Commodity substitutability as a factor mitigating the risk of structural scarcity

An indirect measure of substitutability: the correlation between commodity prices

Published by Luigi Bidoia. .

Procurement Procurement Risk ManagementThe most recent analyses from PricePedia outline, for the 2025–2026 biennium, a scenario of a likely decline in commodity prices, followed by a modest rebound in 2027. For purchasing departments, this suggests a generally favorable phase in which buyers enjoy greater negotiating power and cost reductions can represent an important competitive lever.

However, forecasts represent only the most probable scenario, certainly not the only possible one. Geopolitical shocks, regulatory changes, or market imbalances can rapidly alter supply and price conditions. An advanced purchasing function, therefore, does not limit itself to relying on forecasts for its decisions, but also evaluates supply risks that could emerge from less probable yet still possible scenarios.

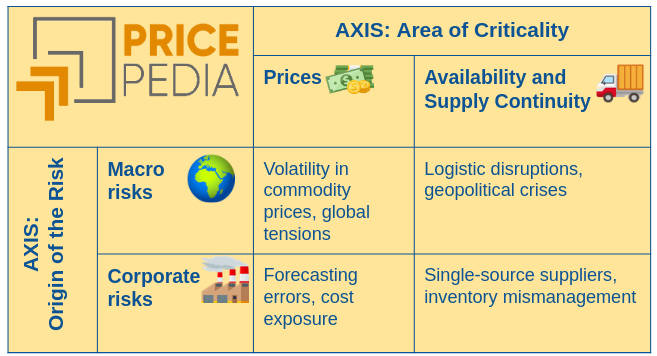

Among these risks, it is useful to distinguish between controllable risks – linked to internal factors such as inventory management or supplier diversification – and exogenous risks, which depend on external factors over which the company has no direct control but can act to mitigate their effects. Within this second category falls the risk of structural scarcity, that is, the possibility that, for a given commodity, global supply may be unable, for a more or less prolonged period, to meet demand.

To strengthen corporate resilience to exogenous risks, PricePedia has launched a project to measure the Exogenous Risks of Commodity Procurement (Rischi Esogeni di Approvvigionamento di una Commodity: REAC). The goal is to provide a synthesized score that allows companies to assess the level of exogenous vulnerability of each monitored commodity.

Among the various components of the REAC, one of the most significant is structural scarcity. This risk can be mitigated, at least in part, through commodity substitutability: the ability to replace one material with another that is functionally similar reduces the impact of supply-side tensions. Understanding and quantifying such substitutability therefore becomes a key step in strategic risk management.

In the following sections, we will explore how the correlation between prices can serve as an indirect measure of substitutability between commodities, providing a useful signal – if correctly interpreted – to assess the resilience of supply chains when facing situations of structural scarcity.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Price correlation as a measure of substitutability between commodities

Substitutability between two or more commodities is primarily a technical matter. Materials may be interchangeable in some applications but not in others, depending on their physical, chemical, or functional characteristics. For example, many grains can be substituted for one another as raw materials in animal feed production, but are far less interchangeable in food processing for human consumption. Similarly, copper and aluminum can replace each other effectively in the production of high-voltage cables, but not in the construction sector, where each has specific properties that limit their interchangeability.

When two commodities are genuine substitutes, their prices tend to move at similar levels and follow comparable dynamics. Persistent price differentials can be justified only if one of the two commodities offers a technical or performance advantage in certain applications. If, however, a significant price gap emerges between two substitute goods, demand will tend to shift toward the cheaper commodity, pushing its price upward and, conversely, driving down the price of the more expensive one. This adjustment process leads to a gradual convergence of the two prices — a typical signal of effective substitutability.

The reverse, however, is not necessarily true: a high price correlation between two commodities does not automatically imply substitutability. Similar or highly correlated prices may instead result from a shared exposure to common external factors influencing both markets. The most important of these is the dependence on the same production input — for example, energy or a specific raw material — whose price fluctuations are transmitted along the value chain. Other shared influences may include weather conditions, geopolitical shocks, or supply-side policies that simultaneously affect multiple commodities.

A methodologically sound approach to using price correlation as an indirect measure of substitutability is therefore to identify pairs of commodities with significantly high correlations while excluding cases where such correlation can clearly be explained by shared inputs or common supply-chain dependencies. Only in this way can price correlation be meaningfully interpreted as a signal — albeit an indirect one — of a real potential for substitution between commodities.

Pairs of Substitute Commodities

The following table presents a selected list of commodity pairs identified as potential substitutes based on the methodological criteria described above. The pairs are ordered in decreasing sequence according to the correlation of their detrended prices, in order to avoid misinterpreting long-term co-movements driven by common growth trends as true substitution relationships.

Pairs of Potentially Substitutable Commodities

| Commodity 1 | Commodity 2 | Price Correlation |

|---|---|---|

| Rapeseed oil | Soybean oil | 0.96 |

| Benzene | Coal tar benzene | 0.96 |

| Barley | Soft wheat | 0.96 |

| Crude palm kernel oil for industrial use | Crude coconut oil for industrial use | 0.95 |

| Copper wire (section > 6 mm) | Unalloyed aluminum wire | 0.81 |

| Tall oil fatty acids (industrial) | Industrial stearic acid | 0.80 |

| Unalloyed primary aluminum | Primary zinc | 0.72 |

Rapeseed oil and soybean oil are highly versatile vegetable oils used both in the food industry (dressings, margarines, baked goods) and in industrial and bioenergy applications (biodiesel). The high correlation of their detrended prices (0.96) reflects a strong technical and commercial interchangeability, particularly in the global vegetable oil markets, where the availability of one directly influences the price of the other.

Benzene can be produced either from coal tar or from petrochemical sources. The two variants are chemically identical and perfectly substitutable, as they represent the same compound derived from different feedstocks. Their nearly perfect price correlation (0.96) highlights their full functional equivalence in all industrial processes where benzene is used.

Both barley and soft wheat are cereals primarily used in animal feed and, to a lesser extent, in human food production (biscuits, blended flours). In the feed sector, they can be easily interchanged as sources of carbohydrates and starch, depending on relative prices and seasonal availability. Their strong price correlation (0.96) reflects both competition within the same agricultural markets and a shared exposure to climatic and logistical factors.

Crude palm kernel oil and crude coconut oil for industrial use share a very similar chemical composition and both originate from tropical palm species. They are widely interchangeable as feedstocks in the cosmetic, soap, natural lubricant, and surfactant industries. The almost synchronous movement of their prices (corr. 0.95) reflects their high functional substitutability and common geographic origin.

Both copper wire and aluminum wire are used in electrical transmission. Copper offers higher conductivity but at a higher cost, whereas aluminum is lighter and more economical, and is therefore often preferred for high-voltage cables or infrastructure where weight is a critical factor. The price correlation (0.81), significant though not high, reflects their partial technical substitutability.

Tall oil fatty acids and industrial stearic acid (corr. 0.80) are both fatty acids used as raw materials in the production of soaps, lubricants, rubber, and cosmetics. Stearic acid is of animal or vegetable origin, while tall oil fatty acids are derived from wood resins. Their similar chemical properties make them partial substitutes in industrial applications, especially where function matters more than purity.

The substitutability between zinc and aluminum occurs mainly through competition among alloys. Zinc-based alloys, such as Zamak, can compete with lightweight aluminum alloys in several die-casting and industrial component applications. This represents a partial and technological substitutability, driven by material performance rather than direct chemical or market equivalence.

Summary

The analysis of price correlations makes it possible to identify groups of commodities that may, at least in some applications, perform similar functions. This information becomes particularly relevant in situations of structural scarcity risk, since the availability of substitutes reduces the potential impact of supply shocks.

Even partial substitutability therefore represents a key lever for strengthening supply chain resilience and for guiding corporate diversification strategies. Understanding where such substitutability exists — and where it does not — helps define more accurate priorities for risk monitoring and mitigation.

[1] For a description of the PricePedia scenario, see the article PricePedia Scenario for October 2025:Downward pressure on commodity prices in 2025-2026