Tall oil fatty acids: a case study on adjusting prices to costs, as well as prices of substitutes

Tall oil acid prices heading towards €1,700/ton, after exceeding €2,000 in 2023-2024

Published by Luigi Bidoia. .

Organic acids Fatty acidsTall oil fatty acids are among the few commodities that have shown strong resistance to the general price decline observed between late 2022 and 2023. As shown in the graph, the average annual price peaked at over €2,000 per ton in 2023, doubling compared to 2019 levels. This value has since remained stable throughout 2024.

Annual price of tall oil fatty acids

The market behavior of this commodity serves as an interesting case study for analyzing the economic forces that can sustain the price of a raw material, even during periods of widespread commodity price declines.

Commodity Analysis of Tall Oil Fatty Acids

Tall oil acid is not a single acid but a mixture of vegetable fatty acids (such as oleic and linoleic acid) and resin acids derived from the processing of wood pulp (mainly pine). Tall oil fatty acids are produced by distilling crude tall oil, a byproduct of the kraft pulping process. Their supply is therefore closely tied to kraft pulp production. Additionally, the availability of tall oil for fatty acid production must compete with its growing use as a renewable resource for industrial applications.

Tall oil fatty acids share many characteristics with other fatty acids of vegetable origin[1]:

- Stearic acid can be produced using tall oil fatty acids as input.

- Oleic acid is one of the fatty acids (along with palmitic and linoleic acids) that make up the mixture of tall oil fatty acids.

- In the production of biofuels, lubricants, and industrial surfactants, tall oil fatty acids can be used as a substitute for vegetable fatty acids.

The primary distinction between vegetable fatty acids and tall oil acids lies in the latter's content of resin acids and sterols, which are of lower quality and may affect their compatibility with certain applications.

Overall, however, tall oil acids and vegetable fatty acids—particularly stearic acid—are substitutes in many manufacturing processes.

Determinants of Tall Oil Fatty Acid Prices

The analysis of the market and production process of tall oil acids identifies two main factors determining their price:

- The price of tall oil, which represents the primary cost component in the production of tall oil acids.

- The price of stearic acid, which serves as a strong substitute for tall oil acids in many applications.

Econometric estimates[2] confirm the significance of these two factors, showing a long-term price elasticity of tall oil acids in response to changes in the prices of stearic acid and tall oil of 0.55 and 0.45, respectively. This implies that a 10% increase in the price of stearic acid and tall oil results, in the long run, in an equivalent increase in the price of tall oil fatty acids.

However, the process of reaching equilibrium occurs gradually. The initial impact manifests in the month following the price shock but with a limited intensity of 0.35. Additionally, the subsequent adjustment follows a path where only 11% of the gap between the equilibrium price and the actual price is recovered each month. In summary, a change in production costs or the price of stearic acid takes approximately six months to be fully reflected in the prices of tall oil fatty acids.

The 2023 Shock

The crisis in the European industry in 2023 led to a 5% reduction in kraft pulp production. This decline followed a 4% drop already recorded in 2022, bringing the EU's kraft pulp production below 22 million tons in 2023. Such a low level had not been reached in this century, except during the great financial crisis of 2009.

The significant slowdown in kraft pulp production resulted in an equivalent reduction in the overall supply of tall oil, driving a sharp increase in its prices, as shown in the graph below.

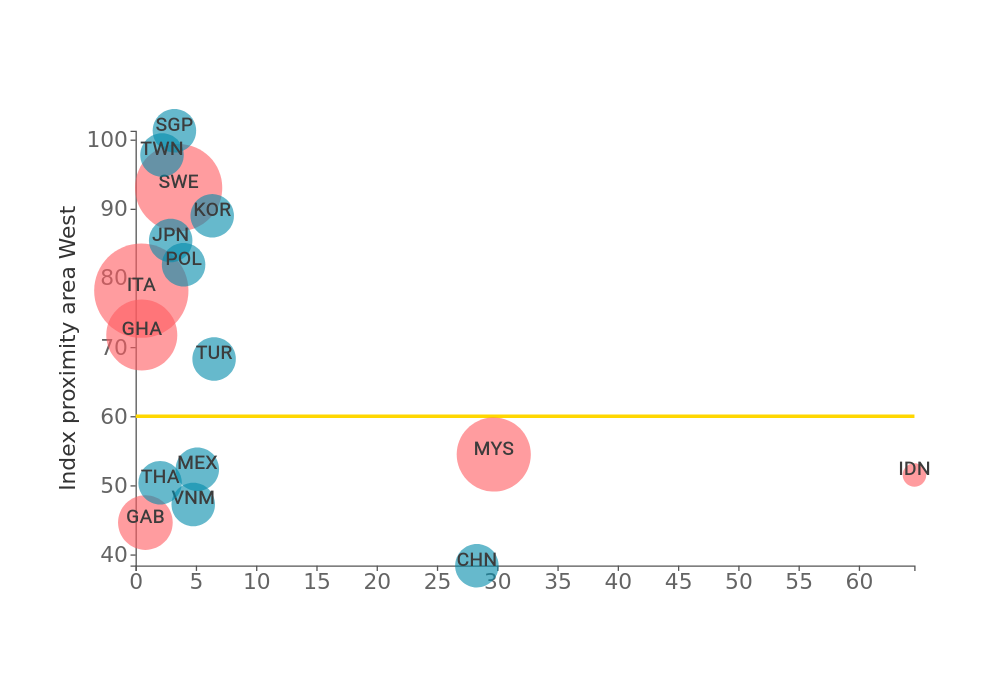

Determinants of the price of tall oil fatty acids

Between July and October 2023, tall oil prices exceeded €1,500 per ton. Considering that, in the first two decades of this century, the maximum price of this product had never surpassed €500/ton, the magnitude of the shock that hit the market in the second half of 2023 becomes evident.

The graph also illustrates the monthly prices of tall oil fatty acids and stearic acid. The data analysis highlights the following key points:

- The increase in stearic acid prices in 2021-2022 led to an initial rise in tall oil fatty acid prices.

- In 2023, the sharp increase in tall oil prices prevented the decline in stearic acid prices from translating into a drop in tall oil acid prices.

- Only towards the end of 2024 did the decrease in both stearic acid and tall oil prices finally trigger, albeit with a delay, a phase of declining tall oil fatty acid prices.

Econometric analyses suggest a long-term equilibrium price of around €1700 per ton, a level not far from what was recorded in the early months of 2025. It appears that the price adjustment phase has now been completed.

Conclusions

Econometric analysis is a fundamental tool for testing theoretical hypotheses about commodity market behavior.

In the case of tall oil fatty acids, it provides a solid foundation for understanding the factors that kept prices above €2000/ton in 2023-2024 and explaining their decline toward €1700 in the early months of 2025.

Only a combined analysis of the effects related to substitutability with stearic acid and the rigidity in cost pass-through allows for an accurate explanation of the price dynamics of tall oil fatty acids and enables reliable forecasts of their future fluctuations.

[1] see article Economic Introduction to Vegetable Fatty Acids

[2] The model was estimated in two steps using the dynamic specification of Engel and Granger.