Neutral speculative effects of trend following on commodity prices

The Global Commodity Trend Index indicates an equality between positive and negative trends in the commodity market

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekIn last week's article ("Weak demand drives down commodity prices"), the first faint signs of a possible recovery in global activity levels were revealed. In particular, it emerged that both the industrial production index and the Exportplanning world trade index picked up in January. These signs are certainly to be interpreted as support for global demand for commodities, however they are not yet sufficient to significantly change its level, which remains weak at the moment. This weakness is also confirmed by the latest quarterly GDP figures for 2023, which point to weaker growth for the US and China, compared to Q3 2023, and stagnation for the Eurozone.

In addition to the above, the current geopolitical risk due to the conflict in

the Middle East seems to have peaked, with prices in the World Container Index

registering an initial weak decline due to lower freight rates on trade routes

connecting Shanghai to the European Union. However, the global shipping

logistics system has not fully absorbed the shock of the Red Sea crisis. The

latter can be deduced from the price development on the routes connecting

Shanghai to the US, which again this week experienced small, but positive

changes.

The critical situation in the Middle East not only has a significant impact on

logistics, by lengthening delivery times for world trade, but also affects

commodity prices, especially for energy commodities. A concrete example is the

price of oil, which, due to the escalation of conflicts in the Middle East,

recorded a positive weekly variation. The level of Brent is, however, still

just above USD 80 per barrel, due to weak global demand.

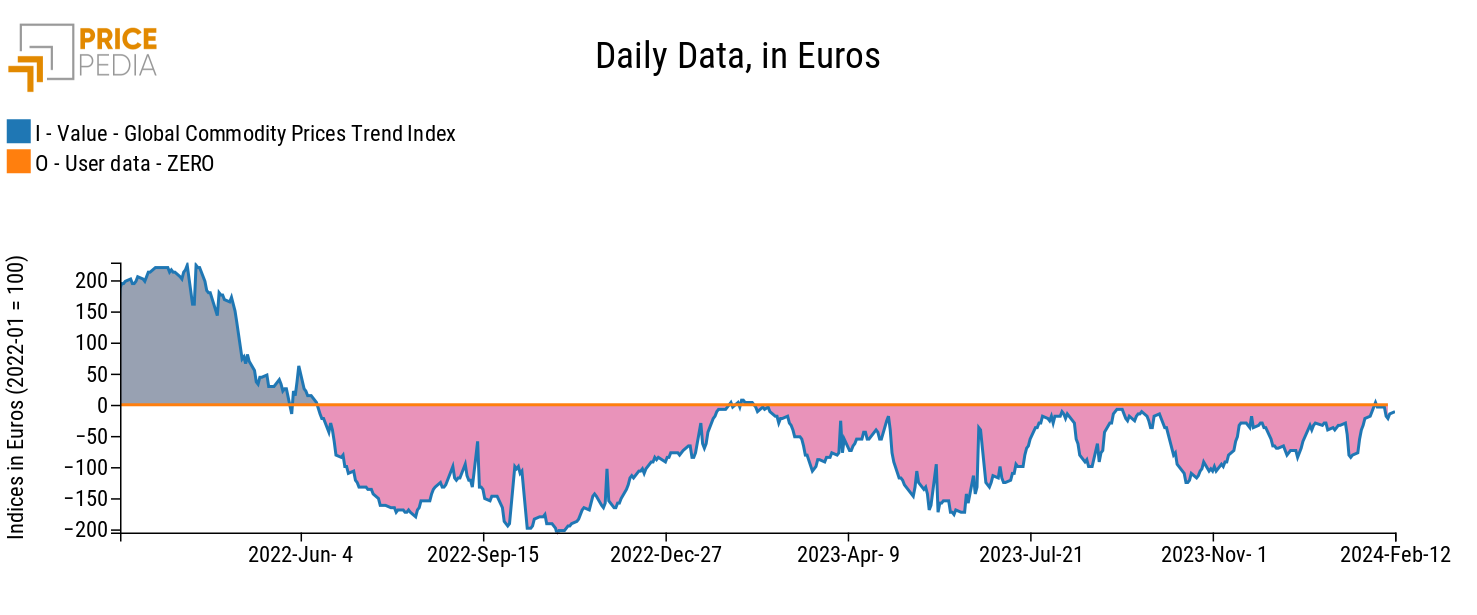

In this macroeconomic scenario characterised by a high degree of complexity, a measure of the currents moving the financial commodity markets can be derived from the global commodity trend index, showed in the following grapgh.

