Effects of monetary policies in the commodity market

Market expectations of a conclusion to restrictive monetary policies can provide support to commodity prices

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial Week

In the meeting on Wednesday, November 1st, the Federal Reserve (FED) decided, for the second consecutive time, to keep the interest rates unchanged within the range of 5.25% to 5.50%.

President Powell stated that the current inflation rate is still far from the 2% target and firmly ruled out the possibility of an upcoming rate cut. The question the Federal Open Market Committee (FOMC) is considering is not about a possible rate cut but rather a potential rate hike.

However, the president's words did not manage to convince the financial markets, which are confident in the conclusion of the monetary tightening. The chances of a rate hike in December 2023 have dropped to 22%, while bets on a rate cut by June 2024 have risen to nearly 70%. The reasons behind the market's doubt in the president's words lie in the excessively high yields of long-term U.S. Treasury bonds. According to the market, U.S. Treasury yields and the tightening of financial conditions should be sufficient to prevent further interest rate increases.

A similar situation occurred following the meeting of the Bank of England (BoE), which also opted to keep interest rates unchanged.

Governor Andrew Bailey stated that it is still too early to talk about a possible rate cut, but the market has already started to factor in rate cuts for the next year.

As acknowledged by the BoE itself, much of the impact of past restrictive measures has yet to affect the UK economy, which could currently be approaching a recession. For this very reason, the market has strong doubts about a further interest rate increase.

Lastly, the Bank of Japan (BoJ) also decided to leave interest rates unchanged, which currently have a negative reference rate of -0.1%.

The BoJ stated that it will continue its policy of purchasing local government bonds, despite increased inflation forecasts.

The decisions of the central banks, in line with the ECB's decision last week, have fueled expectations of the conclusion of restrictive monetary policies.

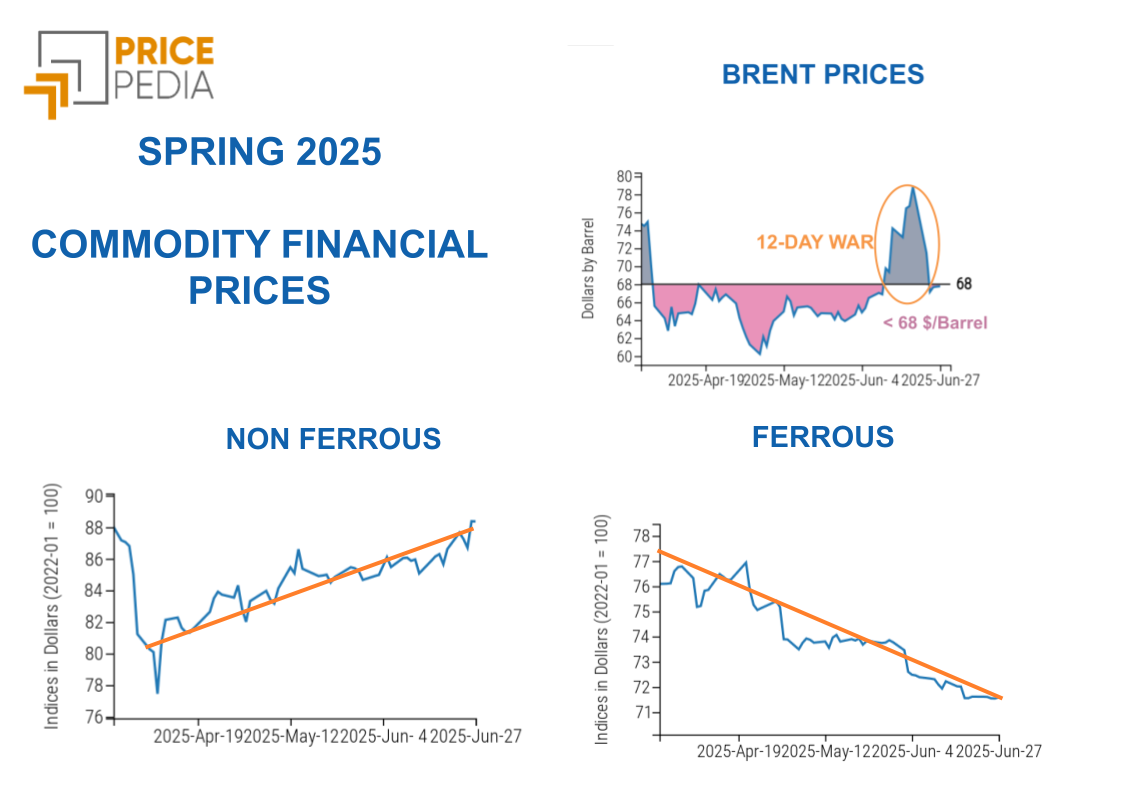

All of this could support the prices of commodities in the energy and industrial metals sectors. The choices of central banks have contributed, for now, to a halt in the decline of non-ferrous metal prices and an increase in ferrous metals.

