Vanadium: A Key Metal for the Green Transition and European Security

A Test Case for the EU Between Batteries, Steel and Geopolitics

Published by Luigi Bidoia. .

Energy Transition Critical raw materialsWhy Vanadium Is Critical

Vanadium is a strategic raw material, essential in numerous high-tech industrial applications. It is used in steel and titanium alloys to enhance resistance to heat, corrosion, and deformation, as well as a catalyst in various chemical processes. Its main function is as an alloying element in the production of high-strength low-alloy steels (HSLA) and superalloys used in the aerospace, nuclear, and high-performance engine sectors.

An additional reason for its criticality lies in its role in the defense sector. Vanadium is present in special alloys for ballistic and armored steels, which are crucial for the production of tanks, armored vehicles, artillery systems, and missiles.

In recent years, growing interest in vanadium redox flow batteries (VRFBs), used for large-scale renewable energy storage, has further highlighted its role in the green transition and in the stabilization of power grids.

Global demand for vanadium is expected to increase in the medium to long term across all its main applications: steel and non-ferrous alloys, chemical products, and energy storage technologies. In particular, VRFBs could become a key driver of demand in the coming decades, supported by the increasing share of renewable energy and the development of large-scale battery storage systems.

Despite its strategic relevance, the European Union relies entirely on imports, lacking any primary domestic production. This exposes it to significant supply risks, especially in unstable geopolitical contexts. Moreover, the absence of technically equivalent substitutes for many applications further increases its criticality. For these reasons, vanadium is included in the EU’s official list of critical raw materials.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Vanadium Commodities: Products, Exporters and EU Suppliers

Vanadium is found in many minerals, but always in very low concentrations. Today, most of the world’s vanadium production comes as a by-product of the steel industry, in the form of slag, or from the oil industry as a residue from heavy hydrocarbons. In both cases, vanadium is obtained from secondary processes, often from what would otherwise be industrial waste.

This "secondary" nature of production severely limits supply flexibility: existing mines and metallurgical plants may not be able to ramp up output quickly, even in the face of sharply rising global demand — as anticipated for vanadium redox flow batteries or strategic military applications.

In the market, vanadium is primarily traded in two main forms:

- Vanadium oxides and hydroxides: used as raw materials in various industrial processes, especially for the synthesis of ferrovanadium. They are also essential for redox battery production.

- Ferrovanadium (FeV): an alloy used in the manufacturing of special and high-strength steels; it represents the main industrial use of vanadium.

With nearly three-quarters of global primary vanadium production (about 70,000 tonnes), China is by far the leading producer, followed by Russia (20,000 tonnes), South Africa, and Brazil. [2]

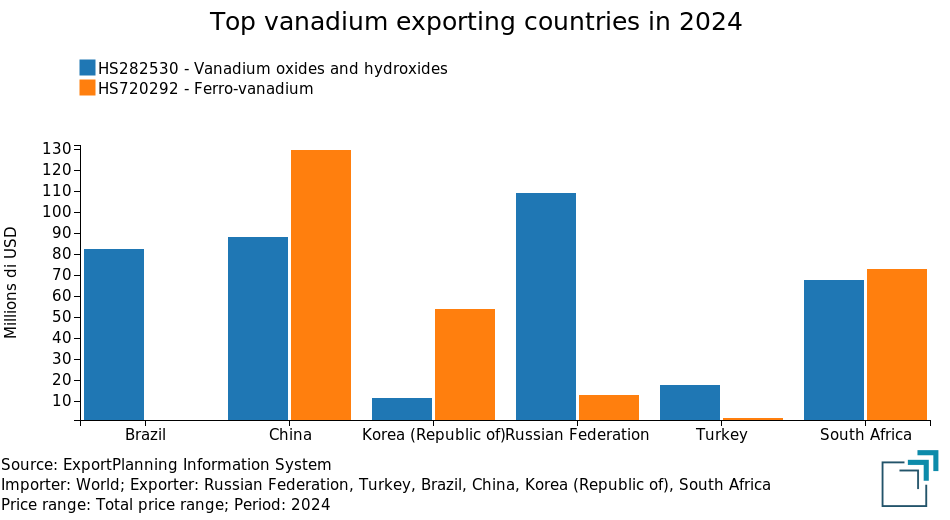

Considering both vanadium oxides/hydroxides and ferrovanadium, China is also the world’s largest exporter. It is followed by South Africa and Russia, whose exports focus primarily on oxides. Brazil and Turkey also mainly export vanadium oxides. Among the key exporters of ferrovanadium, South Korea plays an important role.

