Monetary policies influence commodity demand

Commodity markets will likely recover when the first interest rate cuts take place

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeak Demand for Commodities until Interest Rate Reduction

The current macroeconomic scenario is characterized by a strong performance of the US economy, which, however, remains tied to inflationary problems, stagnation in the eurozone persisting for a year, and Chinese economic growth lower than expected.

In this context, the commodity markets remain characterized by weak global demand due to uncertainty about the intensity of the next global economic recovery and the high cost of inventory stocks.

It is likely that commodity demand will recover only when the first interest rate cuts occur, which are currently scheduled for June 2024.

The weakness in commodity demand underlies the recent downward price dynamics, interrupted only by short-term phenomena mainly related to recent geopolitical risks in the Middle East.

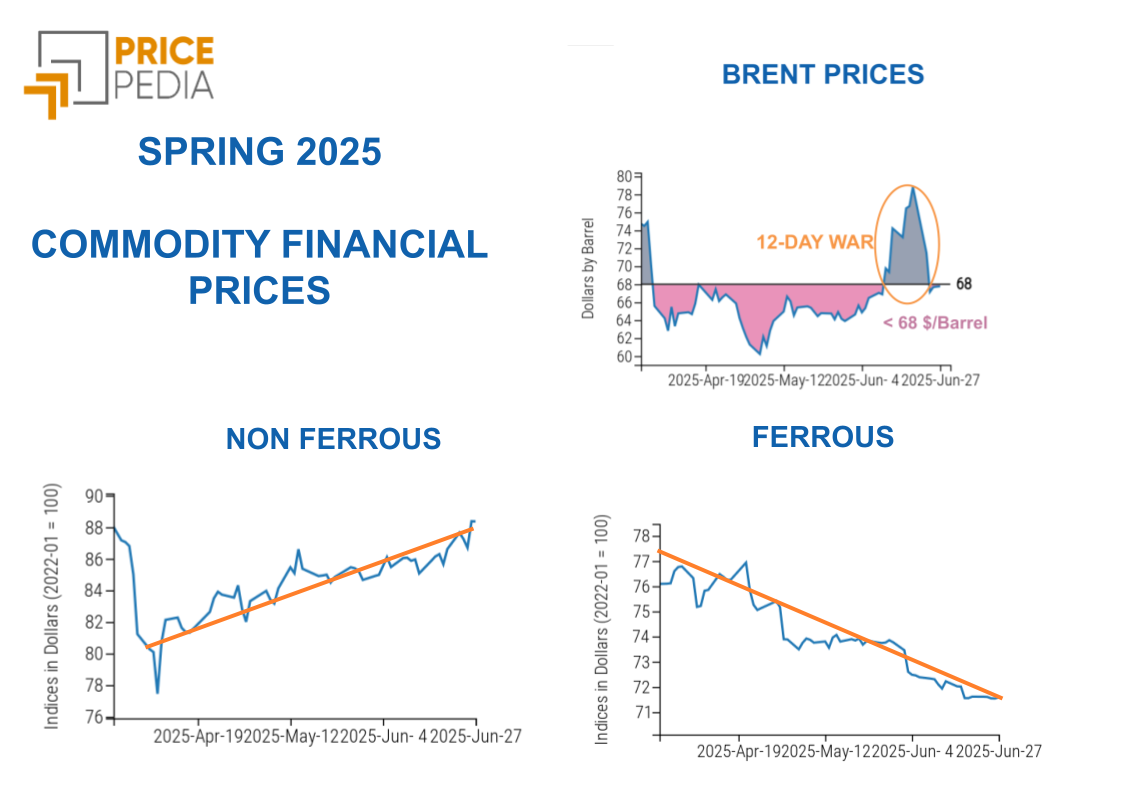

This general trend particularly fits the energy market, which this week also continued to experience opposite-sign fluctuations primarily related to short-term phenomena. Brent prices, in fact, started the week with an increase, then fell, and subsequently returned to register positive variations, continuing to oscillate within the same price ranges as in recent months.

An exception, however, concerns the prices of natural gas in Europe, which are experiencing a long phase of decline, mainly due to the end of the winter season and high gas stocks.

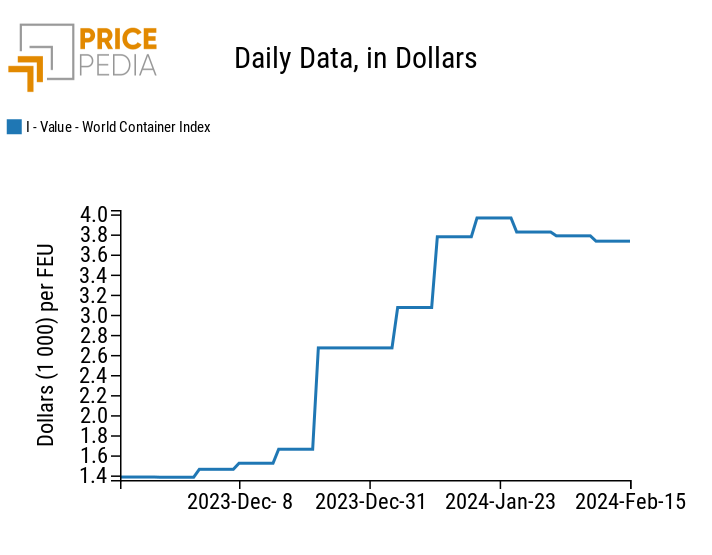

Overcoming the Container Ship Logistic Crisis

Regarding the problems of global logistics, which recently constituted the main reason behind the short-term upward fluctuations in energy commodity prices, this week there has been a decrease, albeit with minimal variations, also in the costs of commercial routes connecting Shanghai to the United States. In particular, the price of the Shanghai-New York route has decreased, while that of the Shanghai-Los Angeles route has remained unchanged. The decrease in the freight rates of the Shanghai-New York route adds to the reductions started several weeks ago in the freight rates of the Asia-Europe routes. The overall effect on global container ship freight rates is the beginning of a slow recovery phase, after the sharp increases at the end of 2023. The decline in global freight rates, although not sufficient to resolve the logistical problems of container ship delays, signals the start of overcoming the most acute phase of early 2024.

Global Drewry Index for the Cost in Dollars of a 40-foot Container (FEU)

ENERGY

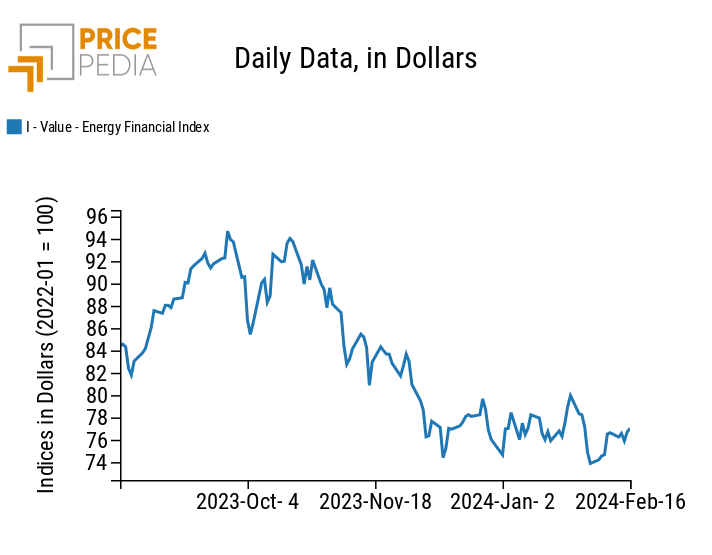

This week, the PricePedia financial index for energy products recorded short-term fluctuations that did not define a clear index trend.

