Sanctions against Russia affect the prices of oil and its derivatives

Metals market: precious down, non ferrous up on lower LME inventories

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThe United States Department of the Treasury has announced sanctions against Rosneft and Lukoil, two major Russian oil producers that together account for about half of national production, in response to Putin's refusal to end the war in Ukraine.

Earlier this year, shortly before the end of his term, the Biden administration imposed similar measures on Gazprom Neft and Surgutneftegas, including restrictions on a significant portion of the so-called Russian "shadow fleet" of tankers. However, these sanctions had a limited impact on Russian oil exports, which remained largely stable. To increase the effectiveness of the restrictions, it will be essential to target the Russian shadow fleet, consisting of foreign-flagged tankers used to circumvent international sanctions. A step in this direction was taken with the EU's nineteenth sanctions package, approved on October 23, which added 117 ships to the Kremlin's shadow fleet list, bringing the total to 558 units. At the same time, the package introduced new prohibitions for member states from engaging in commercial relations with Rosneft and Gazprom Neft, further strengthening the impact of restrictions on the Russian oil sector.

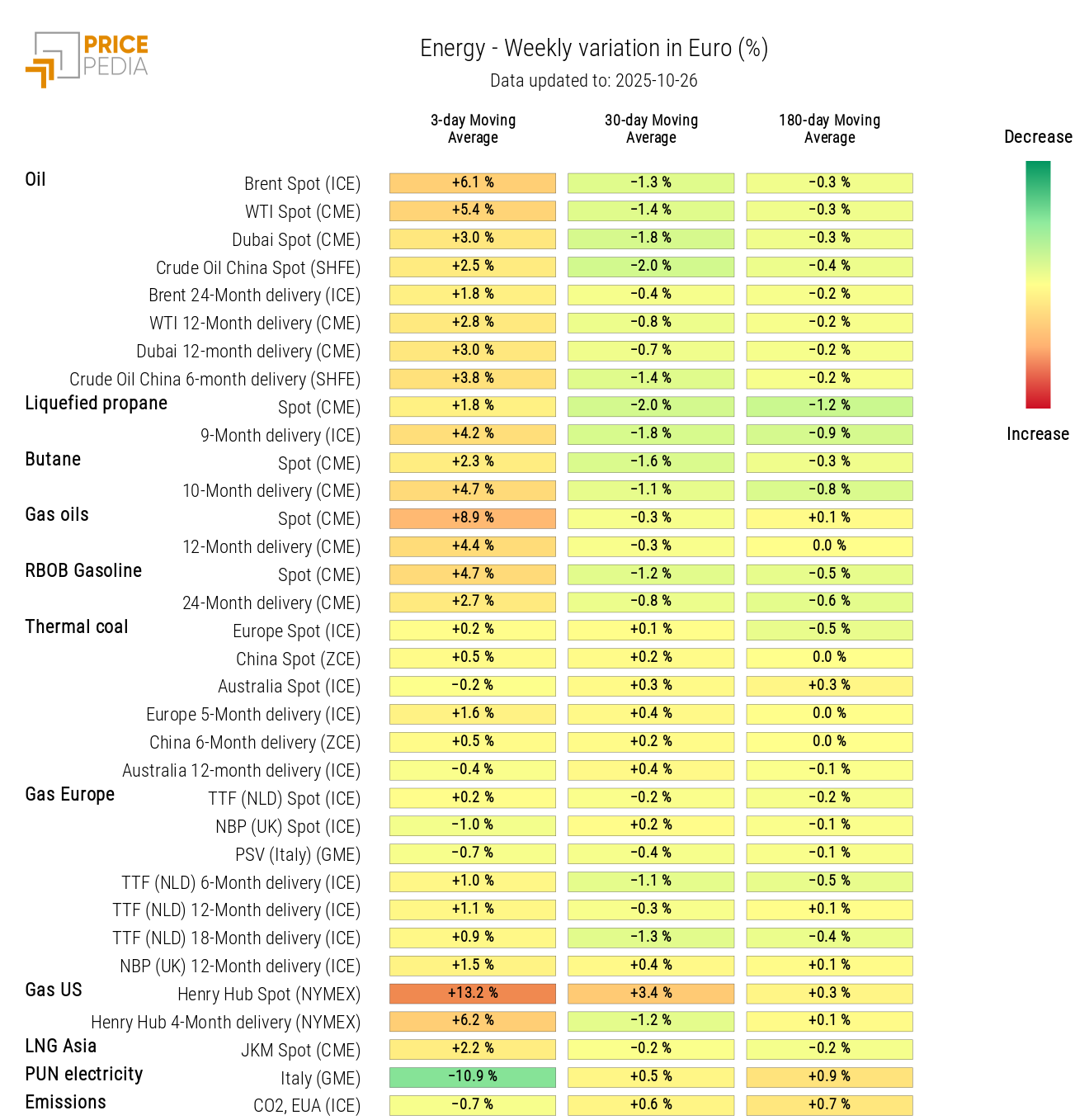

The new sanctions have contributed to reinforcing the upward pressure on oil prices, already in place since the beginning of the week due to the decline in U.S. inventories and the announcement by the U.S. Department of Energy to replenish the strategic reserve.

In the natural gas market, U.S. Henry Hub prices have recorded significant increases, supported by weather forecasts indicating a colder start to November. European TTF Netherlands prices, on the other hand, remained relatively stable despite the approval of the EU's nineteenth sanctions package, which includes a gradual ban on importing liquefied natural gas (LNG) from Russia: short-term contracts must be terminated within six months, while long-term contracts by January 1, 2027.

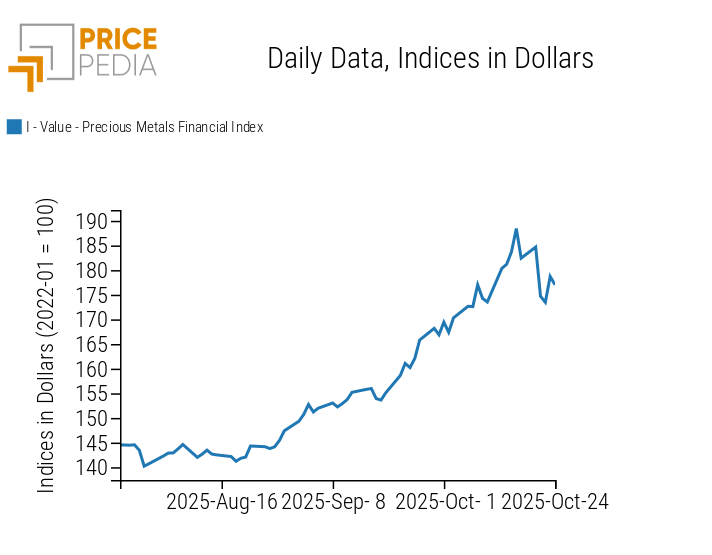

Precious metals recorded a decline due to profit-taking by traders after recent increases. On Tuesday alone, gold and silver lost 5% and 7%, respectively.

In the ferrous metals sector, Chinese prices recovered part of last week's decline, while European prices remained relatively stable. In particular, there was an increase in wire rod and stainless steel coil prices, both listed on the Shanghai market.

The non-ferrous metals sector recorded price increases, supported by a more conciliatory tone from President Trump, who expressed confidence in a trade agreement with China. During LME Week, bullish sentiment further consolidated: concerns about supply disruptions, combined with expectations of new rate cuts by the Federal Reserve, supported price growth. However, concerns about weak Chinese demand remain high.

Among food commodities, differentiated dynamics were observed across various products. The most pronounced fluctuations concerned tropical products, with significant increases for cocoa and coffee, while sugar prices decreased. This reduction is attributed to recent forecasts of a large supply surplus, resulting from increased production by sugar mills, which favored sugar over ethanol.

U.S. Inflation

Despite the U.S. government shutdown, data on the United States Consumer Price Index (CPI) were released this week.

In September, inflation grew less than expected: headline inflation increased by 0.3% month-on-month, compared to the 0.4% m/m forecast, while core inflation, excluding food and energy, rose by 0.2%, versus the expected 0.3%.

