Macro commodity risks and corporate procurement risks

How procurement management is evolving in an uncertain world

Published by Cristina Luca. .

Procurement economic analysis Procurement Risk ManagementWhy Talk About Commodity Risk Today

The global economy is going through an unprecedented phase of uncertainty. Two armed conflicts – involving, directly or indirectly, key countries for the production and distribution of energy – and a global trade war are reshaping economic relations between major regions of the world.

In this context, procurement can no longer be considered a mere cost center. Instead, it must assert itself as a strategic resource for the company and a key player in building business resilience.

The first step toward this goal is to have a clear conceptual map of the issues related to commodity risk. To this end, it is particularly useful to consider that commodity risk can be analyzed along three distinct axes:

- Origin of the risk

- Area of criticality

- Impacting factors

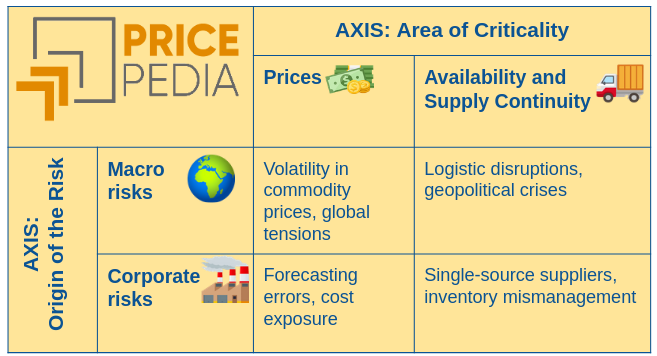

The first two conceptual axes to understand commodity risk

First Axis: Origin of the Risk

Risks can be classified based on their origin. On one side we have macro risks, external to the company; on the other, corporate risks, internal and linked to processes or organizational choices.

- Macro risks (external): geopolitics, market crises, inflation, transportation disruptions, and logistical bottlenecks are all factors beyond the direct control of companies. In this sense, the years 2021–2022 were exceptional: international tensions and market shocks severely tested global supply chains.

In the following years, although some of these risks have eased, the vulnerability of the global system remains high. Consider, for instance, the possible blockage of the Strait of Hormuz during the 12-day war between Israel and Iran, or the persistent volatility in natural gas and LNG prices. - Corporate risks (internal): these risks are linked to internal weaknesses, such as inefficient processes, dependence on a single supplier, or poor stock visibility.

For example, a company that sources a critical component from a single producer may face disruptions if that producer suddenly halts deliveries due to production or logistics issues. Without a secondary supplier (dual sourcing), even a minor issue can halt the entire production.

Second Axis: Area of Criticality

Beyond their origin, risks can also be classified based on the business area they affect. This second axis distinguishes between risks that primarily affect purchase prices and those that impact availability and continuity of supply.

- Prices: price volatility of raw materials represents one of the most complex challenges for companies, as it is often triggered by external factors that are difficult to predict or control. Imbalances between supply and demand, shifts in monetary policy—whether expansionary or restrictive—and rising geopolitical tensions contribute to increased market instability.

- Availability and continuity of supply: supply risk arises when a company fails to receive the necessary materials on time or with the expected quality. This vulnerability may stem from external factors—such as logistical interruptions, geopolitical crises, or natural events—or internal causes, such as excessive reliance on a few suppliers or inadequate inventory planning.