PricePedia Financial Index of energy prices in dollars

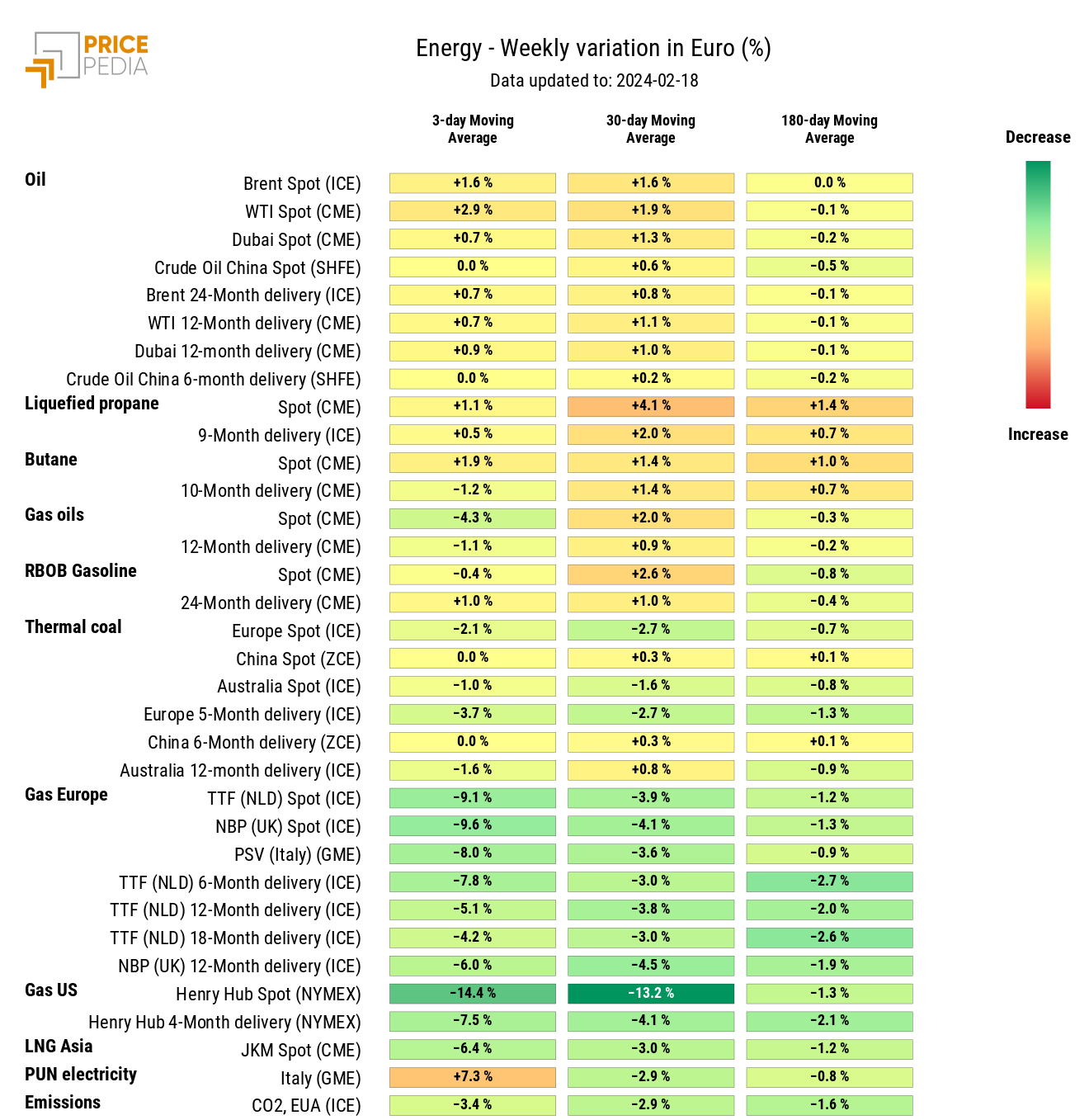

From the energy heatmap, a drop in natural gas prices and the Italian electricity PUN is highlighted, along with an increase in oil prices.

