Geopolitical risks and energy security: the assessment of markets

Rising volatility in food markets: between green challenges, substitution, and climate shocks

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial Week

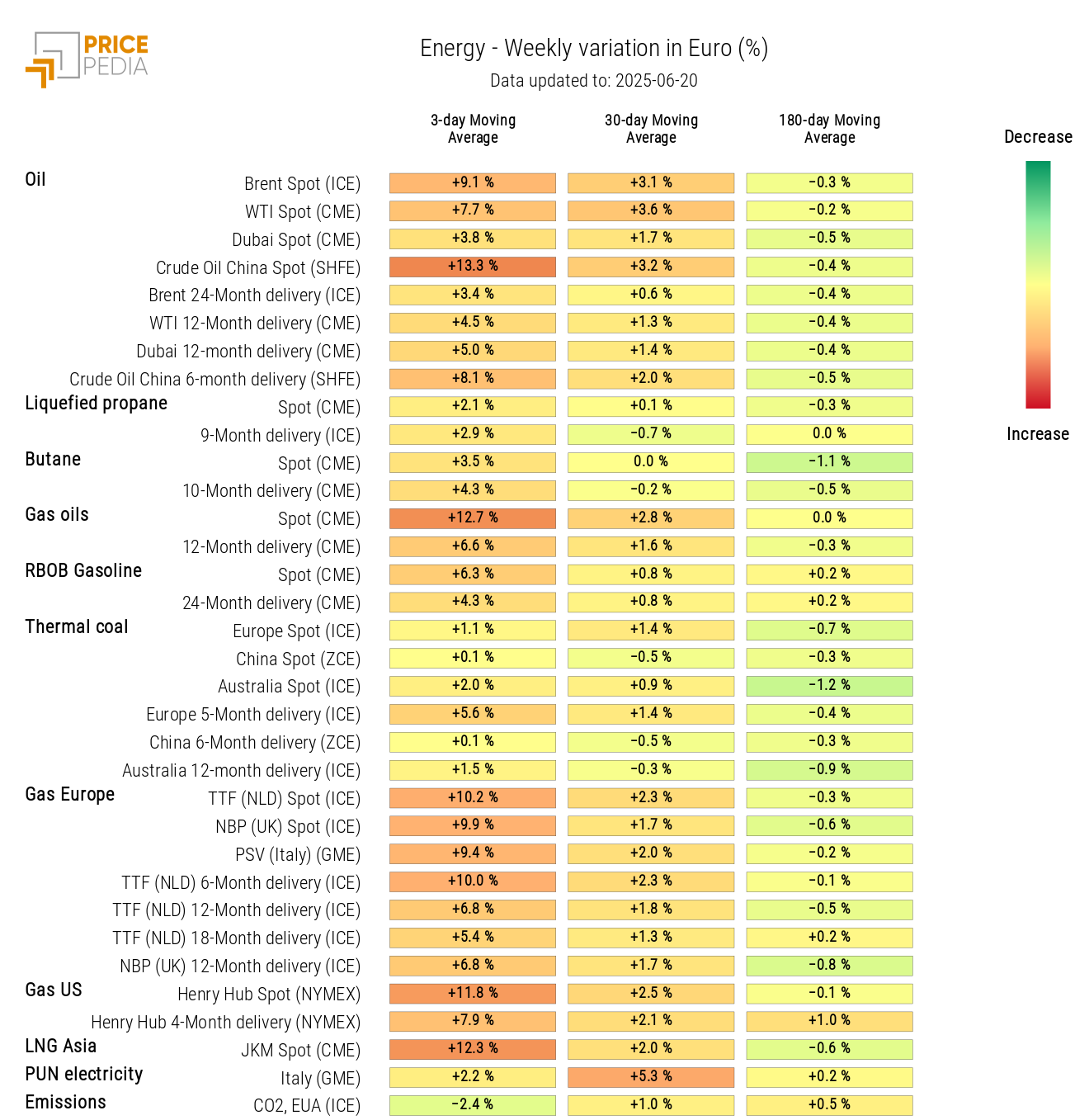

The escalation of geopolitical tensions in the Middle East, fueled by recent statements from President Trump about a possible military intervention against Iran, has triggered a further rise in prices on the energy markets, already increasing for three consecutive weeks.

