EU escalates trade measures against china: the case of TiO2

From provisional tariffs on electric cars to anti-dumping procedures on titanium dioxide, the EU's strategic moves in the trade war with China

Published by Luigi Bidoia. .

Inorganic Chemicals Import tariffsEU Tariffs on Electric Cars

Unless an agreement is reached between the EU Commission and the Chinese authorities, provisional countervailing duties on electric cars imported from China will come into effect at the beginning of July 2024. These duties will not be collected immediately, but only after the introduction of definitive duties (expected by November 2024). The tariffs on electric cars are just the tip of the iceberg of various actions that the EU has been preparing for a long time to win the ongoing trade war with China.

Anti-dumping Procedure

The first significant action dates back to December 20, 2017, when the regulation on defense against dumped imports came into effect. This regulation significantly revised the procedures for calculating the dumping margin, especially when prices and costs may be distorted by state interventions.

For EU partners who are members of the World Trade Organization (WTO), the standard way of calculating the dumping margin is to compare domestic prices in the exporting country with its export prices. However, if domestic prices and costs can be distorted due to state interference in the economy (as in the case of China), then the dumping margin calculation is based on the production costs of a representative country with a similar level of economic development to the country under investigation.

This regulation also establishes a link between the number of companies under the ownership, control, or guidance of the authorities of the exporting country and the likely market distortions in the exporting country.

Finally, this regulation assigns the Commission the task of preparing reports that analyze the economies of certain countries or sectors in terms of direct or indirect state control. The information contained in these reports, along with other information on distortions, is made available to the public and can be used in anti-dumping investigations on specific products.

China Country Report

The first country report focused on China. In April 2024, this report was updated as a Commission staff working document on Significant Distortions in the Chinese Economy. This document is intended to support trade defense investigations. With over 700 pages, it contains a description of the main production factors used in all production processes in China and an examination of cases where the cost of these factors may be lower than the market value.

The Case of Titanium Dioxide and Derived Pigments

An interesting case study regarding requests for anti-dumping policies, based primarily on information derived from country reports produced by the Commission for anti-dumping purposes, concerns titanium dioxide (TiO2) and titanium white.

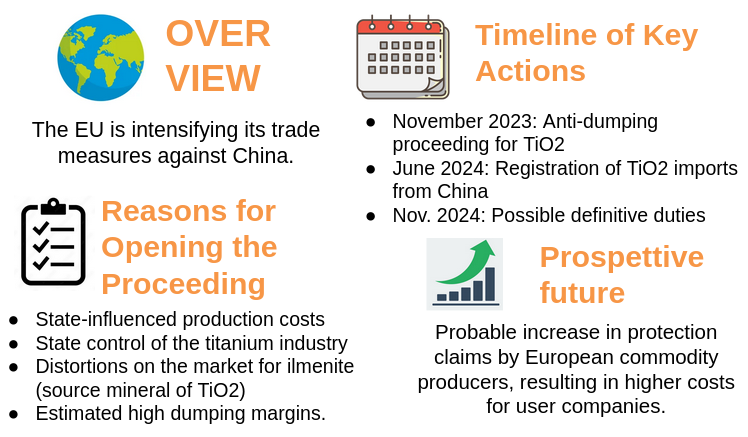

Titanium dioxide is a chemical compound that forms the basis of titanium white, a pigment widely used in industry as a white color (for more details, see The Case of Titanium: Between Abundance and Criticality). In November 2023, the Commission opened an anti-dumping proceeding concerning imports of titanium dioxide and titanium white from China, following a complaint by an association of European TiO2 producers.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The arguments that led the Commission to open the proceeding are:

- The production costs in China appear to be influenced by the factors reported in the Commission's report on "Significant Distortions in the Chinese Economy".

- The degree of control by the Chinese state over the titanium industry is significant;

- An estimate of high dumping margins on exports by Chinese companies[1];

- The presence of distortions related to the Chinese ilmenite market, one of the minerals from which titanium dioxide is derived, which can represent 25% of its production cost.

This proceeding must be concluded by the end of 2024. In the meantime, however, certain facts have emerged (the reduction in import prices from China to the EU and an increase in import volumes) that have led the EU to decide, at the request of European TiO2 producers, to register all EU imports from China of the goods under investigation starting from June 2024, so that any future duties can retroactively apply to them[2].

This registration requirement makes it highly likely that the ongoing investigation will conclude with the introduction of definitive duties. As a result, from an economic standpoint, the effects of the probable upcoming duties on titanium dioxide imported from China have been anticipated to June due to this implementing regulation. From the date of the complaint at the end of September 2023 by European producers to the first economic effects on the costs of user companies, only 9 months have elapsed, representing a significant reduction compared to the standard timeline.

Conclusion

If the case of titanium dioxide represents the new timeline by which complaints from European producers can translate into a concrete form of protection, then it is likely that in the coming months, requests for protection will increase, resulting in higher costs for users.

[1] The dumping margins were calculated by comparing Chinese export prices with undistorted production costs identified in a country other than China.

[2] See the Implementing Regulation on the registration of imports of titanium dioxide originating from the People's Republic of China.