HeatMap of energy prices in euros

PLASTICS

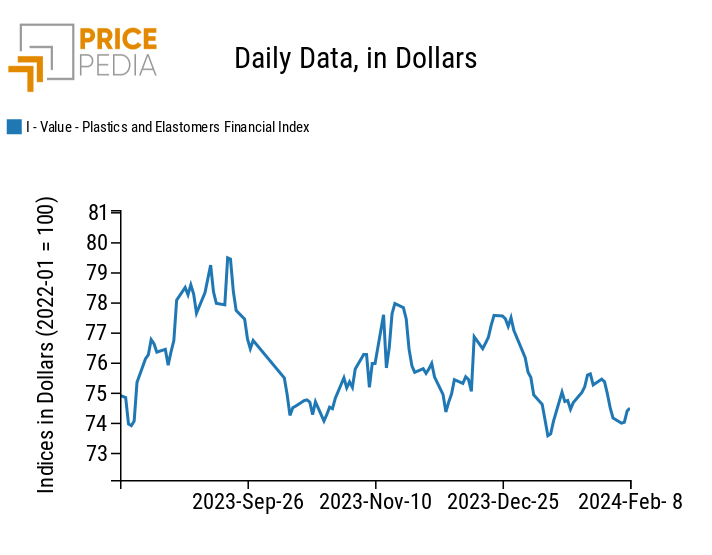

This week, the financial index of plastics quoted in China was not updated due to the closure of the Chinese stock exchanges for the lunar new year holiday.

PricePedia Financial Index of dollar prices of plastic materials

FERROUS METALS

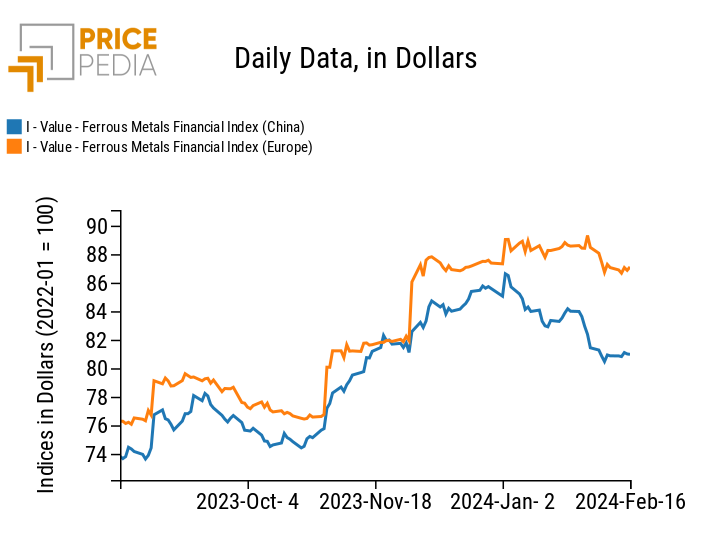

This week, both financial indices of ferrous metals experienced mostly lateral movements.

PricePedia Financial Indices of dollar prices of ferrous metals

INDUSTRIAL NON-FERROUS

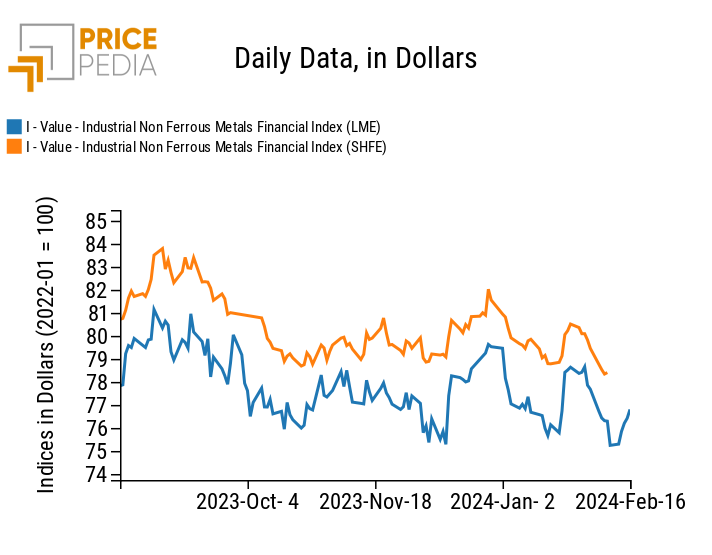

This week, the financial index of industrial non-ferrous metals, quoted on the London Metal Exchange (LME), recovered from the decline recorded last week.

