Favorable commodity price scenario for purchasing departments

PricePedia Scenario for September 2024

Published by Pasquale Marzano. .

Copper Forecast Oil Forecast

The PricePedia Scenario has been updated with information available as of September 6, 2024. It is characterized by the persistent weakness in global demand for commodities, as documented last month, not only in Europe and the United States but also in China. This weakness led the ECB in Europe to reduce interest rates in the Euro Area by 25 basis points last June, and it is highly likely that the U.S. Federal Reserve will also act similarly in mid-September, though the extent of the cut remains uncertain.

Since monetary policy decisions impact real markets with some delay, it is plausible to expect that the phase of economic cycle weakness will continue through the remainder of 2024.

This implies lower global industrial production growth rates than previously forecast: a +1.7% annual increase is expected in 2024, down from the previous scenario's +2.3%.

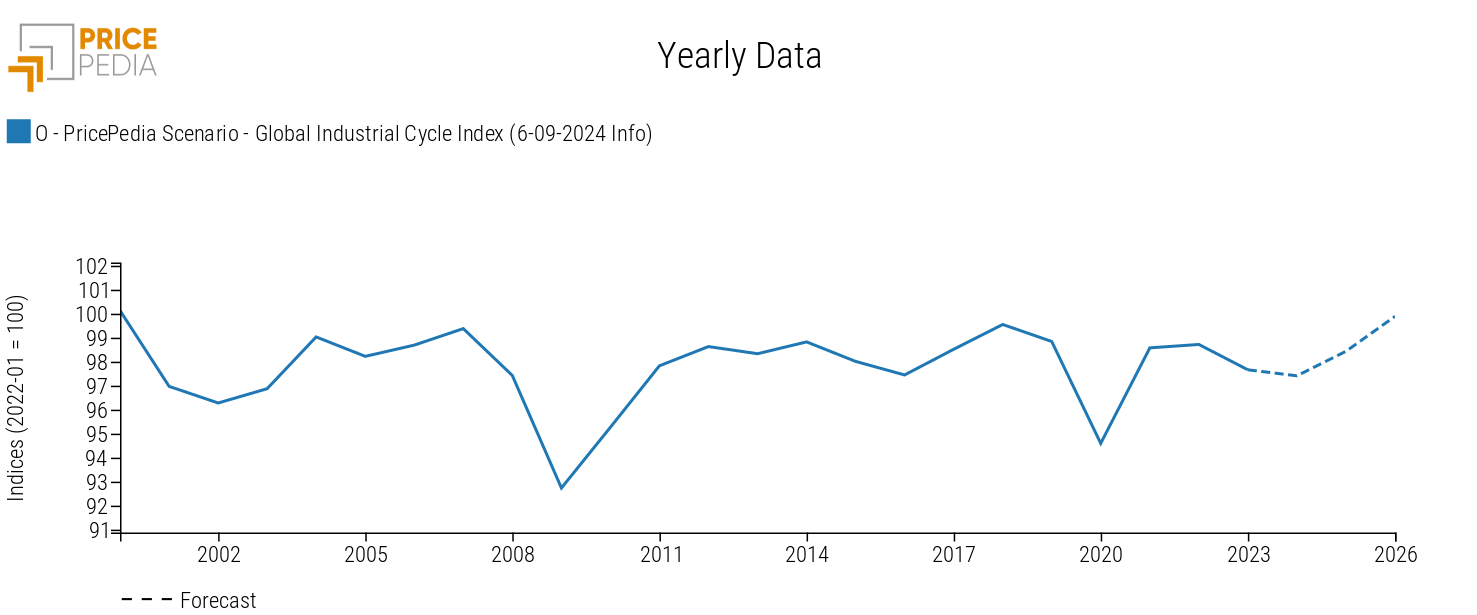

The dynamics of global industrial production result in a decrease in the global industrial cycle[1] during 2024, as shown in the following graph.

In 2024, the reduction in the global industrial cycle is expected to settle around -0.25% compared to the previous year. Growth in the index is postponed to 2025, with a forecasted increase of +1.1%. This change is still lower than the previous August scenario, where the expected growth in 2025 was +1.5%.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Commodity Price Forecast

A relatively more negative scenario for the global industrial cycle implies lower pressure on purchasing material prices. However, it is important to note that the scenario described does not imply that the likelihood of upward risks in prices is completely eliminated, but rather that such likelihood is lower compared to what is incorporated in the current scenario.

The following table illustrates the annual price changes, in euros, of the main commodity categories (Industrial[2], Total Commodity[3] and Total Energy).

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (6-09-2024 Info) | −18.47 | −4.78 | −2.17 |

| I-PricePedia Scenario-Industrials Index (Europe) (6-09-2024 Info) | −13.86 | −4.01 | +1.94 |

| I-PricePedia Scenario-Energy Total Index (Europe) (6-09-2024 Info) | −23.91 | −6.46 | −5.84 |

Compared to the previous scenario, the lower pressure from the global industrial cycle results in more intense reductions and more contained increases.

In the case of Total Commodity, after a decrease of around -18.5%, in euros prices, in 2023, the index is expected to decline in 2024 by -4.8% compared to the previous year, and by -2.2% in 2025. Energy commodity prices are also expected to decrease in both 2024 and 2025, with price reductions exceeding -5% in both years.

Regarding Industrial Commodities, a -4% decline, in euro prices, is forecasted for 2024 (previously expected at -3.7%), followed by a +1.9% growth in 2025.

Two Representative Cases: Oil and Copper Price Scenarios

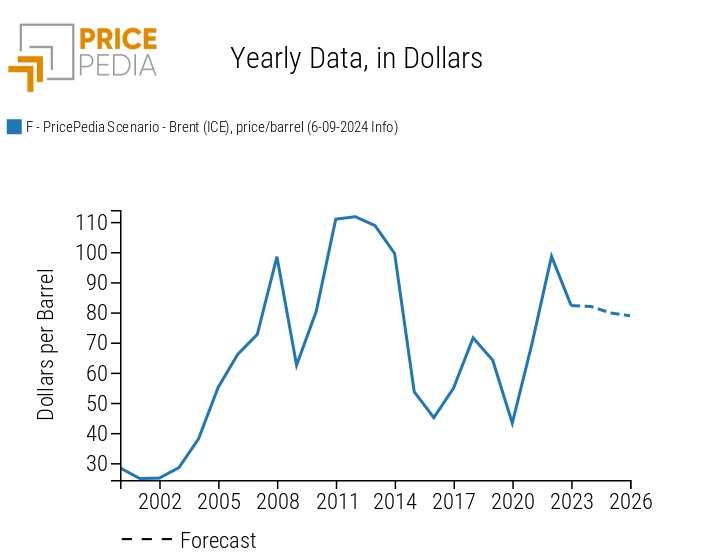

The following graphs show the PricePedia Forecast Scenario for the prices in US dollars of two key commodities, oil and copper, representing the trends in Energy and Industrials, respectively.

Oil Scenario

Copper Scenario

The price of oil has recently experienced declines, despite the fact that OPEC+ members have decided to extend voluntary production cuts until December 2024, instead of stopping in October. This leads to a forecast for Brent prices, in US dollars, to decline slightly in 2024 (-0.3%), with a more significant reduction of -2.6% expected in 2025.

This suggests that in the current scenario, the weakness of the economic outlook is having a greater impact on oil prices than potential supply reductions.

As for copper, the long-term demand for the non-ferrous metal is expected to grow, along with its prices, given its crucial role in the energy transition. However, the current phase of industrial cycle weakness has led to a lower copper price forecast compared to previous predictions. On average, copper is expected to settle just above $9000 per ton in 2024. In 2025, prices are forecasted to average just below $9400 per ton.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.