Gas Prices in Italy: Rising PSV-TTF Spread

Qatar risk and storage delays fuel speculation

Published by Luigi Bidoia. .

Natural Gas Price Drivers

In recent months, the wholesale gas market at Italy's Virtual Trading Point (PSV) has been marked by a significant positive spread (over 3 euros/KWh) compared to gas prices traded at the Dutch Title Transfer Facility (TTF).

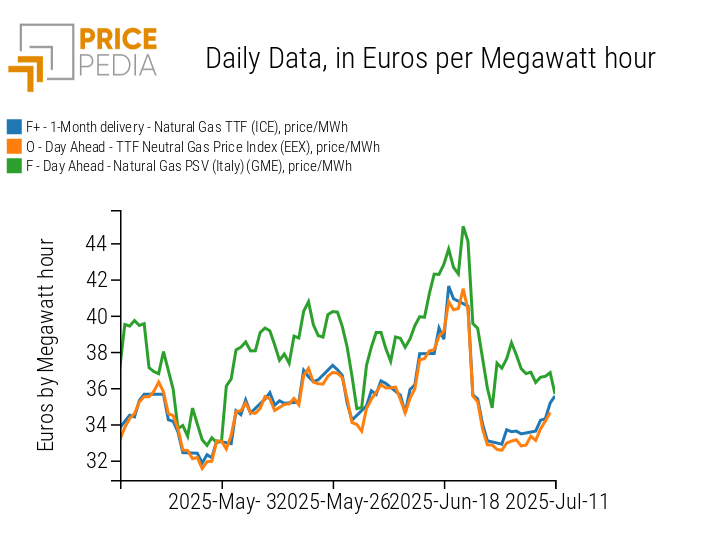

The chart below shows a comparison between Italy’s PSV day-ahead market prices and the natural gas price index of the Dutch TTF market, calculated and published by the European Energy Exchange (EEX), along with the financial price quoted on the Intercontinental Exchange (ICE) for gas delivery contracts for the following month.

As clearly illustrated in the chart, while the two TTF price references are substantially aligned, the PSV traded price consistently shows a higher level.

Comparison of gas price traded at Italian PSV and Dutch TTF

In this article, we will examine the possible drivers behind this spread and, more importantly, assess whether it can be considered a structural element of the Italian market within a specific range, or if there are changes underway that could indicate a trend towards further growth.

Possible Drivers of the PSV-TTF Spread

The drivers behind this spread can be traced to the following factors:

- higher logistical costs for transporting gas through the Italian network;

- greater risks associated with Italy’s gas supply sources;

- the need to source LNG on the global market, competing with Asian demand;

- increased gas demand in Italy to fill storage sites.

All these factors carry some weight, but none of them currently show signs of deterioration that would justify a worsening scenario.

The lower transport efficiency of Italy’s gas network compared to that of Northern Europe is a well-known issue among industry players, yet there are no indications of any recent decline.

Italy’s LNG imports rely on Qatar for nearly 50% of supply. In the event of a blockade of the Strait of Hormuz, Italy’s supplies could be more severely impacted than those of most other European countries. If this supply risk were perceived as significant by the markets, it should have been reflected in a higher PSV gas price spread during the 12-day war (13–25 June) between Israel and Iran. However, over the 12-day conflict, the average spread stood at 3.2, only slightly above the level observed in the first five months of the year.

After remaining below the TTF price for many months, LNG prices quoted at the Japan/Korea Marker (JKM) by Platts and traded on the Chicago Mercantile Exchange (CME) have, since mid-June, traded at a premium exceeding USD 5/MWh over the TTF price. This means that purchasing gas on the global LNG market has become more expensive than in Europe, supporting gas prices in Italy, where LNG accounts for roughly one-third of total gas imports. Historically, however, differentials between JKM and TTF prices have proven temporary, with markets reabsorbing them within relatively short periods. It is likely that the current differential will also be reabsorbed in the near future, eliminating the higher LNG procurement costs.

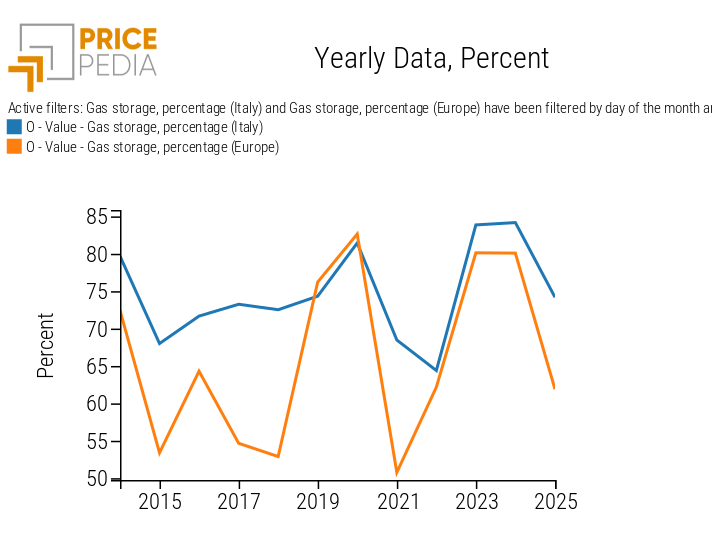

The last factor that could explain the increase in the PSV-TTF price spread is a higher demand for gas in the Italian market linked to delays in storage filling. Indeed, when comparing storage fill levels at Italian sites as of 10 July with the levels on the same date in 2023 and 2022, there appears to be a significant lag in the filling schedule. However, as shown in the chart below, 2023 and 2022 were exceptional years. When the comparison is extended over a longer period the current storage fill level aligns with the historical average.

Percentage of gas stocks filling in Italy and Europe as of July 10 of each year

The chart also shows the storage fill levels relative to the European average. From this perspective, Italy consistently performs significantly better in the storage process. Therefore, if Italian demand were seasonally high due to delays in storage plans, this should be even more true for the European average. This weakens the argument that the PSV-TTF price spread is driven by higher storage-related demand in the Italian market compared to the European average.

In summary

None of the factors analysed in this article seem to justify a progressive increase in the gas price premium at Italy’s PSV compared to the Dutch TTF. The spread increases recorded during the second half of June and the first days of July therefore appear to be driven by speculative actions, based more on market “sentiment” than on actual fundamentals. Confirming this analysis, on 10 July the spread between the two prices returned to around EUR 2/MWh, in line with the average levels observed over the past two years.