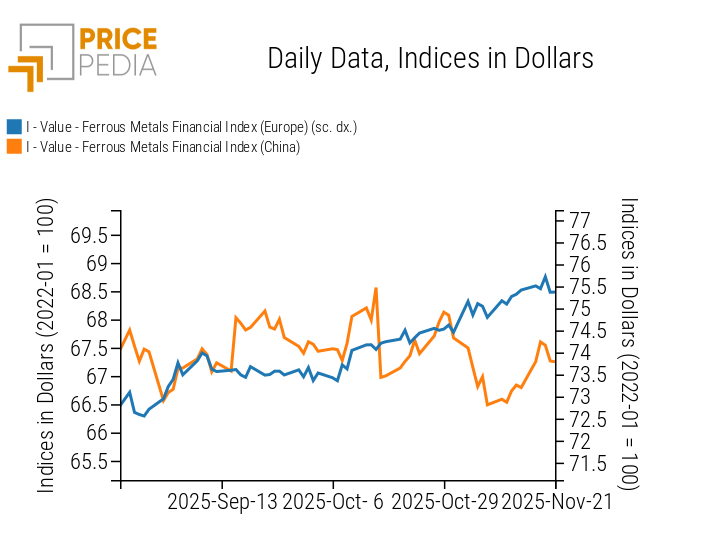

The two PricePedia financial indices for ferrous metals show rising prices in both Europe and China, supported by recent Chinese data indicating a decline in steel production.

PricePedia Financial Indices of Ferrous Metal Prices in USD

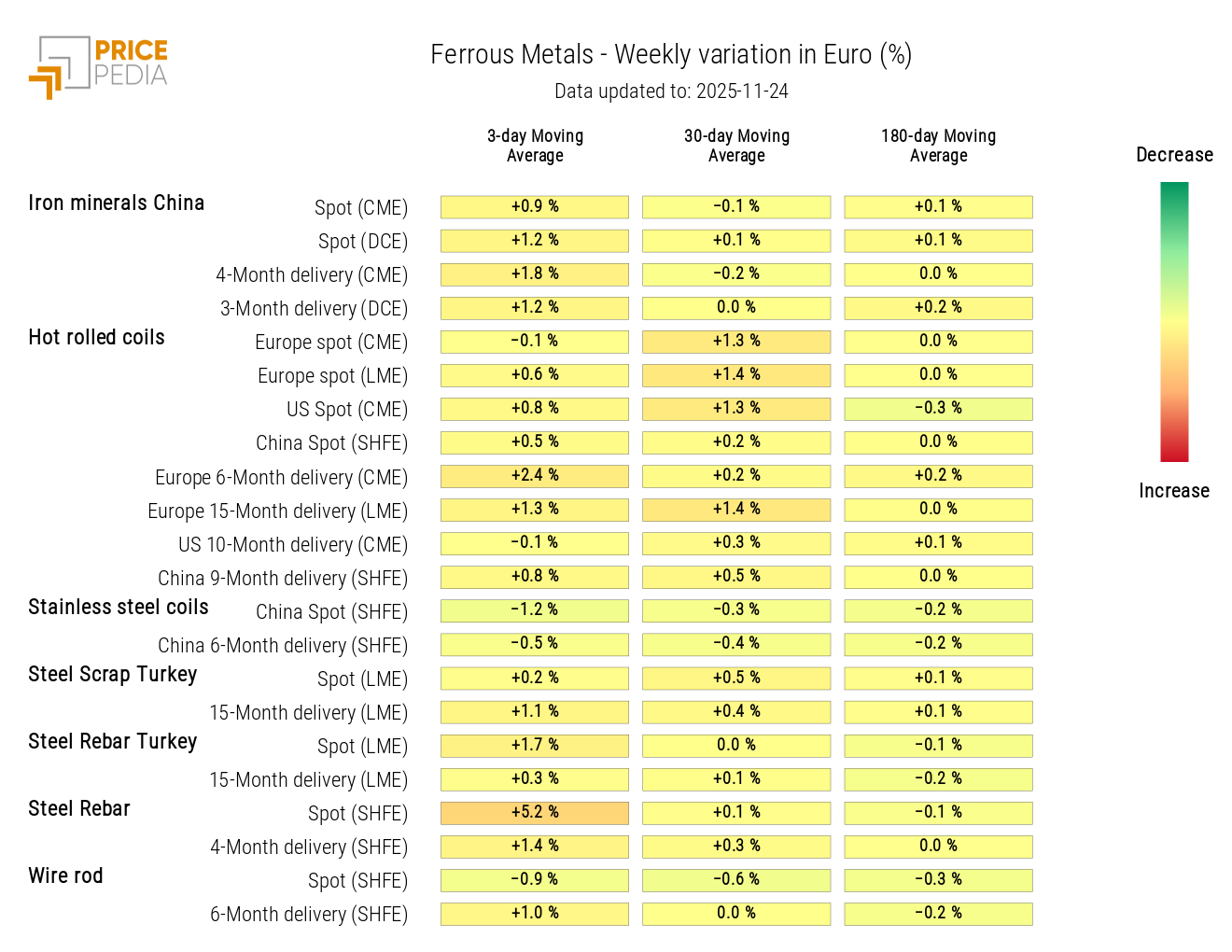

The heatmap shows price increases for steel rebar and Chinese iron ore.

HeatMap of Ferrous Metal Prices in EUR

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

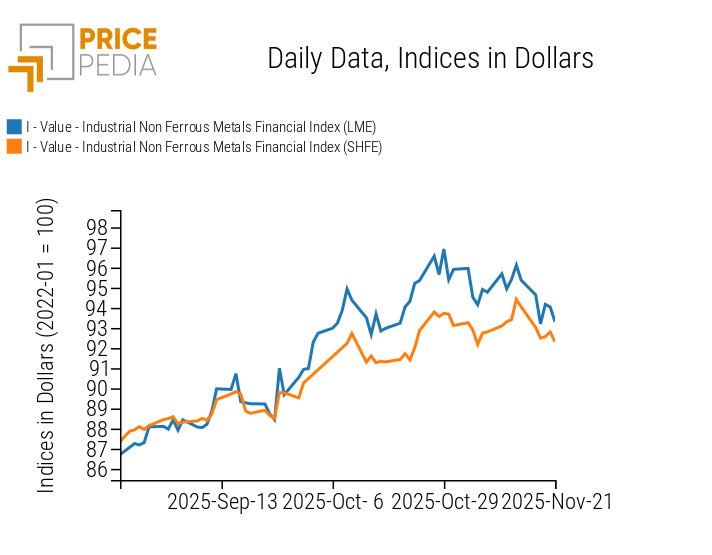

Both PricePedia financial indices for non-ferrous industrial metals show a decline in prices, attributable to weak Chinese macroeconomic data, rising inventories on the Shanghai Futures Exchange, and growing tensions between China and Japan.

PricePedia Financial Indices of Non-Ferrous Industrial Metal Prices in USD

The heatmap of non-ferrous metals shows price declines in nickel, aluminum, zinc, and lead.

HeatMap of Non-Ferrous Metal Prices in EUR

FOOD COMMODITIES

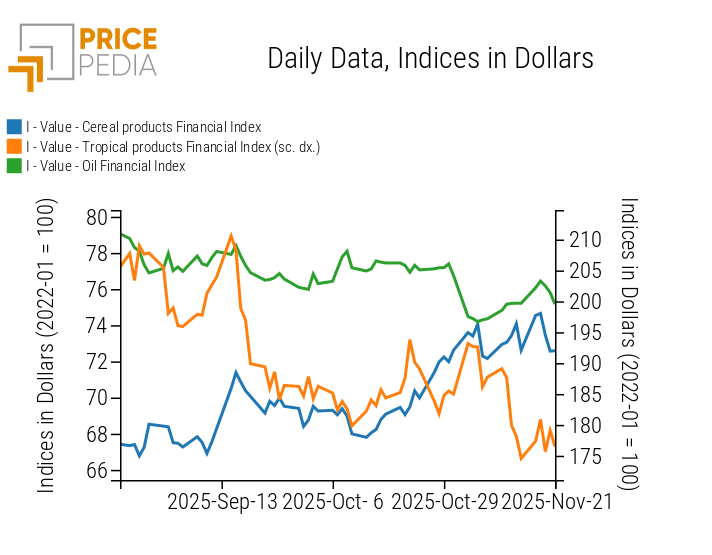

Despite strong weekly fluctuations, all three PricePedia financial indices for food commodities remain relatively stable on a weekly basis.