PricePedia Financial Indices of dollar prices of industrial non-ferrous metals

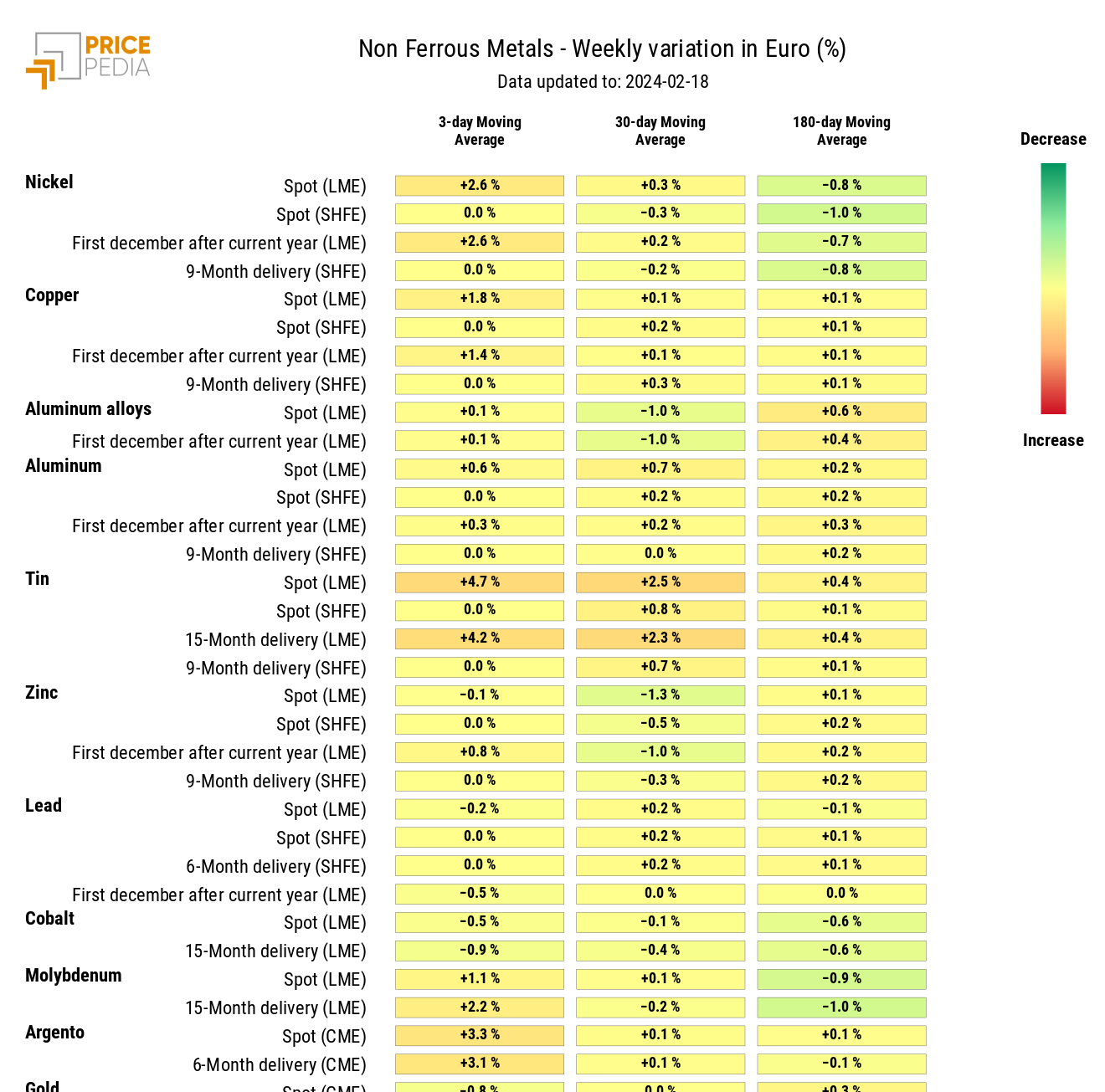

The non-ferrous metals heatmap highlights a strong increase in tin prices.

The second most intense increase is that of nickel prices, which have recently been characterized by prolonged weakness forcing many mining companies to stop or reduce extraction projects. In this regard, Glencore's announcement to withdraw its funding from the loss-making Koniambo Nickel SAS mine, which will remain under maintenance for the next six months, has been rumoured.

