Commodities recovery still seems far off

Inflation data seem to rule out an upcoming interest rate cut

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekEconomic Growth

Official data from the PMI indices of USA and Europe have confirmed the cyclical trend that emerged from last week's flash estimates. The eurozone economy continues to remain in slight decline with a manufacturing PMI of 46.5, while the US economy remains in growth with a manufacturing PMI of 52.2.

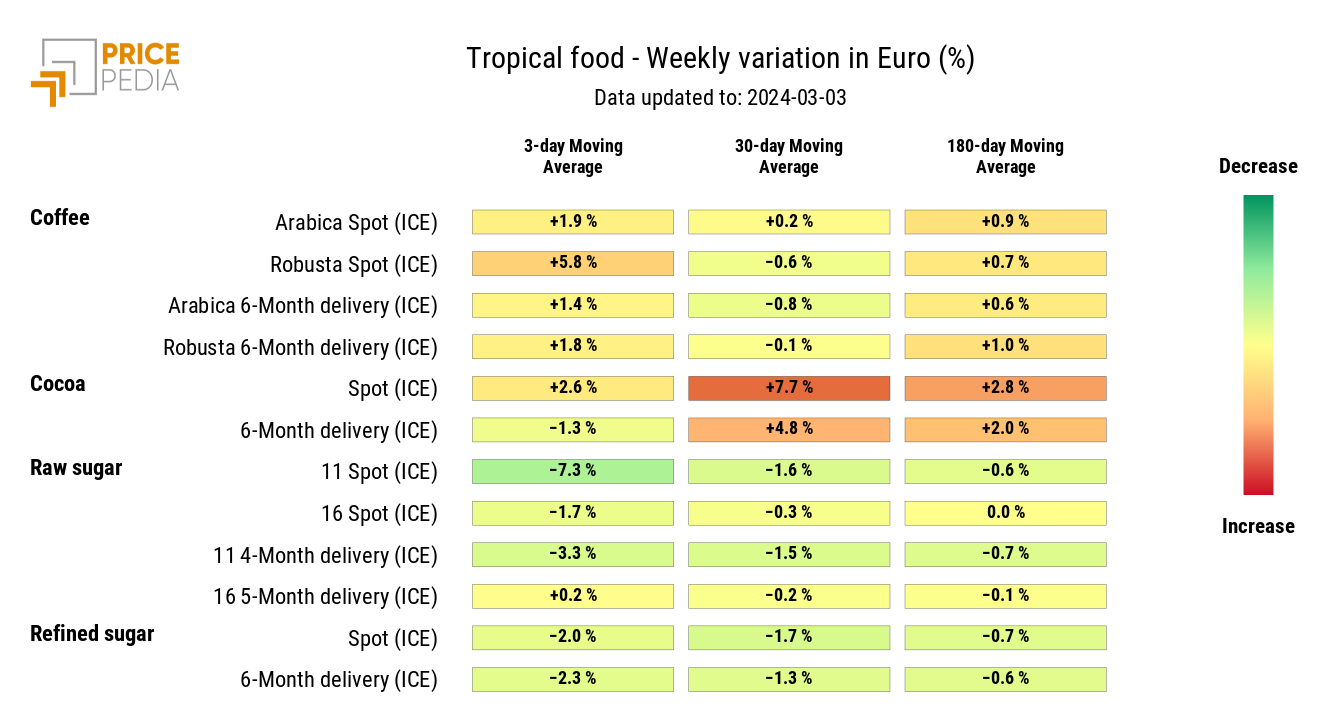

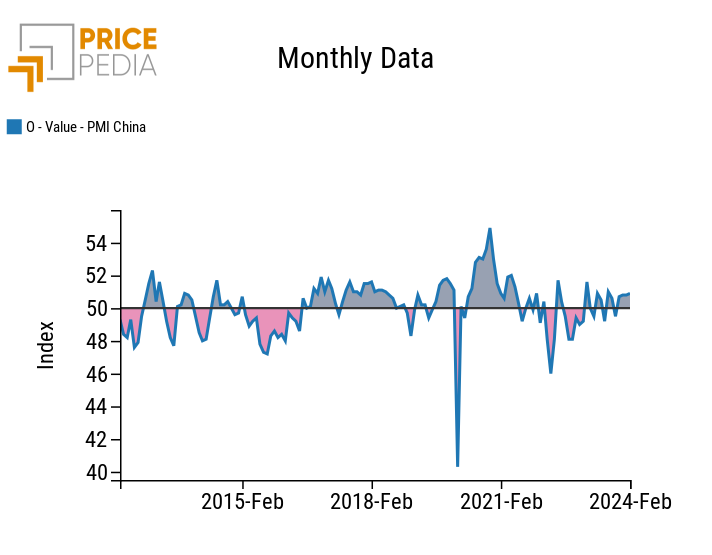

Regarding China, the new data on the two manufacturing PMI indices have moved in opposite directions, but their average continues to remain around the 50-point mark, indicating a stagnation in the economy. Caixin manufacturing PMI increased from 50.8 to 50.9, while the NBS manufacturing PMI decreased from 49.2 to 49.1.

Below is the trend of the Caixin manufacturing PMI found in the Conjunctural Indicators section on the PricePedia website.

Caixin Manufacturing PMI

The gray-colored areas represent a period of manufacturing sector growth, while the pink-colored areas represent a period of decline.

Inflation

This week's data confirms a gradual decline in inflation both in the United States and Europe.

The PCE[1] deflator of the United States signals a decrease in inflation in January to 2.4% year-on-year, compared to the previous 2.6%. Similarly, the core inflation, which excludes its most volatile components (energy, food, alcohol, and tobacco), also decreased from 2.9% year-on-year to 2.8%.

In Europe, the Consumer Price Index (CPI) records a decrease in inflation from 2.8% year-on-year to 2.6% in February. The core inflation figure decreases to 3.3% year-on-year, compared to the previous 3.6%. This latter figure, although lower than last month, indicates that the eurozone's inflation problem is still far from being resolved.