Global Commodity Prices Trend Index

The index graphed above is a financial index provided by PricePedia, which

allows displaying the current trend following strategy prevailing

within the commodity market. This type of strategy, implemented by many

traders, involves identifying a robust trend in price dynamics and following

it to profit. Traders will tend to buy commodities showing

uptrends and, conversely, will tend to sell commodities

following a downtrend. These speculative operations significantly

influence commodity price dynamics. In order to anticipate possible variations

in commodity prices in advance, a measure signaling the prevailing trend

directions at different time frames may prove useful, serving as an indirect

measure of prevailing trend following strategies. The

global commodity trend index is constructed to take on

positive values when, within commodity financial markets,

uptrends outnumber downtrends; conversely, it takes on

negative values when downtrends outnumber uptrends. The graph

shows situations where uptrends prevail in gray and phases where downward

trends prevail in pink.

Observing the graph, it can be seen that from the second half of 2022 until

February 2024, speculative strategies have negatively impacted commodity

financial prices. The analysis of the graph also reveals that, starting from

mid-January 2024, the negative effect of speculative strategies on commodity

prices has gradually diminished, reaching cancellation during the past week

when the global commodity trend index recorded values close to zero.

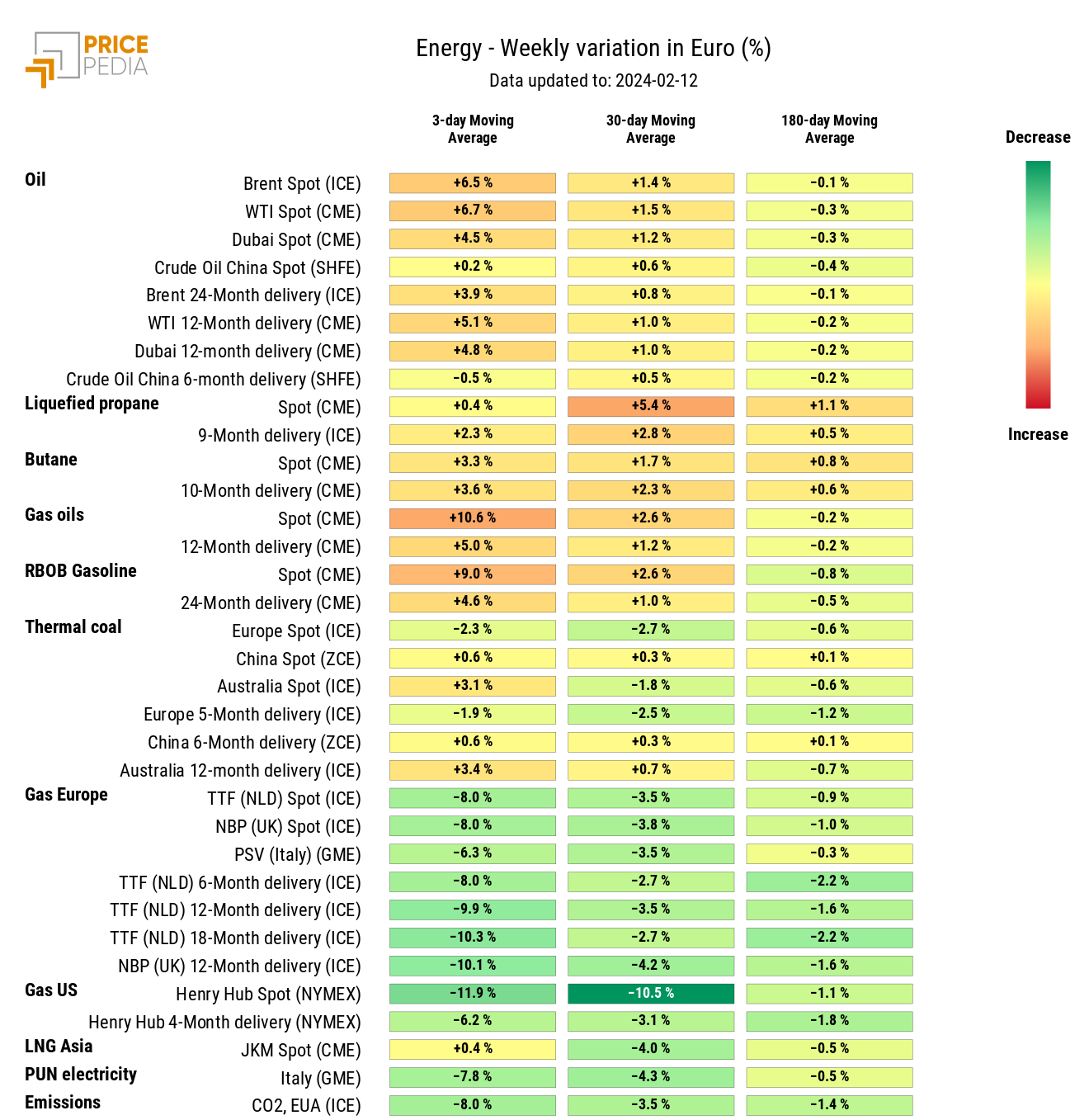

ENERGY

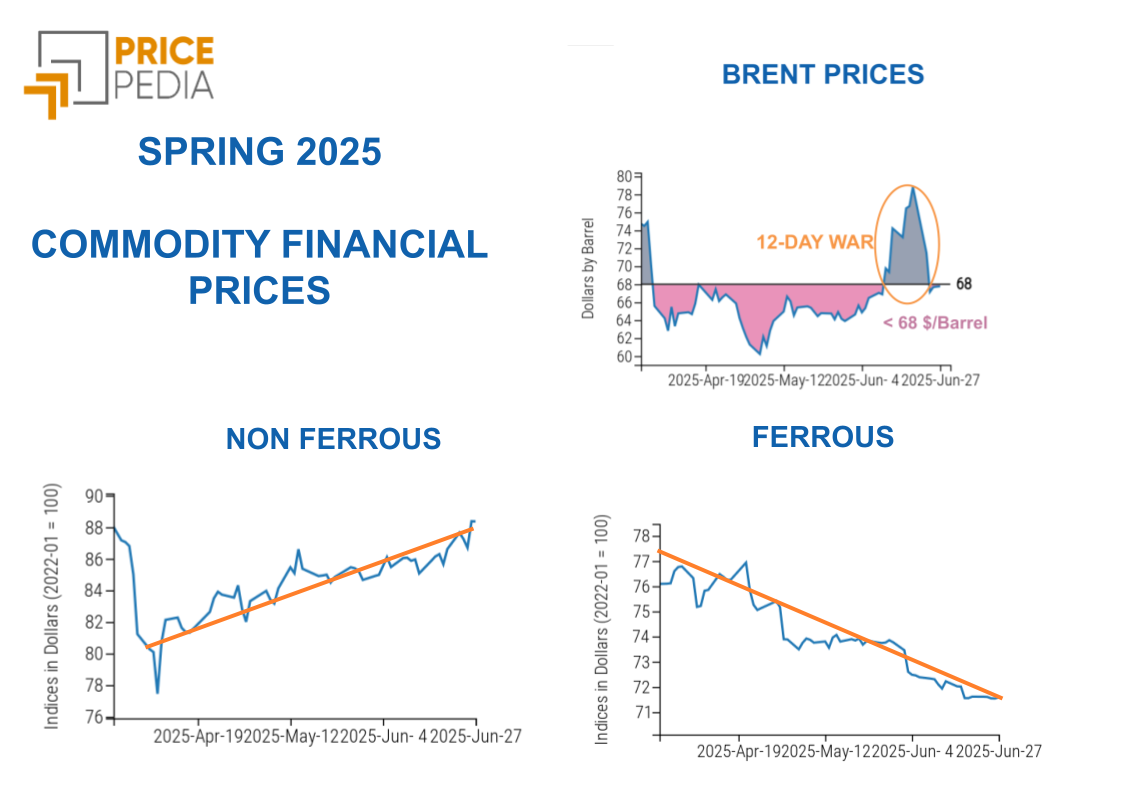

