Price of lithium: crossroads of the world economy

Global lithium market is affected by all the major changes taking place in the world economy

Published by Luca Sazzini. .

Non Ferrous Metals Lithium Price Drivers

The acceleration that the production of electric vehicles (EVs) has experienced in recent years and the growing European concern about the availability of raw materials needed for the energy transition find their meeting point in lithium and lithium-ion batteries, topics that, not surprisingly, have seen a sharp increase in interest in recent years in Google Trend surveys.

These issues intersect with a further fact of fundamental importance in recent years, namely the ongoing trade/technology war between China and the US and its allies.

Analysing the dynamics of the world price of lithium means analysing the effects that the facts listed above have had within the lithium market.

Lithium and accumulators in the context of technology competition between China and the West

Lithium, in its carbonate form, is a key raw material for the production of lithium-ion batteries, which are currently the best technology solution for electric vehicle (EV) batteries.

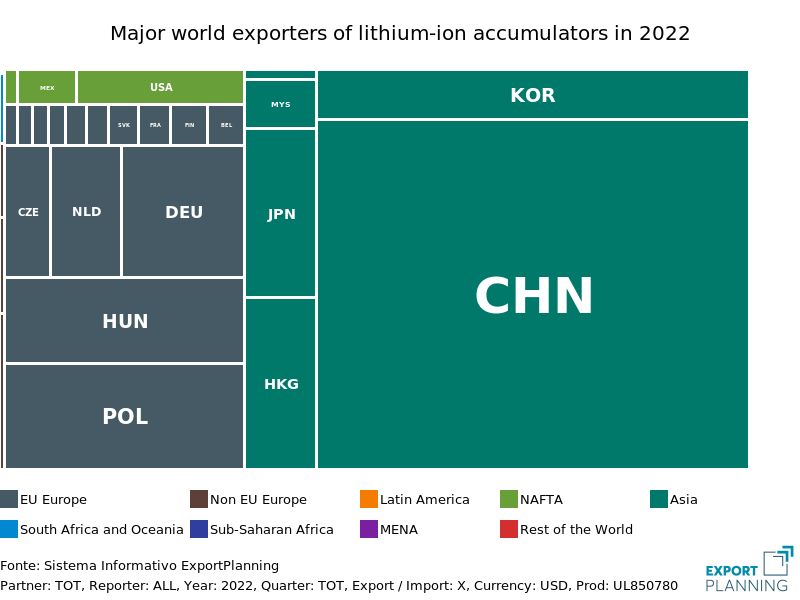

Within these accumulators, China has managed to develop a strong leadership due to its control in the lithium value chain.

As well as possessing abundant lithium resources, China has developed excellent extraction and refining capabilities that have enabled it to specialise in the production of lithium-ion batteries.

China's undoubted leadership in the lithium-ion battery market is evidenced by its share of world trade.

The importance of lithium for the production of batteries and electric vehicles has led the EU commission to include it in the list of strategic raw materials. Where the term 'strategic raw materials' refers to all those commodities that are crucial for strategic technologies used in green, digital, defence and space applications.

The study of these commodities is the subject of the European Critical Raw Materials Act (CRM) of early 2023 [1] .

The acceleration in EV production

Electric car production in the US started to develop in 2011. It was later joined by production in other countries around the world (including the EU and China) and accelerated until 2018. In the following years, the EV sector experienced a period of stability, due to the slowdown in China's economic cycle and the reduction of EV tax incentives. In 2021, a new phase of global EV production growth began, with China playing an increasing role.

According to EV Volumes data , China was able to increase its share of world production of electric vehicles from 19% in 2021, to 32% in 2022.

Lithium carbonate price cycles

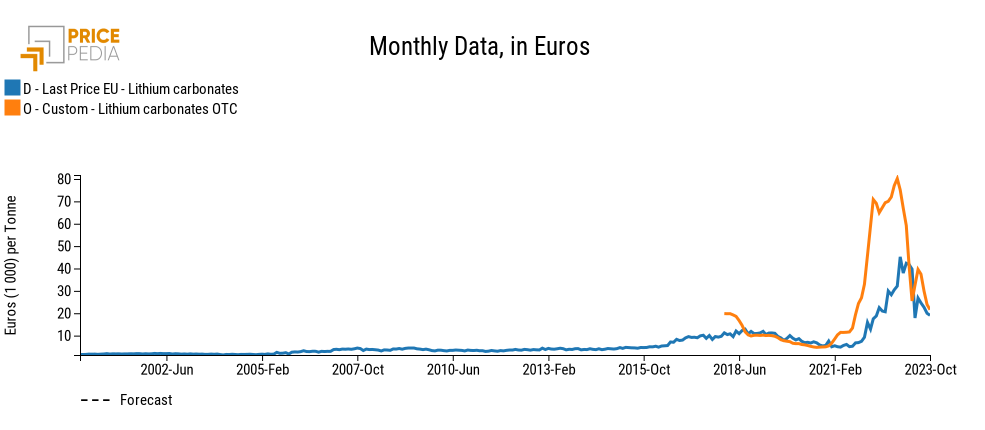

The following graph shows lithium carbonate prices recorded on the Chinese market (shown in the graph as 'Custom Lithium carbonates OTC': orange line) and at customs in the 27 EU countries (Last Price EU: blue line).

From the graph depicting the price development of lithium carbonates, it is possible to divide the price dynamics into four different phases:

- Price cycle 2015-2018: sudden rise in European lithium carbonate prices from less than 5.000 USD to almost 15.000 USD. During this period, there was an initial increase in demand for lithium-ion batteries due to the spread of the EV market.

- Market slowdown 2018 - 2020: due to the slowing development of the electric car market, lithium carbonate prices decreased.

- Price acceleration 2021-2022: with the release of the covid-19 pandemic, there was an unprecedented upswing in lithium carbonate prices. European customs prices jumped from a value of 6.000 USD to over 47.000 USD, while prices on the Chinese market fluctuated even more sharply, from a price of 8.000 USD to one of 82.000 USD.

- Price reduction 2023: over the past year, Chinese lithium carbonate prices have plummeted by more than 70%. This price impact has not yet been fully transferred to the European market, which, however, has already seen a price reduction of more than -50%.

Cycle Determinants

The variable that best summarises the determinants behind the two lithium carbonate price cycles described above are the acceleration and deceleration phases of Chinese lithium-ion battery exports. When these exports accelerate, lithium carbonate prices rise; conversely, when these exports decline, lithium carbonate prices fall.

Conclusion

In recent years, the success in the electric vehicle market has exponentially increased the prices of lithium in its carbonate form, a key element in the production of lithium-ion batteries. Price analysis has shown that changes in Chinese lithium-ion battery exports significantly influence the dynamics of Chinese and European lithium carbonate prices. In periods when lithium-ion accumulator exports accelerate, lithium carbonate prices rise, on the other side when Chinese accumulator exports decelerate.

[1] The goal of the "European Critical Raw Materials Act" (CRM) is to achieve the following parameters by 2030 :

- at least 10% of the EU’s annual consumption for extraction;

- at least 40% of the EU’s annual consumption for processing;

- at least 15% of the EU’s annual consumption for recycling;

- no more than 65% of the EU’s annual consumption from a single third country;