According to analysts, European inflation is expected to remain above 2.5% by the end of this year and will only decrease to 2% towards the end of 2025. Core inflation is expected to be at a rate of 2.1% by the end of 2024 and 1.8% by the end of 2025.

Monetary Policy

In light of the new inflation data, both the FED and the ECB are expected to decide to keep interest rates unchanged. Between the two central banks, the ECB is more likely to make the first rate cut, given the current economic weakness in the Eurozone. However, this probability remains very low, considering that the new inflation data still significantly deviates from the 2% target.

Members of the Governing Council agree on a rate cut by the end of this year, but they remain divergent in opinions regarding the date and intensity of the cuts. Currently, the market still expects a rate cut in June 2024, although some analysts are already starting to postpone this date.

The next Governing Council meeting will be crucial, not so much to confirm the maintenance of the current interest rates, but to verify any change in communication by the ECB.

Commodity Prices

Within this scenario still characterized by inflation above targets and a stagnation of the European and Chinese economies, commodity markets continue to not deviate from the predominantly sideways movement of recent months.

[1] Personal Consumption Expenditure (PCE) price index, also known as the PCE deflator, is an indicator of the average increase in prices for all national personal consumption expenditures in the United States.

ENERGY

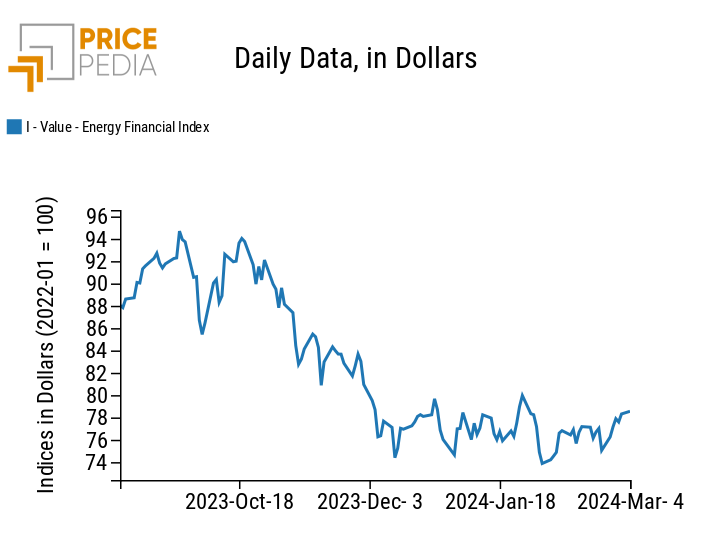

This week, the financial index of energy products by PricePedia recorded growth in the early days of the week, only to ease on Thursday. The early-week increase is attributable to the positive variations recorded by Brent and natural gas prices. The price of Brent rose due to expectations of increased purchases by China, which since mid-February has increased its demand for oil. The gas price increase, on the other hand, is probably attributable to Chesapeake Energy's announcement last week of production cuts due to low prices.

