Lead: a dangerous but indispensable metal for modern industry

Lead analysis: what makes it a strategic metal for the European Union?

Published by Luca Sazzini. .

Non Ferrous Metals Lead Critical raw materialsLead is a highly toxic metal for human health and a major pollutant for the environment. Despite its hazardous nature, significant environmental impact, and numerous regulatory restrictions aimed at limiting its use, lead continues to be widely employed in various industrial sectors and has been included by the European Union in the list of strategic raw materials.[1]

In the past, lead found numerous applications in the construction sector, especially for manufacturing pipes and coverings, thanks to its malleability and corrosion resistance. However, with the introduction of increasingly stringent regulations to protect public health, the use of lead in this sector has drastically declined and today is limited to highly specialized applications, such as shielded walls in healthcare settings used for protection against ionizing radiation.

Almost all lead produced, about 84%, is destined for the production of lead-acid batteries, used both in internal combustion vehicles and electric vehicles. Other minor uses of lead include the production of rolled and extruded products (6%) and ammunition (4%).

Global demand for lead is expected to grow, driven mainly by the lead-acid battery sector.

Although the spread of lithium-ion batteries may partially slow down the growth of lead in the automotive sector, lead remains a competitive choice (compared to lithium) thanks to its lower cost, greater availability, and well-established recycling infrastructure.

Global supply of lead is also expected to increase, mainly due to improved recycling capacity. Currently, over 50% of the world's lead production comes from secondary sources, while in Europe, recycling rates of lead contained in batteries are already close to 100%. However, precisely because of this high recycling rate, the European Union will not be able to further increase its domestic supply through additional investments in recycling. Consequently, in case of rising demand, given the scarcity of mineral resources within European territory, the EU will inevitably be forced to increase its lead imports, thus exposing itself to geopolitical and supply risks.

Commodity and Trade Flow Analysis of Lead

Lead is mainly traded in the form of ores and refined lead. Globally, the trade of ores prevails, with about 3.20 billion kg traded in 2024, compared to 1.92 billion kg of refined lead. In the European Union, however, the quantities of imported ores and refined lead are almost equivalent, both around half a billion kg.

The six leading countries in lead ore extraction are: China, Australia, United States, Peru, India, and Russia.[2] Among these, in 2024 China accounted for about 44% of global production of lead ores and concentrates. The country is, in fact, specialized across the entire lead value chain, from mining to refining. However, despite this strong specialization, China is not among the world’s largest exporters of either lead ores or refined lead. On the contrary, it is the main importer of lead ores: national production is almost entirely destined to meet the country's high domestic demand.

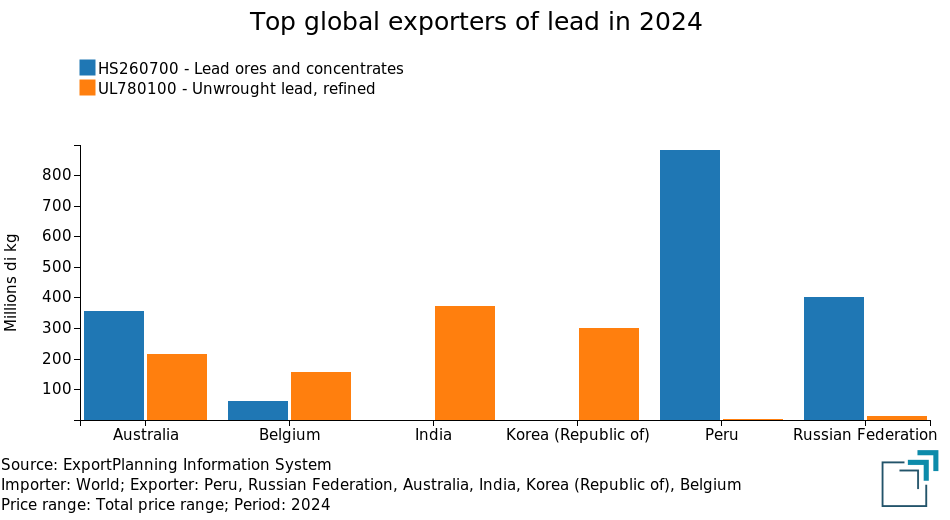

The following chart shows the main lead exporting countries in 2024, expressed in terms of quantity, distinguishing between exports of ores and refined lead.