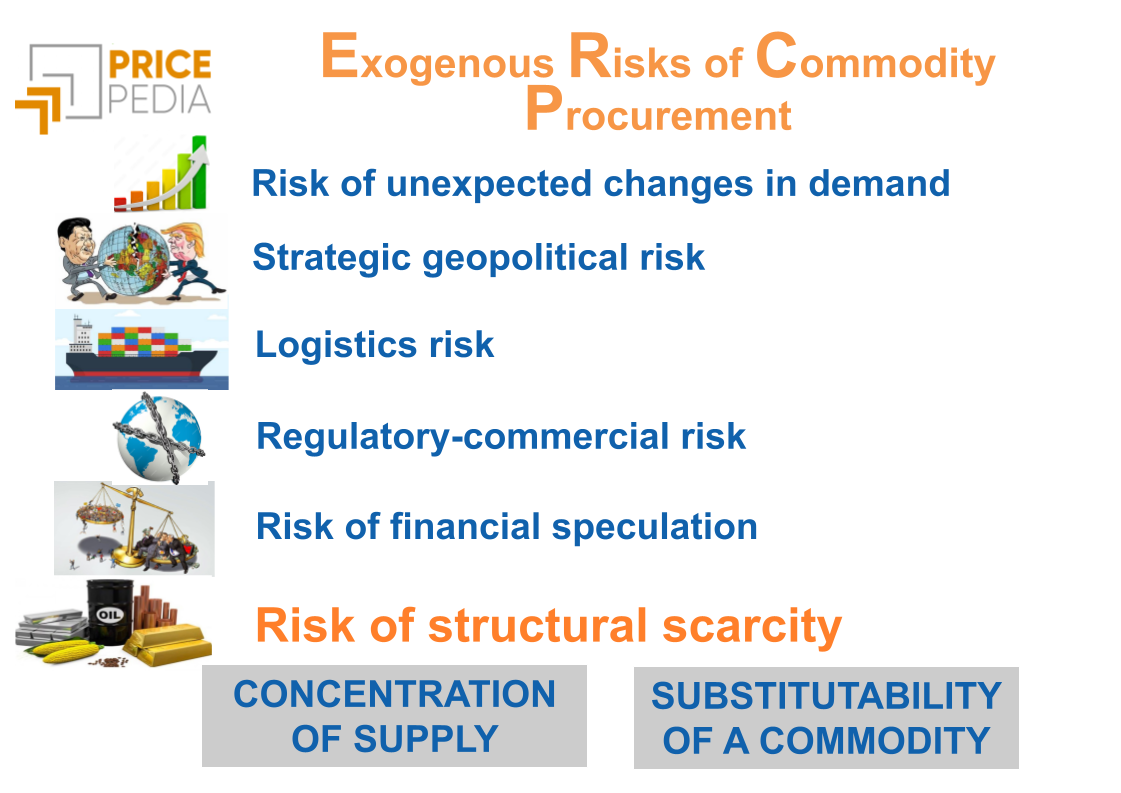

Third Axis: Impacting Factors

A third axis that is very useful for analyzing macro-commodity risk distinguishes risk based on the factors from which it originates:

- Unexpected demand surges: sudden increases in demand that put pressure on both prices and availability.

- Geopolitical-strategic risk: political instability, conflicts, or international tensions that affect supply chains.

- Logistics risk: transport issues, port congestion, or disruptions in distribution networks.

- Regulatory/trade risk: regulatory changes, tariffs, export restrictions, or trade barriers impacting supply.

- Influence of financial markets: effects of speculation, exchange rate volatility, or fluctuations in derivative markets.

- Structural scarcity risk: physical or technological limitations that prevent an increase in supply over the long term.

How to Build a Risk Management Strategy

Once risks are identified according to their origin, area of criticality, and impacting factors, it becomes essential to develop appropriate management strategies. The approach varies depending on the nature of the risk: macro risks, which are external to the company, require different tools than corporate risks, which arise internally.

For Macro Risks

External risks, by their nature uncontrollable, require protection tools and the ability to react quickly.

- Scenario development: building hypotheses on potential future contexts (e.g., trade tensions between China and the United States) to anticipate their effects on supply and prices.

- Hedging tools: adopting financial mechanisms such as hedging helps reduce the impact of price volatility on critical raw materials. Companies can use financial derivatives such as futures, forwards, and options to lock in or limit future costs, thus softening the impact of market fluctuations on performance.

