Signs of weakness in global demand for commodities are increasing

European industrial production falls and US growth declines

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThis week the last annual meetings of Western central banks took place and the end of the rate hike was confirmed.

- the FED kept interest rates stable at 5.25-5.50% for the third consecutive meeting.

Chairman Powell acknowledged for the first time the positive progress on the inflation rate and stated that rate cuts were a subject of discussion by the FOMC[1].

The central bank has estimated that the key rate will fall to 4.6% next year, suggesting three rate cuts in 2024. - the ECB keeps interest rates unchanged, but curbs the market's optimism by declaring that now is not the time to talk about an interest rate cut.

Inflation for 2023 is 5.13%, while inflation rates of 2.7 and 2.1% are estimated for 2024 and 2025 respectively. - the BOE (Bank of England) confirms the current reference rates, but specifies that they will remain high for a long time to come.

- The SNB (Swiss National Bank) maintained the reference rate at 1.75% showing a more accommodating attitude which was interpreted as the end of the rate hike However, no imminent cuts are expected.

Economic trend

The different dynamics of the levels of industrial activity in the three main world economic areas are becoming increasingly evident: the United States recorded a reduction in growth in the last quarter, the b>Europe a drop in industrial production, while China a modest recovery.

In particular, the growth of the US economy is recording a significant slowdown which should bring it below 1.5% in 2024.

Europe recorded a decline in industrial production on a monthly basis of 0.7% and a decrease on an annual basis of 6.6%.

The new European PMI estimates, released on Friday, disappoint expectations, signaling a decline in the index in December which reaches a value of 47 points.

The manufacturing PMI stabilized at 44.2, while in services the index fell to 48.1 from 48.7.

One of the PMIs to record the most significant drop is that of Germany which dropped to 46.7 from 47.8. The German economy, despite the improvement in the ZEW[2] in December, remains in great difficulty and a decline in GDP of 0.2% is expected for 2023.

Weak signals also from the Italian industrial production which began to decline again in October, confirming that the interruption of the fall seen in the previous months was not a sign of a turning point in the cycle.

China records an improvement in industrial production which accelerates to 6.6% y/y in November, from 4.6% y/y in October. Retail sales rose from 7.6% y/y in October to 10.1% y/y in November, but still remain below expectations, signaling a still modest recovery. The real estate sector is still contracting and continues to limit the trend in total investments, which however remain supported by manufacturing and infrastructure.

Commodity trends

In this situation of weak, if not decreasing, demand for commodities and interest rates expected to decrease, expectations of future increases in commodity prices are offsetting market imbalances that would lead to a reduction in prices.

