PricePedia Scenario for June 2025

Favorable raw material prices open room for lower purchase prices

Published by Pasquale Marzano. .

Forecast ForecastThe PricePedia Scenario has been updated with information available as of June 4, 2025. Trade tensions remain in the background: although in recent weeks there have been openings for dialogue among the main players, aiming at de-escalation, in practice there has been a worsening of the measures implemented by the U.S. administration, as tariffs on U.S. imports of aluminum and steel from all partner countries (with the exception of the United Kingdom) have been raised from 25% to 50%. The immediate reaction of the markets is described in the article Commodities: sailing by sight.

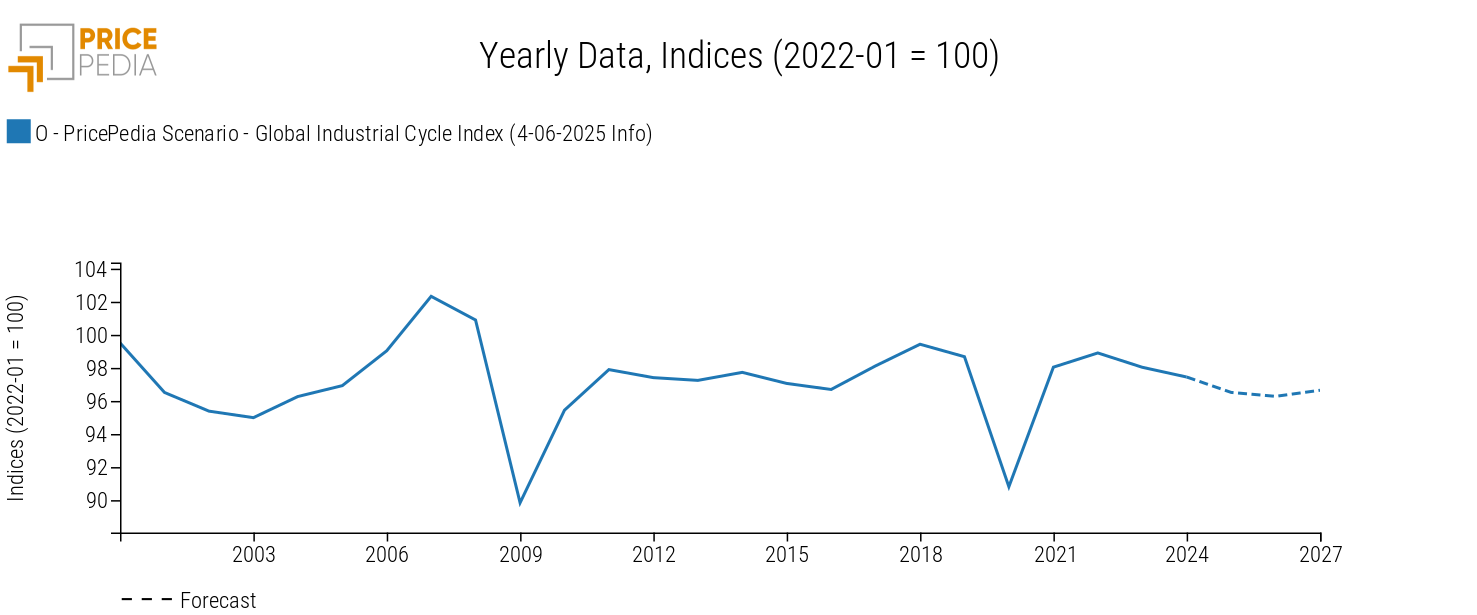

Another factor negatively affecting the current scenario, especially in terms of global demand for raw materials, is the recent deterioration in growth expectations for the Chinese economy (see China drives commodity prices downward), the world's largest consumer of raw materials. All else being equal, a lower internal absorption capacity of its raw material production leads to a greater tendency to export, effectively resulting in an oversupply on global markets. This translates into a prolonged weakness in the global industrial cycle[1], the trend of which is shown in the chart below.

Global industrial cycle, June 2025 scenario

On a yearly basis, the weakening of global demand for raw materials leads to a forecasted average decline of -0.6% in the global industrial cycle index in 2025-2026. A slight recovery is expected in 2027, bringing the index back to the average levels of 2016.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Forecast of purchasing material prices

The price dynamics of raw materials and purchasing materials are affected by the deterioration of the current economic environment, represented by the global industrial cycle. In aggregate terms, this tends to create favorable conditions for purchasing departments to renegotiate lower purchase prices in 2025-2026.

The following table shows the annual changes in euro prices for the main commodity aggregates in the PricePedia Scenario: Industrials[2], Total Commodities[3], Total Energy, and Total Food.

Table 1: Annual variation rates (%) of PricePedia Aggregate Indices, in Euro

| 2024 | 2025f | 2026f | 2027f* | |

|---|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (4-06-2025 Info) | -4.49 | -6.32 | -6.46 | -0.48 |

| I-PricePedia Scenario-Energy Total Index (Europe) (4-06-2025 Info) | -5.89 | -14.00 | -10.98 | -0.39 |

| I-PricePedia Scenario-Industrials Index (Europe) (4-06-2025 Info) | -4.46 | -1.98 | -1.55 | +0.40 |

| I-PricePedia Scenario-Food Total Index (Europe) (4-06-2025 Info) | +3.29 | +10.78 | -6.25 | -3.82 |

In aggregate, euro-denominated prices of purchasing materials are expected to decline over the next 24 months. On an annual basis, the decrease is expected to average around -6.4% in 2025 and 2026, with a substantial stability in 2027 (-0.5%).

Breaking down the total commodity aggregate into its subcategories, a similar but more pronounced trend can be observed for energy commodities. These are expected to decrease by -14% on average this year, followed by a less steep (yet still double-digit) decline in 2026.

The trend in industrial raw materials is also expected to decline on a yearly basis in 2025-2026, though at moderate rates of change, never lower than -2%. From a monthly trend perspective, the lowest point is forecasted during the first three months of 2026. In the following months, prices are expected to slightly rise, returning to June 2021 levels, which are over 20% higher than the 2019 average.

As for food commodities, prices are expected to increase only in 2025, supported by the growth recorded during the first five months of the year. In 2026 and 2027, prices are projected to decline by -6.3% and -3.8%, respectively, effectively returning to 2024 levels.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities.