The Potassium Industry: A Dual Supply Chain Between Fertilizers and Advanced Chemistry

A cost pass-through intensity analysis for the potash chemical supply chain

Published by Luigi Bidoia. .

Fertilizers Cost pass-through

Sodium and potassium, two of the most abundant alkali metals in the Earth's crust, have a strong tendency to combine with chlorine, forming sodium chloride (NaCl) and potassium chloride (KCl) respectively. While the former is commonly known as table salt, the latter serves as the chemical foundation of the entire potassium industry, a sector that is vital to agriculture and numerous industrial applications.

Potassium chloride is primarily extracted from minerals (such as sylvite), and to a lesser extent from concentrated brines resulting from the evaporation of natural salt lakes. Similar to sodium chloride, potassium chloride can undergo electrolysis in aqueous solution to produce potassium hydroxide — commonly known as caustic potash. This is a highly energy-intensive process, and its economic viability depends largely on the cost of electricity, as well as the availability of KCl itself.

Two chemical chains originate from potassium chloride

.From potassium chloride, the industry branches into two distinct supply chains, both strategic but serving different purposes.

The first is the chemical-industrial chain, which begins with the production of caustic potash and leads to a wide range of non-agricultural products: potassium carbonates, Potassium permanganate, liquid soaps, technical detergents, products for the electronics industry, and batteries[1]. In this segment, production costs are influenced both by fluctuations in potassium chloride prices and by the cost of electricity required to produce caustic potash.

The second is the agrochemical chain, focused on fertilizer production. Here potassium chloride is transformed through low to moderate energy chemical processes into:

- Potassium nitrate, mainly used in high-yield crops;

- Potassium sulfate, intended for crops sensitive to chlorine.

These two products, together with potassium chloride itself (which is used directly as a fertilizer), form the core of the “fertilizers” segment within the potassium industry. Unlike the chemical chain, the costs in this area depend primarily on the price of the raw material, with energy costs playing a much smaller role in the overall process.

Cost Pass-Through of Potassium Chloride Prices

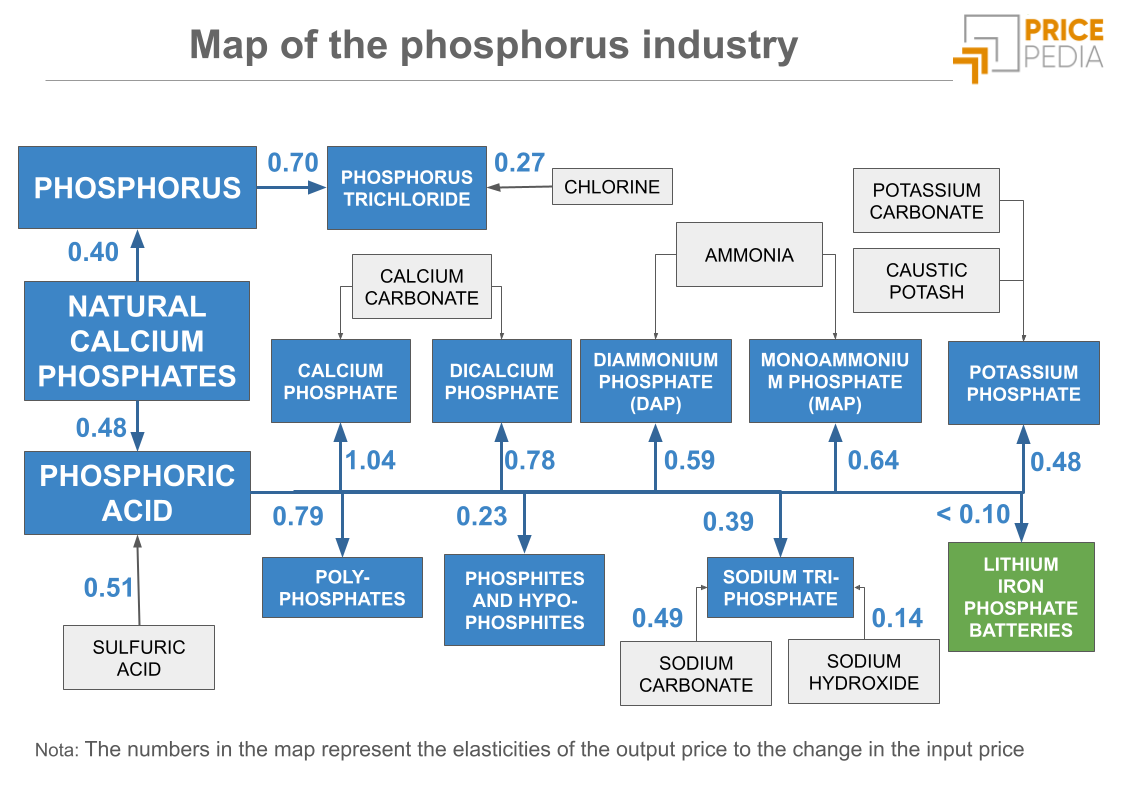

The map below illustrates the main potassium-based chemical compounds and the relationships between the price of potassium chloride and its derivative products. The numerical values shown indicate the price elasticity of each derivative in response to changes in the price of potassium chloride.

The analysis of the elasticities presented in the map highlights a generally moderate cost pass-through mechanism (ranging between 0.5 and 0.6) between changes in the price of potassium chloride and the prices of its derivatives. However, in one case, the elasticity is particularly low: that of potassium permanganate, which is below 0.1. This means that a 10% change in the price of potassium chloride results in a price increase for potassium permanganate of less than 1%. This phenomenon is due to a complex production process involving multiple stages and strict safety and purity protocols.

It is not surprising to observe a low price elasticity of potassium carbonate relative to potassium chloride. Potassium carbonate can be produced through two different processes: the first involves reacting potassium chloride with sodium carbonate; the second uses a solution of caustic potash and carbon dioxide. Considering both production pathways, the overall price elasticity of potassium carbonate relative to changes in potassium chloride prices is approximately 0.41.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Global Production and Trade

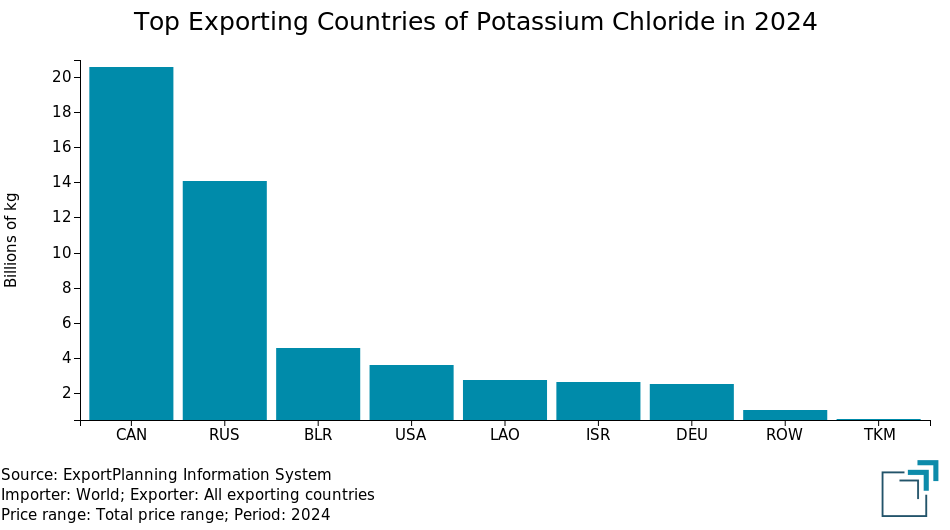

The country that plays a leading role in the potassium industry is undoubtedly Canada, thanks to its mineral reserves, which account for nearly half of the world’s total. Russia and Belarus also hold strategically important reserves.

The hierarchy of countries in terms of mineral resources is reflected in production levels as well, with Canada firmly in first place, followed by Russia and Belarus. Other major global producers of potassium chloride include China, Germany, Israel and Jordan (which extract potassium from the Dead Sea salt flats), and Laos[2]. Thanks to its substantial reserves, Laos could easily climb the ranks of global producers.

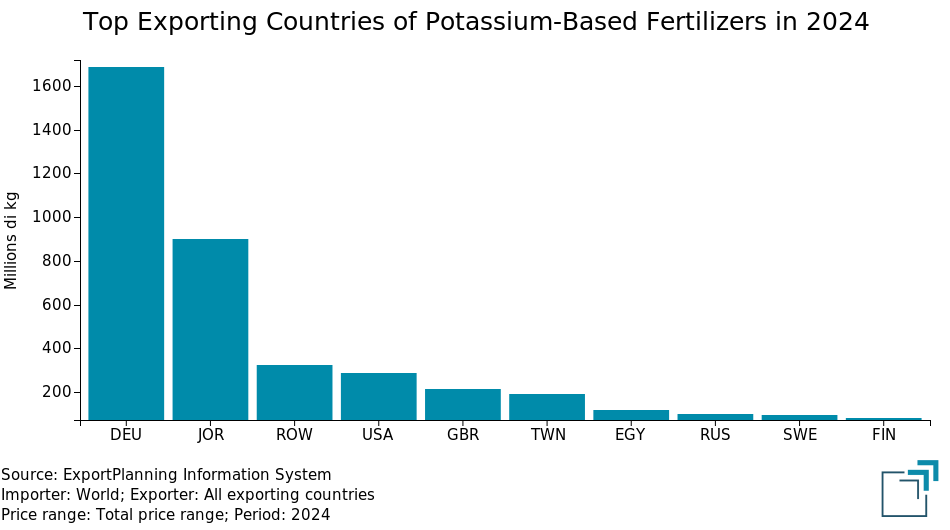

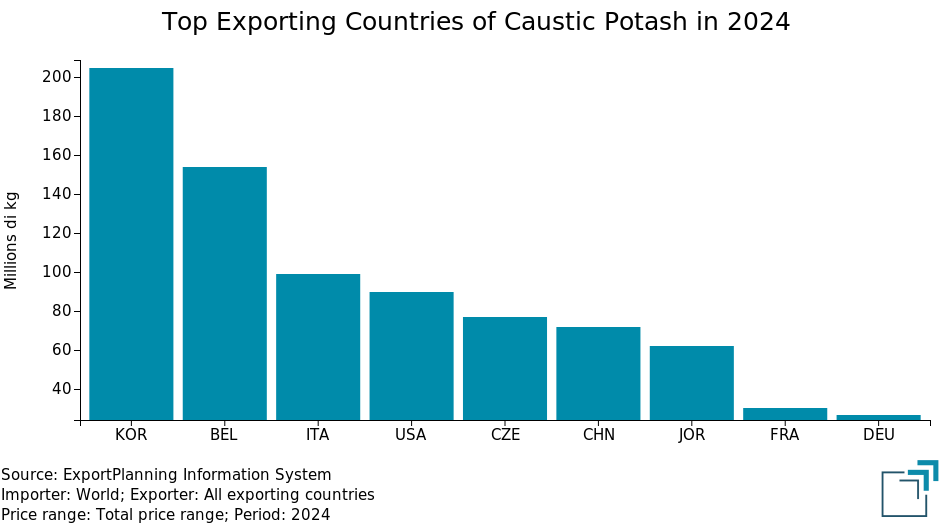

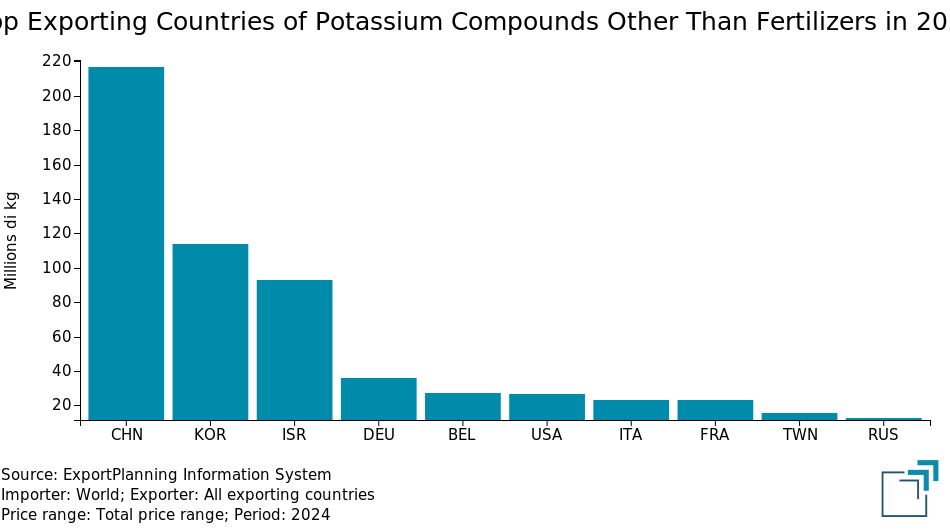

The four figures below show the leading exporting countries worldwide in the four key segments of the potassium industry:

- Potassium chloride, extracted directly from mines;

- Potassium-based fertilizers, which represent the primary industrial use of potassium derivatives;

- Caustic potash, obtained through the electrolysis of potassium brine, marking the first stage of the chemical-industrial supply chain;

- Potassium compounds other than fertilizers, representing the highest value-added segment of the potassium industry.

Top Exporting Countries in 2024 for Potassium Industry Products

| Potassium Chloride | Potassium-Based Fertilizers |

|

|

| Caustic Potash | Potassium Compounds Other Than Fertilizers |

|

|

The analysis of the four charts highlights several key points:

- The global trade of potassium chloride, in quantitative terms, is more than 10 times greater than that of fertilizers and nearly 100 times larger than that of caustic potash and potassium compounds other than fertilizers. This concentration of raw materials makes the industry highly exposed to geopolitical risks. Since 2022, the EU has completely halted imports from Russia and Belarus, replacing them with supplies from Canada, Jordan, and Israel.

- In potassium-based compounds other than fertilizers, which represent the highest value-added products, Asia, particularly China and South Korea, has achieved far more advanced positions compared to other industrialized countries. The only non-Asian country with significant exports in this segment is Israel;

- In high value-added products, the European Union shows a growing trade deficit, which has significantly worsened in 2024.

In Summary

Potassium, together with nitrogen and phosphorus, is one of the key elements for fertilizer production. The growing global demand for food and the need to improve agricultural land productivity make it a strategic raw material for ensuring food security.

However, potassium is not only about fertilizers: its compounds are also widely used across many other industrial sectors.

Analyzing price trends, the cost of potassium and its derivatives has remained relatively stable throughout this century, except for two periods marked by genuine speculative crises, with price increases exceeding 100% within just a few months:

- In 2008, during the final phase of the commodities supercycle, before the price collapse triggered by the 2009 financial crisis;

- During the strong post-pandemic recovery of 2021-2022.

In both cases, the surge in the price of potassium chloride initiated a sharp rise in prices throughout the entire supply chain, with rapid and widespread effects.

The high concentration of mineral reserves and production makes prices highly sensitive to supply shortages. Since 2022, the supply available to European Union markets has become even more concentrated, following the complete halt of imports from Russia and Belarus, thereby increasing supply risk for European companies.

[1] Potassium is emerging as a promising raw material for the development of low-cost batteries, particularly in potassium-ion technologies. Although still in the experimental stage, these batteries offer a potentially sustainable alternative for stationary energy storage due to the greater availability and lower cost of potassium compared to lithium.

[2]: Source: U.S. Geological Survey (USGS): MINERAL COMMODITY SUMMARIES 2025