These data further strengthen expectations of an imminent rate cut by the Federal Reserve.

Regarding next week's ECB meeting, interest rates are expected to remain unchanged, confirming the cautious approach adopted in recent meetings.

NUMERICAL APPENDIX

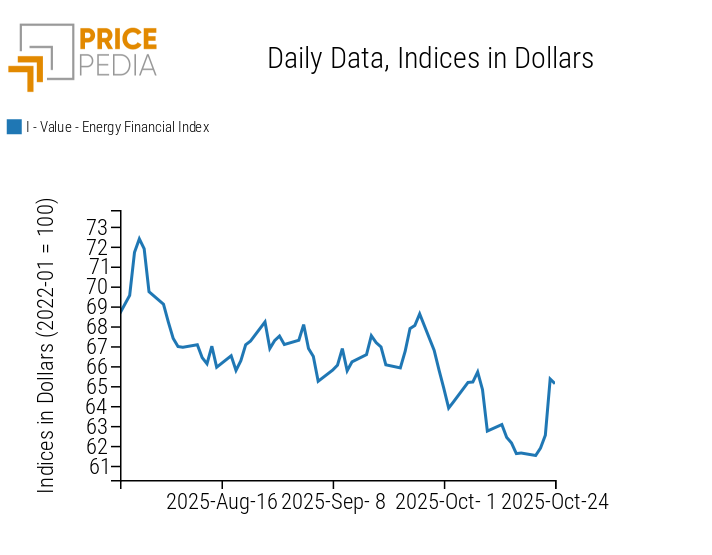

ENERGY

The PricePedia energy index reverses its trend and records a weekly increase in prices.

PricePedia Financial Index of energy prices in dollars

Analysis of the heatmap shows a significant increase in oil prices and U.S. Henry Hub natural gas prices.

Energy prices HeatMap in euros

PRECIOUS METALS

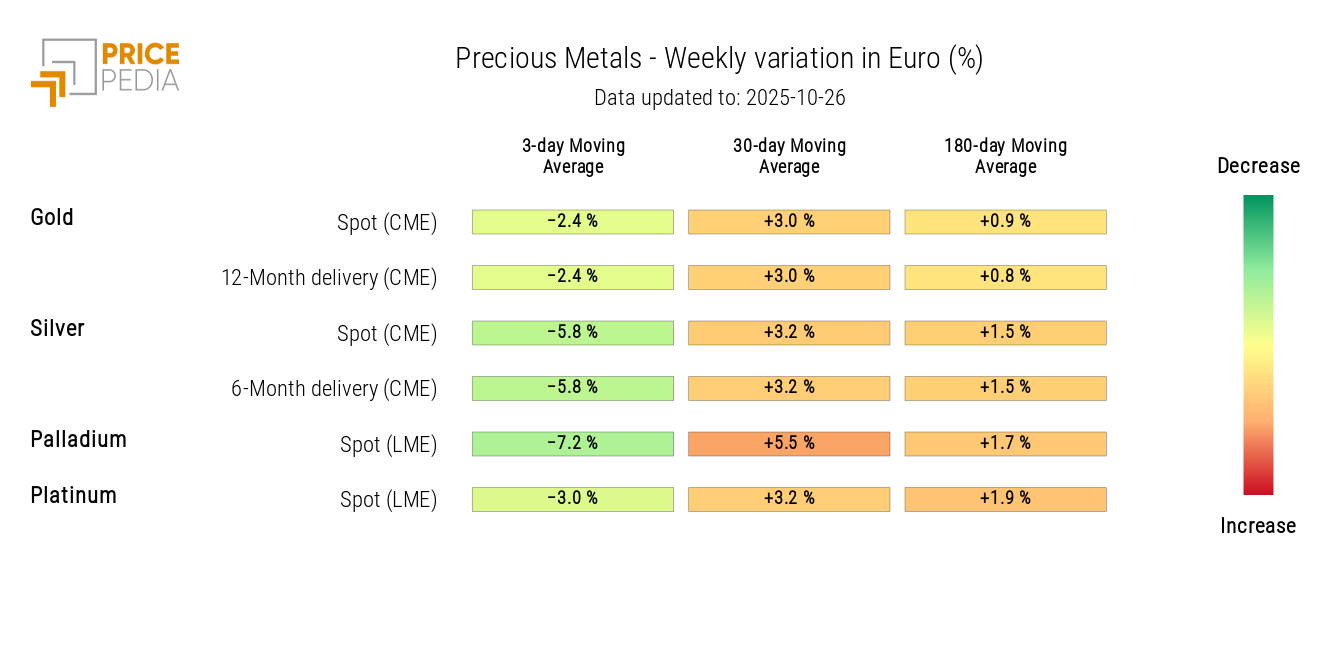

The financial index of precious metals shows a decline due to profit-taking by financial operators.

PricePedia Financial Index of precious metals prices in dollars

The precious metals heatmap shows a general decline in the weekly variations of the 3-day moving averages.

HeatMap of precious metals prices in euros

FERROUS METALS

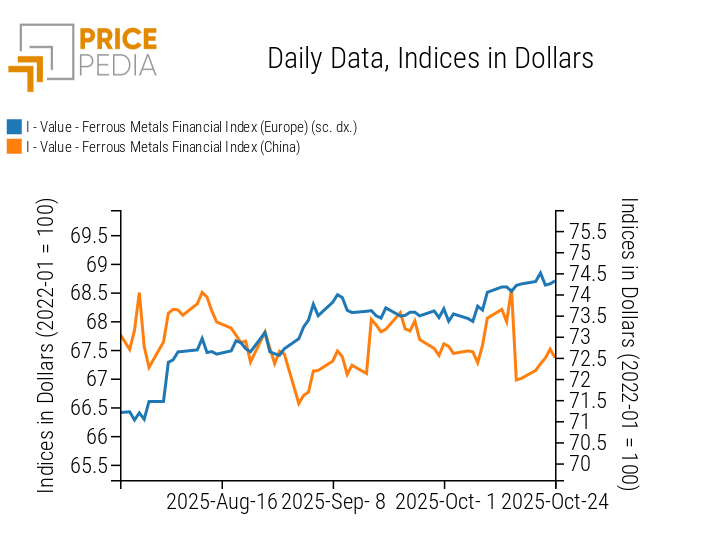

The Chinese ferrous metals index recovers after last week's decline, approaching the European index, which meanwhile followed a mostly sideways trend.

PricePedia Financial Indices of ferrous metals prices in dollars

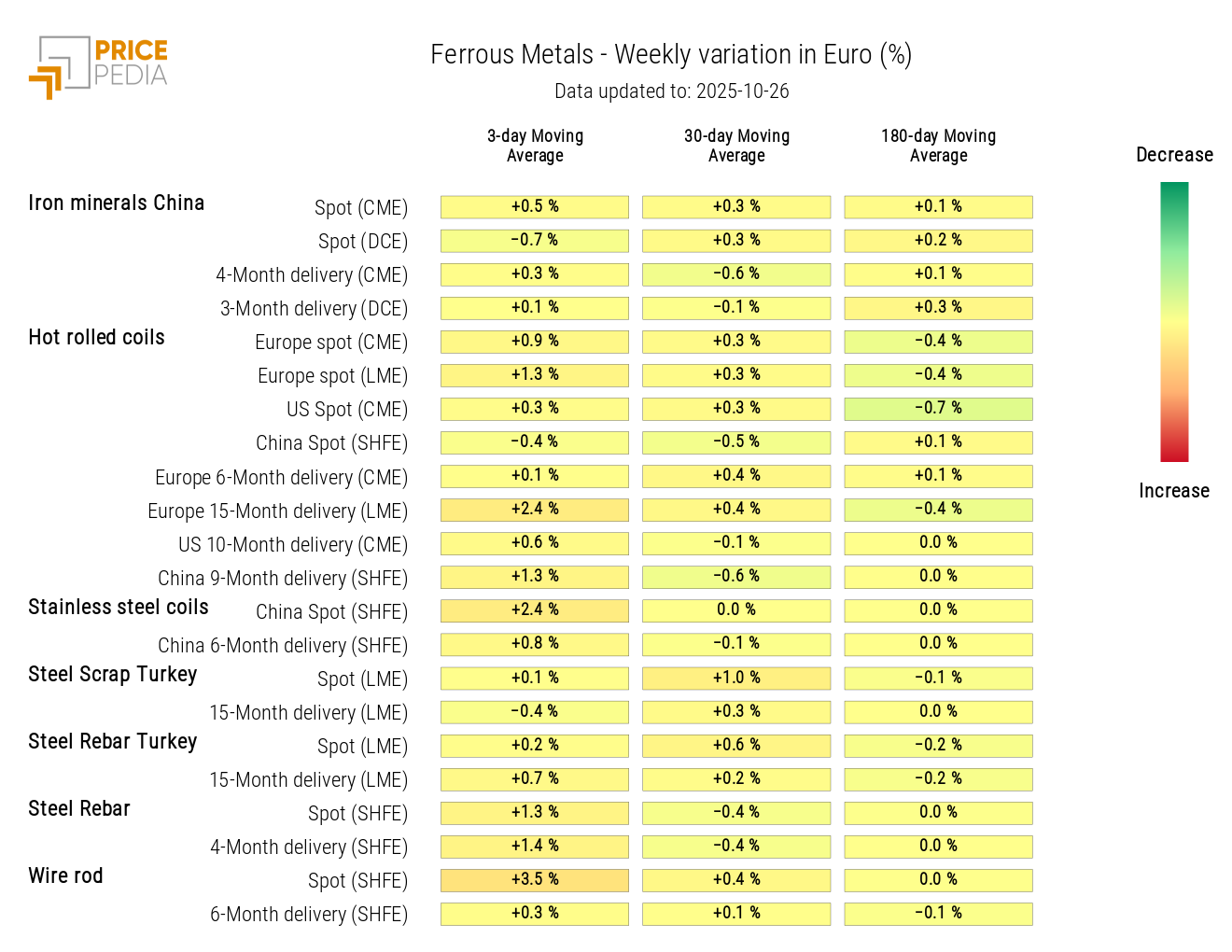

Analysis of the ferrous metals heatmap shows an increase in billet and stainless steel coil prices, both listed on the Shanghai market.

HeatMap of ferrous metals prices in euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

