The impact of renewable sources on Italian electricity reference price

Italy's renewable energy growth begins to reduce the National Single Price

Published by Leonardo Morieri. .

Electric Power Price DriversThis article presents an econometric analysis to understand the daily trend of the Italian National Single Price of electricity (PUN), also considering the influence of the share of electricity generation from renewable sources.

- The National Single Price (PUN) represents the reference price of electricity on the Italian free market, determined on the Power Exchange based on the marginal cost of production. This price is particularly affected by changes in the price of natural gas, which is widely used in power generation in Italy.

- CO2 (carbon dioxide) is a relevant parameter for the energy sector because of greenhouse gas emissions from fossil fuels. Energy companies must purchase CO2 emission certificates (EUAs) to offset these emissions, a cost that is reflected in final prices.

- PSV (Virtual Trading Point) is the Italian natural gas market, where gas supply contracts are bought and sold. Finally, the renewable energy share represents the percentage of electricity produced from renewable sources (such as solar, wind, and hydro) as a percentage of total electricity production.

The Italian electricity market

As described in the article The reform of the European electricity market, the PUN (National Single Price) price for electricity in Italy is determined according to the principle of marginal pricing, based on the cost of the last unit of energy needed to meet demand. In practice, the price is based on the most expensive generating plant among those operating at any given time, usually a gas-fired power plant. Since all power plants receive the same price, set on that of the least efficient power plant, the cost of gas has a strong impact on the PUN.

As a result, when the price of gas rises, the overall cost of electricity also rises, making the electricity market vulnerable to fluctuations in this fuel.

However, the increasing share of renewable energy is transforming this scenario. Sources such as wind and photovoltaics have very low marginal costs, since once the plants are installed, the variable costs of producing electricity are virtually zero. The growth of renewable energy sources can therefore significantly reduce PUN's dependence on fossil fuels.

The role of renewable sources

In recent years, the increase in renewable electricity generation has led to an increasing frequency of zero (and sometimes negative) hourly prices in the day-ahead exchanges of European energy markets.

In 2024, this phenomenon affected many European countries, with more than 200 hours of negative prices in the first half of the year in nations such as France, Spain and Germany. In these countries, electricity prices were negative for about 5 percent of the hours, contributing to a reduction in average daily and monthly energy prices.

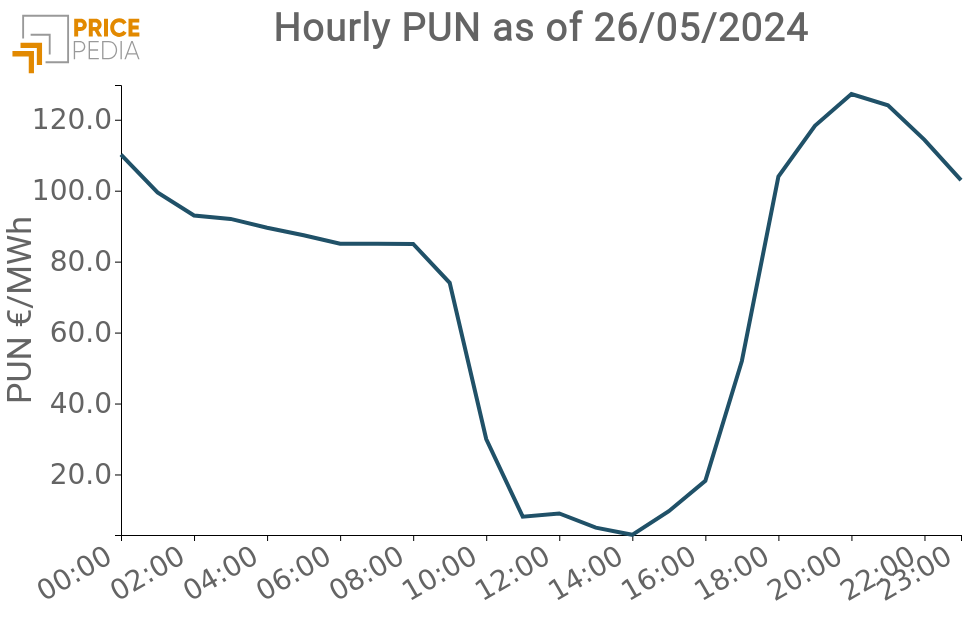

A similar phenomenon, although to a lesser extent, was also observed in Italy. For example, on May 26, the Italian PUN approached zero between 12:00 noon and 3:00 p.m., as shown in the graph below.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Estimating the effects of renewables

