Cobalt: world price formation driven by LME price

LME cobalt anticipates physical price trends and levels in Europe and China

Published by Luca Sazzini. .

Cobalt Energy Transition Price DriversIn the article: “Cobalt Criticality in the EU Market” the criticality of cobalt for the European Union was analyzed.

The analysis showed that cobalt’s high criticality is due to:

- its economic importance: for the production of lithium-ion batteries, used in portable electronic devices, energy storage systems, and electric vehicles (EVs);

- its supply risk: most of the cobalt extracted worldwide comes from the Democratic Republic of the Congo;

- its low substitutability: cobalt has unique chemical and physical properties that limit its substitutability.

In addition to these criticalities, cobalt exhibits high price elasticity to changes in demand, not only actual but also expected. In particular, if financial markets anticipate a future increase or decrease in demand, financial prices react quickly with sharp rises or declines. These price fluctuations, amplified by traders' speculative operations, are subsequently reflected in physical prices, which are closely correlated with the financial benchmark of cobalt quoted on the London Metal Exchange (LME).

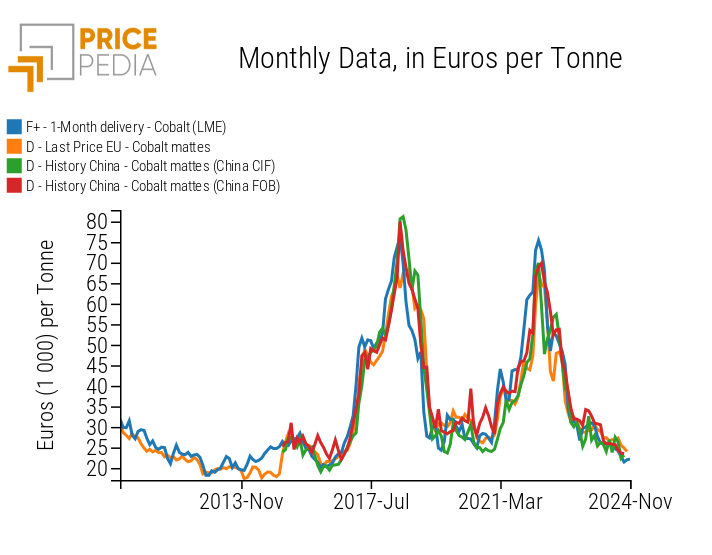

The following chart shows a comparison between the LME cobalt price and the physical prices of cobalt mattes recorded at the customs of Europe and China.

Comparison between financial and physical prices of cobalt

The analysis of the chart shows that the prices of mattes in Europe and China tend to almost overlap with the historical series of LME financial prices. This suggests the presence of a global cobalt market, led by the LME financial benchmark, which not only anticipates the direction of physical price changes but also determines future price levels.

The analysis of historical series reveals two strong price cycles: the first from late 2016 to early 2019; the second from early 2021 to early 2023. In both cycles, the upward phase was caused by the expansion of the EV market, which generated an increase in demand for cobalt for lithium-ion battery production.[1] The slowdown in the development of the electric car market, which in both cycles failed to meet initial expectations, led to the subsequent cobalt price declines.

The first prices to react to demand shocks, both in rising and falling phases, were the LME financial prices.

Physical prices, recorded at the customs of Europe and the United States, subsequently adjusted to the LME prices, replicating their dynamics and price levels. To verify the anticipation of financial prices over physical prices, statistical regression can be used.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Statistical Regressions

The following table shows the long-term estimates of the European and Chinese customs prices of cobalt mattes regressed on the LME financial benchmark.

To interpret the regression coefficients in terms of elasticity, prices were considered in logarithms.

Additionally, possible lags in the financial price were considered to verify the anticipated effect on physical prices.

| Table of regression results between customs prices and the financial price of cobalt | ||||

| Dependent | Explanatory | Lag periods of explanatory | Elasticity | R² |

| Customs price of cobalt mattes in EU: | Financial price of cobalt (LME) | 0 | 0.92 | 0.88 |

| Customs price of cobalt mattes in EU: | Financial price of cobalt (LME) | 1 | 0.94 | 0.91 |

| Customs price of cobalt mattes (China CIF): | Financial price of cobalt (LME) | 0 | 0.94 | 0.86 |

| Customs price of cobalt mattes (China CIF): | Financial price of cobalt (LME) | 1 | 0.98 | 0.91 |

| Customs price of cobalt mattes (China FOB): | Financial price of cobalt (LME) | 0 | 0.84 | 0.88 |

| Customs price of cobalt mattes (China FOB): | Financial price of cobalt (LME) | 1 | 0.87 | 0.93 |

The analysis of regression outputs highlights, as expected, a strong elasticity between LME cobalt financial prices and customs prices in Europe and China. The highest elasticity coefficient is obtained from the regression between the price of Chinese imports of cobalt mattes and the financial price of LME cobalt lagged by one period. The long-term coefficient estimate indicates an elasticity of 0.98, implying that a 10% increase (or decrease) in the financial price of cobalt leads to a 9.8% increase (or decrease) in the import price of cobalt mattes in China.

To assess the quality of the different estimated models, the R² index value has been reported in the last column. Analysis of this index indicates that models considering the financial price lagged by one period offer better explanatory power than those that do not. Specifically, all models where the LME cobalt financial price is lagged by one period can explain over 90% of the variability in the customs prices of cobalt mattes.

Analysis of Annual Average Cobalt Prices

Within customs markets, cobalt is traded in various forms: cobalt ores, cobalt and titanium sulfates, cobalt oxides and hydroxides, and cobalt mattes.

The following table compares the annual averages of different types of cobalt traded on customs markets with the annual average of the LME financial benchmark.

Table of Annual Average Cobalt Prices, in euros/ton

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Cobalt ores | 5302 | 5503 | 8369 | 11361 | 4318 | 3940 |

| D-Last Price EU-Cobalt and titanium sulfates | 4947 | 5736 | 8311 | 10873 | 5458 | 4728 |

| D-Last Price EU-Cobalt oxides and hydroxides | 24646 | 22798 | 30146 | 42525 | 23048 | 17550 |

| D-Historical USA-Cobalt oxides and hydroxides (USA CIF) | 25427 | 21897 | 28867 | 43538 | 23729 | 18848 |

| F+-1-month Delivery-Cobalt (LME) | 29318 | 27445 | 43275 | 60482 | 31560 | 24331 |

| D-Last Price EU-Cobalt mattes | 34415 | 29474 | 37763 | 52447 | 30840 | 26534 |

| D-Historical China-Cobalt mattes (China CIF) | 30188 | 26232 | 35130 | 55085 | 30306 | 25097 |

| D-Historical China-Cobalt mattes (China FOB) | 32946 | 31965 | 40024 | 58625 | 33718 | 25758 |

Over the past 5 years, all cobalt prices have followed the price dynamics described previously.

Analysis of price levels reveals a strong interconnection between prices in the different geographic areas analyzed. Cobalt oxides and hydroxides show very similar price levels in Europe and the United States, and cobalt mattes show similar prices in Europe and China. This further analysis of annual averages supports the thesis of a global cobalt market, characterized by a single world price present in various regional markets.

Conclusion

The analysis of cobalt prices reveals a strong interconnection between prices in different local markets and the financial price quoted on the London Metal Exchange (LME). The LME cobalt price, in addition to anticipating the physical prices of cobalt mattes in Europe and China, records very similar price levels to these.

The elasticity estimate between financial and customs cobalt prices is close to unity, implying that the entire variability in financial prices tends to transfer with the same intensity to physical prices.

Analysis of annual average prices in different geographic areas confirms the hypothesis of a single global cobalt market, characterized by uniform price levels.

See article: “Price of lithium: crossroads of the world economy”