HeatMap of industrial nonferrous metal prices in euros

FOOD

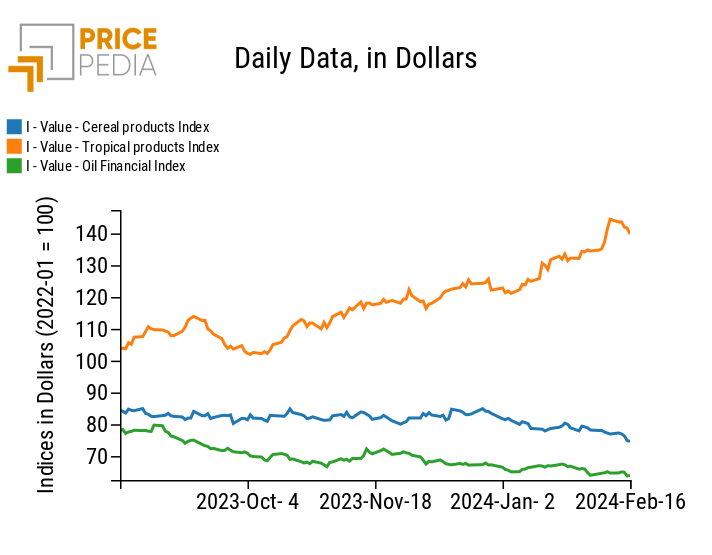

Among food indices, price dynamics have been characterized by different intensities. Cereal prices have clearly trended downwards, tropical prices have interrupted their growth phase, and oil prices have decreased, more pronounced in the last days of the week.