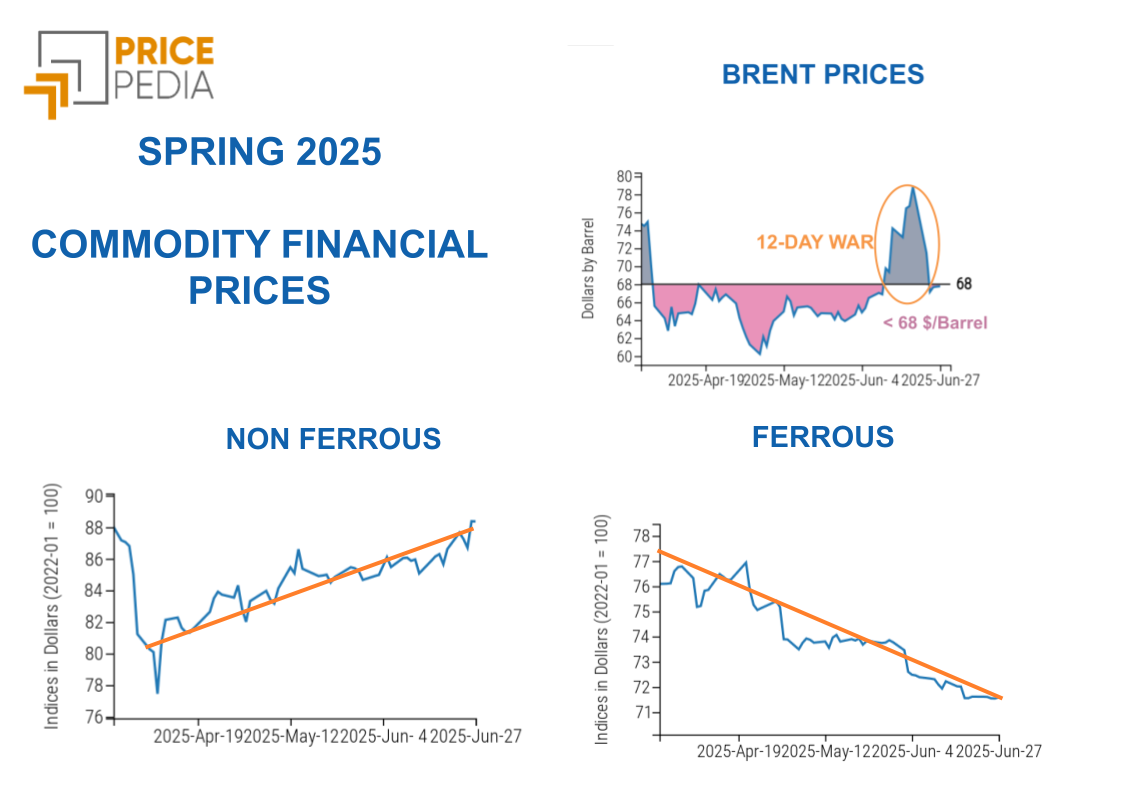

The prices of industrial metals move only sideways, energy prices are decreasing discounting the still high levels and ferrous metals reflect the contingent specificity of the American market.

[1] FOMC: Federal Open Market Committee is a body of the Federal Reserve responsible for regulating monetary policy by specifying the short-term objective, i.e. deciding the level of interest rates in the USA.

[2] The Zew Economic Sentiment Indicator is published monthly and summarizes the opinion of 350 experts on the future of the German economy.

ENERGY

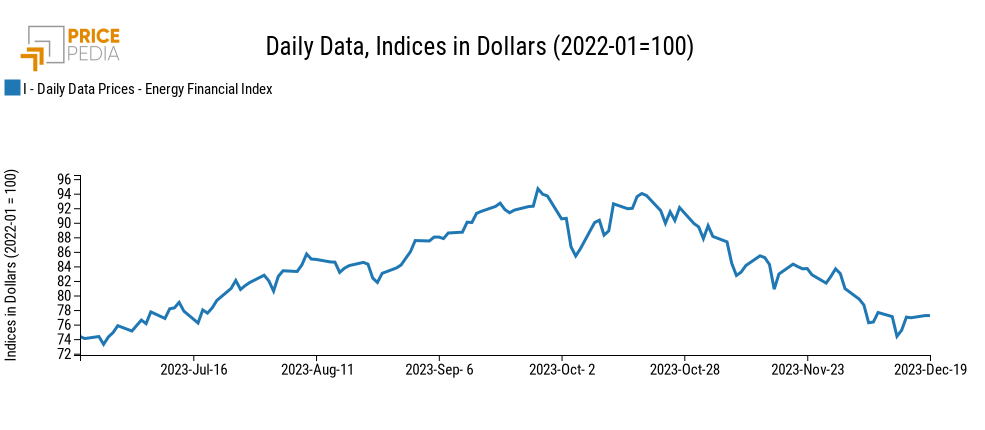

The PricePedia financial index of energy prices continues to decline due to the negative dynamics of natural gas and oil.

PricePedia Financial Index of Energy prices in dollars

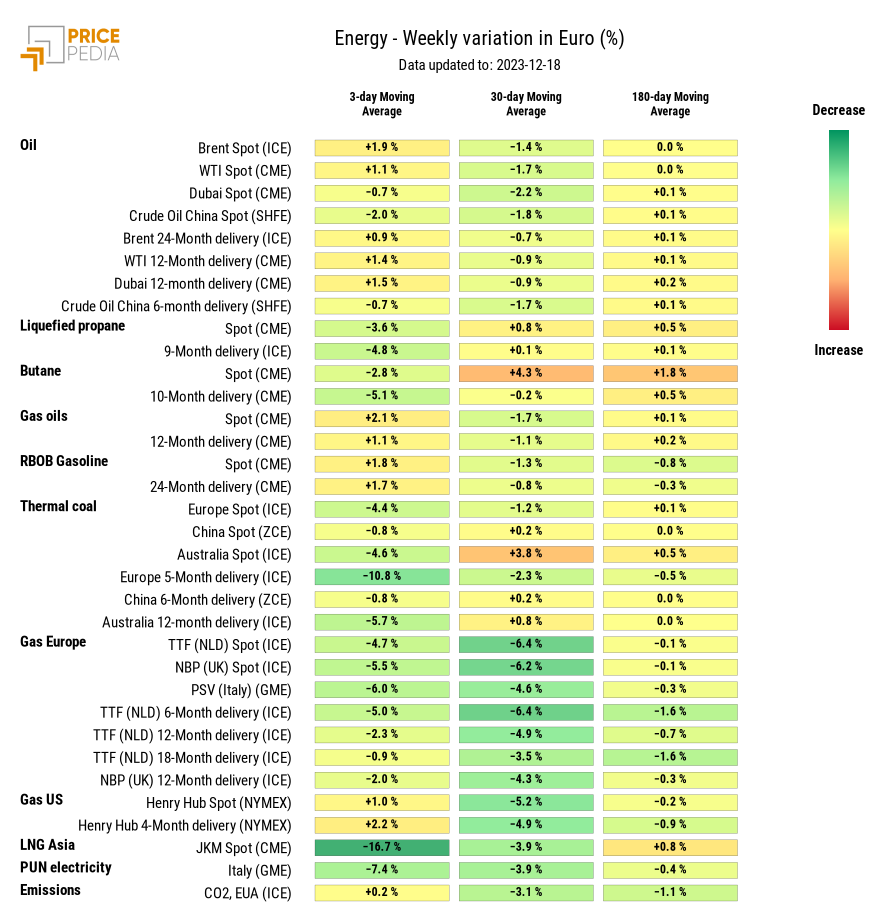

The heatmap below highlights the strong reduction in TTF natural gas prices which recorded a double-digit negative percentage change in the three-day moving average.

HeatMap of energy prices in euros

PLASTIC MATERIALS

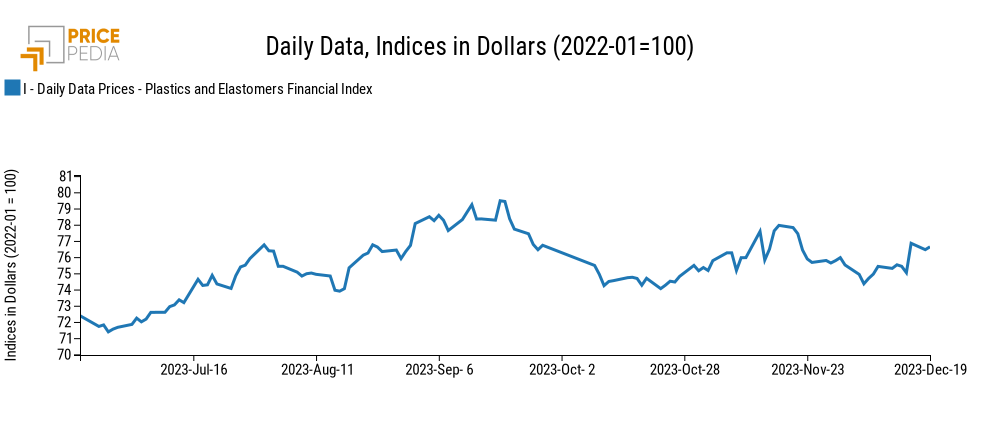

The PricePedia index of prices of plastics and elastomers listed in the Chinese market records mostly lateral movements.

PricePedia Financial Indices of dollar prices of plastic materials

FERROUS METALS

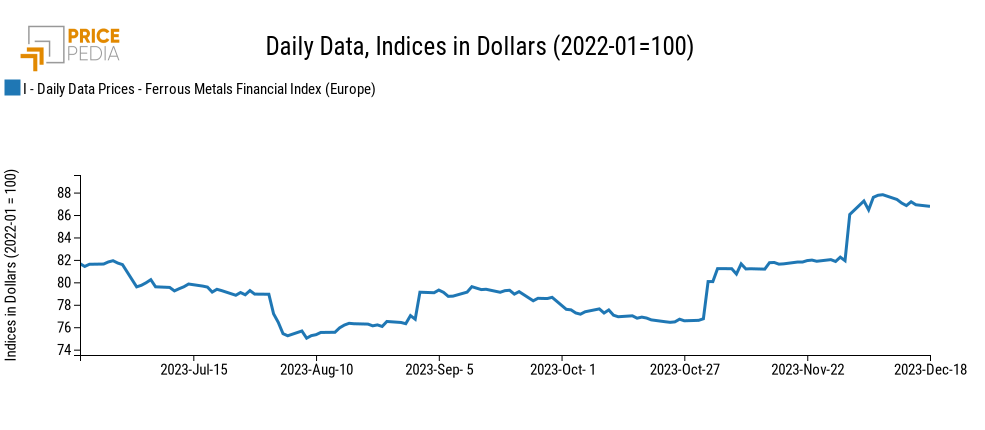

The two ferrous metal indices continue to remain in an uptrend that began two weeks ago.

In the last period, hot rolled coils have been influenced by the growth in prices in the American market caused by a temporary drop in supply.

The United Auto Workers (UAW) strike against Ford, General Motors (GM) and Stellantis generated an extension of delivery times which supported the increase in HRC prices.

Service centers say longer delivery times have driven some of their customers looking for materials into desperation, and some factories have reported not supplying them for the rest of the year.

Steel mills remain confident that they will be able to meet their coil order book by the end of the year, and coil imports from South Korea are expected to arrive between the end of January and February 2024.

The supply crisis is therefore linked to short-term phenomena and US coil prices should see a downward adjustment already at the beginning of next year.