ENERGY

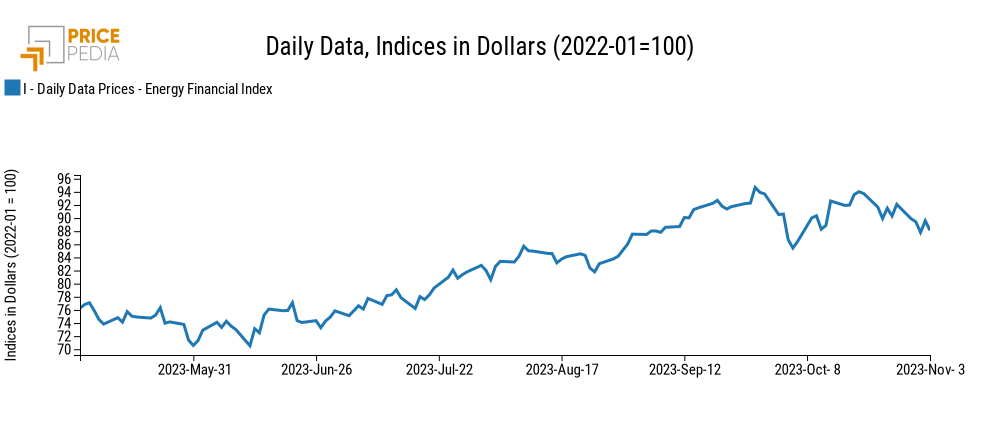

The financial energy products index recorded a weekly decline, with a short break following central bank announcements.

PricePedia Financial Index of energy prices in dollars

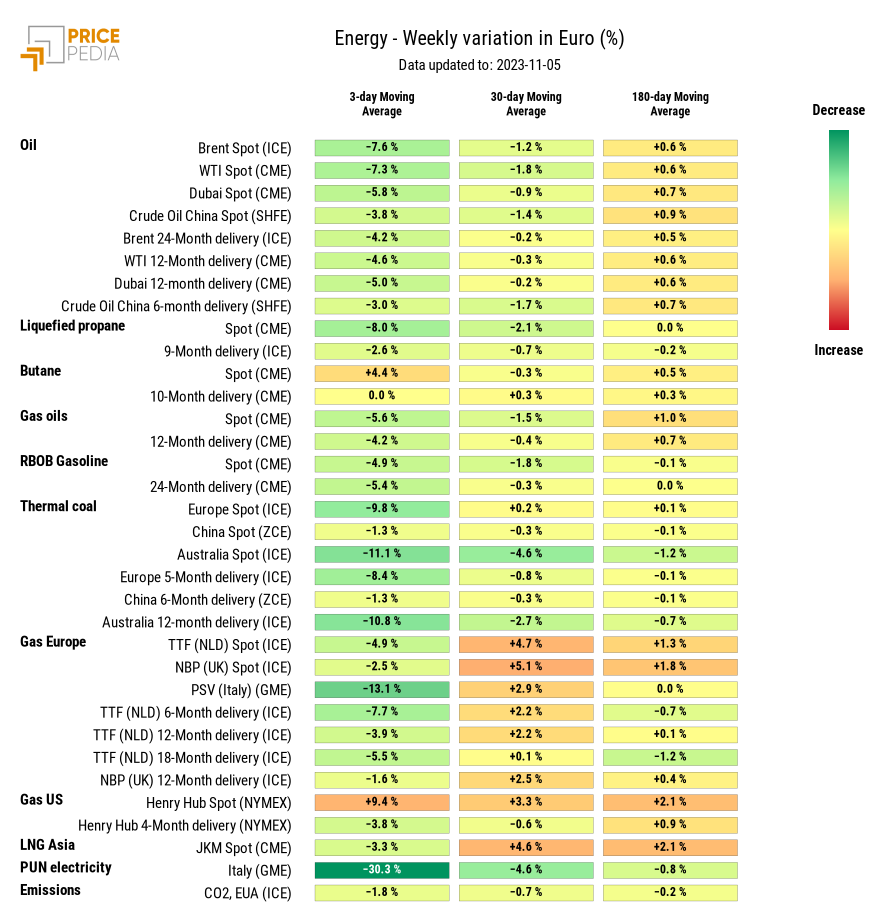

The Heatmap shows a general decline in energy product prices, which affected the prices of PSV (-13.1%) and Italian electricity (-30.3%) the most.