PricePedia Financial Indices of Food Commodity Prices in USD

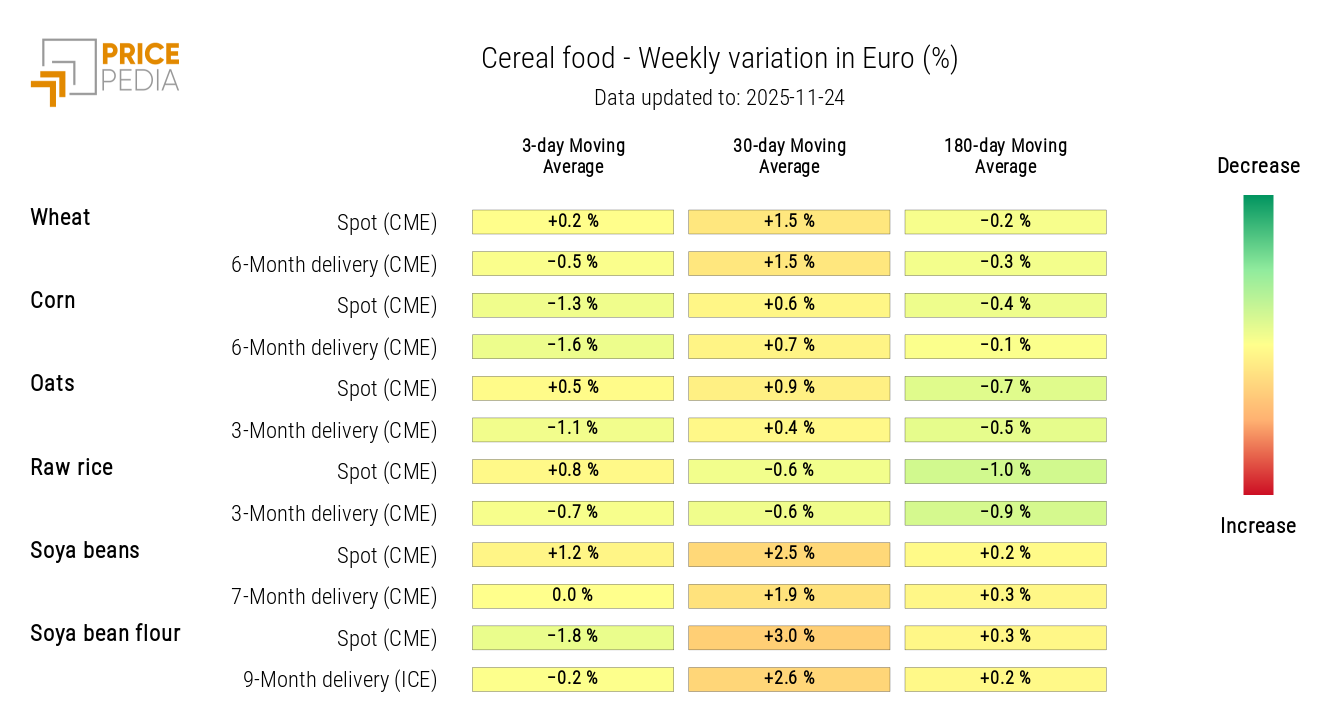

CEREALS

The cereals heatmap shows a weekly decline in the 3-day moving average of soybean meal and corn prices in EUR.