The price of Brent crude reached the threshold of 80 dollars per barrel, mainly driven by fears of a potential blockade of the Strait of Hormuz. Nearly one-third of the world’s seaborne crude oil passes through this strategic maritime passage, making it a critical point for global oil supply. In the event of a closure of the Strait, not even OPEC would be able to offset the supply shortfall, as a large part of its members' production capacity is concentrated in the Persian Gulf. In such a scenario, governments would therefore be forced to resort to strategic oil reserves to meet demand.

Another market affected this week by geopolitical tensions in the Middle East is the European natural gas traded at the TTF (Netherlands).

Qatar, the world's third-largest exporter of liquefied natural gas (LNG), accounting for about 20% of global trade, has instructed LNG-carrying vessels to wait outside the Strait of Hormuz until loading time, as a precautionary measure due to growing regional tensions.

A possible escalation of the conflict in the area would put not only oil supplies at risk, but also LNG supplies, further increasing pressure on the European energy market.

These concerns are compounded by the European Commission’s recent proposal to gradually reduce the EU’s dependence on Russian pipelines and LNG supplies by the end of 2027. The plan includes:

- Ban on new contracts: starting January 1, 2026, the signing of new contracts for the import of Russian gas—whether via pipelines or LNG—will be prohibited.

- Expiry of short-term contracts: all contracts with a duration of less than one year, signed before June 17, 2025, must end by June 17, 2026.

- Termination of long-term contracts: from January 1, 2028, it will no longer be allowed to maintain multi-year contracts with Russian counterparties.

- Ban on technical support for Russian operators: from January 1, 2026, the European Commission will prohibit the provision of technical, logistical, and operational services at European LNG terminals for the benefit of Russian operators. This ban will be gradually introduced and fully enforced by January 1, 2028, by which time all support activities for Russian counterparties must cease.

The industrial metals markets, both ferrous and non-ferrous, remained relatively stable over the week.

The most notable changes occurred in China’s ferrous metals market, marked by rising prices of steel rebar and falling prices of Chinese iron ore. The latter was affected by weakness in the Chinese real estate sector: in April, housing prices declined and there was a slowdown in the launch of new construction projects.

In the food commodity sector, the week was marked by high price volatility.

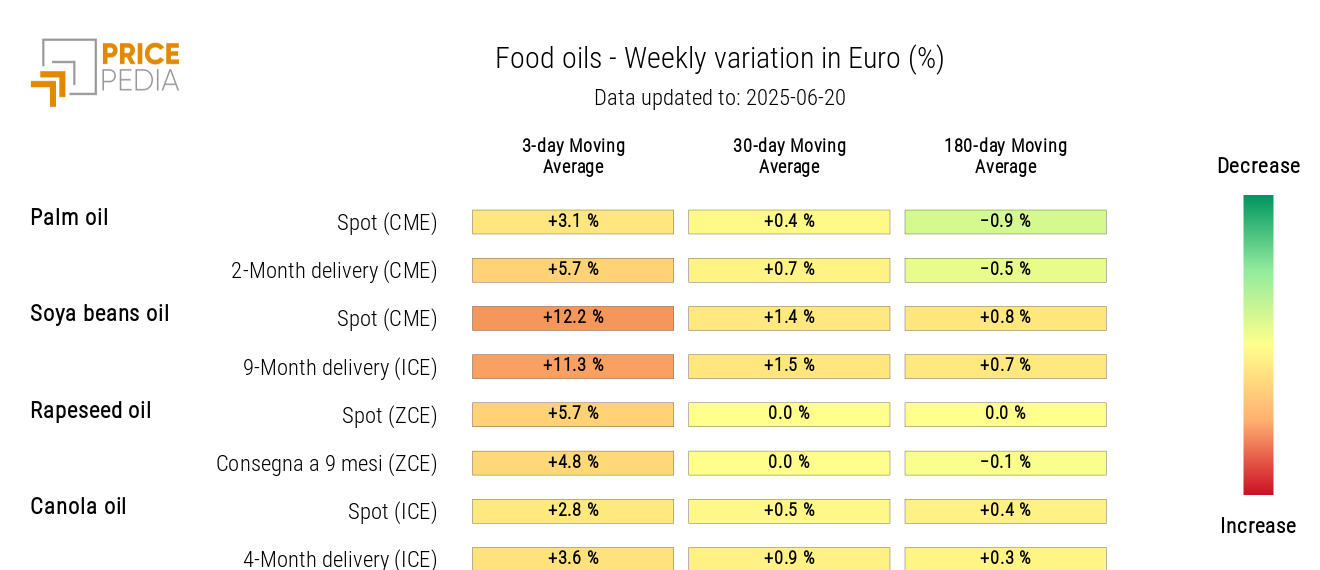

In the edible oils market, there were significant price increases for soybean oil. What surprised the markets was the U.S. Environmental Protection Agency (EPA)’s proposal to substantially raise targets for renewable diesel in 2026, fueling expectations of rising biodiesel demand and, consequently, higher demand for feedstocks such as soybean oil.

At the same time, the increase in oil prices due to tensions in the Middle East has raised the cost of fossil diesel, making biodiesel a more attractive alternative. This further stimulated demand for biodiesel as a substitute for traditional diesel, contributing to the rise in soybean oil prices.

In the cereals market, dynamics were mixed: oat prices declined, while wheat prices rose significantly due to drought emergencies in Russia, the United States, and France—among the world’s top wheat producers.

