The Financial Approach to Commodity Market Analysis: Commodities as Assets

How the Financial Approach Can Be a Useful Tool for Understanding Commodity Markets

Published by Cristina Luca. .

economic analysis Analysis tools and methodologiesThe Usefulness of Financial Markets for Procurement Offices

Financial markets provide tools to manage commodity price risk, but they also play a strategic role: they offer valuable information about the fundamentals of physical commodity markets.

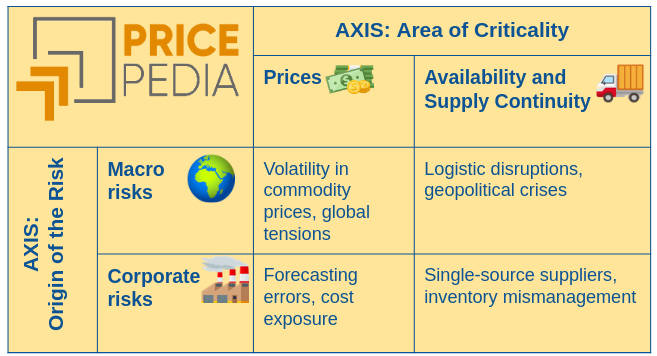

Generally, the financial approach considers commodities as full-fledged financial assets, whose prices are influenced not only by supply, demand, and inventory levels, but also by speculative, financial, and psychological factors.

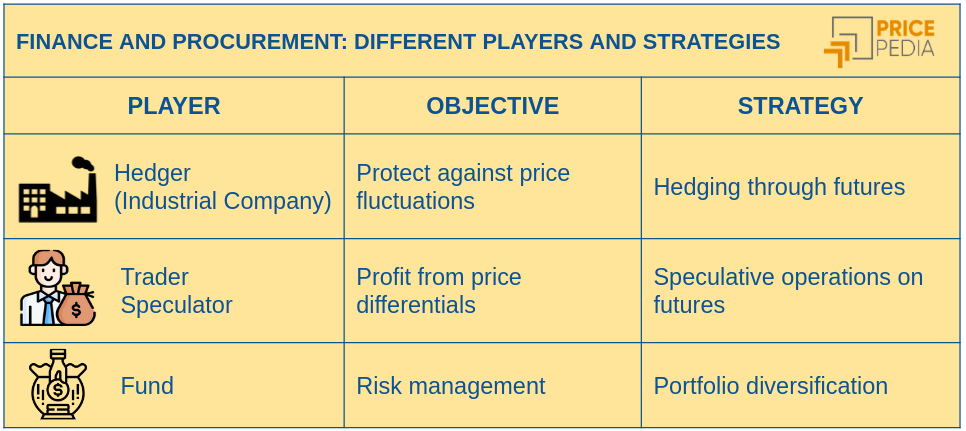

To better understand this dynamic, it is useful to distinguish the different players operating in financial commodity markets, their objectives, and the strategies they adopt.

Finance as a Tool for Interpreting Physical Commodity Markets

To profit in financial markets, financial players study the physical fundamentals of commodities.

The knowledge they develop about physical markets drives their financial decisions, making their expectations and assessments visible—albeit indirectly.

Analyzing financial markets therefore means accessing, through prices and trading volumes, the evaluations that traders and speculators have formed about the actual state of the market.

Financial vs. Physical Markets: A Sometimes Distorted Lens

The trading decisions of financial operators represent a concrete and dynamic form of knowledge, built on the collective interpretation of data, news, and market signals. In some cases, coordinated behavior can make expectations self-fulfilling: if many operators expect prices to rise, their actions contribute to pushing prices higher.

However, this knowledge is not always aligned with the analysis of economic fundamentals—such as supply and demand, inventory levels, production costs, or extreme weather events—and often relies on price differentials, pursuing profit through collective market behavior.

In this context, John Maynard Keynes’s famous beauty contest metaphor is particularly relevant. The economist argued that investors do not choose what they personally consider the best investment, but what they believe the majority of others will consider the best.

Alongside traders and speculators seeking to profit from price changes, other participants—primarily funds—also operate in financial markets, following portfolio strategies based on diversification and risk reduction objectives.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Portfolio Logic of Finance

One of finance’s key tools is to consider the joint risk of multiple assets within a portfolio, reducing overall risk through the combination of assets with specific characteristics.