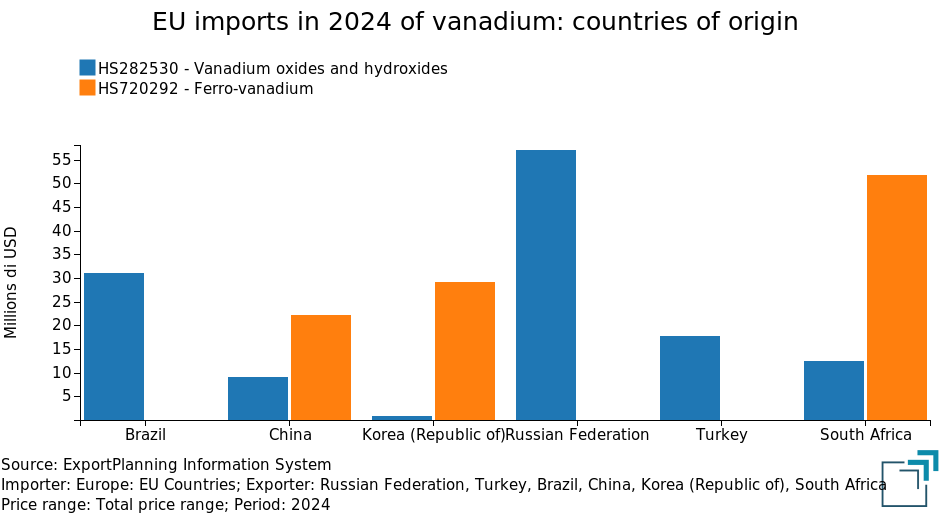

The European Union mainly imports vanadium oxides and hydroxides from Russia, Brazil, South Africa, Turkey, and China. In the case of ferrovanadium, the EU’s main suppliers are South Africa, South Korea, and China.

Vanadium Price Trends in the EU: Three Major Historical Cycles

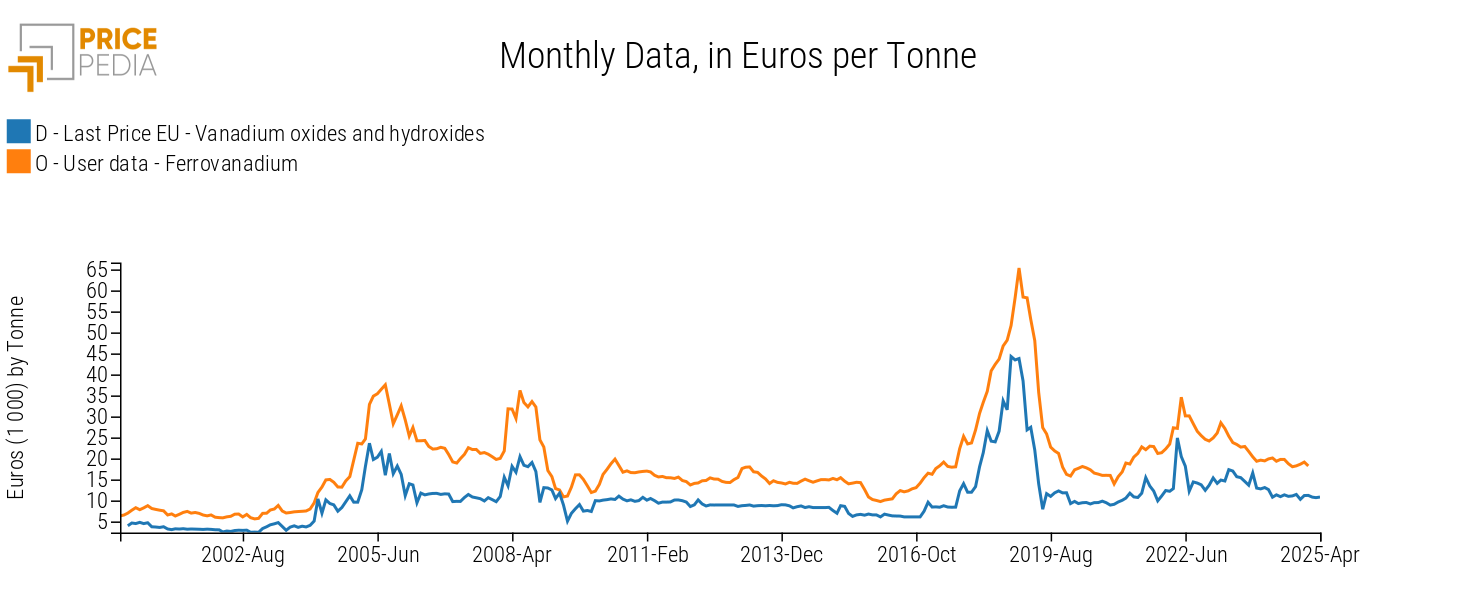

As shown in the graph below, vanadium prices in Europe have experienced three major cycles of sharp increases and subsequent declines over the course of this century.