PricePedia Financial Index of energy prices in dollars

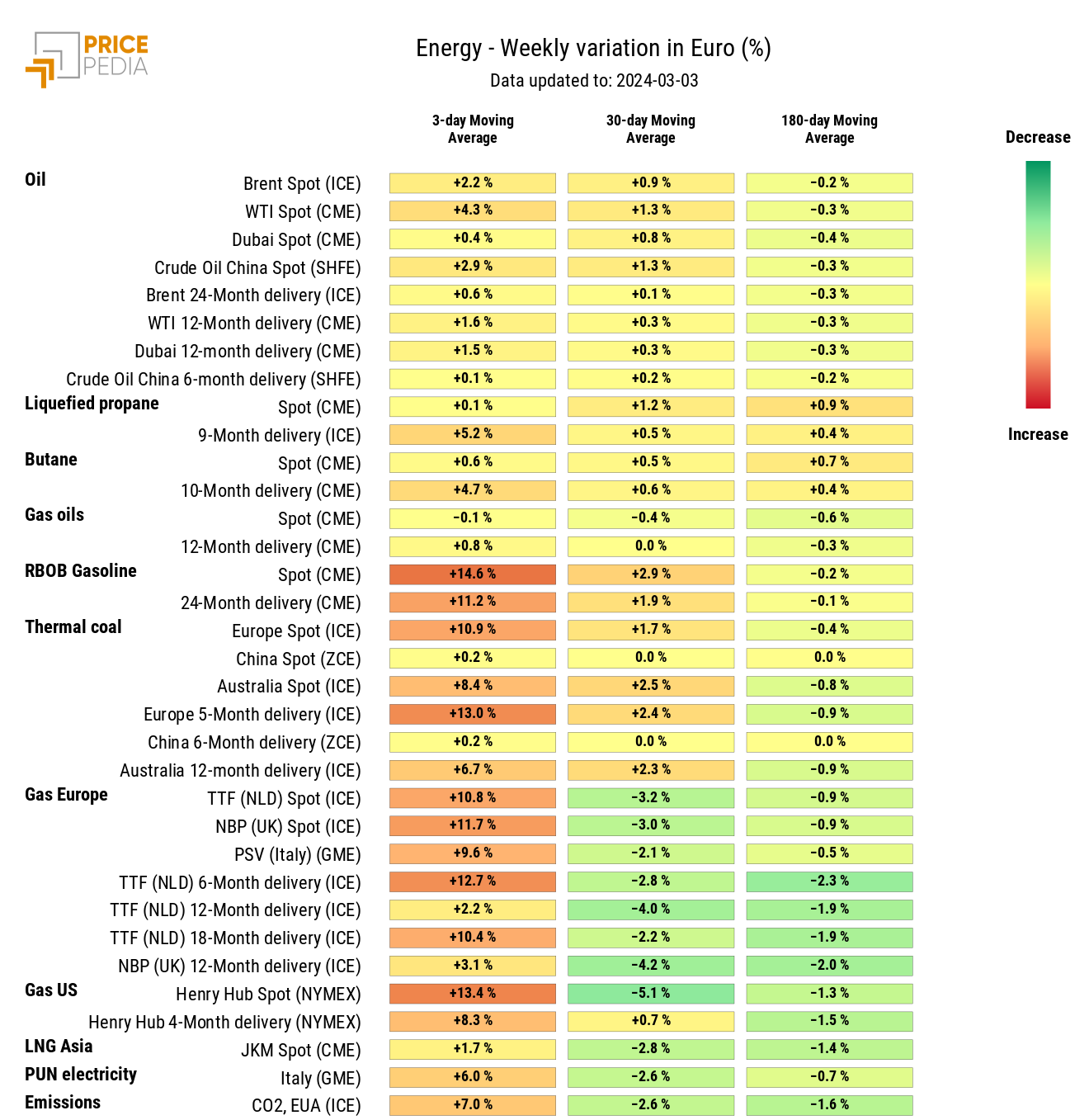

The energy heatmap shows a generalized increase in energy prices, with higher rates for thermal coal and natural gas prices.

HeatMap of energy prices in euros

PLASTICS

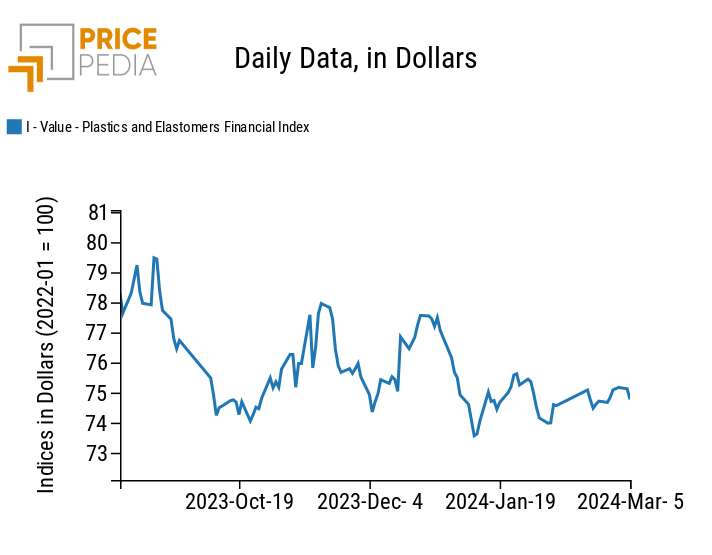

This week, the financial index of China-listed plastics recorded only a short-term swing.

PricePedia Financial Index of dollar prices of plastic materials

FERROUS

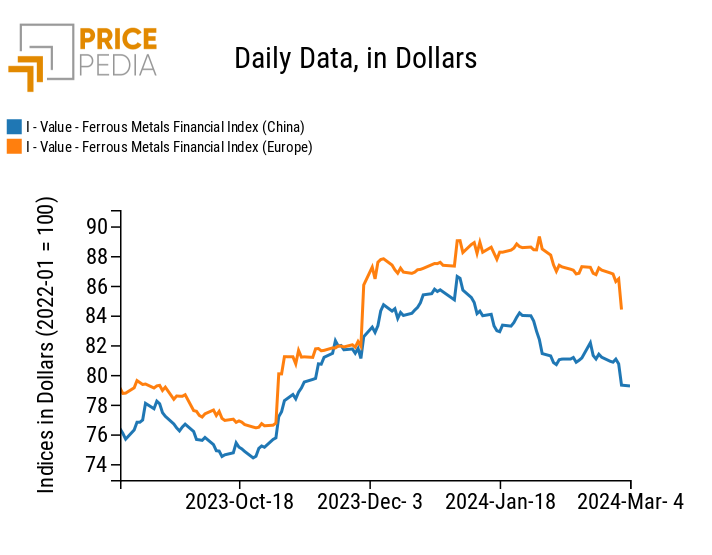

The declining trend of the China ferrous index is slowly intensifying, while the Europe ferrous index continues to remain more stable. Weak Chinese demand combined with the recovery of supply in recent weeks has generated an oversupply in China, leading to an increase in stocks of various ferrous products.

PricePedia Financial Indices of dollar prices of ferrous metals

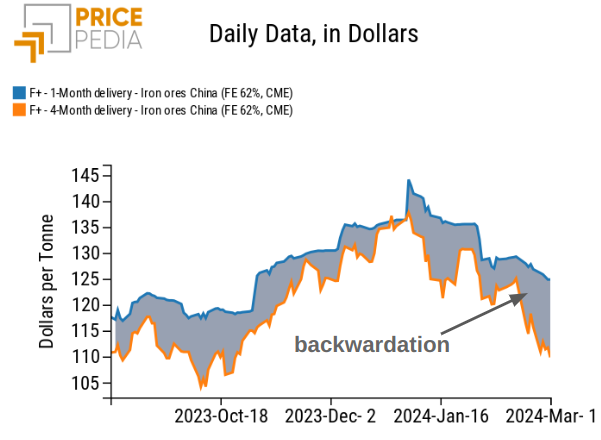

The oversupply has mainly affected iron ore in China, with prices quoted at the CME showing a clear downward trend. As shown in the graph, iron ore prices at the CME are not only in a strong backwardation situation, but the price for 4-month futures is experiencing more pronounced reductions compared to the price for 1-month deliveries. Since the beginning of 2024, prices for 1 and 4 months have decreased by -8% and -19%, respectively.

