US duties on copper: the reasons and expected effects on prices

Financial markets remain uncertain on U.S. duty announcement on 50% copper

Published by Luca Sazzini. .

Copper Non Ferrous Metals USA customs duties Import tariffsOn Tuesday, July 8, President Donald Trump announced his intention to introduce a new additional 50% tariff on copper imports, scheduled to take effect starting August 1. However, no official documents confirming the measure have yet been published, nor clarifications regarding the customs codes involved or any exemptions or reduced tariffs for specific countries. In the absence of a new provision, copper will therefore continue to benefit from the current exemption from additional tariffs provided by its inclusion in Annex II attached to the executive order of April 2.

The possibility of introducing new tariffs on copper, however, is not new. Already last February, President Trump tasked the U.S. Department of Commerce with launching an investigation to assess whether U.S. copper imports could pose a threat to national security.[1] This investigation is part of the procedures provided by Section 232 of the Trade Expansion Act of 1962, which allows the government to introduce trade restrictions if it believes that the influx of foreign goods could undermine sectors deemed strategic for the country’s interest.

The stated goal of the administration remains to strengthen domestic production of commodities considered strategic, such as copper, and reduce dependence on a limited number of foreign suppliers, which exposes the country to risks of vulnerability.

The official results of the investigation have not yet been published, and the final report should be presented by November 22.

In this article, we will first analyze the trade flows related to U.S. copper imports to understand the context that may have prompted the U.S. administration to consider introducing this new protectionist measure. Subsequently, we will focus on the effects that the announcement of the new tariffs has already had on copper financial prices, and on those it could have on the corresponding physical prices should this protectionist measure actually come into force.

Analysis of U.S. copper imports

The United States is a net importer of copper, with an import volume of 1.5 million tons in 2024, compared to exports of just half a million tons. By contrast, it is a net exporter of copper ores, with exports in 2024 amounting to 8,400 tons and imports of just 2,600 tons. The United States is, in fact, the fifth largest producer of copper ores in the world, behind Chile, Congo (Kinshasa), Peru, and China[2].

Focusing on the 1.5 million tons imported in 2024, about one million concerns solely refined unwrought copper not alloyed, while the remaining half million consists of derived products and semi-finished goods such as wires, bars, tubes, sheets, and alloys. These data suggest a solid domestic capacity for processing and manufacturing copper, given that the demand for foreign imports focuses mainly on unwrought copper rather than processed products.

Concentration of U.S. copper supplies

The vulnerability of the U.S. copper supply chain does not depend only on the overall volume of imports, but above all on the high concentration of supplies coming from a few exporting countries.

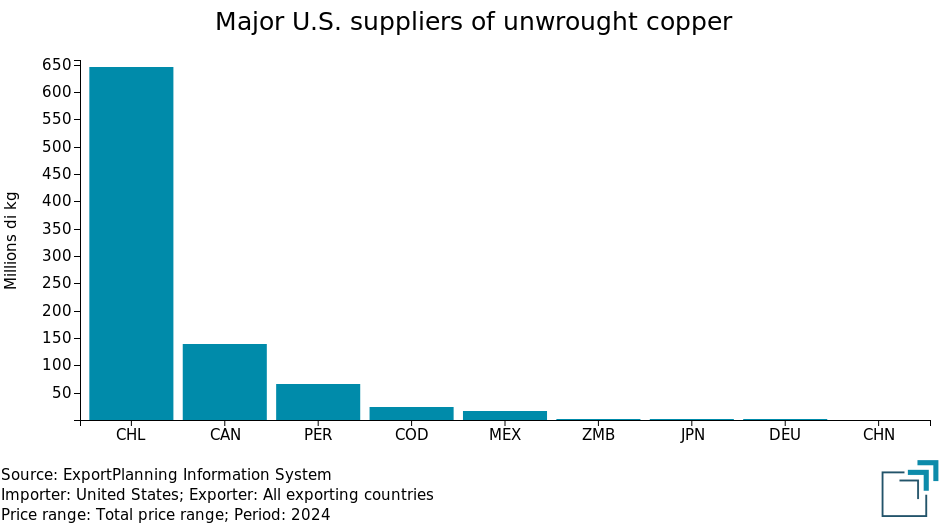

The chart below shows the top 10 copper supplier countries to the United States, expressed in millions of kg.

From the chart analysis, it emerges that in 2024, the United States imported 650 million tons of copper from Chile, accounting for almost 70% of total copper imports. Imports from Canada and Peru are relatively marginal compared to those from Chile.

A possible interruption of Chilean supplies would therefore be enough to significantly reduce the copper supply in the U.S. market. This dependence could have led the U.S. government to consider introducing tariffs, with the aim of better protecting domestic industry and reducing dependence on Chilean imports.