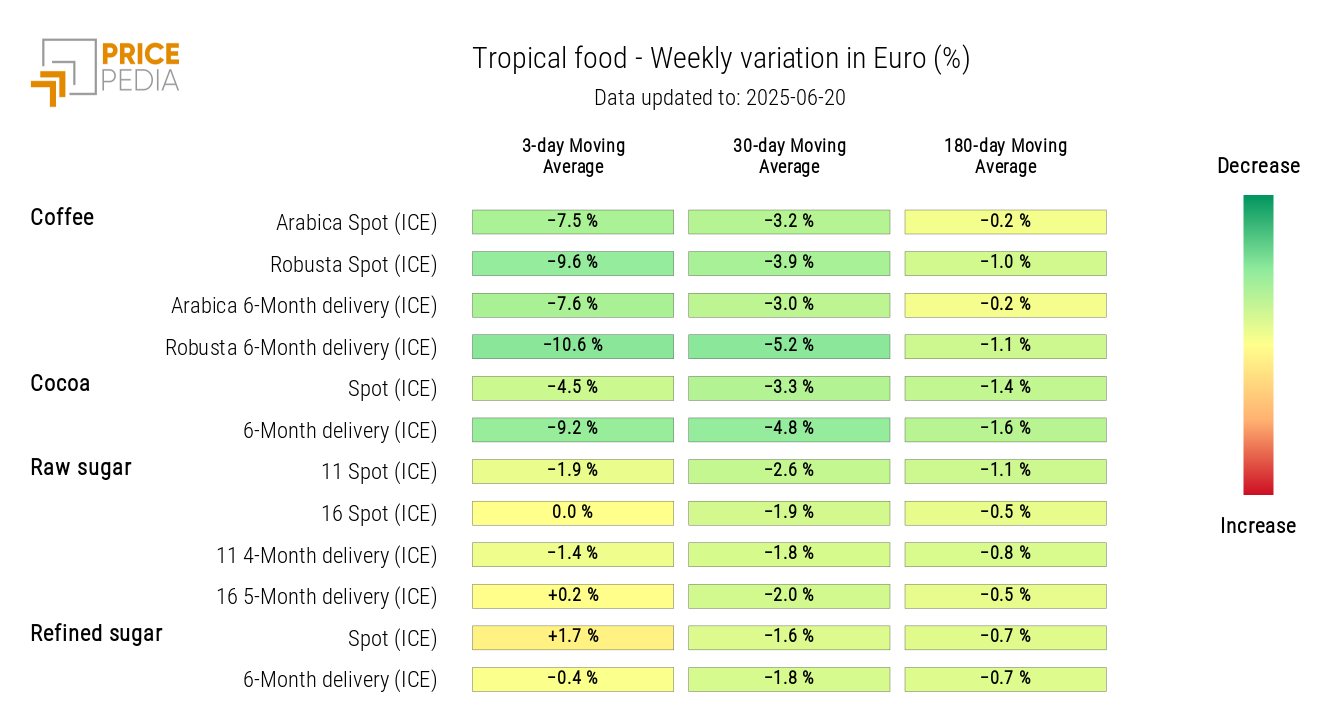

As for tropical products, prices declined, driven by a drop in coffee, in line with expectations of a better harvest in Brazil. Increased rainfall this week helped mitigate the drought problems that had affected much of the 2024/25 season. Additionally, the U.S. Department of Agriculture is forecasting increased coffee production in both Brazil and Vietnam, the world’s leading producers of Arabica and Robusta, respectively.

U.S. Tariffs Also on Steel and Aluminum in Home Appliances

In a context of growing uncertainty and market tensions, President Trump once again reinforces his protectionist policy by announcing new tariffs on imported home appliances.

Starting Monday, June 23, a measure will come into effect imposing additional tariffs of 50% on the steel and aluminum content in home appliances, while the remaining value will be subject to a 10% rate.

FED Monetary Policy

The Federal Reserve (FED) has kept the fed funds rate unchanged at the 4.25–4.50% range, as expected by analysts.

The decision was unanimous, although divisions within the FOMC are becoming evident: some members express more concern about persistent inflation, while others focus on the economic slowdown.

The new projections indicate inflation remaining above the 2% target and slowing growth, fueling debate over when to begin rate cuts. Despite uncertainties, the majority of members still anticipate two cuts by year-end.

During the press conference, Chairman Jerome Powell reiterated that the FED will maintain a cautious approach, emphasizing that upcoming data will be key in guiding future decisions.

The FED’s main concerns center on the potential effects of new U.S. tariffs, which could intensify inflationary pressures and make the central bank’s job more difficult. In this context, the FED remains on hold, balancing the risks of premature easing against those of excessive tightening.

NUMERICAL APPENDIX

ENERGY

The PricePedia energy price index continues to rise, driven by escalating tensions in the Middle East.

PricePedia Financial Index of Energy Prices in USD

The energy heatmap turns red, highlighting sharp increases in oil and natural gas prices.

HeatMap of Energy Prices in EUR

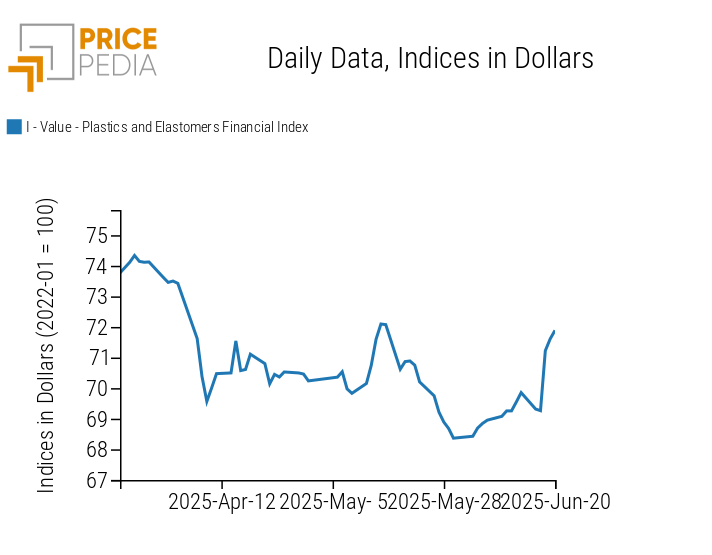

PLASTICS

The growth of the Chinese financial index of plastics and elastomers is strengthening, driven by rising oil prices.

