The chromium market: a strategic raw material for stainless steel

South African leadership in world chromium trade

Published by Luca Sazzini. .

Ferrous Metals Ferroalloys Critical raw materials

Chromium is a strategic raw material, essential for the production of stainless steels and special alloys. In nature, it is primarily found in the form of chromite, the most important mineral from which it is extracted. Approximately 96% of the chromite produced globally is used in the production of ferrochrome, which is obtained by crushing and mixing chromite with coal and fluxes, then melting the charge in electric arc furnaces.

In the European Union, 73% of the produced ferrochrome is exclusively destined for the production of stainless steel, while the remaining 27% is used in the creation of special alloys for steels employed in industrial applications that require advanced technical performance.

Global demand for chromium, both in mineral form and as a ferroalloy, is expected to grow in the medium to long term, mainly driven by the anticipated increase in the use of stainless steel. Global supply is also projected to rise, especially in Zimbabwe, which is expected to significantly increase its production over the next five years. Although not yet among the world's leading producers and exporters of chromium, Zimbabwe holds the largest global reserves of chromium minerals and is intensifying investments to develop local ferrochrome production.

Despite the expansion of global supply potentially offsetting demand growth, the European Union remains exposed to high supply risks.

Domestic chromium production depends almost exclusively on Finland, which hosts the EU's only active chromite mine, the Kemi mine, owned by the company Outokumpu. Although Finland is a significant global producer and exporter of ferrochrome, the EU remains a net importer of both ferrochrome and chromium minerals, with imports concentrated from a few supplier countries. A possible disruption in supplies from even a single exporting country could be sufficient to compromise the chromium supply in the European market. Furthermore, the absence of technically equivalent alternatives for the production of stainless steel makes chromium an indispensable raw material for the metallurgical industry. For these reasons, chromium has been included in the European Union's list of strategic raw materials.[1]

Chromium Commodity: Products, Exporters, and EU Suppliers

Globally, chromium is mainly traded in the form of minerals, while the European Union prefers to import it directly as ferrochrome.

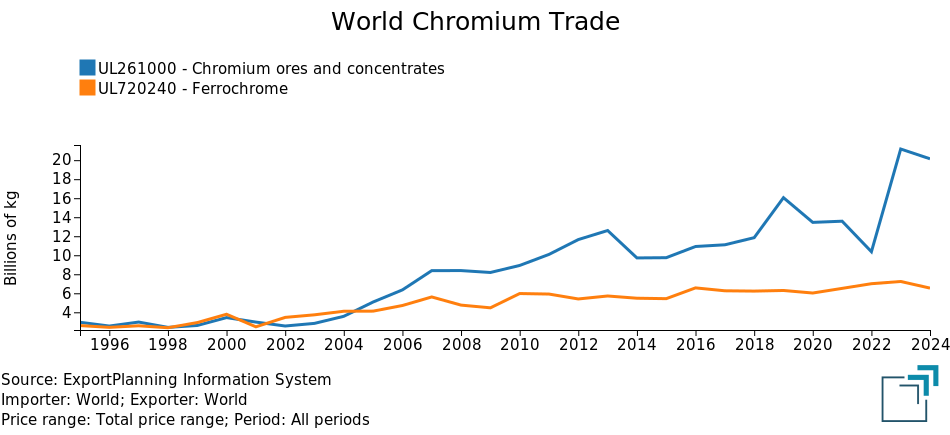

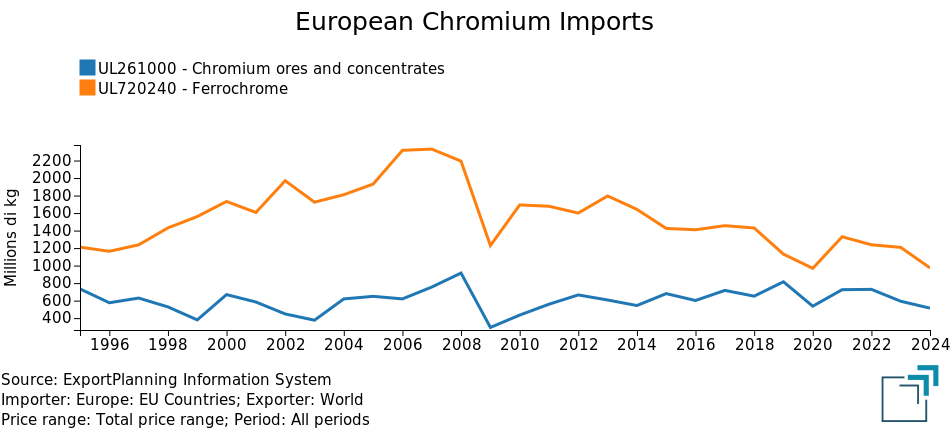

Below are the data related to global and European imports, both of chromium minerals and ferrochrome, in terms of quantity.

|

|

Analysis of the global chromium trade chart reveals that, while in the early 2000s the traded quantities of chromium minerals and ferrochrome were similar, in recent years the volume of chromium mineral trade has surpassed that of ferrochrome by more than three times. However, this dynamic is not observed in the European market, which continues to favor the direct import of ferrochrome over that of chromium minerals.

In terms of mining production, the top five chromium mineral extracting countries in 2024 were: South Africa, Turkey, Kazakhstan, India, and Finland.[2] In 2024, these five countries collectively accounted for 88% of global chromium mineral extraction, totaling approximately 41,500 tons. The availability of mineral resources has enabled these countries to assume central roles in the global chromium trade. South Africa is the undisputed leader in exports of both ferrochrome and, especially, chromium minerals. Turkey ranks second among exporters of chromium minerals, while Kazakhstan, India, and Finland primarily export ferrochrome, positioning themselves respectively as the second, third, and fifth largest global exporters.

Beyond these five countries, Zimbabwe plays an increasingly significant role in the global chromium trade and could challenge South Africa's leadership in the coming years.

In 2024, Zimbabwe was the seventh-largest global producer of chromium minerals and the fifth-largest exporter worldwide. Regarding ferrochrome, it ranked as the fourth-largest global exporter. Its strength lies primarily in its vast mineral resource availability: Zimbabwe holds the world's largest chromite reserves. Additionally, ongoing investments aim to significantly increase the country's production and processing capacity over the next five years.

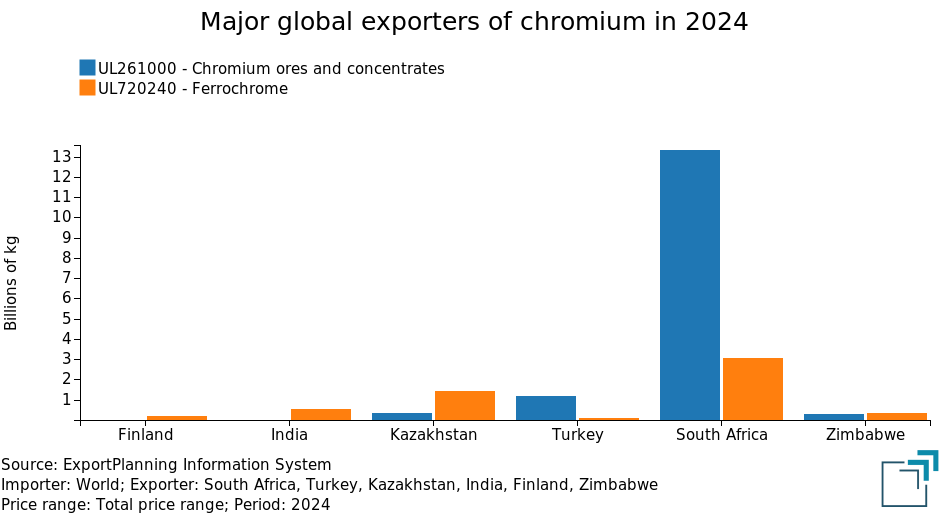

The following chart shows the main chromium exporters in 2024, distinguishing exports between minerals and ferrochrome.

