Market sentiment weighs on copper price

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

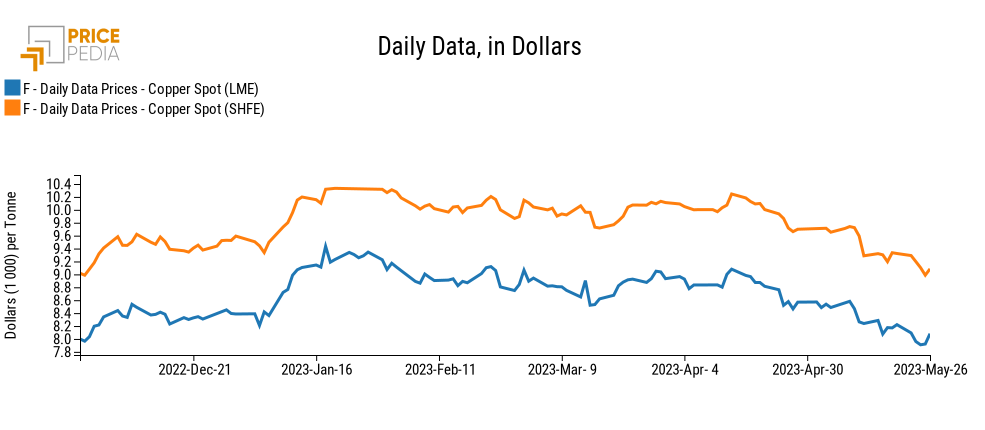

LME Conjunctural Indicators Copper Doctor Copper SaysTimes of decline for the price of copper: after showing a relative stability in late April and early May, in recent weeks the price has resumed the falling trend of the second half of April. This decline thus distances the price from the levels reached in early 2023, when the lifting of Covid restrictions in China had brought general optimism on financial markets about the prospects for a recovery of the Chinese economy; the price of copper, for its part, had risen to the highs of the previous seven months.

The decline of the last few days has brought the price of copper back to the levels of late 2022, both on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE): looking at yesterday's closing values (Thursday, May 25), we are in fact below $9000 per ton at the SHFE, and below $8000 for copper quoted in London, as can be seen from the chart below. The last day of the week saw an upward rebound, especially in London, but this did not change the underlying trend that is characterizing the price of copper.

Summing up, from the beginning of May to present, copper prices listed on both the LME and the SHFE fell by more than 5 percentage points.

China's recovery falls short of expectations

Underlying the price slowdown we can find markets' growing awareness about the recovery of the Chinese economy, which is proving less dynamic than expected. Thus, investors' hopes for a strong copper demand from its largest consumer on a global scale are also waning. Also confirming this line of economic weakness are the latest data on the performance of the Chinese economy, such as April's industrial production, which increased by only 0.12 percent compared to the previous month; also lower than expected was the growth in retail sales, which increased by 0.49 percent compared to March.

Manufacturing weakness for US and Eurozone

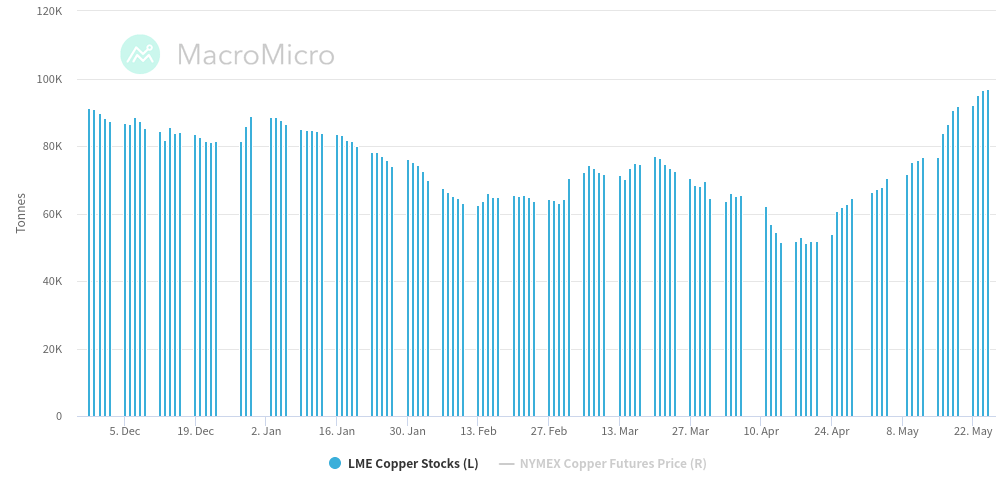

A lackluster Chinese economy is joined by signs of slowing industrial activity in Western countries, as well. Let us look, for example, at the dynamics of copper stocks at the LME, on the rise since the second half of April: supply thus seems to be prevailing over demand, pushing the price down.

Stocks at the LME have not touched such high levels since the fall of 2022.

LME Copper Stocks

(Dec. 2022 - May 2023)

Source: MacroMicro.

Signs of uncertain economic growth for the West also came from the latest PMI indexes, recently released by S&P for May.

The S&P Global Flash US Composite PMI touched 54.4, up from April, indicating a solid expansion in private sector business activity; however, this increase was led by the services sector, compared with only a modest increase in terms of output for the manufacturing sector.

Indeed, the specific S&P Global Flash US Manufacturing PMI showed a contraction below the neutral threshold of 50 in May, signaling a new deterioration in manufacturing operating conditions. As reported by S&P, "The decline in the health of the sector was only marginal, but stemmed from weak demand conditions and a reduced need to hold inputs following improved delivery times and lower new order inflows".

The Eurozone is also witnessing a divergence between industry and services. The Flash Eurozone Composite PMI Output Index (HCOB) remained above the 50 threshold in May, but the specific index for the manufacturing sector hit a three-year low. Strong growth for services thus contrasts with a fall in terms of industrial production, which is in turn linked to a growing divergence between demand for goods and services.