PricePedia Financial Indexes of Plastics Prices in USD

The heatmap indicates an increase in thermoplastic prices, particularly for LLDPE and polypropylene.

Price HeatMap of plastics and elastomers in euros

FERROUS METALS

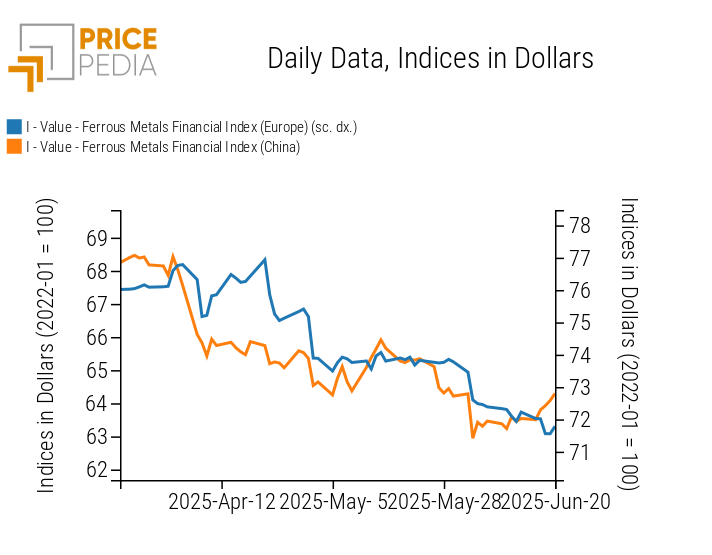

The Chinese ferrous metals index shows a slight increase, while the European one shows a slight decrease.

PricePedia Financial Indices of ferrous metal prices in USD

The ferrous metals heatmap indicates a rise in Chinese steel rebar prices and a slowdown in iron ore prices, traded on the Dalian Commodity Exchange (DCE).

Price HeatMap of ferrous metals in euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

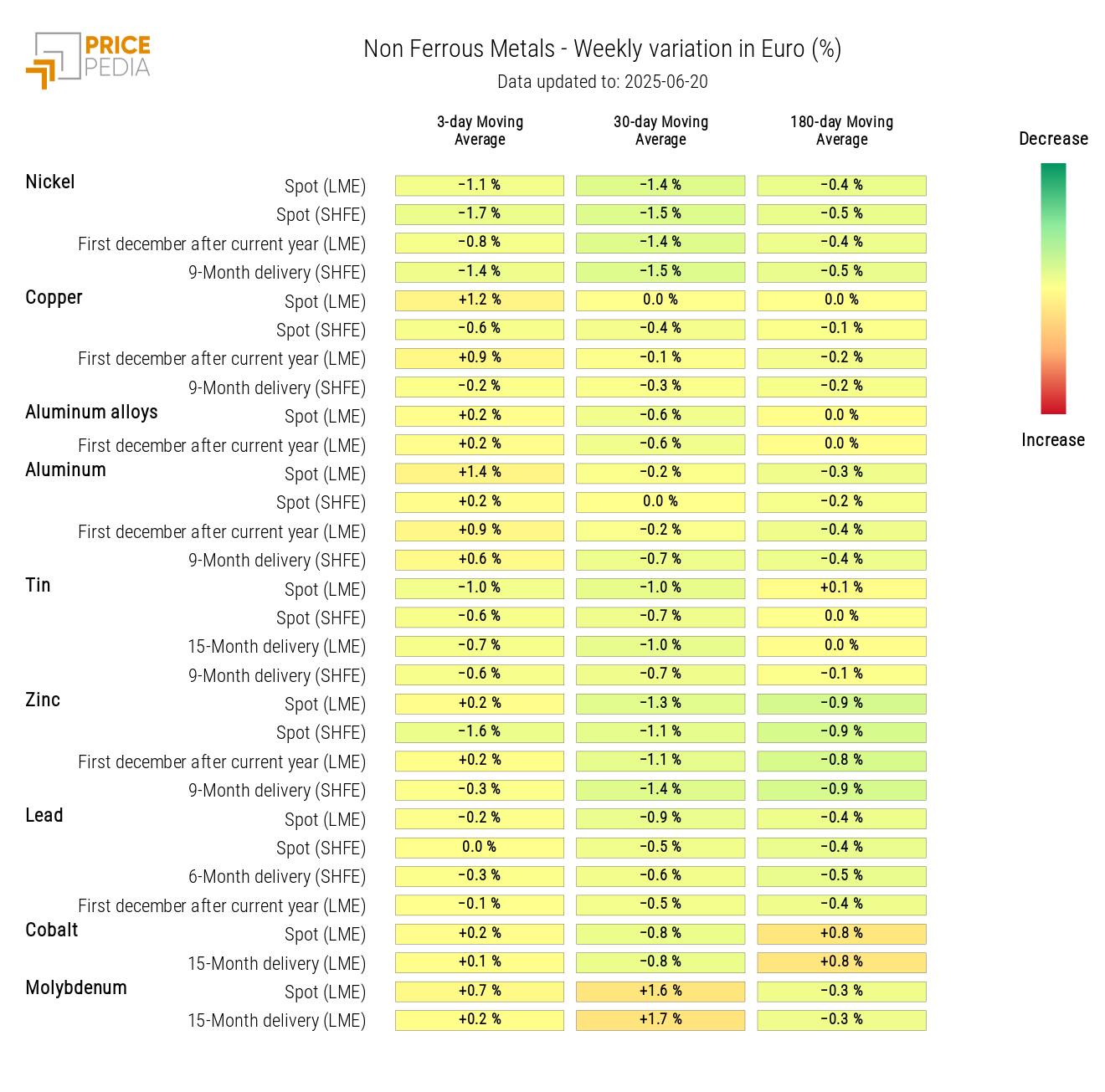

INDUSTRIAL NON-FERROUS METALS

Net of some fluctuations, the two non-ferrous metal indices show mostly sideways price movements.

PricePedia Financial Indices of industrial non-ferrous metal prices in USD

The heatmap analysis shows a slight decline in nickel prices and a modest increase in aluminium prices.

Price HeatMap of industrial non-ferrous metals in euros

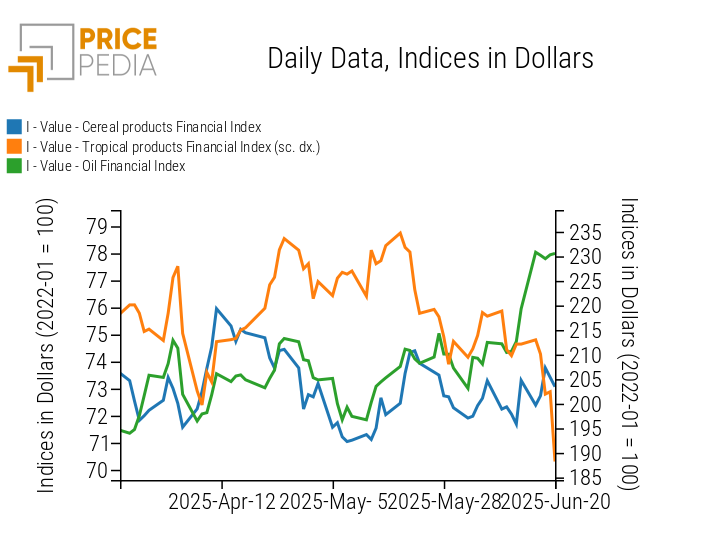

FOOD

The analysis of food price financial indices highlights a collapse in tropical prices, alongside slight increases in cereals and stronger increases in edible oil prices.

PricePedia Financial Indices of food prices in USD

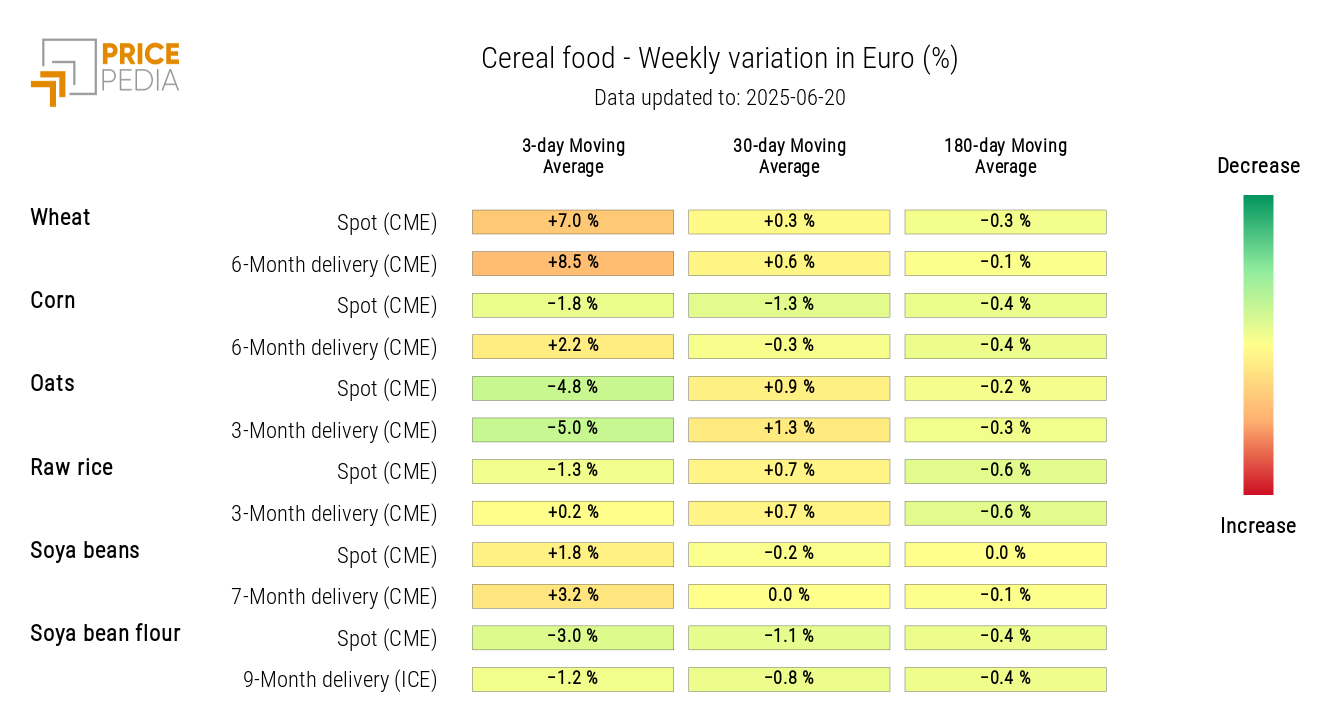

CEREALS

The heatmap analysis shows an increase in wheat prices and a decrease in oat prices.

Price HeatMap of cereals in euros

TROPICALS

The tropical heatmap shows a sharp decline in both coffee and cocoa prices

Price HeatMap of tropical food commodities in euros

EDIBLE OILS

The heatmap highlights a general increase in edible oil prices, especially for soybean oil.

Price HeatMap of edible oils in euros