Iron Ore Prices in China

INDUSTRIAL NON-FERROUS

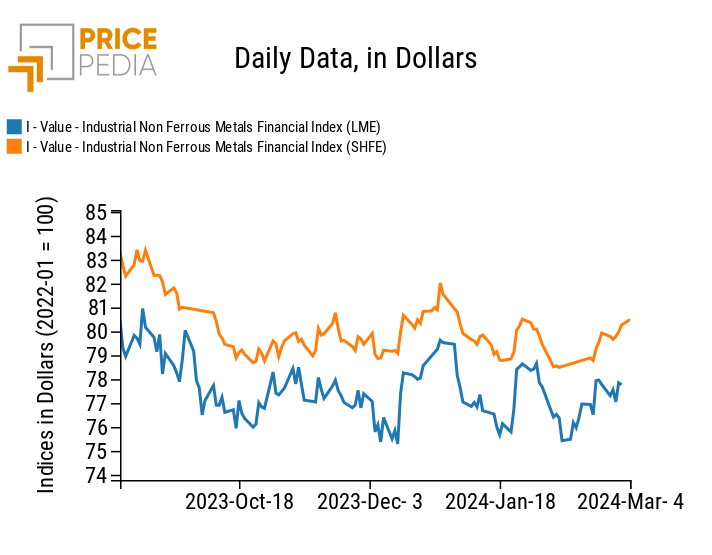

Non-ferrous indices continue to record contrasting short-term fluctuations, no longer outlining a clear price trend.

