U.S. duties at 50% on aluminum: what can we learn from the steel case?

Prices rising in the U.S., falling worldwide: the EU is not entirely safe

Published by Luca Sazzini. .

Non Ferrous Metals Aluminium USA customs duties Import tariffs

The question many analysts are asking is whether the additional 50% tariffs on U.S. aluminum imports will have similar effects to those expected for steel imports, which are also set at 50%.

In the case of steel, a significant increase in prices on the U.S. market is expected, accompanied by weakness, if not a decline, in international prices. The European Union steel market is expected to remain partially immune to these dynamics, thanks to the high level of protection it enjoys.[1]

The analysis of the steel market is simpler than that of aluminum for the following reasons:

- The additional tariffs introduced in 2018 by the first Trump administration were 25% for steel and 10% for aluminum. The impact was therefore stronger – and more easily measurable – in the case of steel. Conversely, the effects on aluminum were less clear and more difficult to quantify.

- Financial markets quote distinct regional prices for steel products, such as HRC (hot rolled coils). In contrast, aluminum quotations on the London Metal Exchange (LME), the Shanghai Futures Exchange (SHFE), and the Chicago Mercantile Exchange (CME) refer to a global benchmark, not tied to a specific geographic area.[2]

The effects of the 2018 U.S. aluminum import tariffs

Looking at the entire period of the first Trump administration – from the introduction of aluminum tariffs in March 2018 to the end of 2021 – during a phase of strong global aluminum price growth, the U.S. producer price increased at a rate 10% higher than intra-EU customs prices and Chinese export FOB prices.

These data are fully consistent with what would be expected from a "textbook" effect resulting from the introduction of 10% tariffs on U.S. imports.

In response to the U.S. tariffs, the European Union already in 2018 introduced additional tariffs of up to 25% on imports of finished and semi-finished aluminum products from the United States. Moreover, fearing that increased competitive pressure on international markets would lead foreign companies to adopt dumping practices, the EU established a prior surveillance mechanism on aluminum imports[3].

This monitoring later led to the introduction of anti-dumping duties, not on raw aluminum, but only on semi-finished and finished aluminum products. Even these targeted duties had – albeit limited – effects on the price of raw aluminum in the EU market.

Before the introduction of anti-dumping duties against China (in 2021), the ratio between the price of raw aluminum in intra-EU customs trade and the FOB price of Chinese exports was 1.07, indicating a 7% higher European price.

After the introduction of the new measures, this ratio rose to 1.15, with a differential reflecting a further increase in European aluminum prices relative to Chinese ones.

Diverging signals on the regionalization of steel and aluminum prices

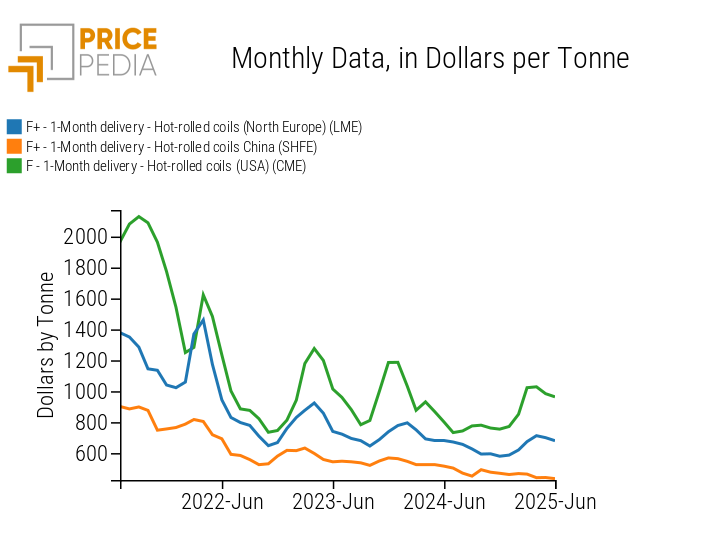

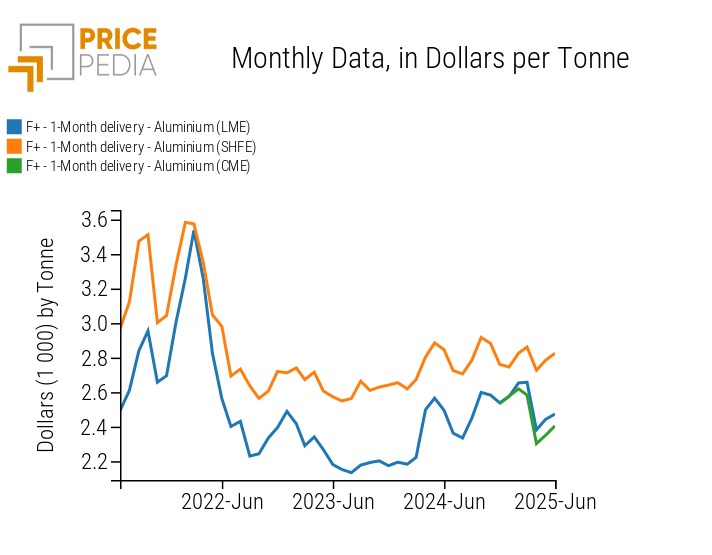

The two charts below compare the financial prices of steel and aluminum on the three main global exchanges: the London Metal Exchange (LME), the Shanghai Futures Exchange (SHFE), and the Chicago Mercantile Exchange (CME).

| Comparison of financial HRC prices | Comparison of financial raw aluminum prices |

|

|

Several key findings emerge from the comparison of the two charts:

- The three steel financial prices clearly show regional differences: the U.S. market exhibits the highest prices, the Chinese market the lowest, while the European market lies in between. Financial prices thus accurately reflect physical price differences in the three regional markets.

- Aluminum financial prices, on the other hand, show smaller differences between the three regions. Most of the gap between SHFE and LME quotations is attributable to the presence of indirect taxes (mainly 13% VAT) included in SHFE prices but not in LME or CME prices. As a result, aluminum financial markets do not signal substantial differences in raw aluminum prices across major world regions.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The anomaly of aluminum prices on the CME

Aluminum quotations on the CME have a peculiarity: they refer to a benchmark price for raw aluminum that can include deliveries in various parts of the world.[2]

It is clear, however, that while a buyer may be interested in purchasing raw aluminum on the CME at an "international" price for use outside the U.S., the same buyer would never purchase aluminum on the CME at a "duty unpaid" price if the intended use is within the U.S. market.

In practice, then, CME aluminum prices represent transactions between operators who will use the metal outside the U.S. market.

This consideration is confirmed by the quotations of the premium for Midwest-delivered raw aluminum, recorded daily by Platts, which serves as the reference for corresponding financial quotations on the LME.

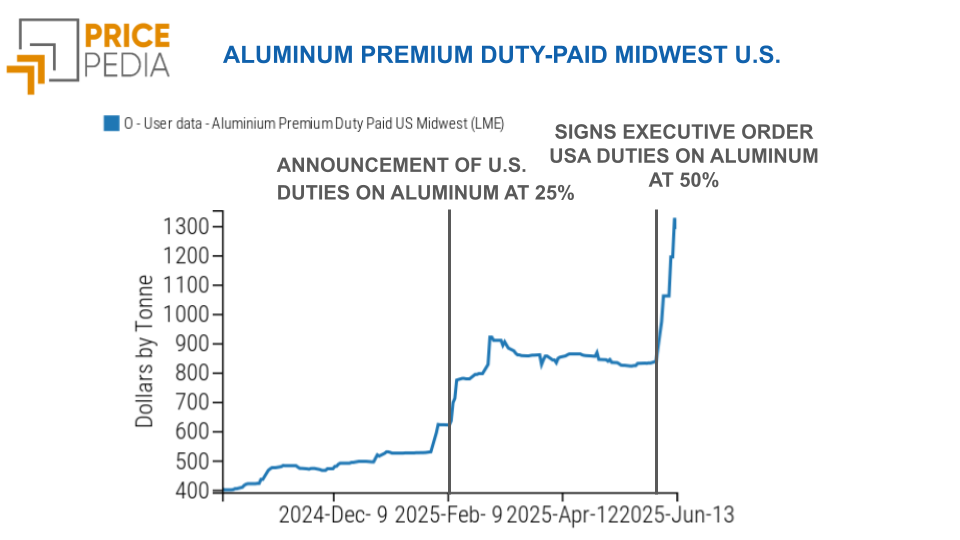

As shown in the chart below, the Midwest USA aluminum premium stood slightly above $600/ton before the February 10 announcement of additional 25% tariffs on all aluminum imports into the U.S. Following Trump's announcement, the premium price rose to over $900/ton within a month, recording a 46% month-over-month increase. Then, starting on June 2, the day before the executive order doubling the U.S. additional tariffs to 50%, aluminum premiums jumped from $838/ton to $1300/ton in less than two weeks.

Conclusions

The uncertainty surrounding the effects of the additional 50% tariffs on U.S. aluminum imports is partly due to the fact that, during the first Trump administration, the additional tariffs on aluminum (10%) had a more limited impact than those on steel (25%). It is also partly due to the specific nature of CME aluminum quotations, which reflect a "duty unpaid" price with global delivery.

Despite these uncertainties, however, the information currently available suggests that the international aluminum market could also experience effects similar to those observed, or expected, in the steel market: strong upward price pressure in the U.S. market and a downward trend in international markets.

In this scenario, the European market could end up only partially shielded from the downward price pressure stemming from the global context.

[1] An analysis of the European Union's protection measures in the case of steel is discussed in the article: HRC: A Partially Globalized and Financialized Market.

[2] See: Key attributes of the physically deliverable CME Aluminum futures contract.

[3] For a more detailed analysis, see the article Effects of trade tariffs on aluminium prices.