The macroeconomic approach to commodity market analysis: the link with the global economy

Demand drivers and price cycles

Published by Pasquale Marzano. .

Food economic analysis Analysis tools and methodologiesThe macroeconomic approach to commodity market analysis focuses on the relationship between economic trends and commodity demand, with corresponding effects on prices. Compared to other analytical approaches discussed in the article Four Lenses to Understand Commodity Markets, it adopts an aggregated and long-term perspective, clearly showing the effects that global economic dynamics have on commodity demand and prices.

The macroeconomic approach studies commodity demand (and partly supply) as a function of major economic and social transformations: population growth, increase in per capita income, industrialization, urbanization, and technological progress.

Commodities are often analyzed by product families (energy, metals, agricultural goods), and prices are interpreted cyclically, distinguishing between short-term cycles (seasonal or speculative fluctuations), medium-term cycles (e.g., investment cycles), and long-term cycles (linked to global structural transitions).

One of the main institutional references of the macroeconomic approach in commodity market analysis is the World Bank Group. In particular, reports and studies conducted by John Baffes and Peter Nagle represent a systematic contribution to understanding the links between economic growth and raw material demand.

In the report Commodity Markets: Evolution, Challenges, and Policies (2022), the authors analyze the evolution of markets and policies for three major commodity groups: energy, metals, and agricultural products.

The study focuses on the structural increase in global consumption volumes and the main underlying factors, particularly population growth and per capita income growth. It highlights that the relationship between economic growth and commodity demand is not uniform but significantly depends on the stage of economic development of different countries. In emerging countries, for example, demand tends to grow faster in the presence of industrialization and urbanization.

Within each commodity group, the composition of demand has changed significantly over time, influenced by technological innovation, which on one hand has expanded the uses of certain materials (e.g., rare earths, lithium), and on the other hand has facilitated substitution among production inputs (e.g., natural gas instead of coal).

The study also highlights the strong heterogeneity of markets: price formation mechanisms and supply determinants can vary considerably across sectors, depending on production structure, technological scalability, and the geographic concentration of resources.

A case study: agricultural goods

The heterogeneity of commodity markets means that the aforementioned determinants tend to have different effects depending on the products considered.

Considering agricultural goods, the World Bank Group report shows that in the case of wheat and rice—essential staple foods—demand growth has historically been driven by global population growth and does not "respond" to changes in per capita income. In economic theory, this translates into an income elasticity of zero.

In the case of other goods, such as edible oils, demand growth is linked to increases in per capita income (with income elasticity equal to or greater than one). This relationship can be explained by the following considerations:

- as income increases, the consumption of processed foods and dining out (restaurants, fast-food) increases, which is associated with more intensive use of edible oils;

- for health reasons, there is a tendency to prefer edible oils over animal fats for cooking;

- edible oils are used to produce biofuels.

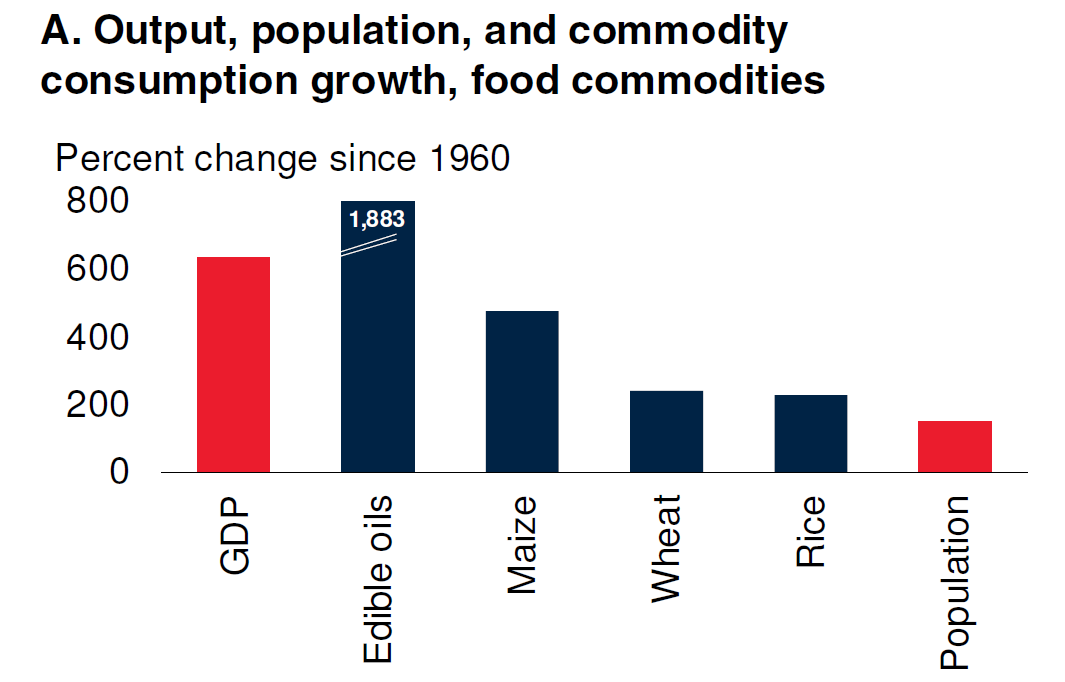

The following chart shows the overall growth from 1960 to 2020 in population, income, and food consumption, measured in percentage terms (source: World Bank Group).

Demand for Agricultural Goods Compared to Population and Income

Cereal consumption closely mirrors global population growth. Corn is an exception, with demand growing at higher rates due to its use in biofuel production. As for edible oils, their consumption shows a growth rate higher than all other food products and also higher than income growth.

On the demand side, factors like population and income growth have played a key role. On the supply side, growth has more than offset rising demand thanks to factors like technological innovation. This was particularly driven by the Green Revolution, which increased crop yields.

Another factor that laid the groundwork for increased global supply was the decline in transportation costs, which also contributed to boosting global commodity trade and enabling countries to exploit comparative advantages.

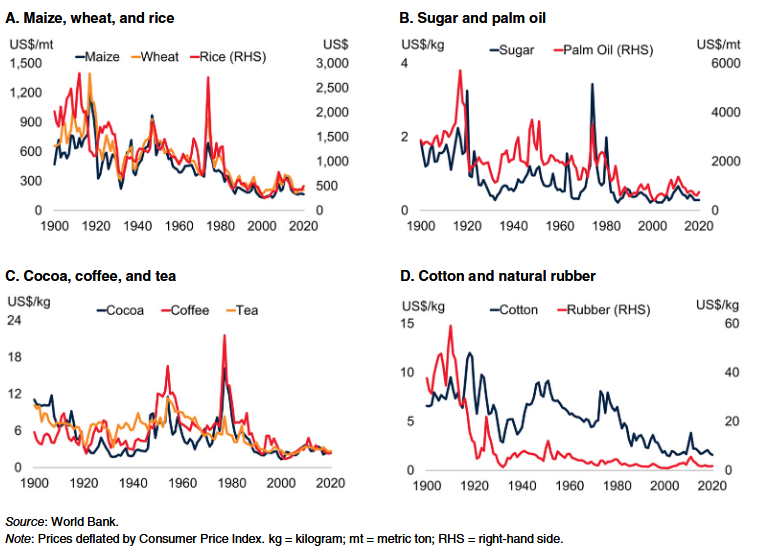

The effect on real prices (i.e. adjusted for inflation) is shown in the following charts (source: World Bank Group).

Real Prices of Agricultural Goods, 1900-2020, in US Dollars

The real prices of all the agricultural commodities shown display a long-term declining trend. This trend is much more pronounced in the case of cereals (wheat, rice, and corn).

In summary

The macroeconomic approach helps to capture the intensity of macroeconomic determinants - such as global income and population growth, technological innovation, etc. - on commodity prices over the long term.

The World Bank Group favors this approach, distinguishing the price effects based on different commodity families (energy, metals, and agricultural goods).