Four Lenses to Understand Commodity Markets

Economic literature has developed four distinct approaches, each useful for interpreting the mechanisms of commodity markets from different perspectives

Published by Luigi Bidoia. .

economic analysis Analysis tools and methodologiesWhen we talk about commodities, we often think of a complex world made up of shifting prices, global dynamics, and geopolitical influences. To navigate it, economic literature offers us four main “lenses”: microeconomics, macroeconomics, qualitative analysis, and the financial approach. Each helps interpret the market from a different angle, but together they offer a truly comprehensive view.

Commodity or Raw Material?

Before diving into the various approaches, it's worth clarifying one thing: a commodity is not the same as a raw material.

Commodities are standardized, fungible goods — meaning they are perfectly interchangeable with one another. It doesn’t matter who produces them: a barrel of oil or a kilo of coffee is considered the same everywhere. Their price is determined on the market, through the interaction of supply and demand. In this scenario, producers cannot freely set the price: they must accept the market price (they are price takers).

Not all raw materials are commodities, and vice versa. A rough diamond, for example, is a raw material, but not a commodity, because each stone is unique. Conversely, a copper wire — although processed — is so standardized that it fully qualifies as a commodity.

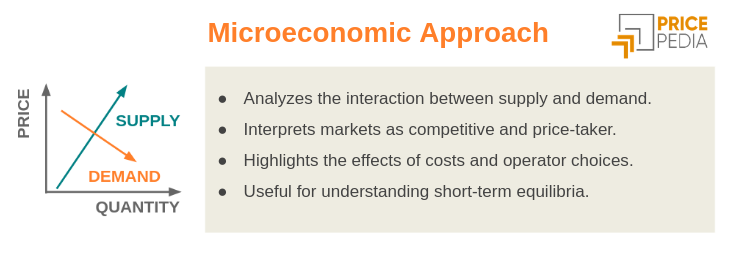

1. The Microeconomic Approach: The Law of Supply and Demand

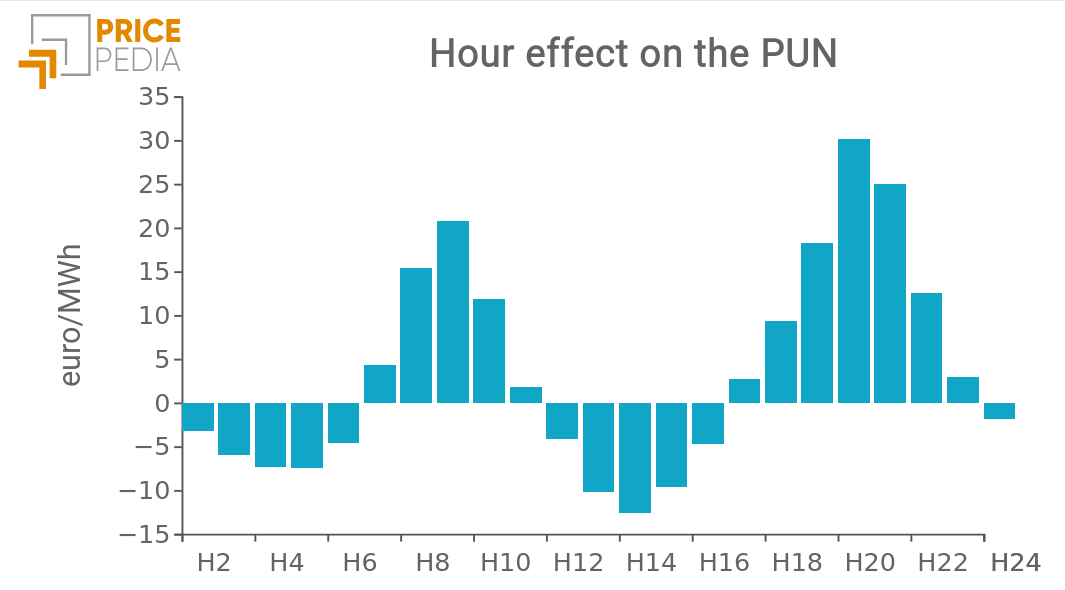

Microeconomics views commodity markets as perfectly competitive systems, where price is determined by the interaction between supply and demand.