PricePedia Financial Indices of dollar prices of ferrous metals

INDUSTRIAL NON FERROUS METALS

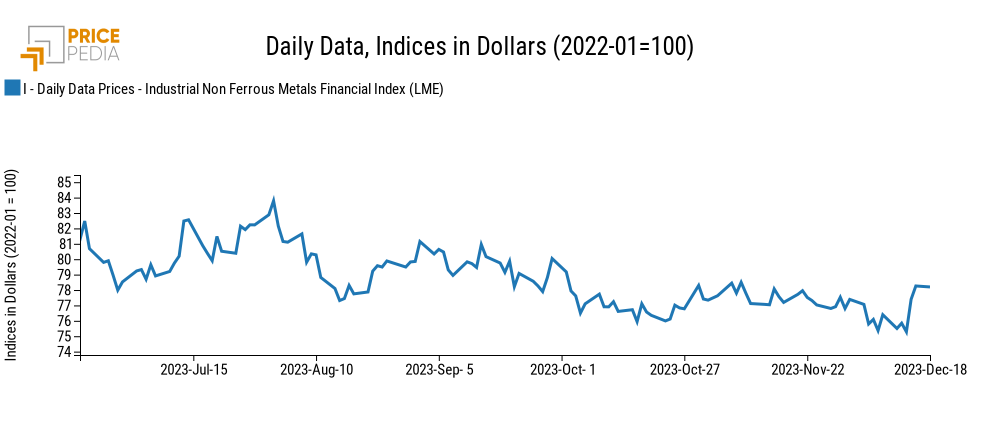

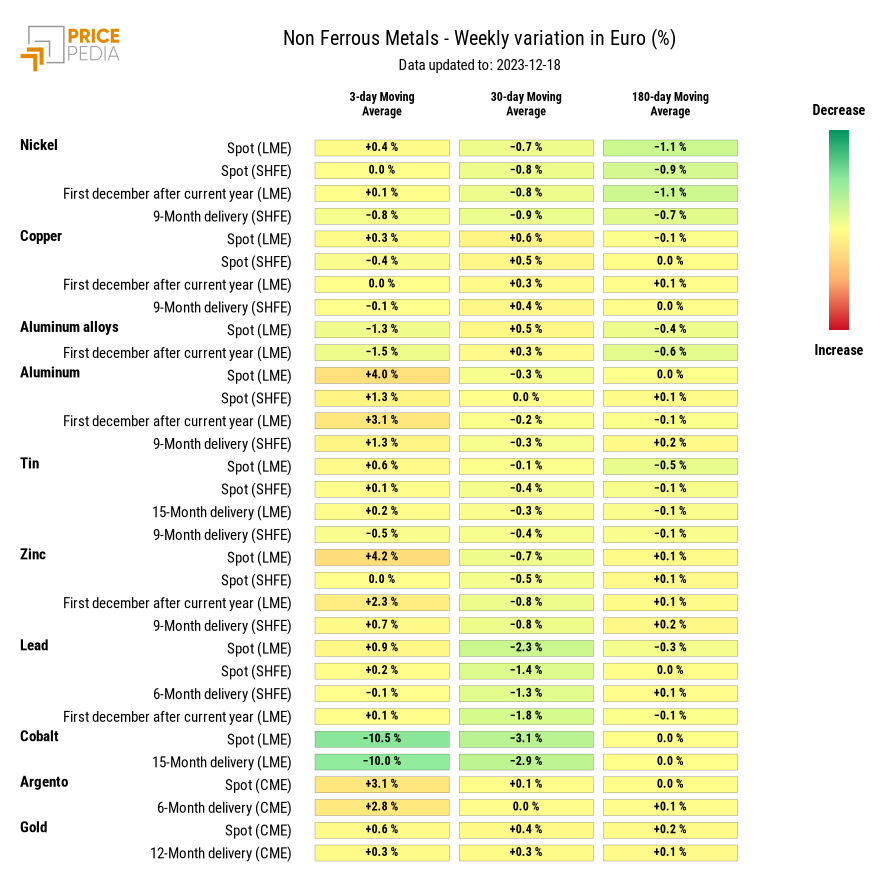

The price stability of industrial non-ferrous metals continues and remains characterized by short-term market fluctuations.

The price of cobalt, however, is an exception and has recorded a strong downward trend in the last period.

PricePedia Financial Indices of dollar prices of industrial non-ferrous metals

The heatmap highlights the strong decrease in the three-day moving average of the price of cobalt.