EU customs price of vanadium oxides and hydroxides and iron-vanadium

Among these, the second cycle—which peaked in mid-2008—coincides with the height of the so-called commodity supercycle (2004–2008), linking vanadium with other raw materials. The causes of this cycle can be traced to the same structural factors driving the supercycle, particularly the sharp increase in global commodity demand driven by China’s rapid economic expansion.

More relevant for understanding the vanadium market, however, are the first and third cycles, whose dynamics stem from more specific sectoral drivers.

The first cycle, which peaked in 2005, was triggered by an extraordinary surge in Chinese demand, driven by a rapid expansion of steel production. Between 2003 and 2005, China’s steel output doubled. The close link between steel demand and vanadium prices is further confirmed by the simultaneous spike in molybdenum prices during the same period.

The 2018 cycle was the result of a combination of factors:

- Rising demand in China due to the introduction of new rebar standards aimed at improving seismic resistance in construction;

- Supply constraints caused by stricter environmental regulations and a ban on imports of vanadium-bearing slags;

- Market speculation by traders anticipating a sustained supply deficit.

The subsequent decline in prices was partly due to the increasing substitution of vanadium with niobium, which can also enhance the structural performance of rebar in construction applications.

Global or Regional Pricing?

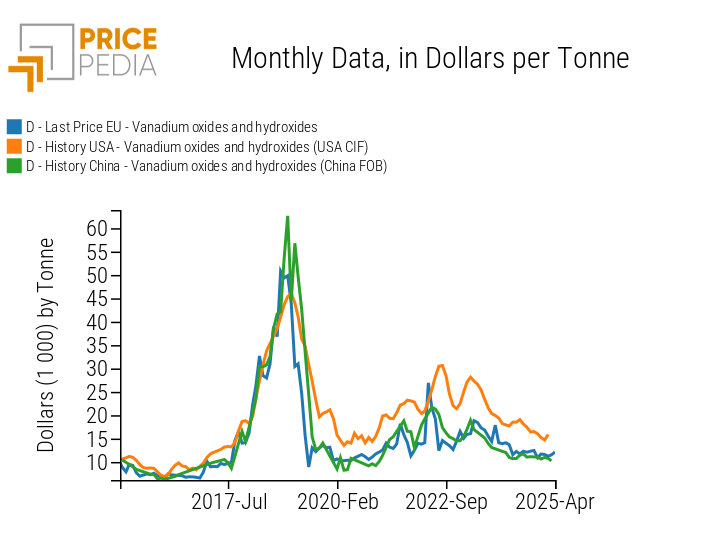

In the previous analysis, it was assumed that vanadium has a single global price, meaning that market changes in China are reflected in similar price variations in both Asian and European markets. This assumption is well supported by data available through the PricePedia information system.

The following graph compares three price series for vanadium oxides and hydroxides:

- EU customs prices: calculated as the average of CIF and FOB prices from intra-EU trade and CIF prices from extra-EU imports;

- CIF import prices in the United States;

- FOB export prices from China.

An analysis of the data leaves little doubt: price shocks in one region tend to translate into comparable changes in other regions. Prices move in a closely aligned fashion across global markets.

Price of vanadium oxides and hydroxides; EU, US and China

It is reasonable to assume that the main driver of this transmission is China’s export prices. This is supported by correlation analysis, where Chinese prices show significantly stronger correlations with both EU and US prices than those observed between EU and US prices themselves.

Summary

Vanadium is unquestionably a critical raw material for the European Union. It plays a vital role in many industrial applications and is difficult to substitute. Due to the lack of significant domestic production, the EU is entirely dependent on imports.

The global market for both vanadium oxides/hydroxides and ferrovanadium is dominated by China, making EU prices heavily dependent on Chinese market dynamics and, ultimately, on the activity levels of the Chinese steel industry.

As long as Chinese steel production remains subdued, vanadium prices are likely to stay within their historical long-term range of $20 to $35 per kilogram. However, if a new phase of steel industry expansion emerges in China, we may again witness strong price cycles similar to those in the past. As history has shown, such cycles tend to be relatively short-lived.

[1] See REGULATION (EU) 2024/1252 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 11 April 2024 establishing a framework for ensuring a secure and sustainable supply of critical raw materials.

For the EU's analysis of vanadium, see EU FACTSHEETS VANADIUM

[2]: Source: U.S. Geological Survey (USGS): Mineral Commodity Summaries 2025