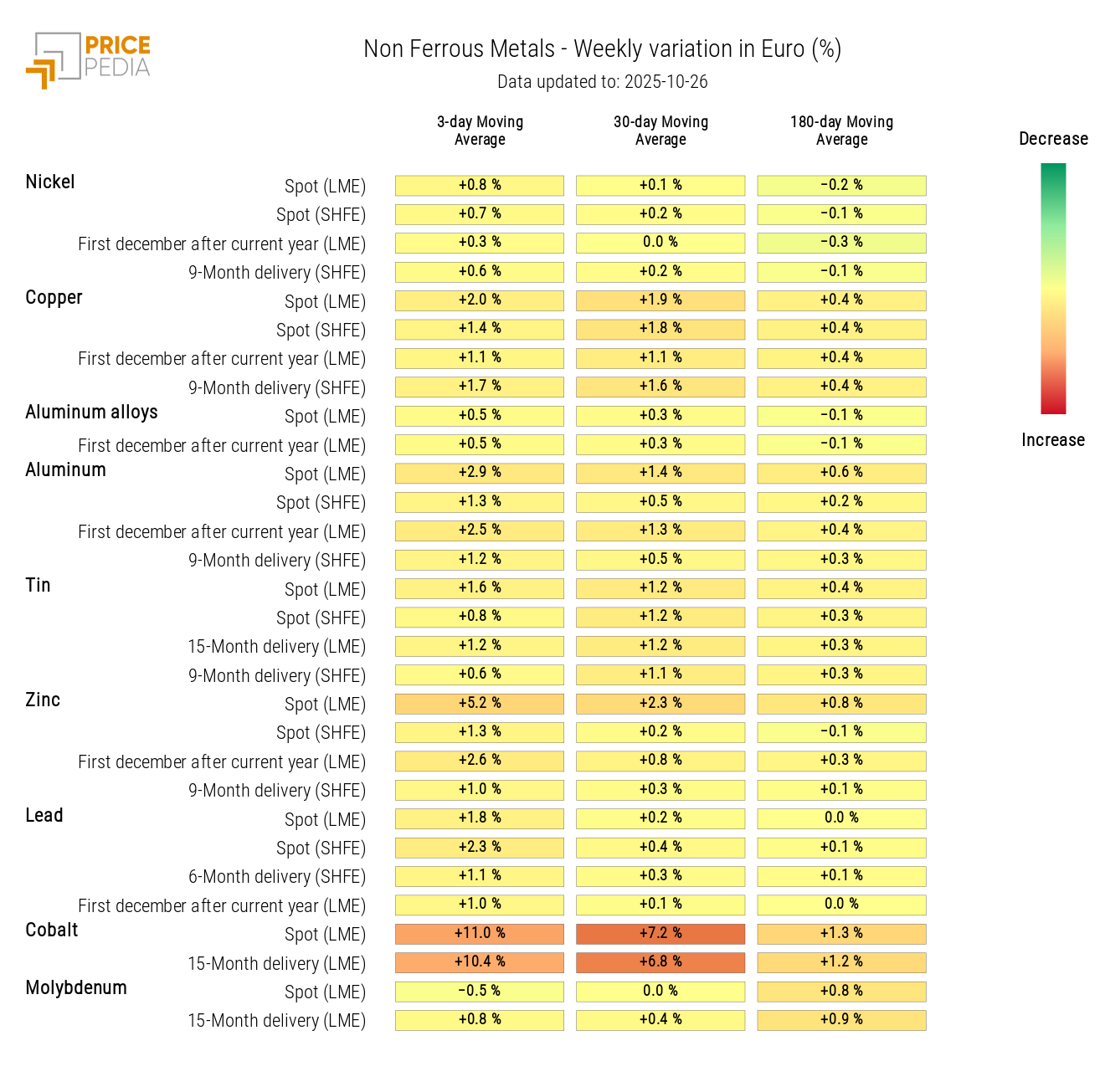

NON-FERROUS INDUSTRIAL METALS

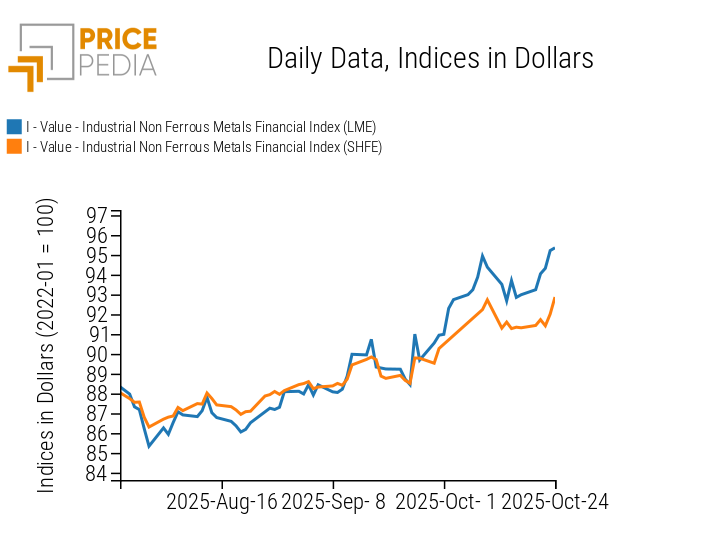

The two non-ferrous metals indices resume the recent upward trend, with the LME index showing a larger price increase than on the Shanghai exchange.

PricePedia Financial Indices of non-ferrous industrial metals prices in dollars

The non-ferrous metals heatmap shows a significant increase in cobalt, zinc, and aluminum prices.

HeatMap of non-ferrous metals prices in euros

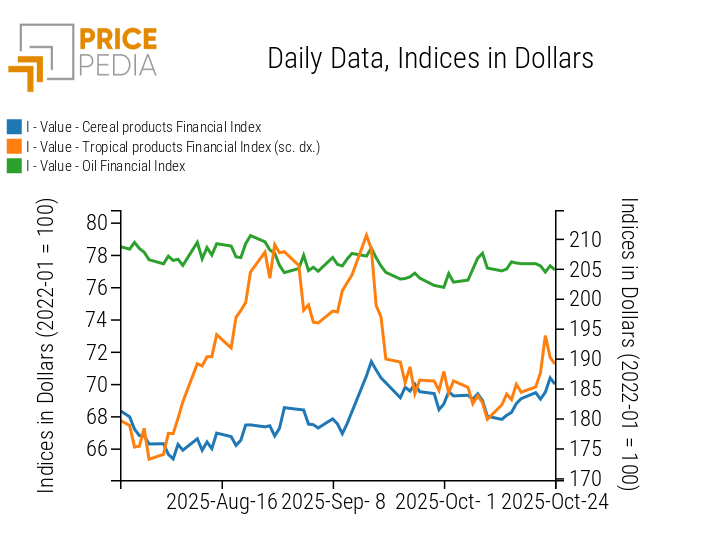

FOOD

This week, the financial indices of food commodities showed different dynamics: cereals recorded price increases, tropicals showed opposite fluctuations, while oils remained relatively stable.

