Differential trend in commodity prices over the next two years

PricePedia Scenario November 2023

Published by Pasquale Marzano. .

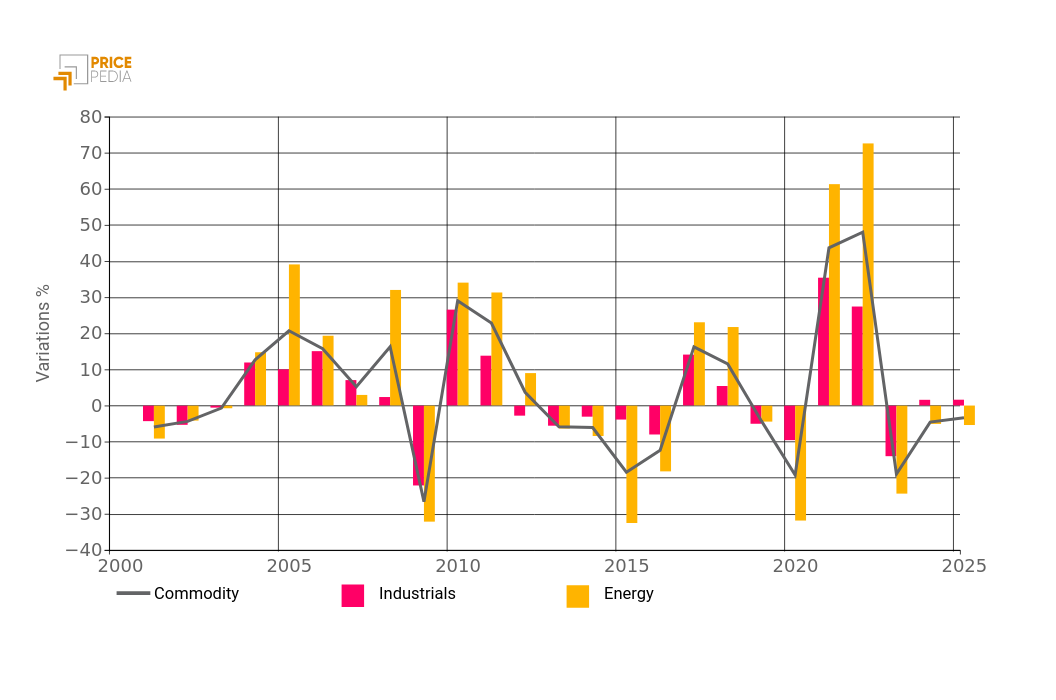

Last Price Forecast ForecastThe PricePedia scenario has been updated with information available as of November 6, 2023. The long-term dynamics of the PricePedia aggregate indices in euros of Total Commodity[1], Industrials[2] and Energy, in terms of percentage changes, are illustrated below annually.

PricePedia Forecast, a long-term scenario

The graph shows the greater volatility that characterizes the prices of energy raw materials in euros. In particular, the latter recorded strong increases in both 2021 and 2022 (respectively +61% and +72% compared to the previous year), culminating in the historical maximum peaks recorded in the summer of 2022. In 2023, commodity prices energy are decreasing compared to the anomalous values of the 2021-2022 cycle. This reduction also continues during the two-year period 2024-2025 until prices are brought back to levels lower than those of October 2021 and more in line with what has been historically recorded.

As regards industrial commodities, after the reduction in prices in 2023, estimated at around -14% compared to 2022 values, in aggregate terms a slight recovery is expected in 2024 which will tend to strengthen over the course of of 2025, in relation to the recovery of the global industrial cycle, illustrated in the following graph.

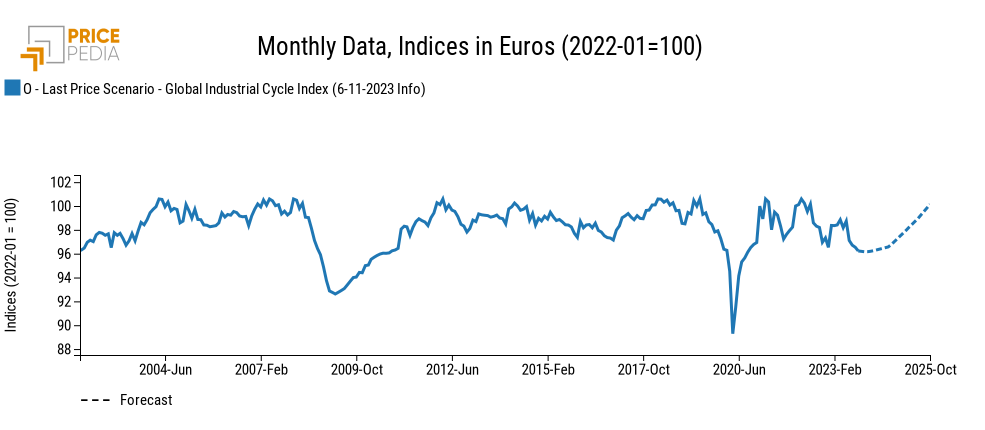

After the double dip of the global industrial cycle, linked first to the crisis in China and, subsequently, to the crisis in European manufacturing, in 2024 there are signs of slight growth. This will tend to consolidate in 2025, in the hypothesis that inflation returns below 3% after the first quarter of 2024.