However, there were some exceptions, the three-day moving average of Henry Hub and butane prices recorded weekly changes of +9.4% and +4.4% respectively.

HeatMap of energy prices in euro

PLASTIC MATERIALS

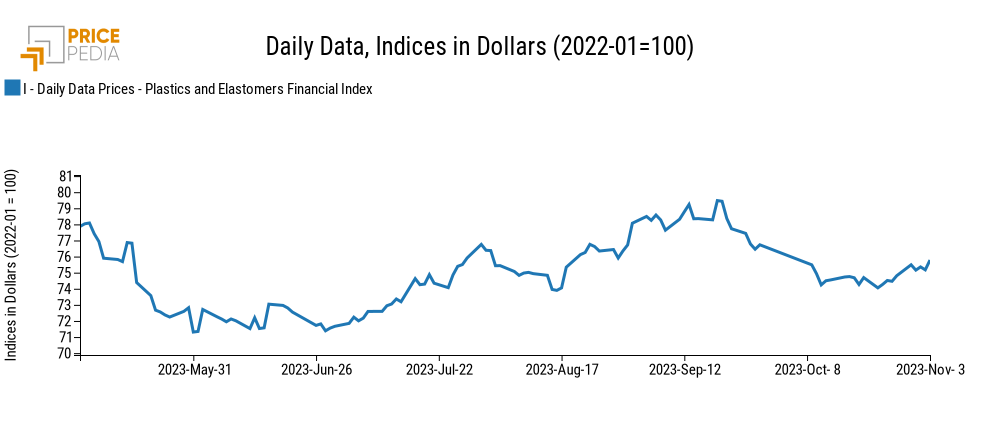

The Chinese plastics financial index remained stable throughout the week and turned slightly upwards on Friday.

PricePedia Financial Index of Plastics in dollars

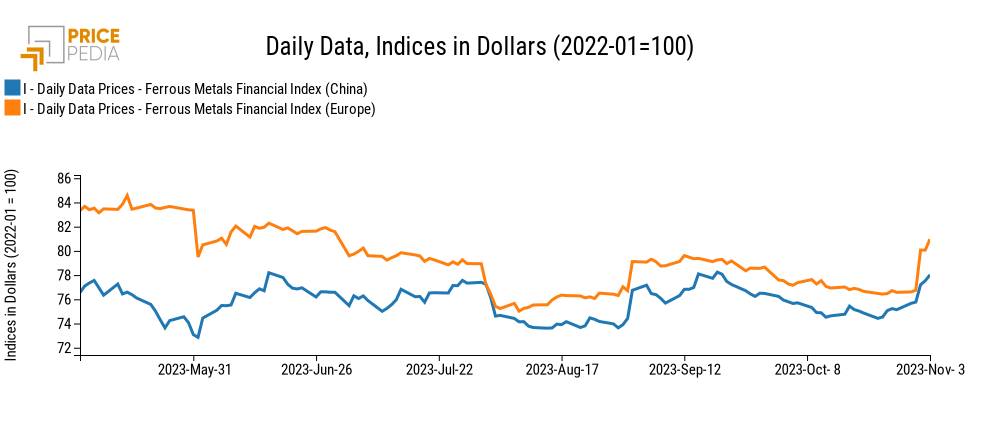

The heatmap below shows the euro prices of the plastics contained in the index.

HeatMap of plastics prices in euro

The heatmap does not show any significant price changes.