PricePedia Financial Indices of food prices in dollars

CEREALS

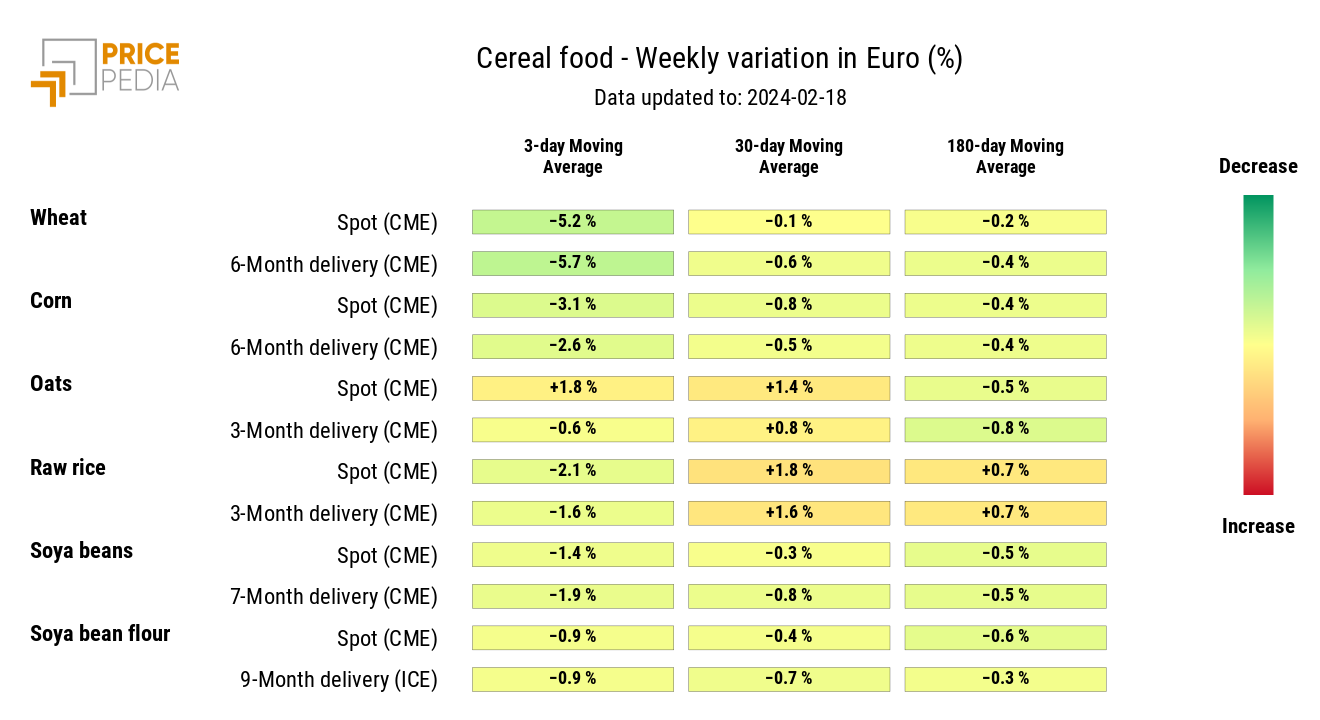

The heatmap shows a widespread decrease in cereal prices, with significant intensity for wheat prices.

HeatMap of Cereal Prices in Euros

TROPICAL

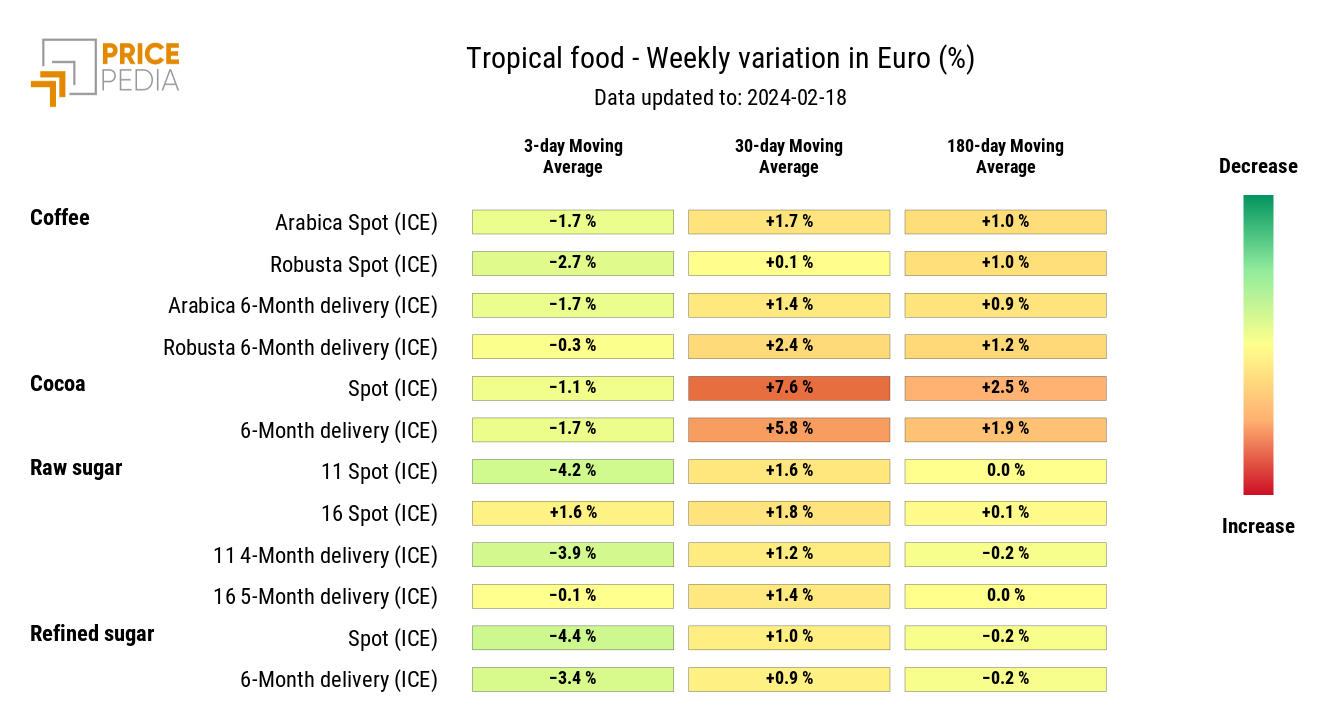

The tropical food heatmap signals a positive change in the three-day moving average for cocoa even this week.

The heatmap also highlights how the 30-day moving average of all tropical food prices is turning red, indicating that this phase of increases is characterizing the entire family of tropical foods.

HeatMap of tropical food prices in euros