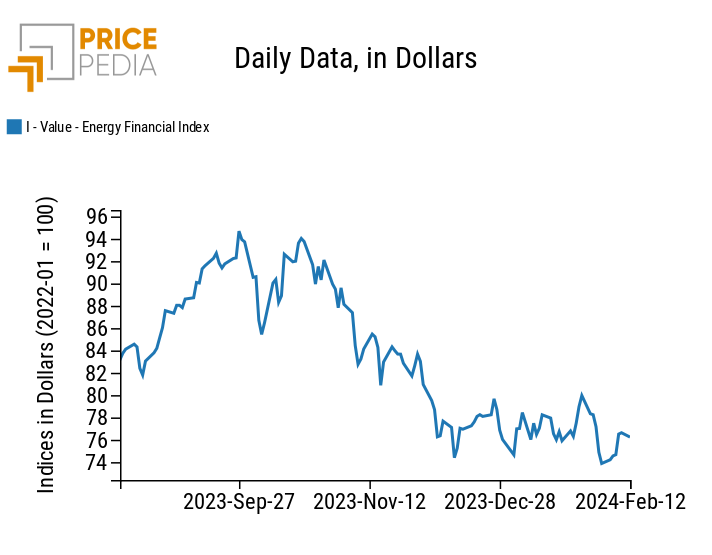

This week, PricePedia's Energy Products Financial Index increased, driven by the rise in oil prices. Despite the current weakness in demand preventing significant growth in oil prices, Israel's refusal to cease fire against Hamas increased fears of a possible escalation in the Middle East and positively impacted ICE-listed Brent oil prices.

PricePedia Financial Index of energy prices in dollars

The heatmap indicates a rise in Brent prices and a decline in TTF natural gas prices due to high European storages and the approaching end of the winter season.

HeatMap of energy prices in euros

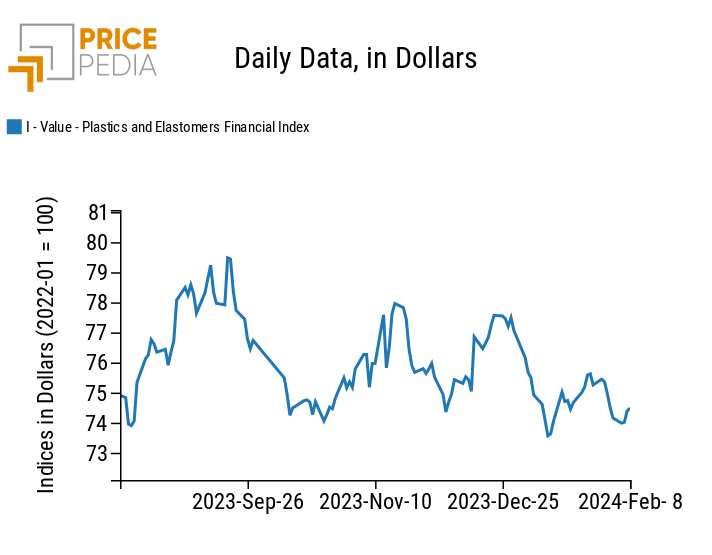

PLASTIC MATERIALS

China's listed plastics financial index ended the week with a positive turnaround due to rising Brent prices.

PricePedia Financial Index of dollar prices of plastic materials

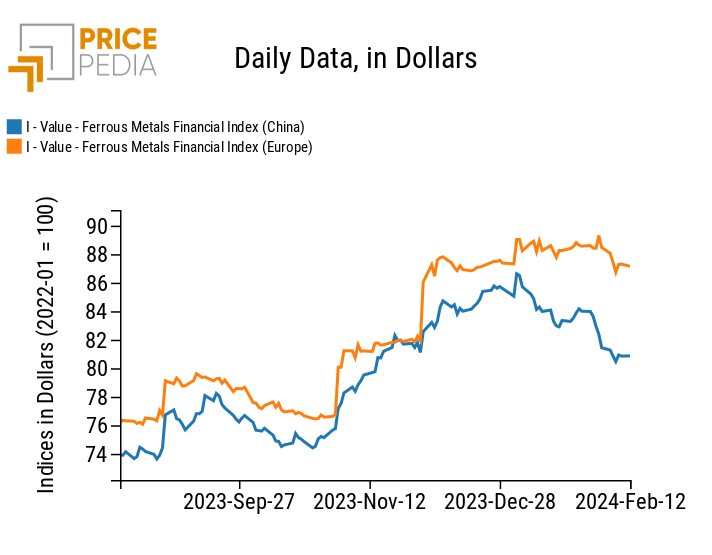

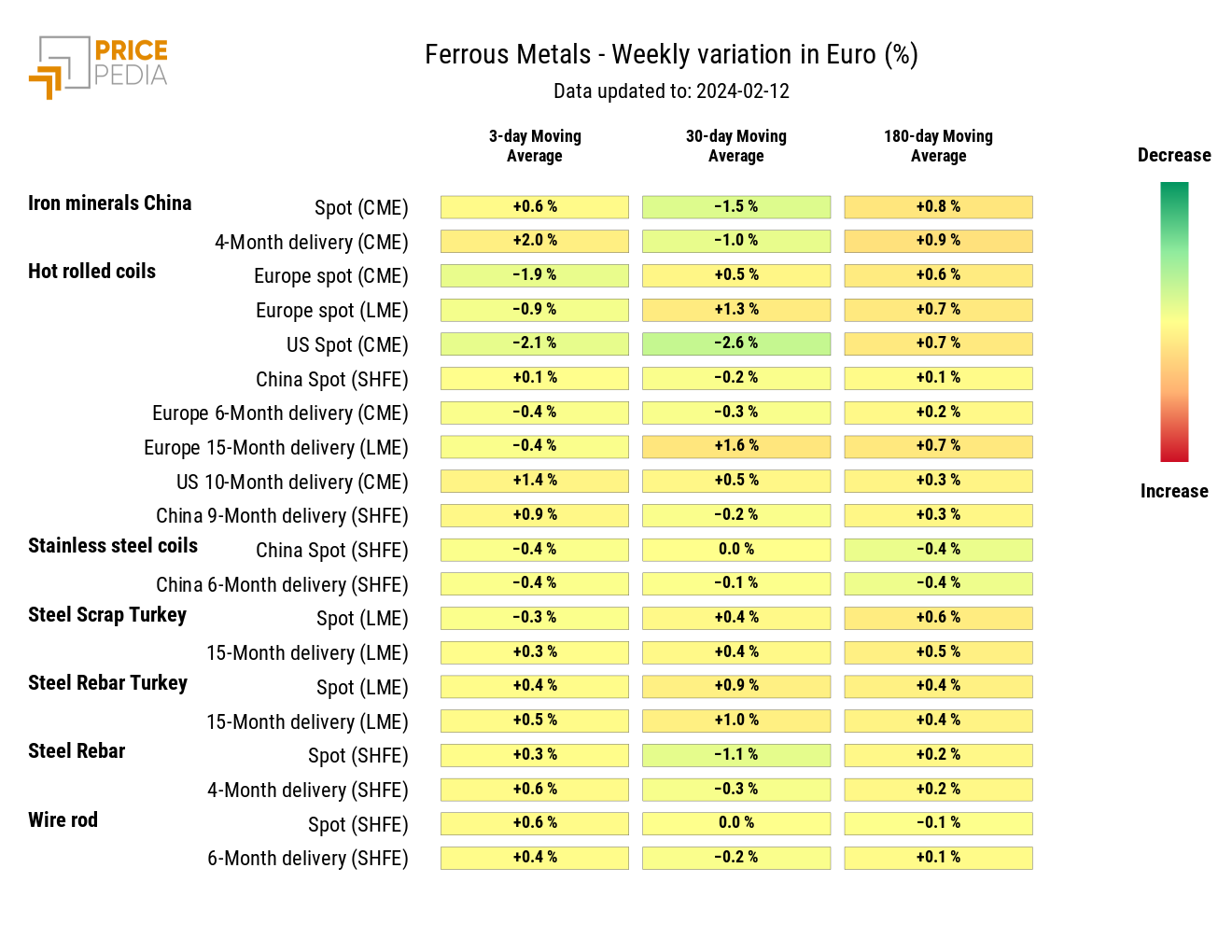

FERROUS METALS

The two financial indices for ferrous products both recorded a decline in the ferrous markets, but this was more pronounced in the Chinese market. The most pronounced decline in the Chinese market is attributable to the dynamics of iron ore, which recorded its lowest price in three months on Wednesday.

PricePedia Financial Indices of dollar prices of ferrous metals

The ferrous metal price heatmap shows a reduction in the prices of stainless steel coils China and HRC USA.

HeatMap of ferrous metal prices in euro

INDUSTRIAL NON-FERROUS

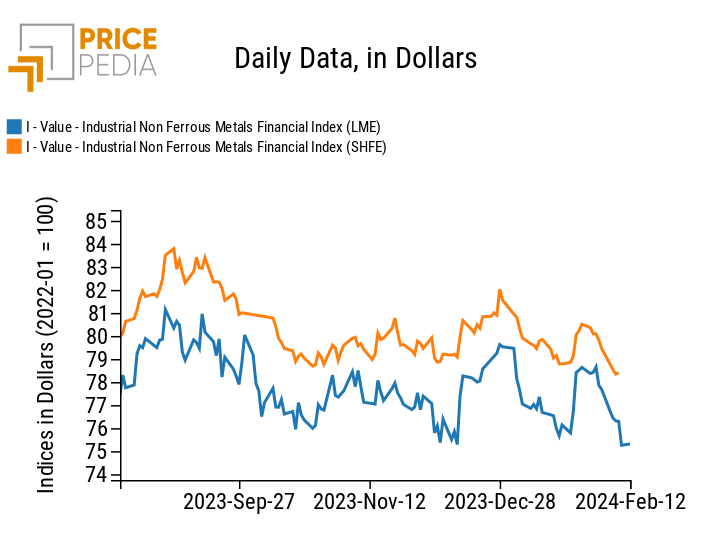

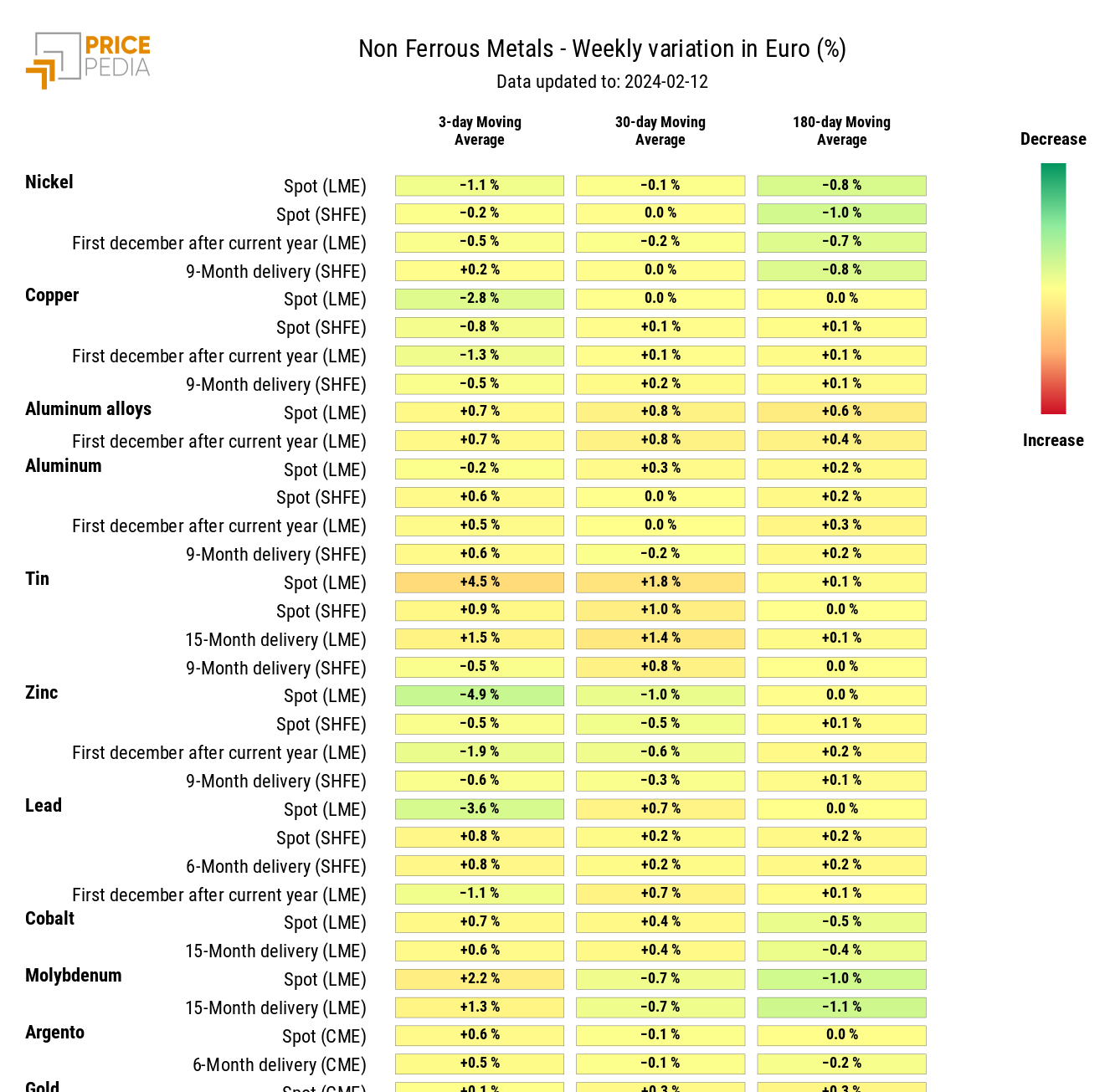

Both industrial non-ferrous indices recorded significant falls led by copper and zinc prices, which fell on news of their increased potential supply.

PricePedia Financial Indices of dollar prices of industrial non-ferrous metals

The heatmap shows a reduction in zinc and copper prices.

HeatMap of industrial nonferrous metal prices in euros

FOOD

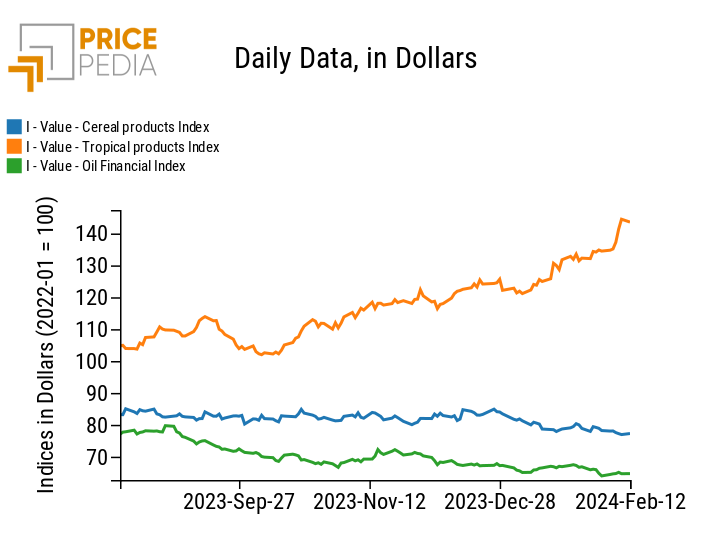

Among the food indices, the tropical index continues to show the strongest positive changes. The oils index is stabilising, while the cereals index remains characterised by short-term fluctuations on a slightly negative trend.

PricePedia Financial Indices of food prices in dollars

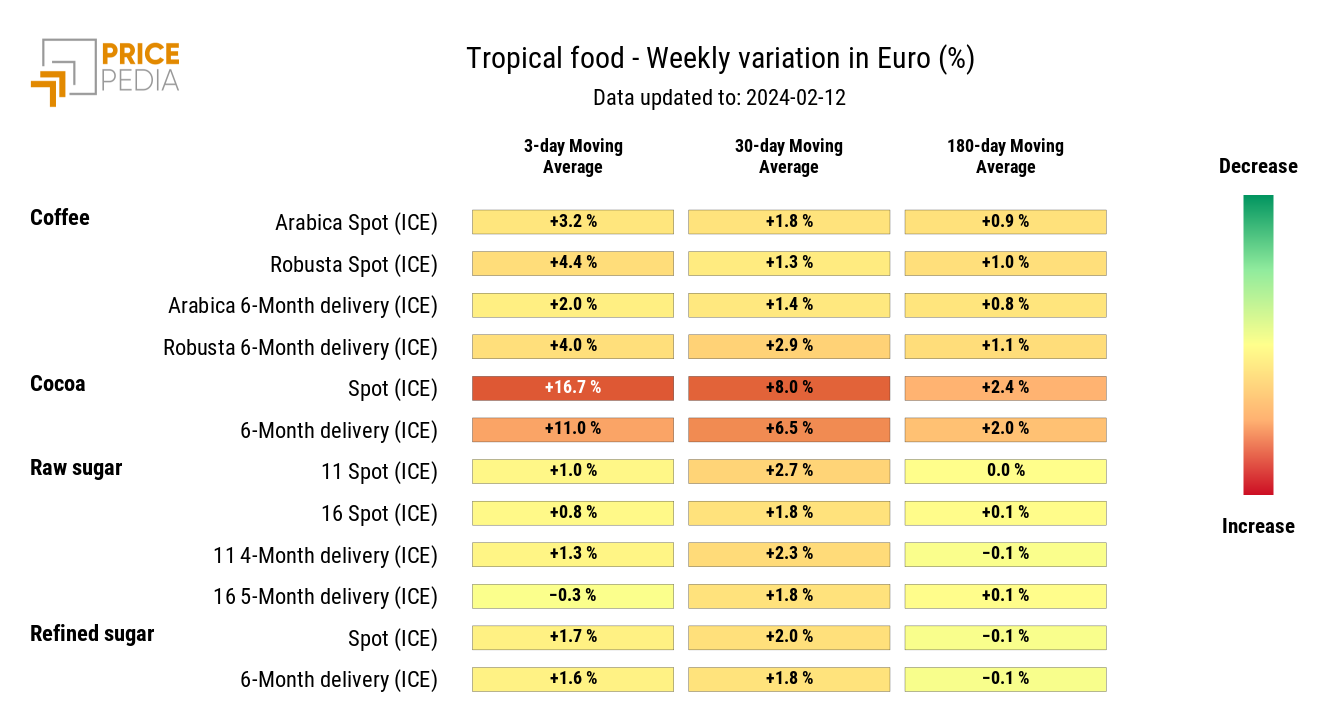

The tropical food heatmap indicates the continuation of the strong growth of cocoa prices, which continue to record new all-time highs, day after day.

HeatMap of tropical food prices in euros