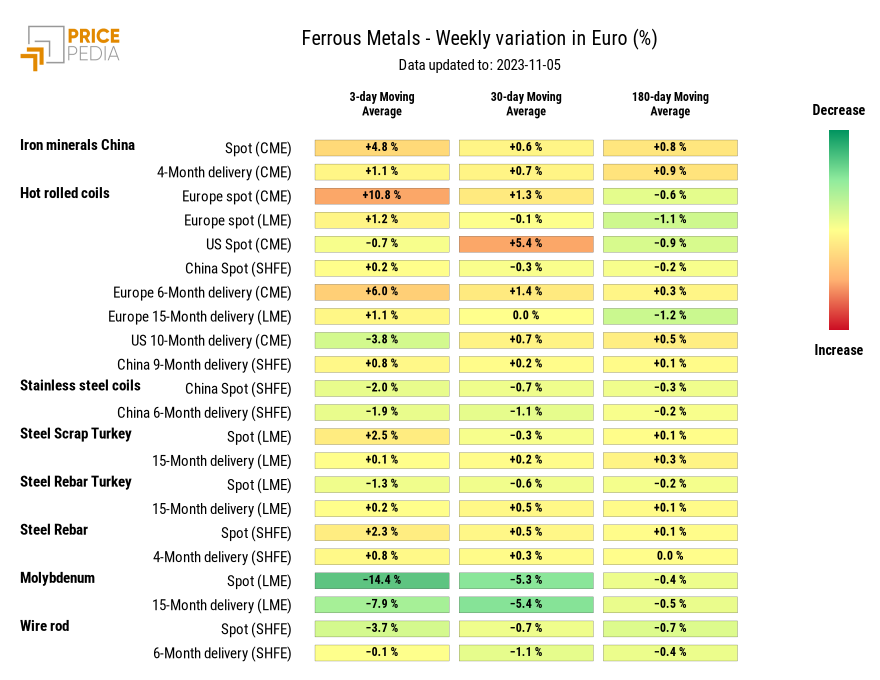

FERROUS

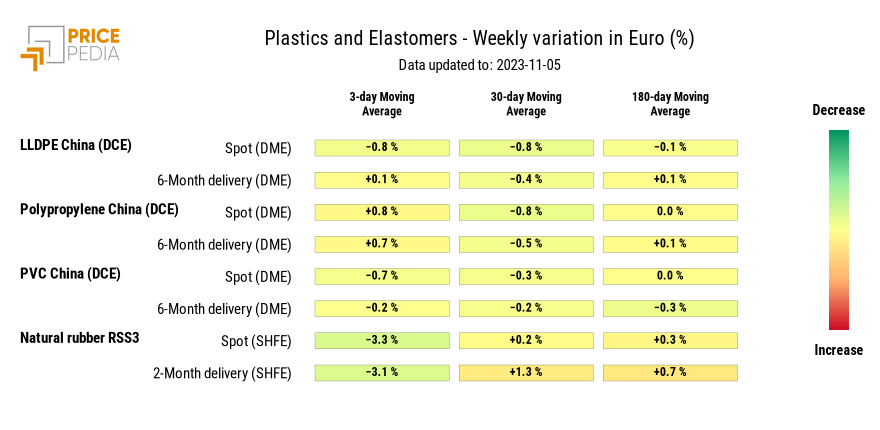

This week, both ferrous indices recorded price increases.

PricePedia Financial Indices of ferrous metal prices in dollars

The heatmap shows the general increase in ferrous metal prices with increases close to double digits for Coils Europe. The only exception is the price of molybdenum, which recorded a more than significant drop (-14.4%).