HeatMap of Cereal Prices in EUR

TROPICALS

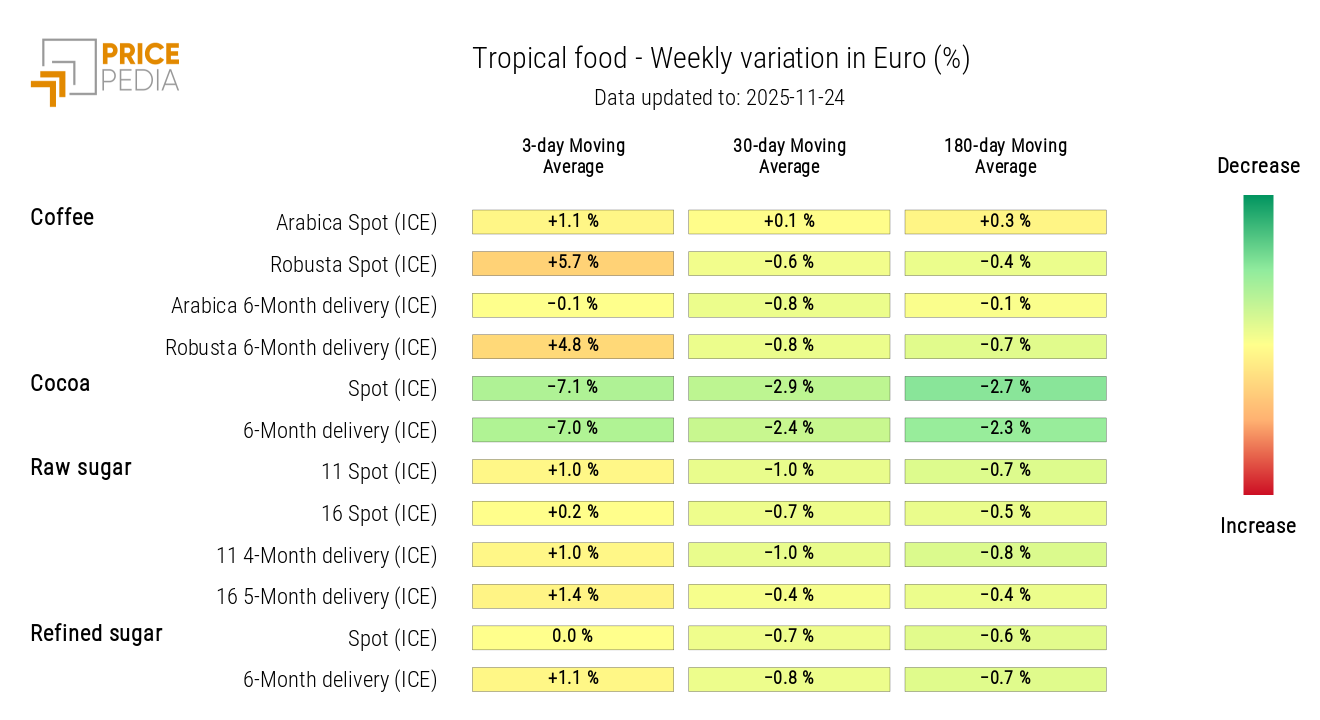

The tropicals heatmap highlights rising prices for robusta coffee alongside a decline in cocoa prices.

HeatMap of Tropical Food Commodity Prices in EUR

OILS

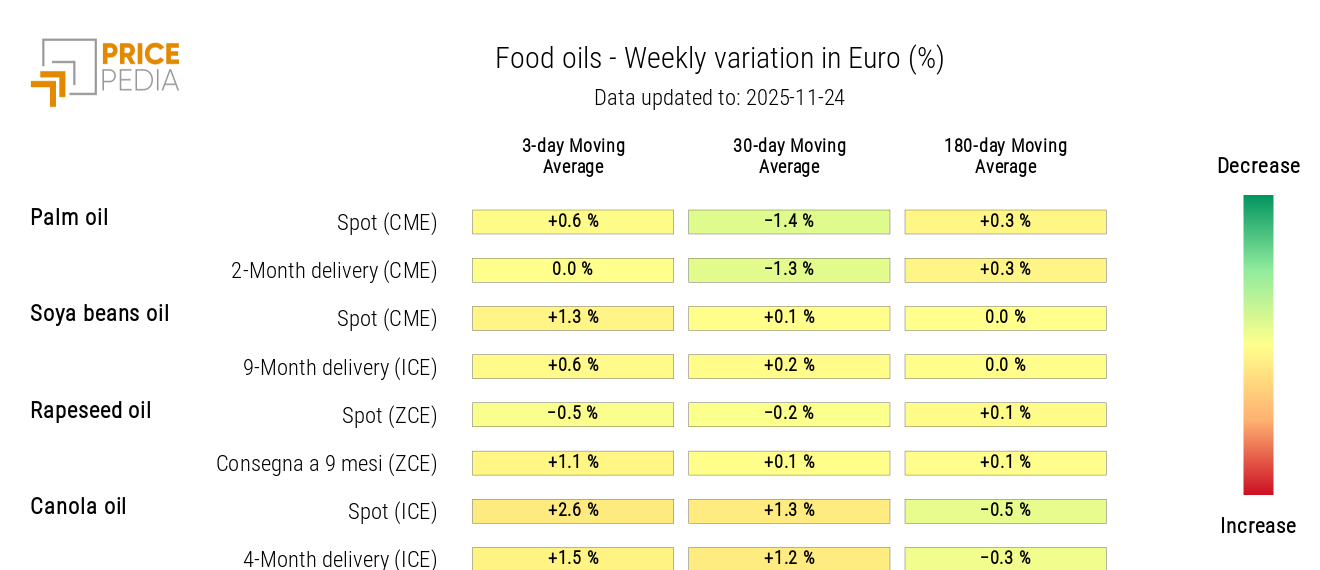

The heatmap of edible oils shows rising prices for canola oil.

HeatMap of Edible Oil Prices in EUR