HeatMap of industrial nonferrous metal prices in euros

FOOD

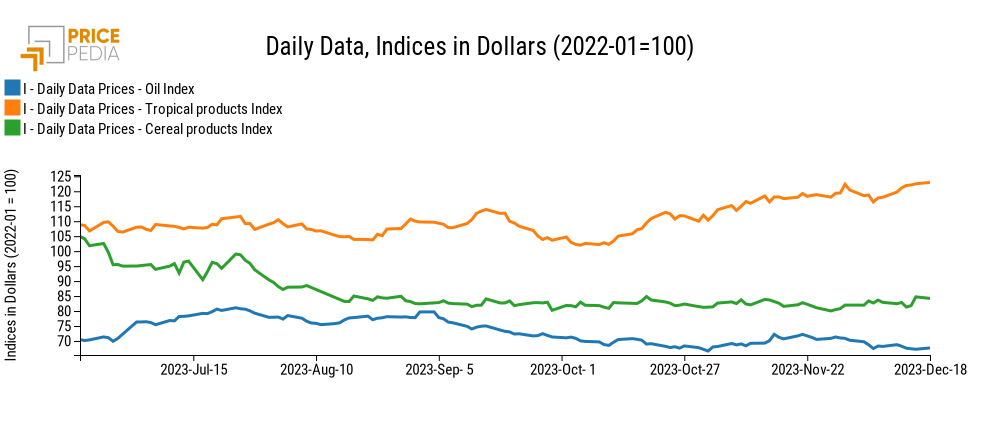

The price indices of the three food families monitored in PricePedia continue to report mixed signals.

This week the tropical index resumes its price rise, while the cereal index continues to follow mostly temporary fluctuations.

However, the oil index remains in decline.

PricePedia Financial Indices of food prices in dollars

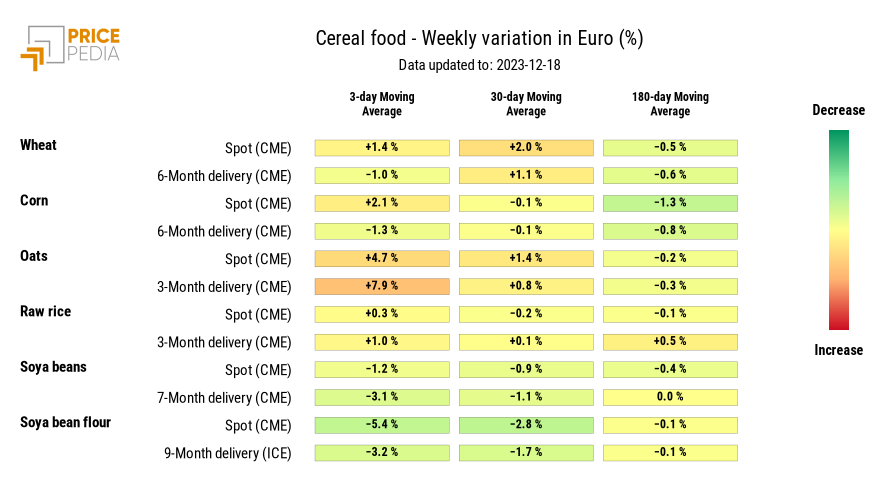

The cereal food heatmap signals a reduction in the prices of wheat, corn and oats.

HeatMap of Cereal prices in euros

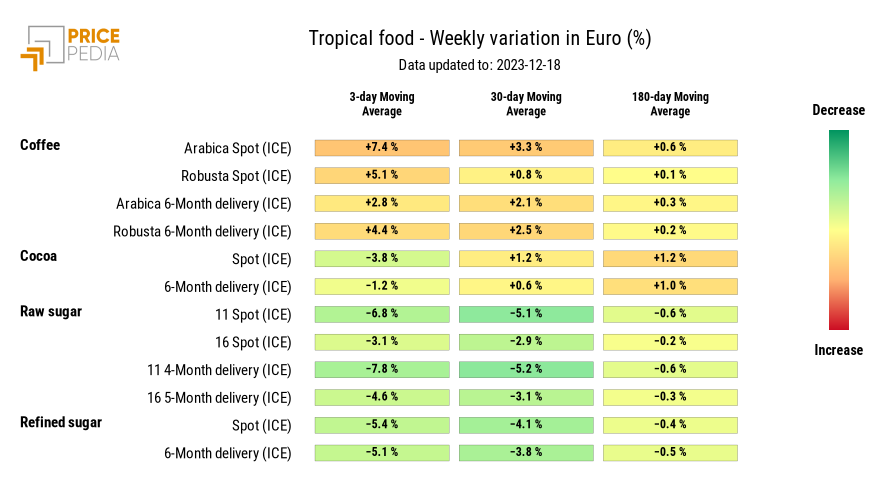

The tropical food heatmap shows a strong increase in coffee prices, while sugar prices remain in decline.

HeatMap of tropical food prices in euros