HeatMap of ferrous metal prices in euro

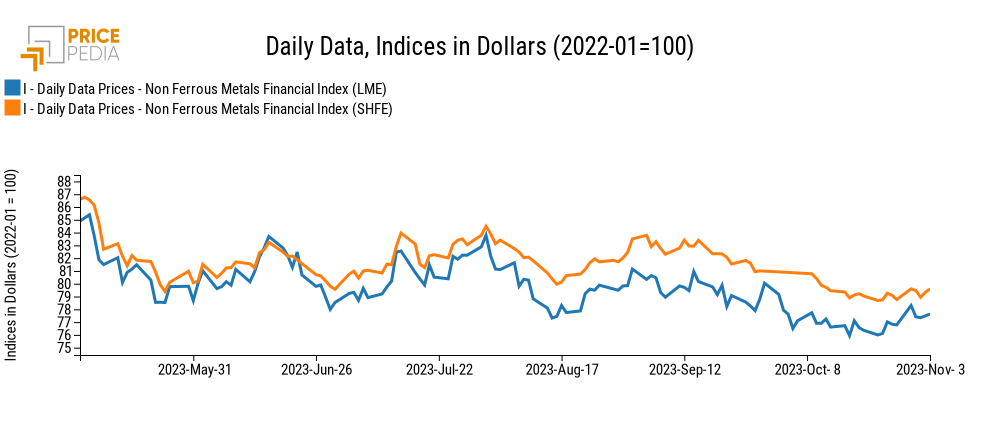

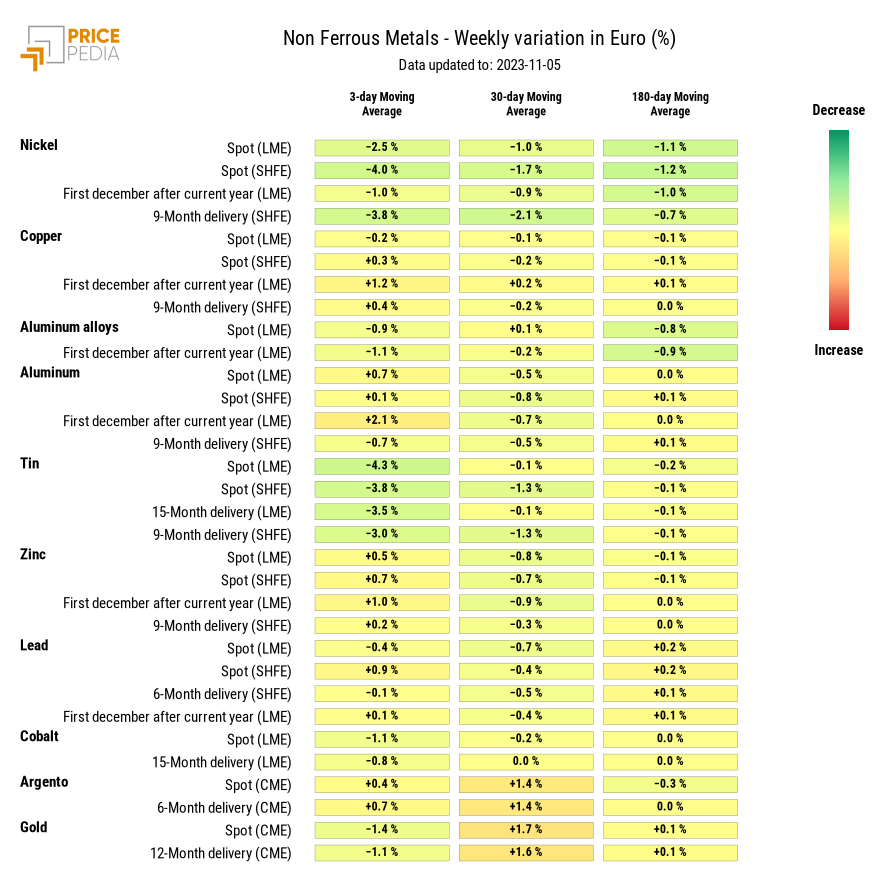

NON FERROUS

This week, both non-ferrous indices declined slightly in the first days of the week, then stabilised in the following days.

PricePedia Financial Indices of non-ferrous metal prices in dollars

The heatmap shows substantial stability for all prices, with the exception of the decline in nickel (-4%) and tin (-4.3%) prices.

HeatMap of non ferrous metal prices in euro

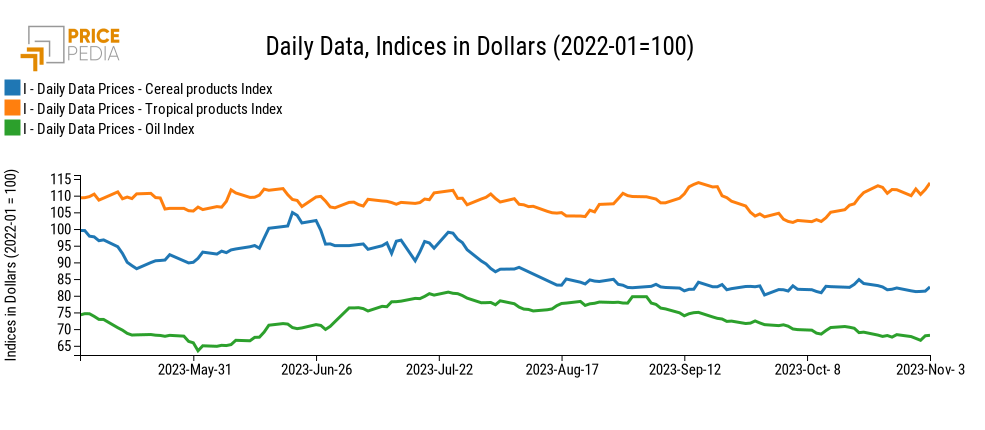

FOOD

The financial indices for foodstuffs showed opposite fluctuations, which offset each other during the week.