PricePedia Financial Indices of dollar prices of industrial non-ferrous metals

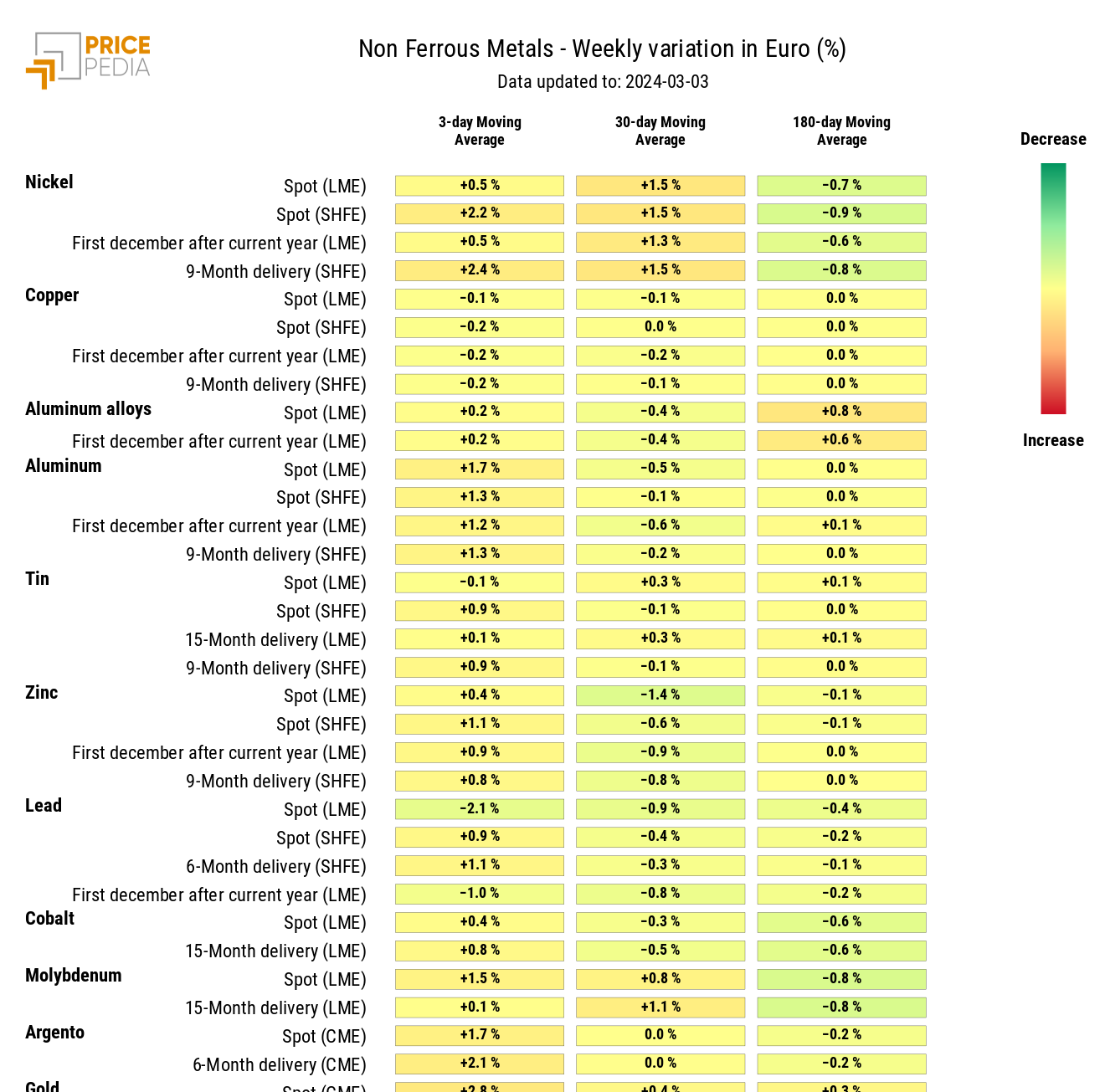

The non-ferrous metals heatmap highlights an increase in LME nickel prices.

Following the sharp drop in nickel prices, which led to levels close to $15,000 per ton, Indonesia announced it would reduce its production if prices fell below $15,000/ton. This led to a recovery in LME nickel, which has already exceeded $17,000/ton. However, prices are not expected to exceed $18,000/ton significantly, as Indonesia intends to keep supply stable to support the competitiveness of nickel batteries compared to other alternatives like lithium iron phosphate batteries.

HeatMap of industrial nonferrous metal prices in euros

FOOD

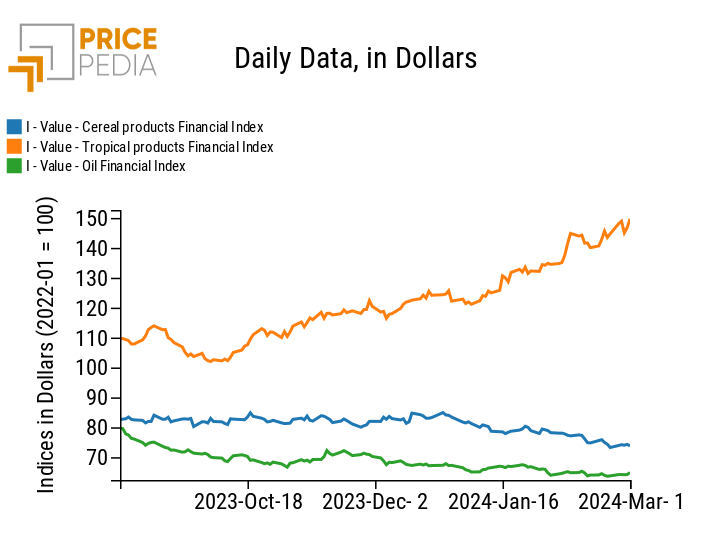

This week, food indices recorded weak short-term oscillations that are not sufficient to alter the current dynamics of the three indices.

PricePedia Financial Indices of food prices in dollars

TROPICALS

Despite cocoa prices having surpassed their historical highs for some time, the tropical food prices heatmap registers a positive weekly change in the cocoa moving average.

Another positive change emerging from the heatmap concerns coffee prices, listed on the Intercontinental Exchange (ICE)

HeatMap of tropical food prices in euros