Analysis of the chart highlights South Africa's leadership in global exports of both ferrochrome and, especially, chromium minerals. In 2024, South Africa exported 13.3 billion kg of chromium minerals, a volume over 11 times higher than that of Turkey, the second-largest global exporter.

In the ferrochrome market, South Africa's primacy is also evident: exports in 2024 exceeded 3 billion kg, more than the combined total of Kazakhstan, India, Zimbabwe, and Finland, which are the next four largest global exporters of ferrochrome after South Africa.

Analysis of European Imports

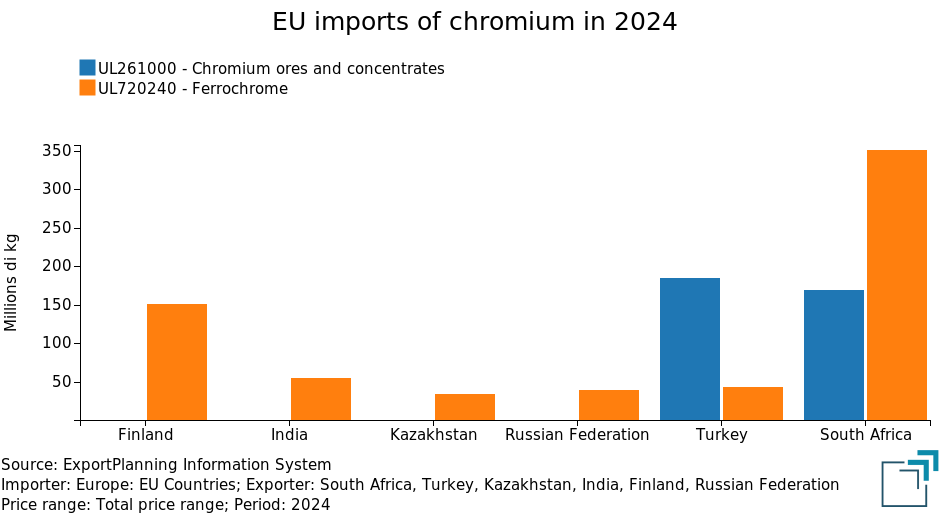

The main supplier countries to the EU of chromium minerals and ferrochrome coincide with the five largest global exporters mentioned above. Additionally, Russia is the fourth-largest European supplier of ferrochrome, and Belgium ranks third among suppliers of chromium minerals and second for ferrochrome. However, Belgium is not a direct producer of chromium: its significant role in European trade derives from acting as a transit point, importing raw materials from third countries and then re-exporting them within the European Union. For this reason, Belgium is not considered among the primary direct supplier countries to the EU in the following chart.

Analysis of the chart once again reveals South Africa's clear leadership as the main European supplier of ferrochrome. In 2024, the European Union imported over 350 million kg of ferrochrome from South Africa, a quantity exceeding the combined imports from the other four main supplier countries.

In the chromium minerals market, the EU also shows a strong dependence on South Africa, which ranks as the second-largest supplier after Turkey.

These data suggest that any disruption in South African supplies could significantly reduce the internal availability of ferrochrome and chromium minerals in the European market.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of European Prices for Chromium Minerals and Ferrochrome

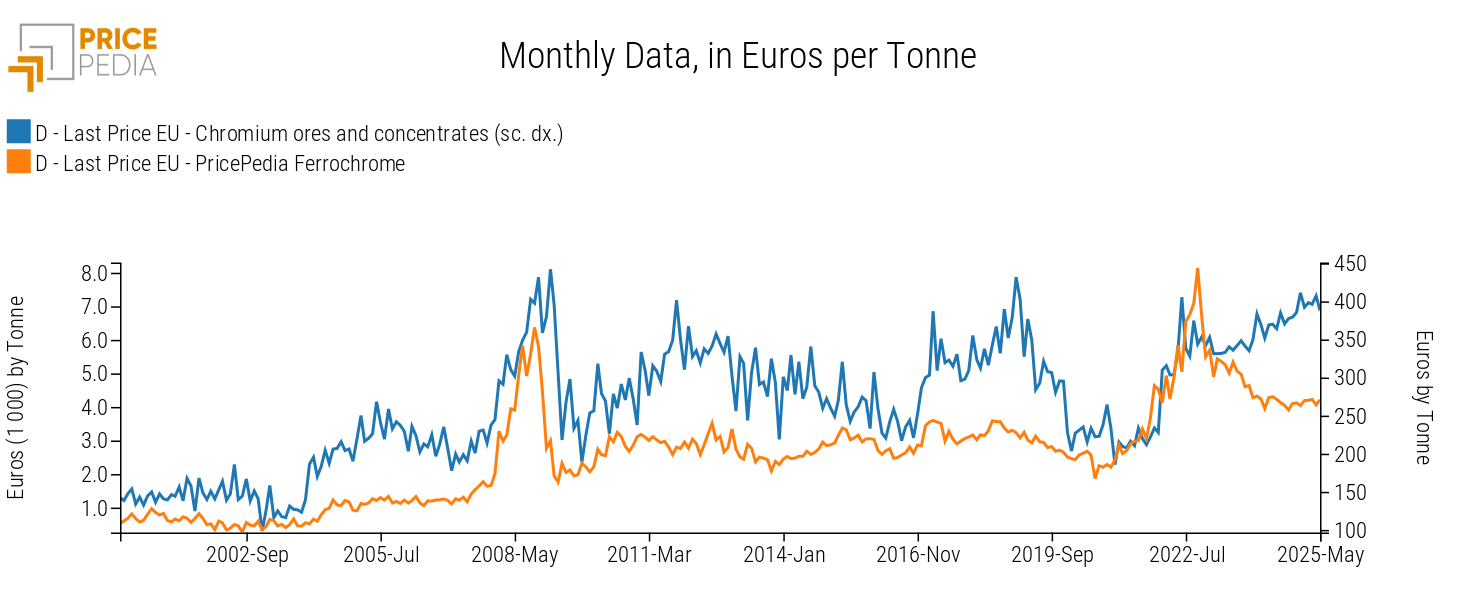

The following chart presents a comparison between European prices of chromium minerals and ferrochrome. For ferrochrome, the PCA[3] price was used, calculated from various customs prices related to ferroalloys with different carbon content percentages.

European Prices of Chromium Minerals and Ferrochrome, expressed in euros/ton

In the first price cycle of 2008, triggered by the global financial crisis, the prices of chromium minerals and ferrochrome followed very similar trends. Between the end of 2009 and the end of 2020, the two series continued to show a common dynamic, although chromium mineral prices exhibited significantly higher volatility compared to those of ferrochrome. In the latest cycle, however, after the marked increase recorded in the 2021-2022 biennium, ferrochrome prices began to decline following the drop in energy prices, while those of chromium minerals remained at high levels, with slight further increases.

In Summary

Chromium is a strategic metal essential for the European industry, particularly for the production of stainless steels, for which there are no valid substitutes. In Europe, production is entirely concentrated in Finland, which ranks as the fourth-largest global producer of ferrochrome, after South Africa, Kazakhstan, India, and Zimbabwe.

The European Union predominantly imports chromium in the form of ferrochrome, unlike the rest of the world, which mainly imports chromium minerals.

The EU is a net importer of both ferrochrome and chromium minerals and heavily depends on supplies from South Africa. A disruption in South African exports could generate a significant supply shortage in the European market, both for chromium minerals and, especially, for ferrochrome.

Currently, European customs prices for chromium minerals and ferrochrome are less aligned than in the past. Since the end of 2022, European ferrochrome prices have started to decline, while those of chromium minerals have remained at high and generally increasing levels.

[1] For the EU analysis on chromium, see EU FACTSHEETS CHROMIUM

[2] Source: U.S. Geological Survey (USGS): Mineral Commodity Summaries 2025

[3] Principal Component Analysis (PCA) is a statistical method that makes it possible to identify common patterns among multiple variables, summarizing most of the information into one or more principal components.