Indirect effects of U.S. duties on zinc

U.S. duties and substitution effects between aluminum and zinc

Published by Luca Sazzini. .

Zinc Non Ferrous Metals USA customs duties Import tariffsPresident Donald Trump is pursuing a protectionist trade policy aimed at strengthening domestic U.S. production and reducing dependence on foreign supply. To this end, in addition to introducing general tariffs of 10% and reciprocal tariffs against major trading partners with which the United States runs a trade deficit, the Trump administration has imposed specific tariffs on metals considered strategic for U.S. industry.

Currently, the only tariffs in force concern steel and aluminum, both subject to an additional 50% tariff. The measure also applies to goods containing these metals: in the case of derivative products, the 50% tariff is calculated exclusively on the portion corresponding to the steel or aluminum content, while a 10% tariff is applied to the remaining value of the product.

Starting August 1, a 50% tariff is also expected to be introduced on copper, another strategic metal for the U.S. economy, whose demand is predominantly met by foreign supply.

The application of selective tariffs on specific metals alters their relative profitability, encouraging a substitution effect: U.S. companies, penalized by the increased costs caused by the tariffs, may shift part of their demand to cheaper alternative metals not subject to tariffs. One example is the potential substitution of aluminum with zinc, a strategic metal included in Annex II, which exempts it from import tariffs into the United States and, unlike copper, does not yet appear to be targeted by U.S. trade policy. Zinc can in fact be considered a partial substitute for aluminum and, although it cannot replace it in all its applications—especially where weight and thermal or electrical conductivity are key factors—it can represent a valid alternative in various sectors. Zinc is widely used to protect steel from corrosion through galvanization, a technique that significantly extends the lifespan of metal products. In certain construction and infrastructure applications, galvanized products can be a more cost-effective alternative to aluminum, where reduced weight and maximum corrosion resistance are not priorities.

Moreover, in die-casting technologies, zinc can replace aluminum in the production of complex industrial components, especially when lightweight properties are not a priority. A typical example is Zamak alloys (zinc alloyed with smaller amounts of aluminum, magnesium, and copper), used in many high-precision technical products, including hardware, automotive components, and electronic items.

In the absence of a specific tariff on this metal, it is therefore plausible to expect that part of U.S. demand for aluminum could shift toward zinc, especially in sectors where there are economic advantages and a relatively high degree of technical substitutability.

This article will first analyze the trend in U.S. zinc imports to determine whether they increased following the introduction of tariffs on aluminum imports during Trump’s first term, while also assessing the concentration level of foreign supply. Subsequently, we will examine the evolution of international zinc prices, as recorded by the customs of the European Union, the United States, and China.

Analysis of U.S. Zinc Imports

Globally, zinc is predominantly traded in the form of ores.

In 2024, world trade in zinc ores amounted to 10.3 million tons, more than double that of unwrought zinc, the second most traded type, with 4.75 million tons. However, in the case of the United States, imports mainly concern unwrought zinc, while volumes of imported ores are marginal.

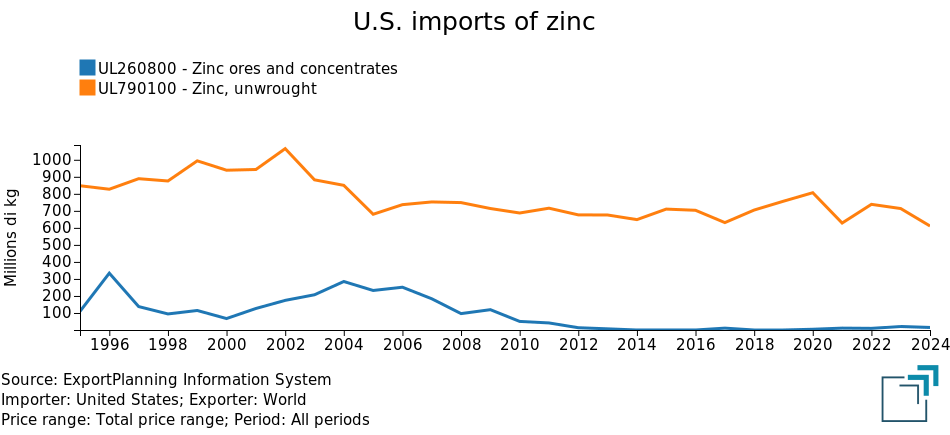

The following chart shows the historical series of U.S. imports of zinc ores and unwrought zinc.

The analysis of U.S. zinc imports reveals three key points:

- clear predominance of U.S. imports of unwrought zinc over ores: in 2024, unwrought zinc imports amounted to 611 thousand tons, compared to just 14.7 thousand tons of zinc ores. The United States is in fact a net importer exclusively of unwrought zinc, while it is a net exporter of ores, thanks to high domestic production. In 2024, the country ranked as the world’s fifth-largest producer of zinc ores, after China, Peru, Australia, and India;[1]

- decline in U.S. zinc imports compared to the early 2000s: compared to the early years of the new millennium, U.S. imports of zinc—both in unwrought and ore form—have declined;

- increase in unwrought zinc imports during Trump’s first term: starting in 2018, the year when the U.S. imposed 10% tariffs on aluminum, unwrought zinc imports rose from 630 thousand tons in 2017 to over 800 thousand tons in 2020. In 2021, the year the Biden administration lifted U.S. tariffs on European aluminum, imports declined, mainly due to the effects of the pandemic crisis.

Analysis of Major U.S. Suppliers of Unwrought Zinc

Since U.S. zinc imports are almost entirely in the form of unwrought metal, the analysis will focus solely on this type.

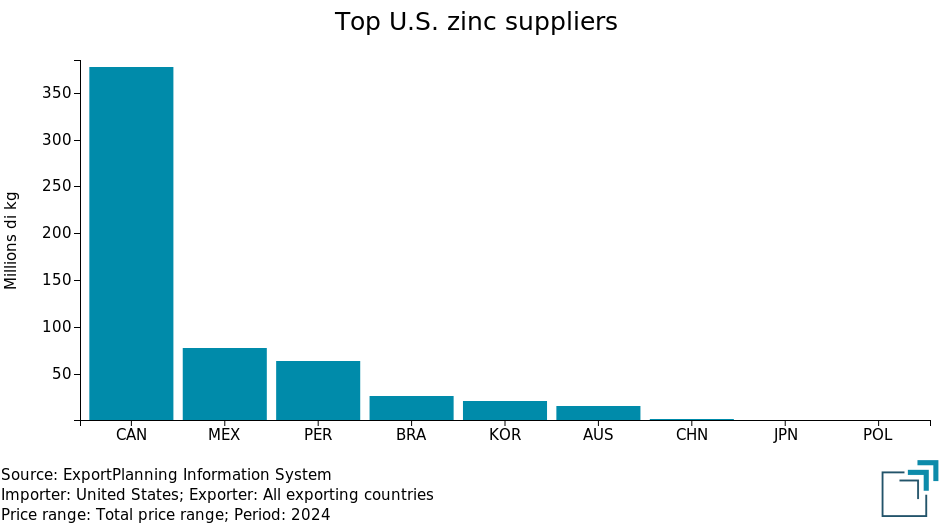

The chart below shows the top 10 suppliers of unwrought zinc to the United States in 2024.

In 2024, U.S. imports of unwrought zinc from Canada amounted to 377 thousand tons, accounting for over 60% of total foreign supply. This high concentration of imports represents a potential risk to supply security: any disruption of Canadian exports would be enough to cause a significant supply shortage in the U.S. market.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of International Zinc Prices

In customs markets, unwrought zinc prices are classified by purity level. The most commonly traded grade, both globally and in the United States, has a zinc content of over 99.99%, which is also the standard used in the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

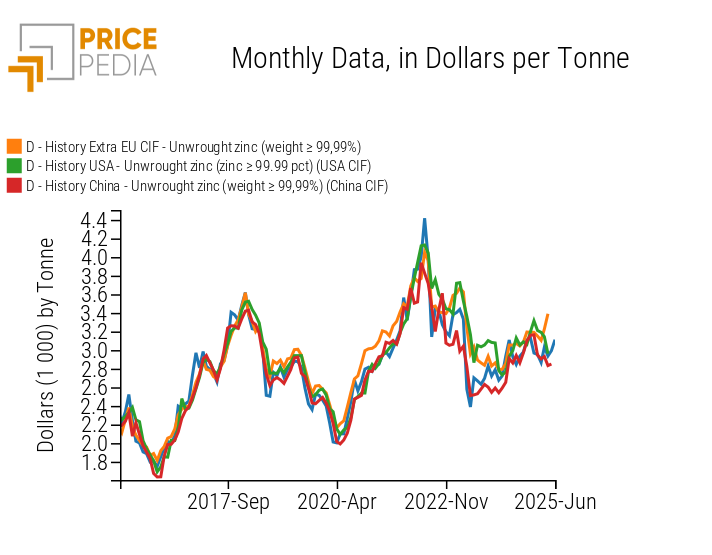

The chart below compares CIF customs prices of the highest purity unwrought zinc, as recorded at the customs of the European Union, the United States, and China.

CIF Customs Prices of Unwrought Zinc with Purity above 99.99%

The analysis of customs prices highlights the strong correlation between international prices of unwrought zinc, which tend to follow a common trend. The unwrought zinc market can in fact be considered a global market, where physical prices align with the performance of international financial benchmarks.

Price levels also tend to be very similar, with Chinese prices slightly lower than those in Europe and the U.S. However, there are no clear differences between U.S. and European prices. In fact, U.S. prices do not appear to be consistently higher than European ones, not even during periods when U.S. aluminum import tariffs were in place.

Summary

The introduction of differentiated tariffs on substitutable commodities can create market inefficiencies, prompting economic agents to replace the taxed metal with a cheaper, exempt one, thus altering their original preferences. A concrete example is the U.S. trade policy that imposed 50% tariffs on imported aluminum while exempting zinc, which is included in Annex II of tariff-free goods. Given the partial substitutability between zinc and aluminum in some industrial sectors, this tariff asymmetry can encourage a shift in U.S. demand from aluminum to zinc. This dynamic already occurred during Trump’s first term: starting in 2018, when aluminum tariffs were introduced, U.S. imports of aluminum began to decline, while zinc imports increased. However, U.S. prices of unwrought zinc did not rise more than those in other regions, not even during the periods when tariffs on U.S. aluminum imports were in effect. Zinc prices tend to remain aligned in both trend and level across markets.

[1] Source: U.S. Geological Survey (USGS): Mineral Commodity Summaries 2025.