The qualitative approach to commodity market analysis: the details that make a difference

When the measurement of phenomena is complex if not impossible

Published by Luca Sazzini. .

Energy Transition economic analysis Analysis tools and methodologiesThe qualitative approach to commodity market analysis is based on the observation of recent events and the interpretation of their potential impact on the demand, supply, costs, or prices of a specific commodity. Compared to other analytical methods (see Four Lenses to Understand Commodity Markets), the qualitative approach is characterized by the absence of formal models and quantitative measurements of events and their potential effects.

This perspective makes it possible to grasp the concrete dynamics of markets in real time, often anticipating reactions that other, more formalized approaches capture with a delay.

The range of topics addressable through qualitative analysis is vast, as evidenced by the numerous articles published daily in economic journals and newspapers.

Among the notable contributions derived from this approach are those by Gianclaudio Torlizzi, published in his 2021 book “Materia Rara”.

Materia Rara: an example of qualitative analysis

The central thesis of the book is that the end of 2020 marked the beginning of a fourth supercycle in commodity prices, driven by three main factors:

- The development of “green” policies: environmental policies aimed at combating climate change have increased the demand for strategic commodities for the energy transition, such as metals. Conversely, in the field of fossil energy, the expected outcomes of environmental policies have led to a reduction in investment plans;

- Supply restrictions: fears of a demand collapse due to the pandemic crisis led producers to cut production just before the consumption boom;

- The consumption boom: in response to the Covid-19 pandemic, central banks and governments adopted strongly expansionary monetary and fiscal policies, triggering a surge in global demand and leading to a marked increase in consumption.

In 2021, analyzing each of these drivers was particularly complex, given the recency of the events and the lack of adequate tools to quantify them. Only a qualitative analysis could grasp these dynamics as they were unfolding.

However, the absence of quantitative measurements led to the interpretation of certain phenomena as long-lasting, when they later proved to be temporary—such as the demand surge induced by Keynesian fiscal policies and the supply reduction largely caused by the shipping logistics crisis.

