Long steels: Italian efficiency challenges high energy cost

Analysis of the main cost factors affecting long steel prices

Published by Luca Sazzini. .

Long steels Price Drivers

In the analysis of steel prices, it is useful to group products based on homogeneous technical characteristics that may influence their price, such as: the cost of the steelmaking charge, the alloying elements used, the type of processing (hot or cold), and the shape.

Among these characteristics, a key distinction is between long and flat steels, which mainly differ in terms of production processes and the composition of the steelmaking charge: the former are produced using electric arc furnaces from scrap, while the latter are obtained via blast furnaces, with costs tied to the prices of iron ore and coking coal.

Within long steels, the categories are classified based on the shape of the product (bars, tubes, profiles...) which, in addition to having different price levels, also have varying degrees of trade protection from imports originating outside the EU.

In this article from last week, "HRC: A Partially Globalized and Financialized Market", the latest safeguard measures introduced by the European Union for hot-rolled coils were analyzed. However, these measures do not extend to the entire long steel segment, whose level of protection varies depending on the specific product type.

In general, safeguard measures for long steels are less restrictive than those for hot-rolled coils. While the additional duty rate (25%) applied in case of quota exceedance remains the same for long steels, the country-specific ceilings on residual tariff quotas are generally higher than those for coils (set at 13%) and range from 15% to 30%, depending on the product type. Furthermore, some long steel categories are not subject to the ban on volume carryover: it is thus possible to accumulate unused duty-free import quotas from one quarter and carry them over to the next.

The only element that fully aligns them with the measures for coils is the reduction, starting from July 1st, in the liberalization rate of the annual increase of tariff quotas, from 1% to 0.1%.

By contrast, U.S. trade policy does not make such distinctions, applying uniform tariffs to all imported steel types. Currently, steel imports into the United States from the European Union are subject to a 25% tariff; however, starting July 9th, these tariffs may double to 50% if trade negotiations between the U.S. and EU fail to yield a positive outcome.

Since the production of long steels mainly relies on electric arc furnaces, their price is closely linked to the dynamics of electricity and scrap steel costs.

Focusing initially on electricity costs, all other things being equal, an increase (or decrease) in electricity prices tends to result in a corresponding increase (or decrease) in the price of long steels.

It may therefore be useful to verify whether countries with lower electricity costs are also the main exporters of long steels.

The following table presents the annual European electricity prices for Italy, France, Germany, Poland, Spain, and Hungary.

European Financial Electricity Prices

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025* | |

|---|---|---|---|---|---|---|

| F-Day Ahead - Electricity price Spain (OMIE), price/MWh | 34.0 | 112.2 | 167.5 | 88.4 | 63.2 | 60.2 |

| F-Day Ahead - Electricity price France (Entsoe), price/MWh | 32.2 | 109.2 | 275.8 | 96.9 | 54.6 | 72.4 |

| F-Day Ahead - Electricity price Germany (Entsoe), price/MWh | 36.9 | 96.8 | 235.4 | 95.2 | 74.8 | 95.3 |

| F-Day Ahead - Electricity price Poland (Entsoe), price/MWh | 46.7 | 87.0 | 166.7 | 111.7 | 88.3 | 100.7 |

| F-Day Ahead - Electricity price Hungary (HUPX), price/MWh | 39.0 | 114.0 | 271.5 | 106.9 | 101.0 | 115.7 |

| F-Day Ahead - PUN Italy (GME), price/MWh | 38.9 | 125.7 | 304.1 | 127.0 | 108.6 | 121.7 |

| * average of the first four months of 2025. | ||||||

The analysis of the table reveals significant discrepancies in electricity prices across different European countries. For example, since 2022, the average electricity price in Italy has been 165 euros/MWh, nearly double the price in Spain.

Given the lower electricity costs in Spain, France, and Germany, it may be interesting to investigate whether these three countries export larger quantities of long steel products compared to those with higher energy costs, such as Italy, Hungary, and Poland.

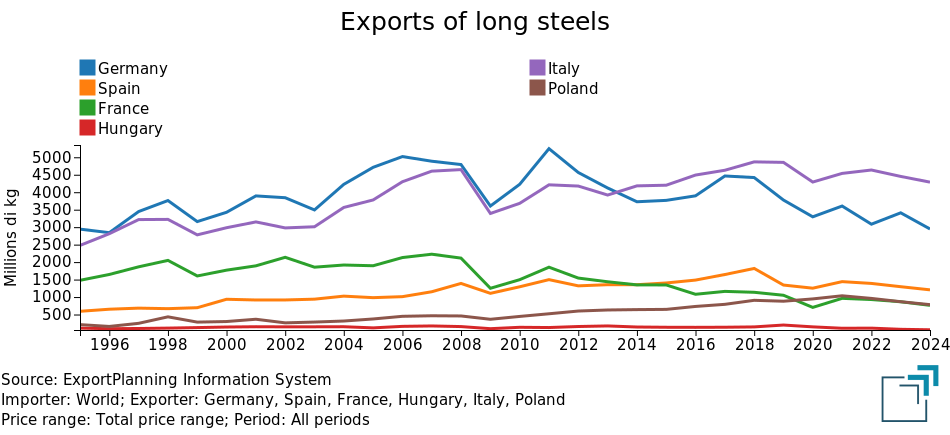

The chart below shows the exports of long steel products from Spain, France, Germany, Italy, Hungary, and Poland.

The chart shows that, among the six countries considered, Italy is the leading exporter of long steel products, despite its high electricity costs. In 2024, Italian exports reached 4.3 million tonnes, more than double the combined exports of Spain and France, the two countries with lower electricity prices.

Within the European Union, Italy, together with Germany, is a leader in both the production and export of long steel products, thanks to the widespread presence of electric arc furnaces and a well-established specialization in the scrap recycling supply chain. The Italian steel industry, in fact, manages to offset its energy disadvantage through high efficiency in the collection and processing of ferrous scrap, remaining competitive in the long steel markets.

To test this hypothesis, we estimated the price elasticity of long steel products with respect to changes in scrap and electricity prices. If, indeed, price elasticity with respect to scrap is significantly higher than with respect to energy, it is plausible that even a modest advantage in scrap availability may compensate for a substantial disadvantage in energy costs.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Price Elasticity of Long Steel Products

Model Specification

To analyze the price elasticity of European long steel products to changes in scrap and electricity prices, a regression was performed using the European index of long steel products against scrap and electricity prices.

As a proxy for scrap prices, the financial benchmark of Turkish steel scrap on the LME was used, while for electricity prices, a PCA (Principal Component Analysis) was extracted from the European electricity prices available in the Daily Data Prices section of the PricePedia website.

A logarithmic transformation was applied to all model variables to interpret the estimation results in terms of elasticities.

Estimation Results

From the long-term analysis using the Engle and Granger econometric model, it emerged that the price elasticity of the PricePedia index of long steel products to scrap prices is 0.57. This implies that, all else being equal (ceteris paribus), a 10% increase (decrease) in scrap prices corresponds, on average, to a 5.7% rise (drop) in the average price of long steel products.

The price elasticity of European long steel products with respect to electricity prices, on the other hand, is 0.17: a 10% change in energy costs thus results in only a 1.7% variation in long steel product prices.

Conclusions

The production of long steel products mainly takes place in electric arc furnaces, where scrap is used as the main input. As a result, the price of long steel products depends on both scrap and electricity prices. However, among these two components, scrap costs emerge as the primary determinant of competitiveness in the long steel market. A prominent example is Italy, which, despite having generally higher electricity prices than its main competitors, has managed to maintain its share of global demand, in contrast to a sharp decline in German exports. This performance is made possible by Italy’s highly specialized electric steel industry and its established capability in collecting and recycling ferrous scrap.

The central role of scrap is further confirmed by the estimated price elasticities of long steel products: the impact of scrap prices on long steel prices is more than three times greater than that of electricity prices.