Portfolio risk decreases when asset returns are weakly correlated—or negatively correlated—with each other.

Returns from financial commodity markets often show low or negative correlation with other financial assets (e.g., equities, currencies), prompting financial investors to buy commodity assets as a way to reduce overall risk.

Several studies empirically confirm this result. For example, precious metals such as gold show near-zero, or even negative, correlation with certain equity indices.

Including commodities in a portfolio therefore improves its diversification.

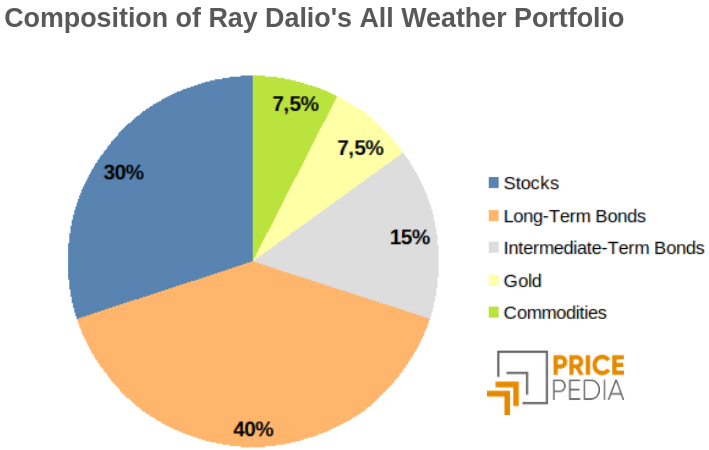

A well-known example of using commodities for diversification purposes is the All Weather Portfolio designed by renowned investor Ray Dalio. This strategy, built to perform under all market conditions, is based on balancing assets that are only weakly correlated with one another.

The logic of portfolio construction is based not only on correlation of returns, but also on how sudden shocks or major changes in one market can affect the volatility of others—so-called volatility spillovers. In the case of commodities, understanding these mechanisms is crucial for financial players aiming to build portfolios that are resilient to external shocks. When a significant event occurs—such as a geopolitical crisis or financial collapse—affecting a traditional asset, the volatility transmitted to commodities tends to be weaker, making them a potential source of stability during stress periods.

Interpreting price dynamics in financial commodity markets as a reflection of fundamentals therefore requires considering not only market-driven motives but also portfolio strategies guiding investors’ decisions.

Financial Instruments for Managing Commodity Price Risk

The primary instrument for managing commodity price risk is the futures contract. Through this tool, a buyer in the physical market can limit the maximum purchase price for a future delivery period, while a seller can lock in a minimum selling price.

However, futures are also powerful information tools: they reflect the expectations of financial market participants regarding future prices.

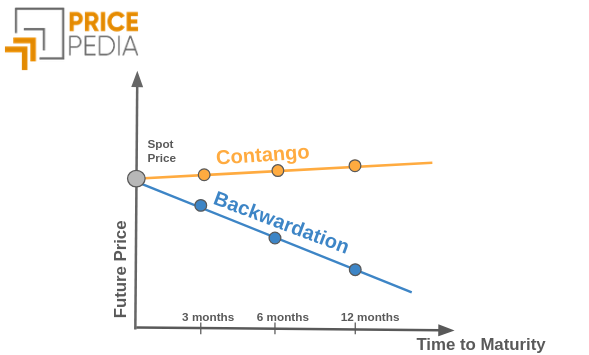

These expectations can be inferred by comparing futures prices with different maturities to the spot price for near-term deliveries. Two typical configurations result from this:

- Backwardation provides a strong signal of a possible future price decline.

- Contango offers weaker signals of a potential price increase, since anticipated increases tend to be reflected early in the spot price, reducing the gap between futures and spot.

Summary

Financial markets provide procurement departments with tools to hedge against commodity price risk.

They also offer, indirectly, insights into the fundamentals (demand, supply, costs, etc.) of physical commodity markets.

Hence, correctly interpreting the signals from financial markets means understanding that these reflect not only fundamental conditions, but also speculative behavior and—most importantly—portfolio-driven strategies.