The reaction of financial markets to the announcement of U.S. tariffs

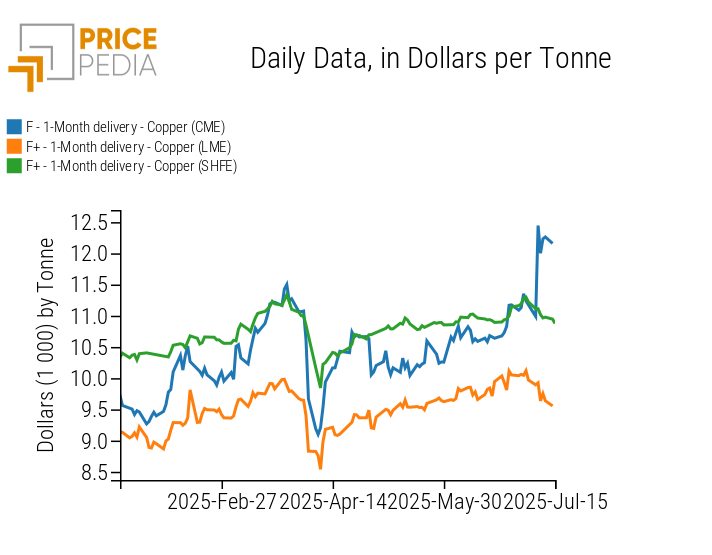

As reported in the article: Financial markets waiting for US tariffs to come into force, on Tuesday, July 8, following the announcement of new additional 50% tariffs on U.S. copper imports, Comext (CME) copper financial prices rose by over 13%, while those quoted on the London and Shanghai exchanges recorded daily changes close to 0%. The following chart shows a comparison of copper financial prices quoted on the Chicago Mercantile Exchange (CME), the London Metal Exchange (LME), and the Shanghai Futures Exchange (SHFE), expressed in euros/ton.

Comparison of copper financial prices, expressed in euros/ton

The chart highlights the sharp rise in Chicago copper financial prices compared to those recorded on the London and Shanghai exchanges. The announcement of the new 50% U.S. tariffs on copper imports pushed CME copper prices up to €10,500/ton, exceeding LME prices by over €2,000/ton and Shanghai prices by over €1,000/ton, which, unlike the other two prices, also include the cost of VAT and other taxes.

The sudden rise in CME copper financial prices is attributable to the fact that financial operators did not expect U.S. copper tariffs to be so high. This led to a rapid increase in demand for CME copper ahead of the imminent introduction of tariffs, with Comex warehouse stocks overall surpassing those accumulated at the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

Despite this large gap between CME copper prices and those on the London and Shanghai exchanges, the increase in prices on the U.S. market does not yet appear, at least for now, proportional to the magnitude of the tariffs announced by Trump. The market seems to maintain a cautious attitude toward the actual introduction of such a high tariff, factoring in only a partial price increase compared to the expected tariff amount.

The markets’ hesitation stems from the fact that a tariff increase of this magnitude could fuel inflationary pressures and cause a significant drop in domestic demand, further complicating the Federal Reserve’s decisions regarding the next interest rate cut.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Effects on physical prices of a U.S. copper tariff increase

Effects on physical prices of an increase in US tariffs on copper

All else being equal, an increase in tariffs on US imports of copper leads to higher copper prices in the United States and lower prices on the international market. This happens because tariffs encourage US suppliers to divert part of the exports originally destined for the United States to other foreign markets, thus reducing the supply available on the US market while increasing competition abroad.

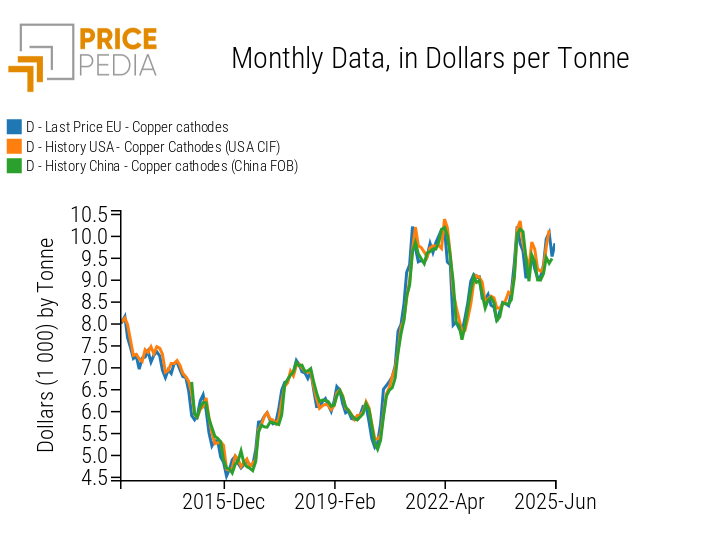

The introduction of new trade tariffs on copper could therefore, for the first time in history, lead to a regionalization of copper prices. Until now, copper prices have been a classic example of a global market, where different regional areas show aligned price levels and dynamics. To support this statement, the chart below compares the historical series of customs prices of copper cathodes in the three main world economic areas: the European Union, the United States, and China.

Comparison of customs prices of copper, expressed in euro/tonne

In summary

The announcement of new tariffs on US imports of copper is partly consistent with the United States’ high dependence on Chilean supplies, which account for almost 70% of the country’s foreign demand for unwrought copper. The US government may therefore have considered introducing such tariffs to encourage domestic production and reduce dependence on foreign suppliers like Chile and Canada.

However, financial markets have only partially priced in the impact of a potential 50% trade tariff. Futures prices quoted on the Chicago Mercantile Exchange are “only” 18% higher than those quoted on the London market. Operators remain partly skeptical about the actual implementation of such high tariffs, as this would have negative effects on the US economy: an increase in domestic prices and a consequent drop in demand, which would further complicate the Federal Reserve’s monetary policy.

[1] See: ADDRESSING THE THREAT TO NATIONAL SECURITY FROM IMPORTS OF COPPER.

[2] Source: U.S. Geological Survey (USGS): Mineral Commodity Summaries 2025.