PricePedia Financial Indices of food prices in dollars

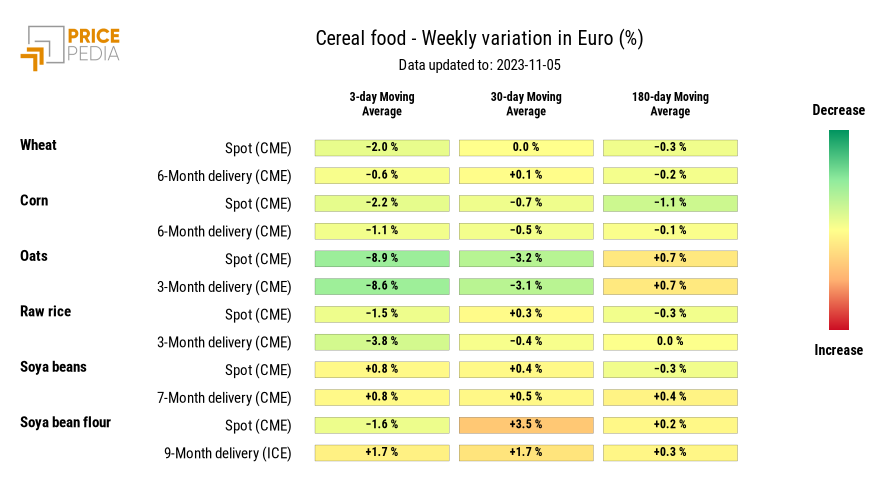

CEREALS

The heatmap shows a decrease in oat prices (-8.9%).

HeatMap of cereal prices in euro

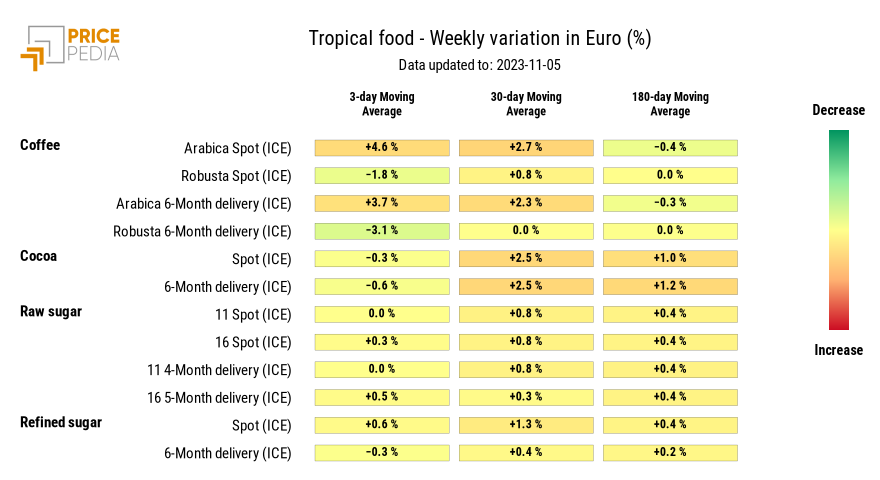

TROPICAL FOOD

The heatmap shows a stability of tropical food prices, the biggest change being the rise of Arabica spot Coffee with an increased of +4.6% .

HeatMap of tropical food prices in euro

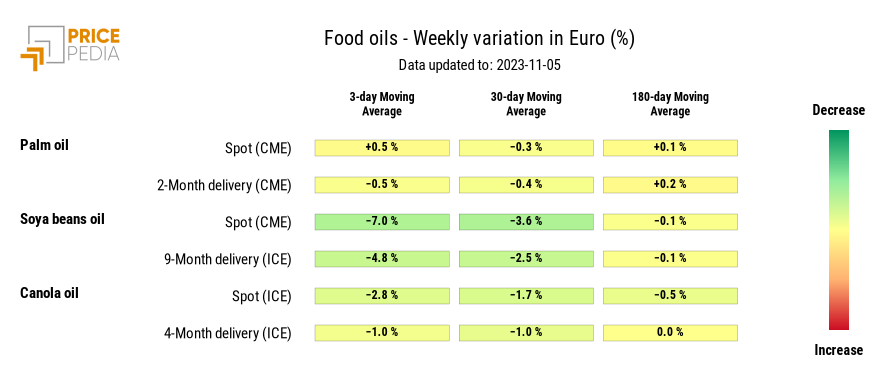

FOOD OILS

The heamap shows a decrease in soybean oil prices (-7%).

HeatMap of oil prices in euro