Sticky prices and elastic prices

Although in aggregate terms industrial commodities will tend to grow in the two-year period 2024-2025, the dynamics of individual commodities can also be very different, and are predominantly driven by the current price levels achieved. In particular, it is possible to distinguish between two groups of commodities:

- commodities whose prices remained at high levels even in the recent phase of reduction (sticky prices). Over the next two years the prices of these commodities will be subject to competitive forces which will tend, albeit slowly, to reduce their levels;

- commodities whose prices recorded significant reductions during 2023 (elastic prices). They will reflect the improvement in demand conditions, especially from the second half of 2024, presenting a growth profile that will tend to accentuate during 2025.

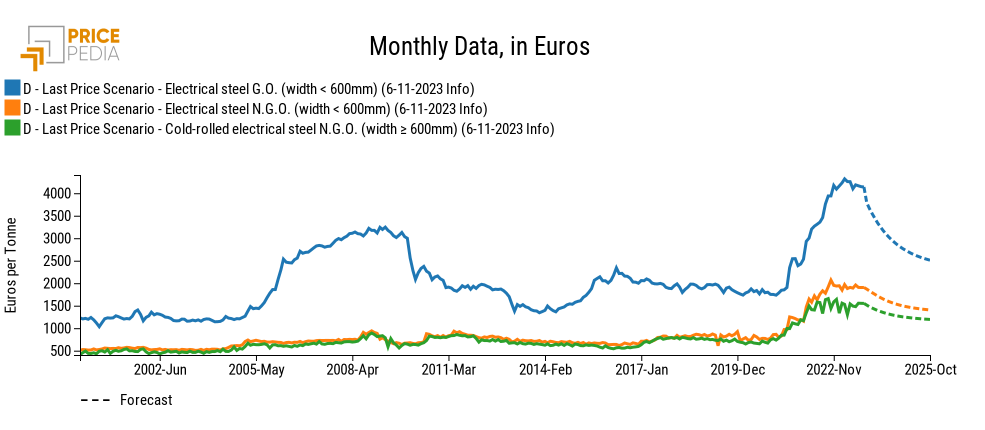

An example of the first group of products is given by electrical steels. The following graph shows the relative prices, expressed in euros per ton.

In the current phase, the prices of electrical steels are still close to the maximum points reached in the final phase of 2022, and, in the case of G.O. electrical steels, in the first part of 2023. In the two-year period 2024-2025 all three products illustrated are expected to decrease. The most intense fall is expected for the price of N.G.O. electrical steels (width greater than 600 mm) (-24.7% in 2024 and -15.8% in 2025).

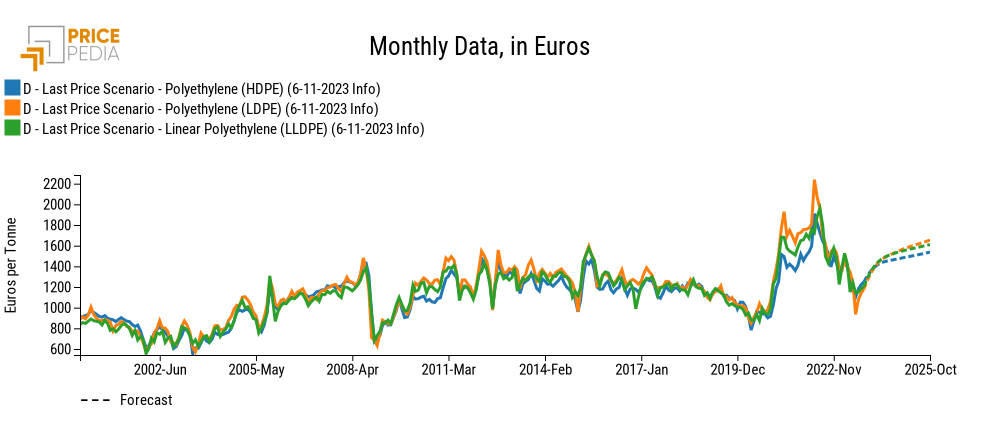

The second group of commodities is represented by polyethylene, whose prices, expressed in euros per ton, are shown below.

Contrary to what was seen with the price dynamics of electrical steels, the prices in euros of the various grades of polyethylene have been affected by a decreasing trend since the summer of 2022. This trend continued for about a year, bringing prices to levels close to those at the end of 2020.

In more recent months, a change of direction has been observed, with prices starting to grow again. Growth will strengthen over the next two years to bring prices to values that are more than +35% higher than the average values of 2019.

1. The PricePedia Industrial index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialties, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Fibers Textiles.

2. The PricePedia Total Commodity index results from the aggregation of indices relating to industrial, food and energy commodities.