The role of distributors in the 2020-2023 price cycle: the case of thermoplastics

Comparison between customs and distribution prices in the thermoplastics market

Published by Luca Sazzini. .

Plastics and Elastomers basic thermoplastics technopolymers Commodity price cycle 2020-2023 In last week's article The 2020-2023 price cycle: the case of thermoplastics the dynamics of the financial prices and physical prices of thermoplastics in the last cycle 2020-2023 was analyzed .

In this article, the same cycle will also be analyzed from the point of view of the pricing policies implemented by the distribution.

Role of distribution in the thermoplastics market

Plastics distributors play a crucial role in the supply chain of the plastics industry. Their main functions are:

- splitting of purchases: as intermediaries between plastics producers and end users, distributors allow user companies to purchase appropriate quantities of material without having to deal with large quantities directly with the producers;

- wide assortment: distributors offer a wide variety of plastics, allowing end users to access different types of materials without having to deal with multiple manufacturers;

- warehouse and logistics management: distributors maintain a warehouse of plastic materials, reducing waiting times for companies that need materials quickly. Additionally, they manage the logistics for efficiently delivering materials to customers;

- technical support and advice: distributors offer technical advice and support to customers to help them choose the material best suited to their specific needs. This may include selection of plastic type, advice on specific applications, and technical assistance;

- Customization and additional services: Some distributors may offer customization services, such as coloring or adding special additives.

Thanks to the offering of these services, a distributor can create a high value for the user company and be compensated for these services by applying a mark-up to the purchase prices of plastic materials. It is therefore part of the normal functioning of a market for the distributor's selling price of a given thermoplastic resin to be significantly higher than the price charged by the manufacturer. This difference, however, tends to change as market conditions change, following the demand cycle: it increases when market conditions are favorable and decreases when demand is weak.

Distribution pricing policies in the 2020-2023 cycle

A valuable source of information for measuring the pricing policies of the distribution of thermoplastics are the surveys carried out monthly by the Milan Chamber of Commerce. These are surveys based on a panel of expert operators, made up of producers, users and distributors. However, the different convenience of participating tends to unbalance the panel towards a greater presence of producers and distributors. In this sense, rather than an average market price, the panel's results sometimes represent the prices that producers and distributors desire. Without prejudice to this warning, there is no doubt that this source is very useful for gathering information on the levels and dynamics of thermoplastic prices, especially when compared with the results of different sources. A different source, for example, are the prices of trade between countries, recorded at customs. This second source, based on the Combined Nomenclature classification, is less detailed from a product point of view than the surveys of the Milan Chamber of Commerce, but is more objective, because it relates to a large number of actual transactions.

Given that customs prices can be considered production prices and since Milan Chamber of Commerce's prices also reflect distributor prices, the comparison between the two types of prices, without prejudice to the warnings already described regarding classification and robustness, can provide useful indications on the margins applied from distribution.

The prices of basic thermoplastics

The following table shows, for the main basic thermoplastics, the prices recorded, in the recent 2020-2023 cycle, at the customs and Chamber of Commerce of Milan (CCIAA Milan).

| Physical prices EU market: basic thermoplastics | |||||||

| (euros per ton) | |||||||

| 2020 | 2021 | 2022-H1 | 2022-H2 | 2023 | 2023-12 | ||

| LDPE polyethylene: | |||||||

| - EU customs | 942 | 1369 | 1682 | 1513 | 1261 | 1238 | |

| - CCIAA Milan (resina base) | 937 | 1880 | 2015 | 1621 | 1235 | 1180 | |

| Linear polyethylene (LLDPE): | |||||||

| - EU customs | 941 | 1534 | 1784 | 1549 | 1265 | 1236 | |

| - CCIAA Milan (butene based resin) | 857 | 1634 | 1750 | 1450 | 1170 | 1140 | |

| - CCIAA Milan (metallocene) | 1006 | 1886 | 2192 | 1834 | 1360 | 1260 | |

| HDPE polyethylene: | |||||||

| - EU customs | 942 | 1369 | 1682 | 1513 | 1261 | 1238 | |

| - CCIAA Milan (molding) | 827 | 1535 | 1625 | 1418 | 1214 | 1155 | |

| - CCIAA Milan (blowing) | 847 | 1550 | 1643 | 1448 | 1221 | 1175 | |

| - CCIAA Milan (extrusion) | 1278 | 2153 | 2532 | 2518 | 1700 | 1490 | |

| - CCIAA Milan (films) | 863 | 1557 | 1673 | 1462 | 1223 | 1165 | |

| - CCIAA Milan (monofilaments) | 878 | 1576 | 1765 | 1596 | 1265 | 1165 | |

| Polyvinyl chloride (PVC): | |||||||

| - EU customs | 755 | 1272 | 1705 | 1399 | 1031 | 934 | |

| - CCIAA Milan (suspension) | 855 | 1560 | 1986 | 1764 | 1200 | 1052 | |

| Virgin polyethylene terephthalate (PET): | |||||||

| - EU customs | 737 | 1094 | 1564 | 1438 | 1088 | 1156 | |

| - CCIAA Milan | 752 | 1210 | 1588 | 1452 | 1112 | 1040 | |

| Recycled polyethylene terephthalate (RPET): | |||||||

| - EU customs | 769 | 985 | 1478 | 1563 | 1139 | 1009 | |

| - CCIAA Milan (multicolor) | 618 | 843 | 1170 | 1230 | 845 | 650 | |

| - CCIAA Milan (clear) | 1409 | 1997 | 2228 | 1419 | 950 | ||

| - CCIAA Milan (blue) | 1180 | 1788 | 1780 | 1214 | 800 | ||

| Polipropilene (PP): | |||||||

| - EU customs | 998 | 1529 | 1794 | 1468 | 1254 | 1236 | |

| - CCIAA Milan (homopolymer) | 1041 | 1942 | 2144 | 1652 | 1251 | 1125 | |

| - CCIAA Milan (heterophasic copolymer) | 1111 | 2012 | 2214 | 1740 | 1318 | 1180 | |

| - CCIAA Milan (random copolymer) | 1179 | 2093 | 2379 | 1907 | 1458 | 1270 | |

The analysis of this data highlights the following facts:

- the level of the Milan Chamber of Commerce's prices was on average 11% higher than the customs prices, confirming that they reflect, at least in part, the distribution margins;

- there is a very high degree of correlation between the prices of the two sources, indicating that both are able to precisely measure price dynamics;

- the maximum distance between Milan Chamber of Commerce's prices and customs prices was recorded in 2021 and in the first half of 2022. This is the period in which demand was maximum, also for precautionary purposes. The fear of production interruptions due to lack of material has led user companies to prioritize the availability of the material over price convenience.

The prices of technopolymers

The following table shows the prices recorded for some technopolymers, in the recent 2020-2023 cycle, at the customs and Chamber of Commerce of Milan (CCIAA Milan).

| Physical prices EU market: Technopolymers | |||||||

| (euros per ton) | |||||||

| 2020 | 2021 | 2022-H1 | 2022-H2 | 2023 | 2023-12 | ||

| Polyamide 6 (PA6): | |||||||

| - EU customs | 1615 | 2240 | 2971 | 3265 | 2519 | 2338 | |

| - CCIAA Milan (not added) | 1487 | 2539 | 3083 | 3115 | 2202 | 2035 | |

| - CCIAA Milan (added: for molding) | 1886 | 2857 | 3287 | 3295 | 2373 | 2235 | |

| Polyamide 6.6 (PA6-6): | |||||||

| - EU customs | 2751 | 3440 | 4408 | 4576 | 3768 | 3152 | |

| - CCIAA Milan (not added) | 2615 | 3865 | 4583 | 4310 | 3256 | 2720 | |

| - CCIAA Milan (added: for molding) | 3098 | 4419 | 4867 | 4680 | 3590 | 3040 | |

| Polycarbonates: | |||||||

| - EU customs (standard + special) | 1909 | 2561 | 3161 | 3395 | 3010 | 2814 | |

| - CCIAA Milan (standard) | 2062 | 3425 | 3792 | 3330 | 2564 | 2200 | |

| Polymethyl methacrylate (PMMA): | |||||||

| - EU customs | 2223 | 2647 | 2988 | 3211 | 2696 | 2637 | |

| - CCIAA Milan | 2842 | 3235 | 3542 | 3825 | 2807 | 2525 | |

| Acetal resin (POM): | |||||||

| - EU customs (copolymer and homopolymer) | 1782 | 1997 | 2454 | 2907 | 2548 | 2327 | |

| - CCIAA Milan (copolymer) | 1654 | 2584 | 4250 | 3720 | 2563 | 2155 | |

The analysis of this data highlights situations substantially similar to those already reported for thermoplastics, especially if we consider some product differences between customs prices and Milan Chamber of Commerce's prices. The customs categories are increasingly broader, including all the commercial flows of the thermoplastics considered; the Milan Chamber of Commerce findings are much more specific and concern commercial products defined not only on the basis of chemical composition but also on other characteristics, such as intended use.

Conclusions

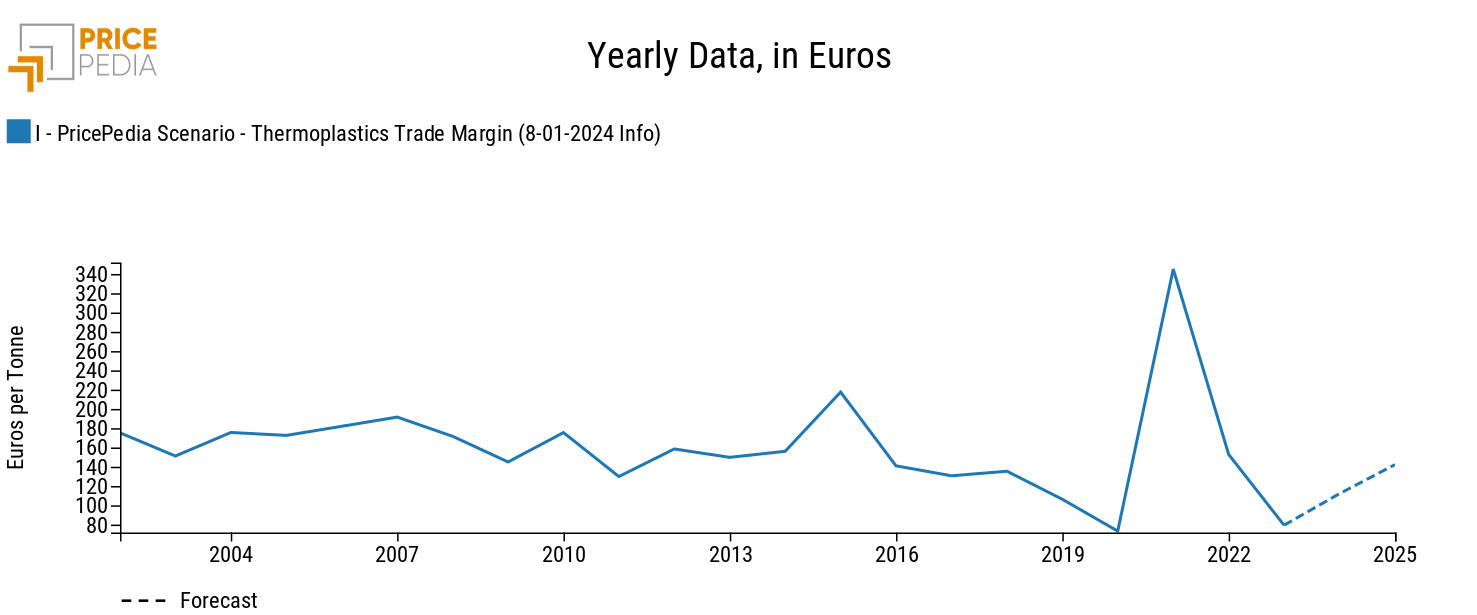

Based on the difference between the Milan Chamber of Commerce's prices and the customs prices of basic thermoplastics (which, as we have seen, are more homogeneous from a product standpoint) it is possible to calculate a synthetic index of the commercial margins applied by distribution on the Italian market. The following graph shows the calculated margins expressed in euros per ton.

Commercial margin in the basic thermoplastics market

This graph allows us to highlight some aspects of particular interest:

- from the beginning of the century until 2015, distribution margins on thermoplastics were pro-cyclical, but with relatively limited fluctuations, within the range of 130-220 euros per ton;

- a downward phase began in 2016 which culminated with the minimum in 2020, with average margins of 73 euro/ton.

- 2021 is a completely anomalous year, with margins that have risen to 345 euros/ton;

- already in 2022 the margins dropped sharply until they collapsed again below 100 euro/ton in 2023, due to the need for distributors to dispose of stocks accumulated in previous years;

- the market should progressively rebalance in the near future, allowing margins to return towards values of 150 euro/ton.