PricePedia Financial Indices of food prices in dollars

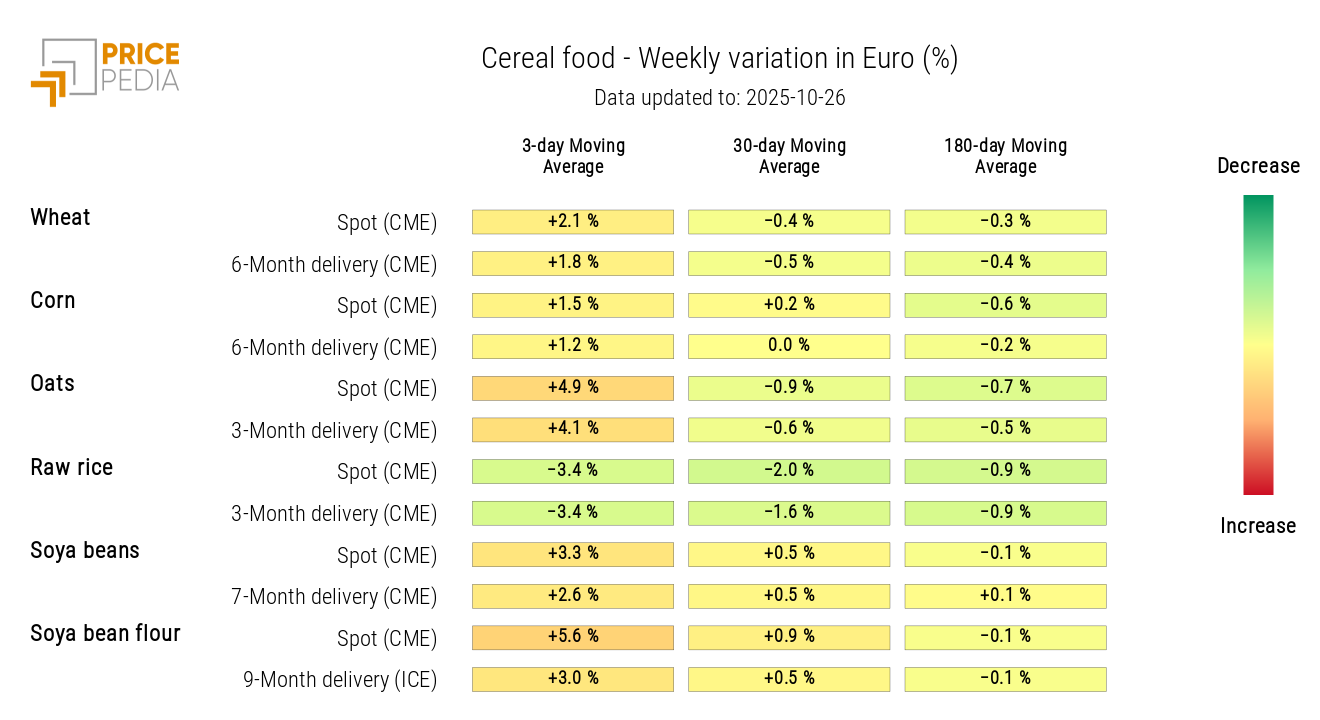

CEREALS

The cereals heatmap shows a general increase in prices, except for rough rice.

HeatMap of cereals prices in euros

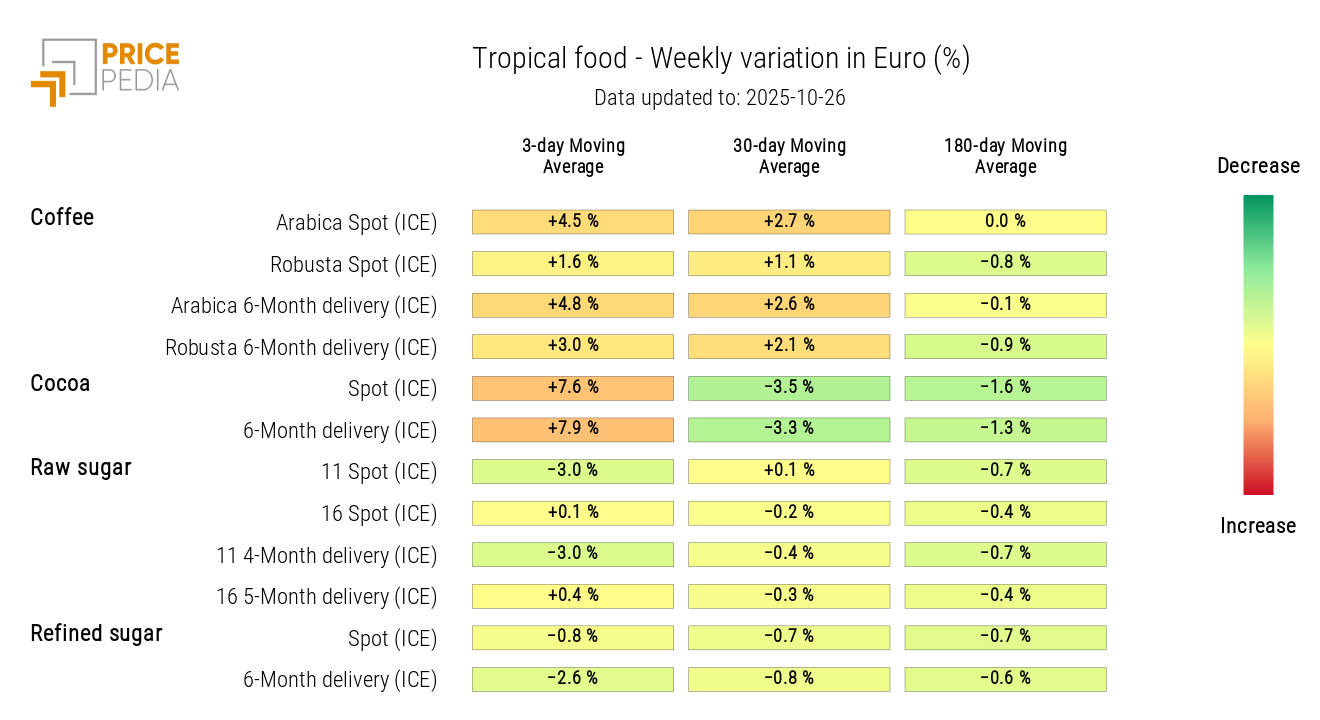

TROPICALS

The tropicals heatmap shows an increase in coffee and, especially, cocoa prices, while sugar prices decreased.

HeatMap of tropical food prices in euros