The key players are rational and respond to economic incentives. Producers cannot set the price — they must accept it and adjust their production decisions accordingly. Likewise, consumers adjust their demand based on the price.

This approach is especially useful for understanding short-term dynamics. For example:

- If energy costs rise, producing aluminum becomes more expensive, and supply may fall.

- If diets change and interest in plant-based foods increases, the demand for soybeans may grow.

The theoretical foundation of this approach dates back to Alfred Marshall (1890), who explained how the equilibrium price is formed at the intersection of supply and demand curves on a Cartesian coordinate system.

2. The Macroeconomic Approach: The Link to the Global Economy

Macroeconomics views commodity markets as an integral part of the global economy, linking them to aggregate variables such as growth, inflation, exchange rates and monetary policies.

Commodities become indicators of economic performance and vehicles of transmission between sectors and countries.

During expansionary phases, demand increases and prices rise; during recessions, the opposite happens.

But the relationship between economic growth and commodity demand varies depending on the level of development:

- In emerging countries, industrialization and urbanization stimulate demand.

- In advanced economies, demand can stabilize or decrease as a result of environmental transitions.

Central bank decisions, such as interest rate increases, influence global demand. This approach is essential for interpreting medium-long term trends and assessing the impact of systemic events.

3. Qualitative Analysis: The Details That Make the Difference

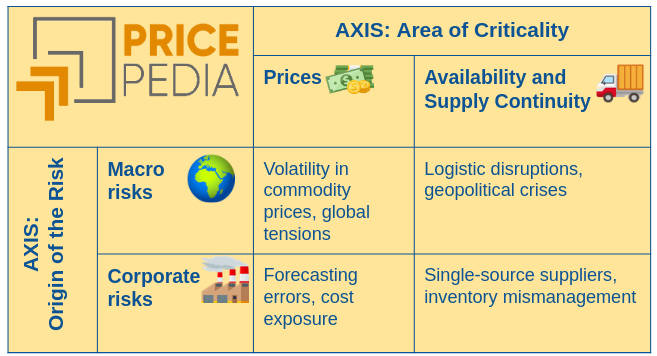

Qualitative analysis focuses on what numbers alone cannot explain. It examines the specific and contextual factors that influence each market. These include, for example, geopolitical conflicts, regulatory changes, extreme weather events, technological innovation, and corporate strategies.

This is a more empirical approach, based on reports, interviews, and industry analysis. It is ideal for identifying temporary imbalances or structural shifts that traditional economic models may not immediately detect.

4. The Financial Approach: Commodities as Assets

In recent years, commodities have become increasingly financialized. They are no longer just physical goods, but also financial instruments used for investment, risk hedging, or speculation.

Through derivatives such as futures, options, or ETFs, one can take a position on a commodity without physically owning it. This has made markets more liquid, but also more volatile, as investor expectations can amplify or distort prices — at least in the short term.

For example, a wave of speculative buying can drive up the price of oil even if actual demand remains unchanged. This approach is therefore essential for understanding price volatility, the role of financial leverage, the interactions between finance and physical markets, and the importance of regulation.

In Summary: Four Lenses, One Comprehensive View

Each approach reveals only part of the mechanisms that govern a market:

- Microeconomics explains the relationship between supply and demand.

- Macroeconomics connects commodities to major global economic movements.

- Qualitative analysis captures the specific context and critical details.

- The financial approach highlights the role of investors and speculation.

Used together, these tools provide a far more complete view. That is why PricePedia has developed all four analytical lenses and applies one or more of them as needed — selecting the most suitable combination based on the market and the specific situation.