- Flexible logistics partnerships: partnering with operators capable of quickly adapting to new routes or delivery modes in times of crisis.

For Corporate Risks

Internal risks, on the other hand, can largely be reduced or eliminated through organizational and strategic actions.

- Audits and mapping of critical suppliers: identifying weak points in the supply chain to build a strengthening plan.

- Dual/multi-sourcing and nearshoring: strategies to reduce dependence on single suppliers and shorten supply chains.

- Supply chain digitalization: useful for improving visibility and control of flows.

- Adopting a just-in-case approach instead of just-in-time: maintaining safety stocks helps absorb delays and disruptions without halting production.

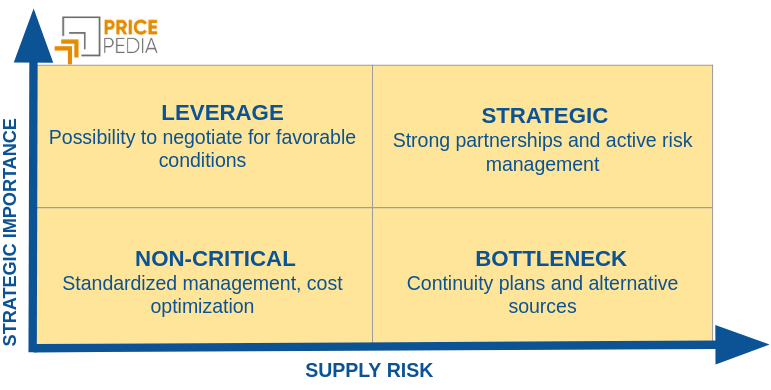

Not All Purchases Have the Same Priority

Naturally, not all purchases have the same level of importance for the company. A well-established approach is the use of the Kraljic Matrix, which classifies purchases based on their strategic importance and the supply risk in case of disruptions.

This matrix identifies four categories of purchases:

- Non-critical items: low impact and low risk – standardized management, cost optimization.

- Bottleneck items: low impact but high risk – require continuity plans and alternatives.

- Leverage items: high impact and low risk – enable negotiation for better terms.

- Strategic items: high impact and high risk – require strong partnerships and active risk management.

Although the Kraljic Matrix is an effective tool for mapping purchases based on their impact and supply risk, it is not designed to capture the macroeconomic and geopolitical dynamics that can rapidly reshape the global landscape. For this reason, it can be useful to complement it with a measure of macro-commodity risk, not to replace the matrix, but to enrich it with a complementary perspective—particularly valuable in areas where the company has limited information and visibility.

Macro-Commodity Risk and Its Uses

The macro-commodity risk score is an analytical tool for assessing a company’s exposure to external factors such as price volatility, geopolitical dynamics, regulatory risks, and structural resource scarcity. When integrated into a broader risk management framework, this measure begins with the identification of key variables, summarizes them into a score, and, if necessary, aggregates them into a rating system to facilitate comparison and prioritization across product categories. In doing so, macro-commodity risk does not replace well-established models like the Kraljic Matrix but complements them by offering an additional view of external threats.

Its main uses include ranking purchases by exposure level, identifying the most vulnerable categories, and supporting strategic decisions such as supplier diversification or the adoption of hedging policies. In this way, companies can enhance their resilience in increasingly uncertain market conditions.

In Summary

In recent years, the role of procurement has undergone a profound transformation. From a simple order handler and cost center, it is becoming a true risk manager and a key element for corporate resilience and competitiveness.

The ability to anticipate and manage risks requires not only a shift in mindset but also the adoption of established practices and the smart use of the growing amount of available information. Market data, supplier analysis, geopolitical and economic indicators, and commodity-specific risk metrics can become valuable tools for making more informed decisions and building more robust supply chains.

In a global context of rising uncertainty and interdependence, procurement can no longer remain an auxiliary function: it must evolve into a strategic player capable of ensuring operational continuity and guiding corporate planning even in turbulent times.