Virgin naphtha: price, cost and substitutability among regions

How Brent prices and international trade affect the price of virgin naphtha

Published by Luigi Bidoia. .

Petrolchimica Price DriversGlobal Market for Virgin Naphtha

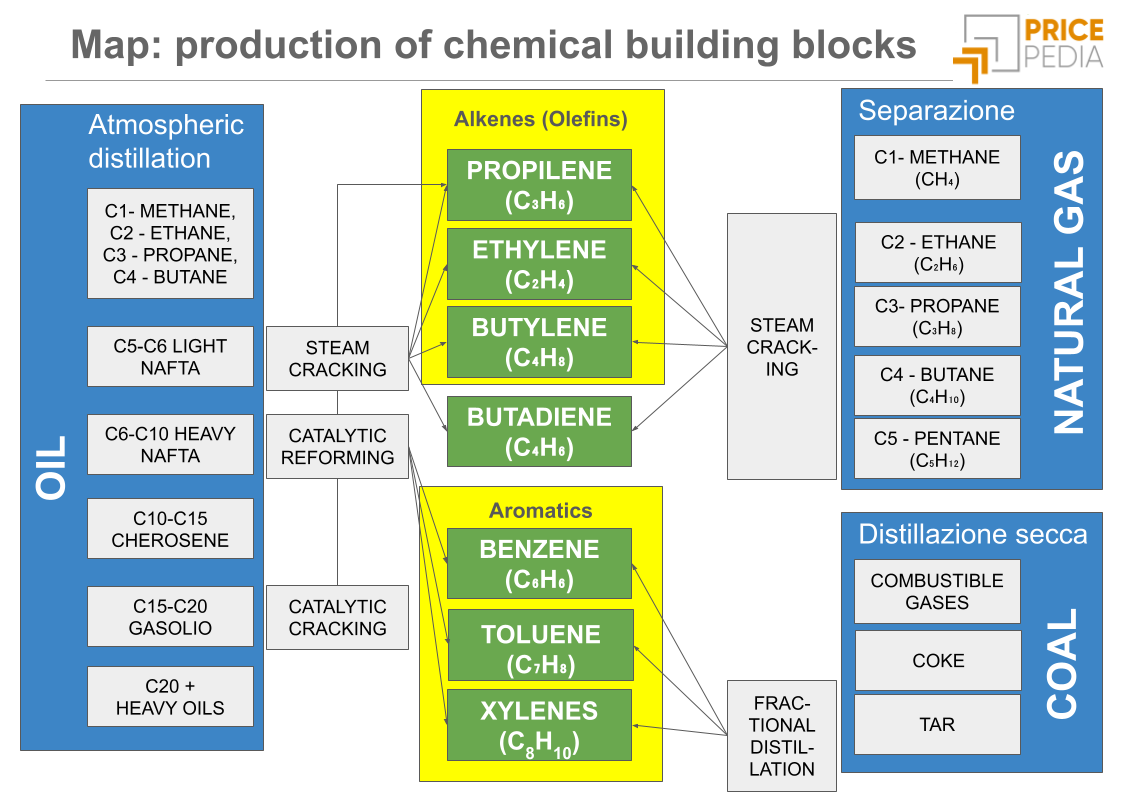

Virgin naphtha is a key product of the oil industry. It serves as the feedstock for many of the primary "building blocks" of petrochemicals, from ethylene to benzene, and from propylene to toluene.

The price of virgin naphtha is therefore the main determinant of the cost of many thermoplastics.

Understanding the dynamics of the global virgin naphtha market provides valuable insights for anticipating future price trends of numerous petrochemical intermediates and, consequently, of many thermoplastics.

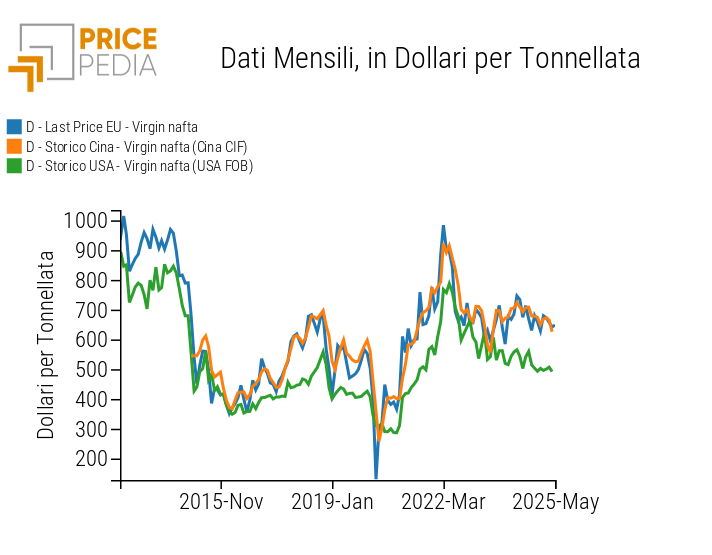

The current situation of the global virgin naphtha market is clearly illustrated in the graph below, which compares the EU customs price with the CIF price of Chinese imports and the FOB price of Chinese exports.

Comparison of regional prices of virgin naphtha

The chart highlights the strong correlation in virgin naphtha prices across the three main global economic regions. The alignment between EU and Chinese prices is nearly perfect, both in terms of trends and absolute levels. The US price closely follows the same dynamics, but remains consistently lower. The price gap between the EU (and China) and the US widened in the first part of 2024, then gradually narrowed in the following months.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Relationship Between Brent Prices and Virgin Naphtha

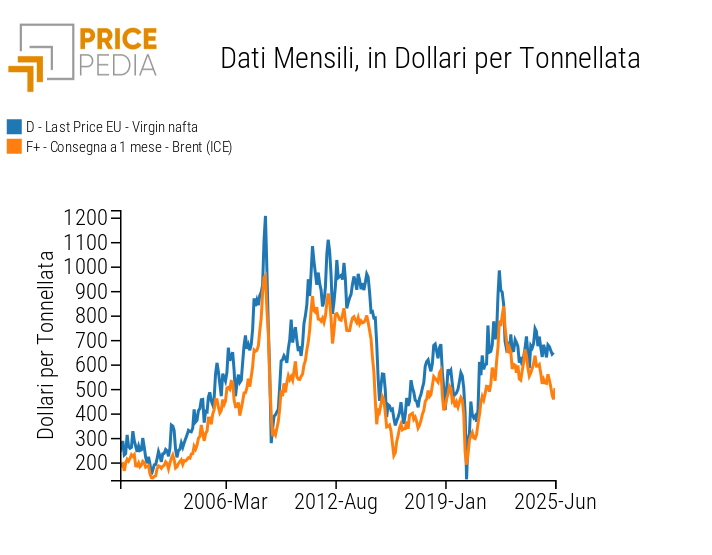

The price of virgin naphtha is, naturally, strongly linked to the price of crude oil. This is clearly shown in the graph below, which compares the EU virgin naphtha price with Brent crude prices, both expressed in $/ton, to enhance comparability.

Oil and virgin naphtha prices

There is no doubt that a strong long-term relationship exists between the price of crude oil and the EU virgin naphtha price, and consequently, with other regional virgin naphtha prices as well.

Long-Term Cost and Substitution Relationships

The data on regional price trends clearly indicate the existence of:

- Three long-term relationships between regional virgin naphtha prices and the price of crude oil — which can be defined as cost relationships;

- Three relationships connecting each regional naphtha price to the prices in the other two regions — referred to as substitution relationships.

These relationships can be easily estimated using simple OLS models, since they are, from a statistical point of view, relationships between cointegrated variables.

Estimation Results

Long-term cost equations

The table below presents the estimated coefficients[1] for the cost relationships, all of which are highly significant.

Elasticity of naphtha prices to changes in oil prices

| Virgin naphtha prices | Elasticity to Brent crude price |

|---|---|

| EU Customs | 0.87 |

| USA FOB | 0.73 |

| China CIF | 0.79 |

The estimated coefficients confirm, as expected, a strong effect of Brent crude prices on virgin naphtha prices. This relationship is particularly strong for the EU customs price, whose elasticity is close to 1. This implies that changes in Brent prices are almost fully transmitted to the price of naphtha traded in the European Union.

In contrast, the elasticity of the US FOB naphtha price is high but statistically below 1, indicating that—also in the long run—factors other than Brent crude prices play a role in determining the price of US exports.

The price of naphtha imported into China shows an intermediate behavior, with elasticity values falling between those of the EU and the US.

Long-run substitution equations

The statistically significant parameters related to the substitution relationships are presented in the table below.

Elasticity of naphtha price to changes in naphtha price from other regions

| Virgin naphtha prices | Elasticity to price in: | ||

|---|---|---|---|

| EU | USA | China | |

| EU Customs | 0.98 | ||

| USA FOB | 0.86 | ||

| China CIF | 0.41 | 0.56 | |

The substitution relationships among the different regional virgin naphtha prices confirm the high level of integration in the global market. Specifically, the results highlight that:

- The EU customs price is strongly influenced by China’s CIF price, with an elasticity close to 1. This indicates an almost perfect substitutability between naphtha traded in Europe and naphtha imported from China.

- The US FOB price is also significantly affected by the Chinese price, although with a slightly lower elasticity (0.86), pointing to a strong but not complete relationship.

- China’s CIF price responds to both EU and US prices, with lower elasticities whose sum approaches 1. This suggests that Chinese import prices reflect global market conditions rather than those of any specific regional market.

Overall, these findings reinforce the idea of a highly integrated global virgin naphtha market, where China’s CIF import price acts as a global benchmark, with its dynamics also influencing the FOB price of US exports.

Short-Term Relationships

To better understand the functioning of the global virgin naphtha market, it is also useful to examine the short-term relationships among the various regional prices. In this case, the focus is on assessing how monthly changes in Brent prices affect monthly virgin naphtha prices in different regions, and above all, how prices adjust when there is a deviation between the long-term equilibrium price and the actual market price.

To this end, a short-term equation[2] was defined for each regional naphtha price, in which monthly price changes are explained by:

- changes in Brent crude prices;

- changes in the other regional naphtha prices;

- two error correction mechanisms (ECM), accounting for deviations from the long-term cost relationship and the long-term substitution relationship.

The following table presents the estimation results.

Short-run equations for regional virgin naphtha prices

| Virgin naphtha prices | Shock Effect | Error Correction | ||

|---|---|---|---|---|

| Cost Variation | Substitute Price Variation | Cost Equilibrium | Substitute Price Equilibrium | |

| EU Customs | 0.49 | 1.05 | 0.62 | 0.48 |

| USA FOB | 0.34 | 0.31 | (*)0.02 | 0.24 |

| China CIF | 0.29 | 0.19 | 0.31 | 0.27 |

| * not statistically significant | ||||

The estimated parameters from the short-term equations reinforce the economic interpretation of the differentiated behavior observed in the global virgin naphtha market, as already highlighted by the long-term results. In particular:

- The CIF price of Chinese imports acts as the global benchmark for virgin naphtha. This price appears to be relatively less dependent on both costs (as represented by crude oil prices) and on substitute prices in the EU and the US. The most reasonable economic interpretation is that it also reflects specific demand conditions within the Chinese market.

- The price of intra-EU transactions is the least influenced by specific market conditions within the European region. Its main determinants are the Brent crude price (quoted on financial markets) and the Chinese benchmark price.

- The FOB price of US exports reflects general conditions in the global virgin naphtha market but adjusts much more slowly compared to the EU price. Its adjustment to the financial Brent price is relatively weak. This could be due to two factors: (a) the effective oil purchase price for the US petrochemical industry is not closely linked to the Brent benchmark; (b) the production mix of the oil industry is misaligned with domestic demand, resulting in a higher supply of virgin naphtha than needed within the internal market.

Summary

Analyzing the relationships among regional virgin naphtha prices, and their connection with crude oil, allows us to build a model for anticipating how recent oil price shocks — especially those linked to the Middle East crisis — may impact virgin naphtha prices and, in turn, the prices of thermoplastics.

Although China is a net importer, the CIF price of its naphtha imports serves as a global benchmark. The EU price is perfectly aligned with the Chinese price, with a rapid transmission of market movements. The United States, despite being a net exporter, exerts a more limited influence on the global market.

Contrary to what might be expected based on the trade balances of China and the US, price analysis reveals a greater dependency of the EU price on the Chinese import price rather than the US export price. Therefore, in order to anticipate EU virgin naphtha price dynamics, it is far more effective to monitor developments in the Chinese market than in the American one.

[1] Variables have been log-transformed, allowing the estimated coefficients to be interpreted as elasticities.

[2] From a statistical perspective, these short-term equations are ARDL models with restrictions on long-term relationships (Restricted Long-run AutoRegressive Distributed Lag model).