China Drives Commodity Prices Downward

Financial markets are becoming immune to Trump's statements

Published by Luigi Bidoia. .

Conjunctural Indicators Commodities Financial WeekAs financial markets grow increasingly immune to Trump’s remarks, a clear signal is emerging: the downward revision of China’s economic growth expectations is translating into downward pressure on global commodity prices.

The Trump administration’s frequent and rapid reversals of its own statements and intentions are creating an immunization effect in financial markets. As a result, reactions to various announcements are becoming progressively weaker and shorter in duration.

Legal Dispute Over Trump’s Tariffs

This week, however, was marked by a legal setback for the Trump administration’s tariff policy. A ruling by the US Court of International Trade deemed the use of the International Emergency Economic Powers Act (IEEPA) to impose global tariffs unlawful. The White House has already appealed the decision and obtained a temporary suspension.

It is highly likely that the dispute will reach the Supreme Court. If the Court upholds the lower court’s ruling, the Trump administration would be forced to radically revise its tariff strategy and rebuild it on new legal grounds.

This legal challenge, combined with the administration’s erratic communication, has added to the uncertainty in financial markets. While reactions to individual news items are becoming less intense and shorter-lived, other factors — particularly the outlook for the Chinese economy — are increasingly driving commodity price dynamics.

China’s Impact on Commodity Prices

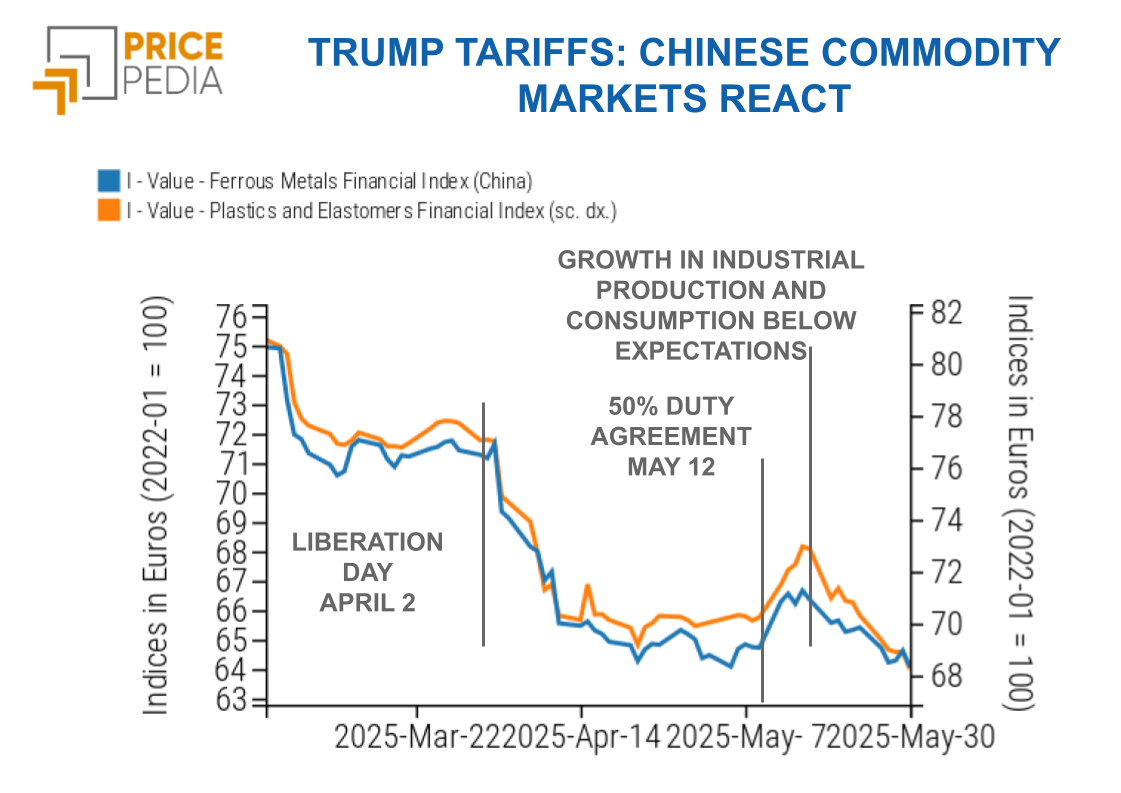

The most evident impact on the commodity market concerns the lowered expectations for China’s economic growth and, as a result, for global demand. This trend is clearly reflected in two PricePedia indexes based on financial prices of commodities traded on Chinese markets.

The first is the Plastics and Elastomers index, which aggregates prices mostly quoted on Chinese exchanges. The second is the Ferrous (China) index, which tracks the prices of ferrous raw materials tied to the Chinese market.

The following chart displays the performance of these two indexes.

The analysis of the chart highlights the following key points:

- For over three months, the two indexes have shown a perfectly aligned trend, indicating that both are influenced by prevailing market sentiment in China;

- After the price drop triggered by the announcement of reciprocal tariffs on April 2 and the subsequent escalation, the positive effect of the May 12 announcement — regarding an agreement to cut tariffs by 50% — lasted only a few days;

- Over the past 15 days, following disappointing news on China’s economic performance — first in industrial production and then in consumer spending — both indexes have entered a phase of significant decline.

Further confirmation of the "China-driven" nature of the current downward pressure on global commodity prices comes from the comparison between two PricePedia indexes: one tracking the customs prices of industrial commodities (metals, plastics, chemicals, and non-food agricultural products) traded within the EU, and the other tracking the FOB prices of Chinese exports.

The comparison clearly shows a significant drop in the Chinese FOB price index in April, while EU prices have remained more stable.

Industrial Commodity Price Indices: FOB China Exports and EU Customs