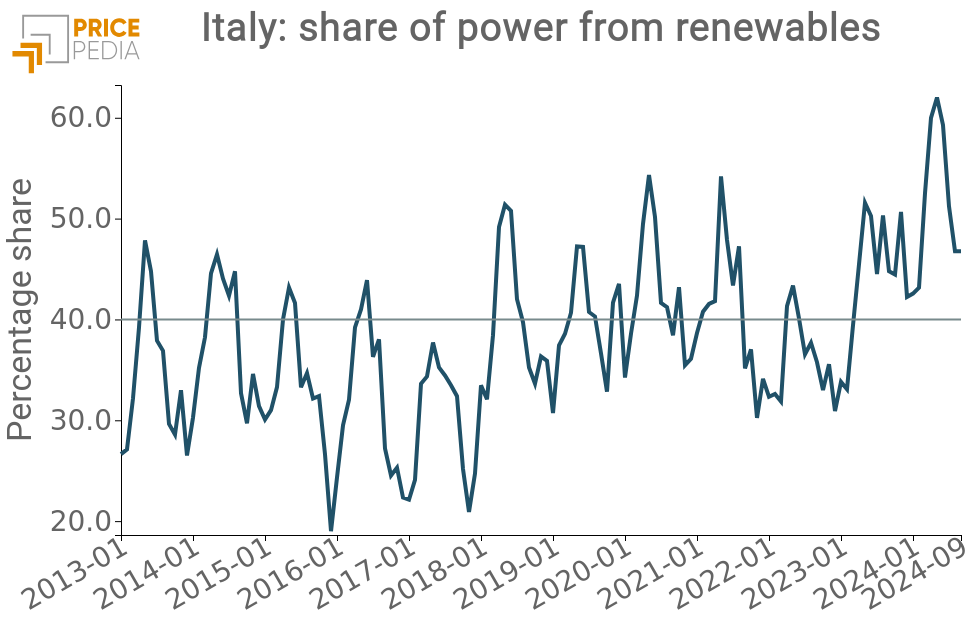

In 2024, the share of electricity produced from renewable sources (SFER) exceeded 40% every month, as shown in the following graph.

Even in previous years, the 40% threshold had been exceeded in several months, but in 2024, a structural increase occurred, raising the annual average level of production from renewable sources.

We have therefore developed a regression analysis to verify whether the SFER variable is starting to influence the daily and monthly average prices of the PUN, the price of electricity in Italy.

The regression results show that:

- The coefficient for the PSV gas price is about 2, consistent with an average production efficiency of gas-fired plants of 50%.

- The coefficient for the CO2 emission certificate price is about 0.3, in line with the technical parameters for CO2 emissions per MWh.

- The coefficient for the SFER share is negative, as expected. In particular, it is -0.82, indicating that, all other conditions being equal, a 10% increase in the share of electricity from renewable sources reduces the PUN by 8.2 €/MWh.

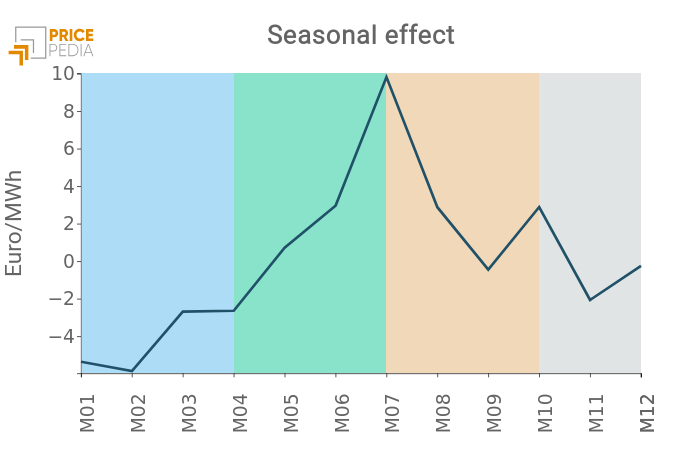

The results shown in the following figure are therefore consistent with the available technical information[1].

One point to highlight is the robustness of the results obtained. In addition to being perfectly consistent with the theoretical values predicted, they show a very narrow confidence interval. For example, for the gas price, there is a 95% probability that the true value linking the PUN price to the gas price lies between 1.809 and 1.824.

Conclusions

Although marginally, the Italian electricity market has begun to show the first effects of the increase in the share of energy from renewable sources on the PUN. Preliminary estimates indicate significant effects: a 10% increase in the share of renewable energy production can reduce the PUN by 8.2 €/MWh.

The effects of renewables on the PUN point to a gradual structural reduction in energy prices, with significant benefits for consumers and end-users. However, they also raise the issue of the sustainability of electricity production in a market where prices can frequently crash to zero. Although the marginal cost of energy from renewable sources is close to zero, the total costs are not, making the sector less profitable and limiting investments in new production capacity.

To address this situation, the implementation of recent EU directives for the electricity market reform is not only necessary but also urgent.

[1] For further reading on the regression analysis, see the articles: