PricePedia Scenario for May 2025

Downside risks for commodity prices

Published by Pasquale Marzano. .

Forecast ForecastThe PricePedia Scenario has been updated with information available as of May 7, 2025. Over the past month, there have been continuous twists and turns in U.S. trade policy and relations between the United States and its partner countries. The most recent development is a 90-day suspension of the tariff war between the United States and China and the willingness to continue negotiations in search of an agreement (see the article Commodity prices waiting for U.S.-China talks for more details on financial price trends in the past week).

Although this latest development represents a positive shift in global trade relations, it is worth noting that it does not result in the immediate elimination of tariffs between China and the U.S., but rather brings them back to still elevated levels (U.S. tariffs on Chinese imports at 30%, and Chinese tariffs on U.S. imports at 10%) compared to recent years.

In this context, uncertainty about the macroeconomic outlook remains high, and consequently, so does uncertainty regarding global demand for commodities.

This is reflected in the trend of global industrial production, which is indicative of global demand for manufactured goods, and whose average growth is projected to remain below 1.5% over the next two years.

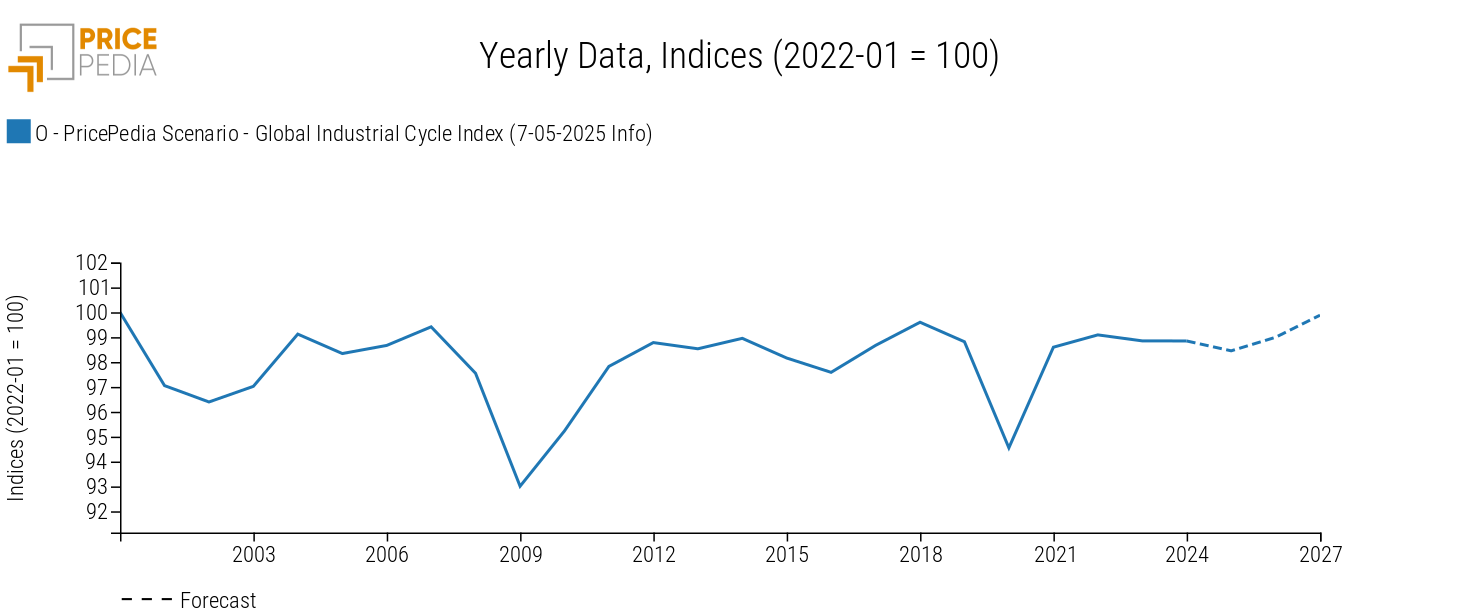

Below is the trend of the global industrial cycle index[1], which mirrors that of industrial production.

Global Industrial Cycle, May 2025 Scenario

Over the next two years, the industrial cycle is expected to remain roughly at 2024 levels: the projected annual decline in 2025, of nearly half a percentage point, is offset by the expected increase in 2026.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Forecast for procurement material prices

The weakness in the global industrial cycle is expected to drive a downward trend in commodity prices over the next two years.

Below is a table showing the annual price changes in euros for the main commodity groups (Industrials[2], Commodity[3], Energy, and Food).

Table 1: Annual Rate of Change (%) of PricePedia Aggregated Indices, in Euro

| 2023 | 2024 | 2025f | 2026f | |

|---|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (7-05-2025 Info) | −17.93 | −4.45 | −8.46 | −3.47 |

| I-PricePedia Scenario-Industrials Index (Europe) (7-05-2025 Info) | −13.85 | −4.41 | −2.91 | −0.61 |

| I-PricePedia Scenario-Energy Total Index (Europe) (7-05-2025 Info) | −23.36 | −5.84 | −16.84 | −6.77 |

| I-PricePedia Scenario-Food Total Index (Europe) (7-05-2025 Info) | −5.18 | +3.34 | +7.09 | −2.14 |

On aggregate, commodity prices in euros are expected to continue their downward trend, with an annual decrease in 2025 more pronounced than in 2024, reaching -6%. This downward trend is expected to slow in 2026, with prices decreasing by -3.5%.

The only group expected to increase in 2025, by about +7%, is that of Food, although this rise has largely already occurred in the early months of the year. Furthermore, in 2026, food prices in euros are expected to fall by over -2%.

The sharpest decline over the next two years is forecast for energy raw materials prices in euros, with a total decrease of -23.6%.

Even in the case of core industrial commodities, a downward price trend is observed, with prices expected to fall by about -3% in 2025 and by nearly one percentage point in 2026.

A comparison between scenarios

The increasing uncertainty surrounding the macroeconomic context implies that the current scenario incorporates a higher probability of downside risks to prices than upside risks. This perspective is also aligned with the commodity price forecast scenario published on April 29 by the World Bank, which, unlike the PricePedia scenario, does not factor in the most recent developments.

In this regard, the World Bank scenario can be considered as a lower bound for price trends.

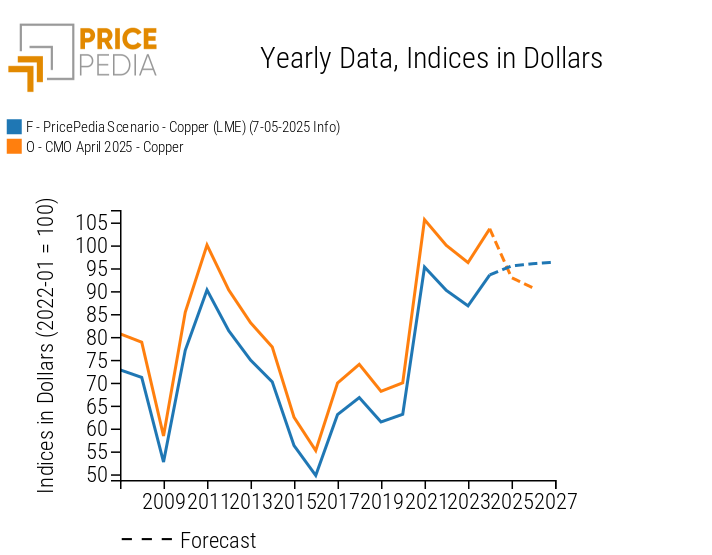

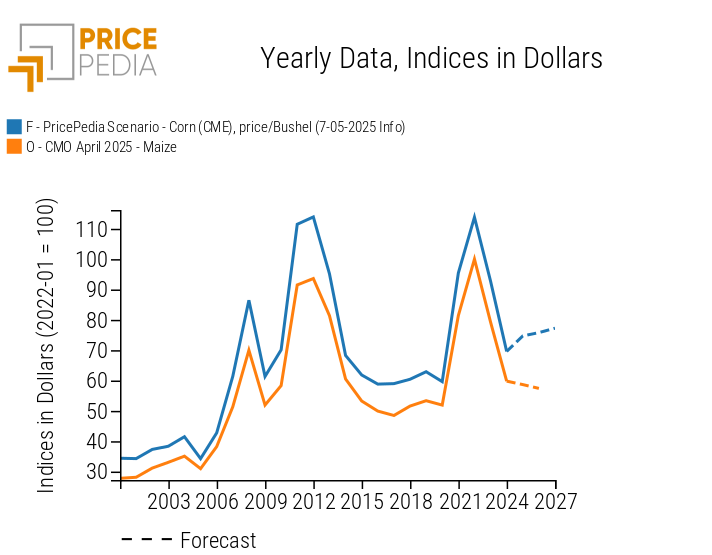

The charts below compare the PricePedia and April 2025 World Bank forecasts for copper and corn prices in dollars, expressed as indices with base 100 in January 2022.

Copper

Corn

For both copper - representative of industrial metal trends - and corn, the World Bank scenario projects a more bearish price outlook in dollars compared to the PricePedia forecast.

Specifically, in the case of copper, the World Bank anticipates a price decline in 2025 approaching double digits. For corn, the expected decline is more modest, at around -2%.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities.