The economic effects of the Houthi attacks on ships in the Red Sea

The importance of basing assessments on the analysis of a large set of data

Published by Luigi Bidoia. .

Freight Global Economic Trends

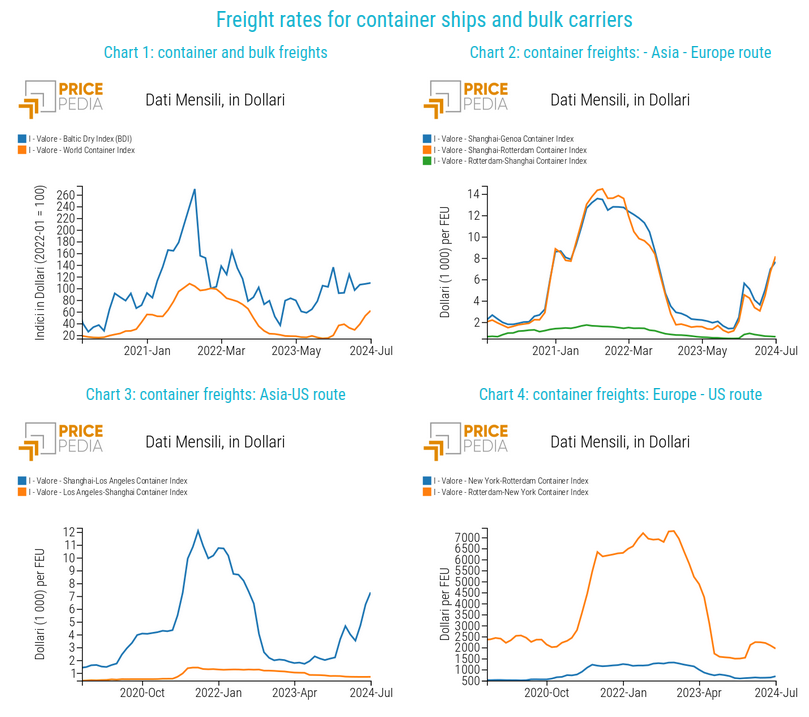

Every Thursday, consulting firm Drewry updates the World Container Index, a measure of shipping freight rates of containers. This measure concerns the transport of a 40-foot container (FEU) on various maritime routes, then summarized in a single index which represents the measure most followed by economic analysts on the global dynamics of maritime transport costs.

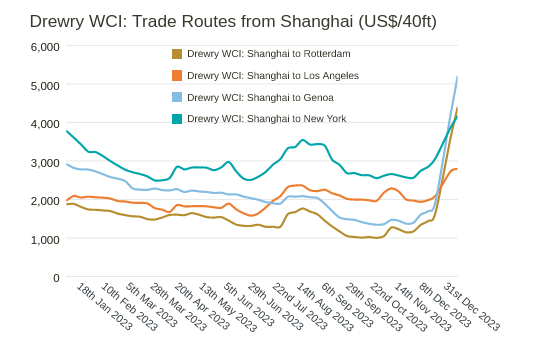

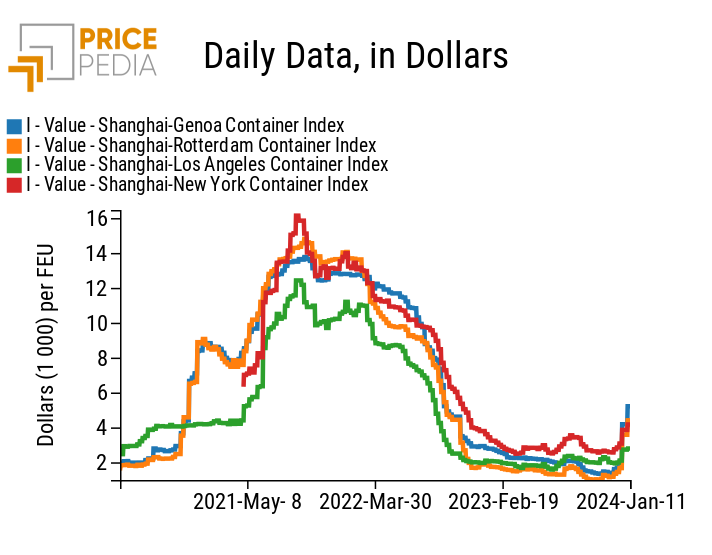

Yesterday's update, Thursday 11 January, was particularly important because it provided an updated measure of the impact the Red Sea crisis is having on the cost of container ship freight. Below is the graph on the Drewry website of the cost of transport for routes departing from Shanghai.

Container freight rates for routes from Shanghai (source: Drewry)

From the graph it is clear that the cost of transport in recent weeks has increased at very high rates for the routes to Rotterdam and Genoa, those most impacted by the reduction in marine safety on the Red Sea. The cost of transporting a 40-foot container from Shanghai to Rotterdam went from $1667 on December 21, 2023 to $4406 on Thursday January 11th in a few weeks; that of transport from Shanghai to Genoa passed in the same period from 1956 $ to $5213. It is clear that the increase in these costs will have an impact on the costs in Europe of goods imported from China and more generally from Asia.

The problem is, of course, quantifying this possible increase. Without claiming to provide an exhaustive analysis, it may be useful to make an initial examination of the possible calculation of the impact that the increase in the cost of transport from Asia could have on the prices of raw materials in Europe. To this end it is useful to break down this effect into different parts:

- incidence of the cost of transport on the price of the imported goods;

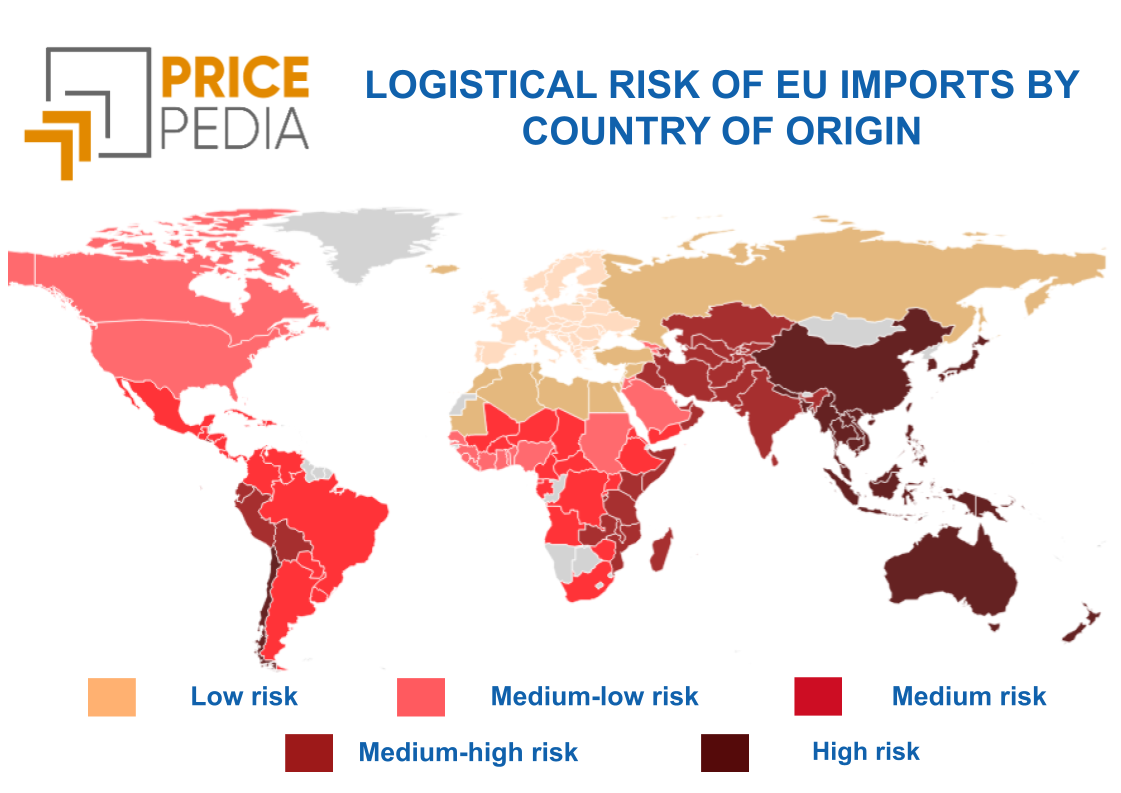

- share of EU imports from Asia;

- possible effects of lack of supply on the EU market;

- global effects on world shipping;

This examination, although partial, can be useful to evaluate how proportionate are the statements, for example, of Vincent Clerc, head of Maersk, who in a recent interview with the Financial Time hypothesized that the current crisis on the Red Sea "could have significant consequences for global growth".

Possible effects of lack of supply on the EU market

This effect depends on a variety of factors, including

the extension of transport times, in the event that ships decide not to pass through the Red Sea, but to circumnavigate Africa. The estimated impact of these choices on transit time is 7-10 days, which out of a total of 30-40 days of the overall sea transport time between Asia and Europe, means an extension of transport times 20% and 30%. Even in this case the delays are not comparable to what happened during the 2021 crisis.

The biggest unknown is the behavior of the suppliers. If fears of a lack of materials lead purchasing departments to simultaneously and suddenly increase the volume of orders, as happened in 2021, then the effects on commodity prices are difficult to predict. The current European economic situation is, however, very different, for two reasons: industrial activity levels are stable, if not declining, unlike the strong post-pandemic growth; the cost of inventory is now much more expensive than it was in 2021, where interest rates were at historic lows.

Global effects on world maritime transport

Many logistics operators are reporting that the critical issues affecting the Red Sea are in addition to those that have been ongoing for months for the Panama Canal, two waterways where almost 20% of world trade passes. The danger is that there will be a domino effect of disruptions to supply chains caused by late ships. The risk is certainly real. However, the likelihood of large-scale disruption to supply chains is low.

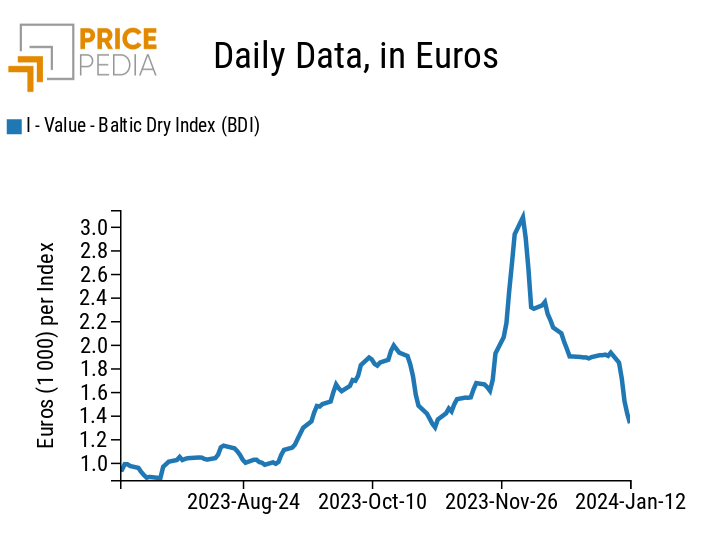

On the one hand, in fact, the effects on transport with bulk carriers,

due to fewer transits on the Panama Canal, they seem to have partially recovered, as shown by the ongoing reduction in the price of bulk cargo freight[2].

Baltic Dry Index (BDI) of bulk carrier freight rates

On the other hand, the effects on freight rates for container shipping on routes other than the Asia-Europe route are starting to be signaled by increases in freight rates on other routes. However, these increases are very limited. For example, the cost of transport between Shanghai and Los Angeles has gone from $2,100 to 2,790% in recent weeks; that of the Shanghai and New York route from $3074 to $4170. Certainly these are significant increases, but also very far from what happened in 2021.

Conclusions

The Red Sea crisis and what is happening to global transport on the Asia-Europe route is certainly a non-negligible fact for the purchasing offices of Italian and more generally European companies. In this regard it will be important to monitor the various facts regarding the safety of maritime transport and their possible impact on maritime freight rates and the prices of transported commodities. It is equally important to distinguish within the different news items those which are based on analysis

objective analysis of the different aspects of a phenomenon, from those that emphasize only one aspect,

often not aimed at a greater understanding of the phenomenon, but at changing the opinions of economic operators.

In this regard, it may be useful to compare the graph on container freight rates published at the beginning of this article with the one presented below. The data is the same, but reported in a different historical perspective.

Drewry indices of container freight rates for routes from Shanghai

If placed in historical perspective and compared with the increases recorded in 2021, the freight increases of the last few weeks are, at least until now, less dramatic and not comparable with those of three years ago. It is very likely that their effects will not be comparable either.