As for ores, the top three exporters in 2024 were Peru, Russia, and Australia. In particular, Peru maintained a clear lead, exporting about 880 million kg of lead ores, an amount higher than the combined exports of Russia and Australia, which were the second and third largest global exporters respectively.

Among these three countries, only Australia is also specialized in exporting refined lead, ranking as the fourth largest global exporter in this category.

The top spot in refined lead exports belongs to India, followed by South Korea and Belgium, two countries known for their strong specialization in lead processing. Although not among the top producers of lead ores, South Korea and Belgium have consolidated their role thanks to excellent refining and processing capabilities, starting from imported raw materials. These two countries rank, in fact, second and fourth respectively among the largest global importers of lead ores.

Analysis of European imports

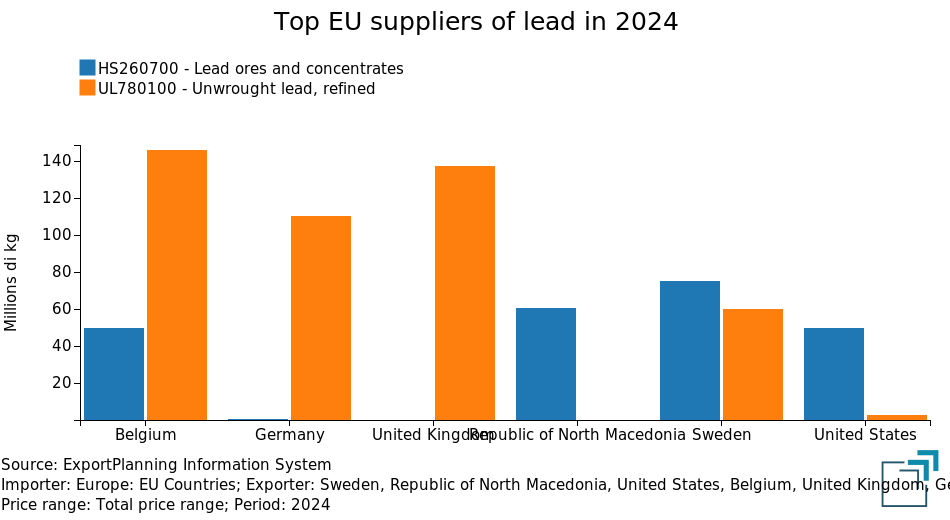

The following chart shows the main EU suppliers of lead ores and refined lead in 2024.

None of the top three countries supplying lead ores to the European Union are among the world's top three exporters (see previous chart). Among them, only the United States plays a truly significant role globally: it is the fourth largest global exporter, the third largest producer of lead ores, and the sixth country by estimated reserves.[2]

Regarding the refined lead market, the main suppliers to the European Union are Belgium, the United Kingdom, and Germany. Both Belgium and Germany are highly dependent on imports of lead ores, ranking fourth and third respectively among the world's largest importers.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Lead price analysis

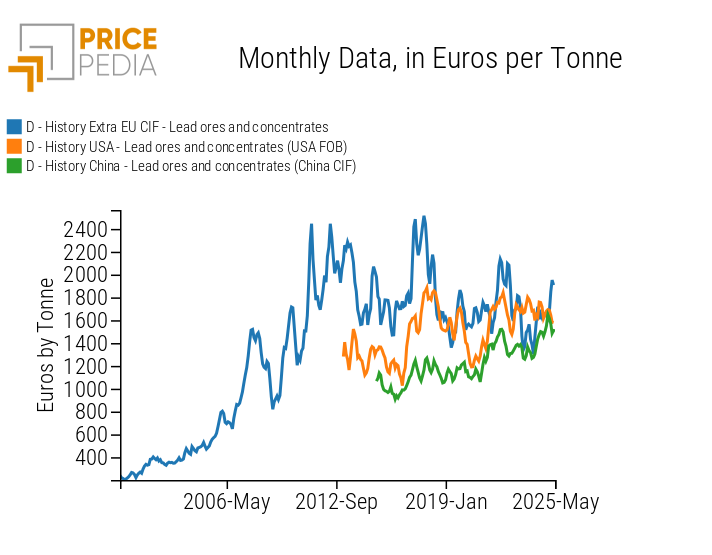

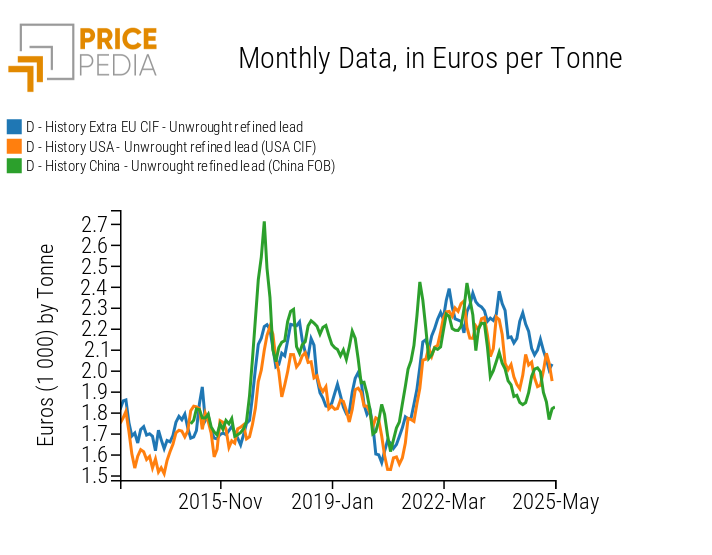

The following chart compares the price dynamics of lead ores and refined lead in three major global regions: European Union, United States, and China.

| Customs prices of lead ores | Customs prices of refined lead |

|

|

Analysis of historical series shows that both ore prices and, above all, refined lead prices tend to follow similar trends across different global regions.

The high convergence of refined lead prices is partly attributable to international financial quotations, which, by impacting their respective physical prices, tend to align the dynamics of various physical markets.

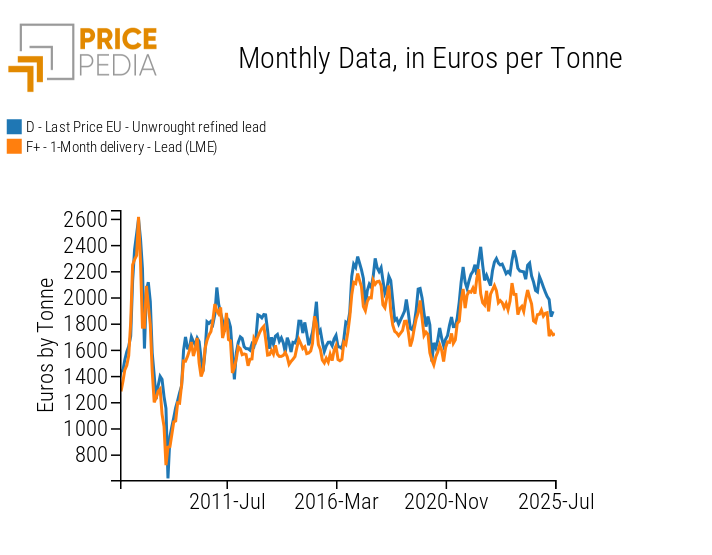

The following chart shows the comparison between the European CIF price of refined lead and the corresponding financial prices quoted on the London Metal Exchange (LME).

The comparison clearly shows how physical prices are strongly correlated with LME financial price dynamics, with a correlation coefficient of 0.95 out of a maximum of 1.

In summary

Although lead is a harmful and highly polluting metal, it continues to play a crucial role in modern industry thanks to its use in lead-acid batteries, a solution that is significantly cheaper than lithium-ion batteries.

In Europe, the recycling rate of lead contained in batteries is already close to 100%, which means that, in the absence of new domestic mineral resources, production has already reached its maximum limit. Consequently, should demand increase further, the European Union, lacking significant lead reserves on its territory, would be forced to meet the additional demand exclusively through higher imports from third countries. This would make it more vulnerable to geopolitical risks and potential supply issues.

An analysis of lead prices in the main geographical areas shows that both ore prices and, above all, refined lead prices tend to follow similar trends in the EU, USA, and China. In particular, refined lead prices are strongly correlated with financial market quotations on international exchanges, which help align the dynamics of physical markets across different regions.

[1] For the EU analysis on lead, see EU FACTSHEETS LEAD

[2] Source: U.S. Geological Survey (USGS): Mineral Commodity Summaries 2025.