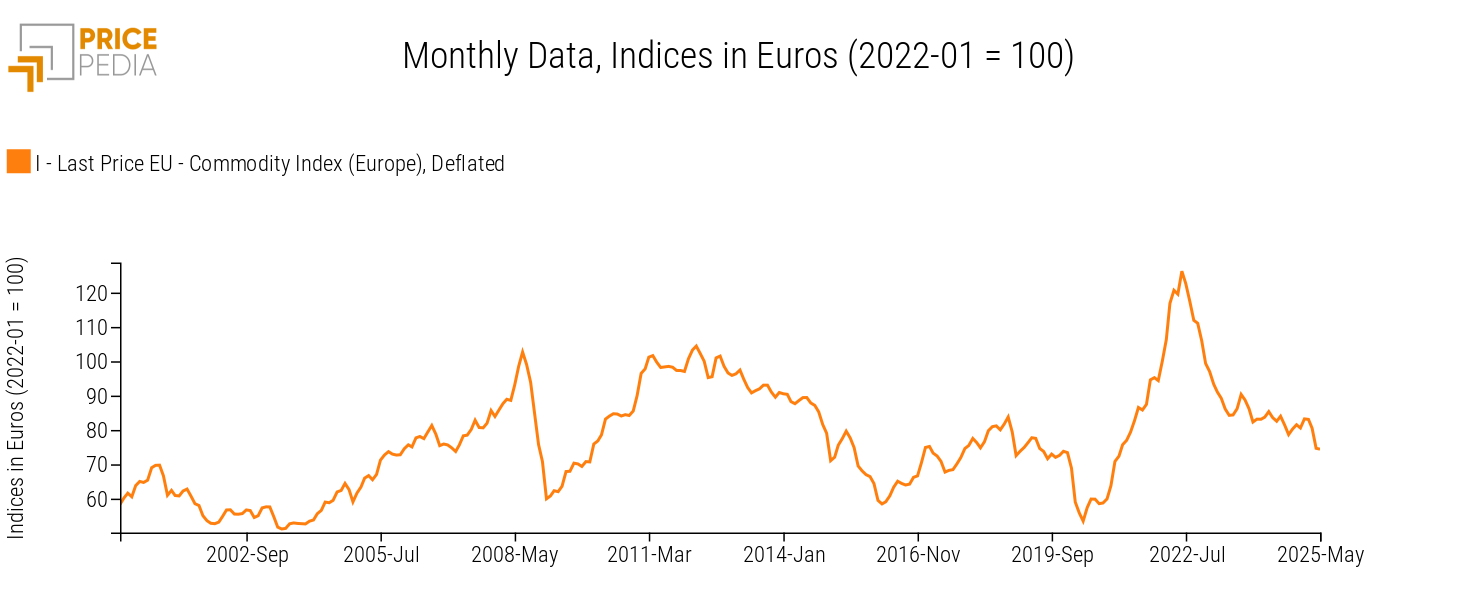

In the following years, the slowdown in global demand, the gradual restoration of global logistical capacity, and the onset of restrictive monetary policies led to a widespread decline in commodity prices. Most commodities returned to pre-pandemic levels, especially when evaluated in real terms, i.e., net of inflation. This trend is well illustrated in the graph below, which shows the dynamics of the PricePedia Total Commodity Index (Europe), constructed by aggregating industrial[1], food, and energy commodities. The index has been adjusted for inflation to reflect real-term dynamics. As of mid-May 2025, the euro-denominated index has returned to the average values recorded in 2019.

Total Aggregated Commodity Index (Europe), Deflated

The strengths of qualitative analysis in *Materia Rara*

The main merit of the qualitative analysis conducted by Torlizzi in *Materia Rara* is undoubtedly its ability to identify the potential impacts of the green revolution on raw material consumption, particularly metals and rare earths.

The analysis offers a clear view of future challenges related to the procurement of these strategic resources, highlighting the importance of considering geopolitical and technological risks that will influence supply and demand in the long term.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The green impact on the consumption of metals and rare earths

The qualitative analysis presented in *Materia Rara* highlights how the energy transition—driven by the climate emergency and the goals of the Paris Agreement—could spark a growing demand for metals and rare earths, essential for the development of new low-carbon technologies.

The electrification of transportation, the growth of renewable energy, and the construction of new infrastructure will require unprecedented quantities of metals and rare earths. According to Torlizzi, citing the European Commission, by 2030 the demand for lithium and cobalt—needed for EV batteries and energy storage—is expected to increase by 18 and 5 times respectively compared to 2021 levels. By 2050, these needs are expected to grow even further, with lithium demand projected to be 60 times greater and cobalt demand 15 times higher.

There is also an expected surge in the consumption of rare earths for the production of NdFeB permanent magnets, essential components in electric motors and wind turbines. Global demand for these magnets is projected to grow steadily, with a compound annual growth rate of 8.6% between 2022 and 2035, driven precisely by the increasing adoption of green technologies.

Although these projections still need to stand the test of time and can only be confirmed by future quantitative analyses, there is broad analyst consensus on the results reported in *Materia Rara*. In particular, it is increasingly evident that the European Union must safeguard against the potential supply risks associated with the expected green-driven increase in metal and rare earth consumption.

Supply risks related to the increase in green demand for metals and rare earths

The sharp rise in demand for metals and rare earths risks further increasing the already massive dependence of Western economies on foreign suppliers. In 2021, over 90% of the rare earths imported by the European Union came solely from China, while in the United States the share exceeded 80%.

This growing dependence of Western economies on the supply of rare earths and other strategic metals—essential for the energy transition—has led some analysts to coin the term “electrostates” to describe countries that control these critical resources. Among them are China, which dominates the entire rare earth supply chain; Chile, the world’s top exporter of lithium and copper; the Democratic Republic of Congo, which supplies over 70% of global cobalt; Australia, rich in lithium, bauxite, and rare earths; and Indonesia, a leader in nickel production.

In a sense, these “electrostates” could become for the electric transition what “petrostates” were for the oil era: crucial power hubs whose centrality derives not from black gold, but from the critical metals needed for clean energy.

In summary

The qualitative approach has the valuable advantage of capturing emerging phenomena in real time, offering a forward-looking vision of reality. However, due to the lack of quantitative tools, it can sometimes lead to interpretations that are not confirmed by subsequent data validation.

A powerful example of this approach is found in Gianclaudio Torlizzi’s 2021 book *Materia Rara*, which brought to public attention the trade-off between the green revolution and the rising consumption of metals and rare earths, highlighting the supply risks for countries lacking strategic natural resources, such as the European Union. At the same time, however, the hypothesis of the beginning of a fourth supercycle in commodities has been weakened by developments over the past two years, during which the prices of many commodities have returned to pre-pandemic levels, especially when considered in real terms, that is, net of inflation.

[1] The term industrial commodities refers to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Pharmaceutical Chemicals, Specialty Chemicals, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.